What is PMF? Is it when you start acquiring consumers or when you start making money from them? How can a founder attain PMF? And what happens after?

Product-Market-Fit, or PMF, is like that one contentious topic capable of dividing the room at a party. Not very surprisingly, Sajith Pai will be found at these parties ferociously taking notes from both sides. In this post, Sajith presents his interpretation of PMF and how founders should align their company goals according to where they are on their journey towards PMF.

This post was created from presentations made by Sajith at various founder forums. The link to the full deck is available here.

This is from the article that introduced product market fit formally to the world by Marc Andreessen. The article is called ‘The Only Thing That Matters’. Andreessen wrote this in 2005, and then sometime in the last 10 years, he deleted his entire blog. But the internet never forgets and this was retrieved.

In the article, he talks about how a founder can feel that PMF is happening. This reminds me of a famous judgment in US law around pornography by Justice Potter Stewart. He said that ‘I can't define it, but I know it when I see it’.

Per Bryan Schreier of Sequoia Capital, about a quarter of seed-stage companies get PMF. Per John Danner, a preseed investor, only about 5% of seed-stage companies do get to PMF. The answer is somewhere in the middle. That said the percentage of seed stage companies that get the next round of funding is 20-30% (20% per John Danner, and 30% from the below chart from Bain’s India VC Report 2021).

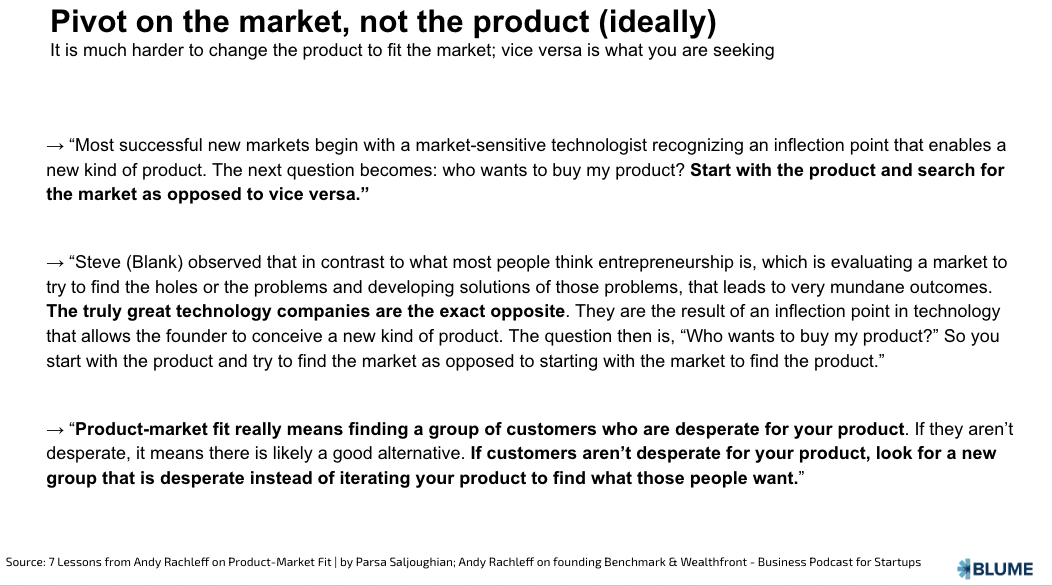

Andy Rachleff founded Benchmark, the fund, and then went out and founded WealthFront. Marc Andreessen credits him for coming up with the term product market fit.

He says you can do all of the things, execute, hire really well, think of marketing campaigns etc., but if people don’t take to the product, the dogs don't eat the dog food, you're going to fail. So, fundamentally, the product has to succeed. It's a bit like if you run D2C food brands, and you can do everything in the world, the best marketing, great product placement, but if the product doesn’t taste well, then people will say no, not really, and you won’t succeed.

The concept of PMF came from VCs, not founders. Founders don't have a formal definition of PMF, nor do they see themselves (or did see themselves) as actively striving for PMF. They focused on growth, strived for high retention, and left it to VCs to judge if they had PMF or not.

They see PMF as an abstraction layer.

VCs, on the other hand, obsess over the definition of PMF or think of their startup as striving for PMF. This is because, for VCs, PMF is as much a gating mechanism.

Historically a convention existed that Series A VCs typically want to see PMF happening before they invest. The years 2020 and 2021 saw a divergence that is now getting corrected. So again, founders, for your Series A rounds, most good VCs will make an evaluation of if you have achieved PMF before they open their purse strings.

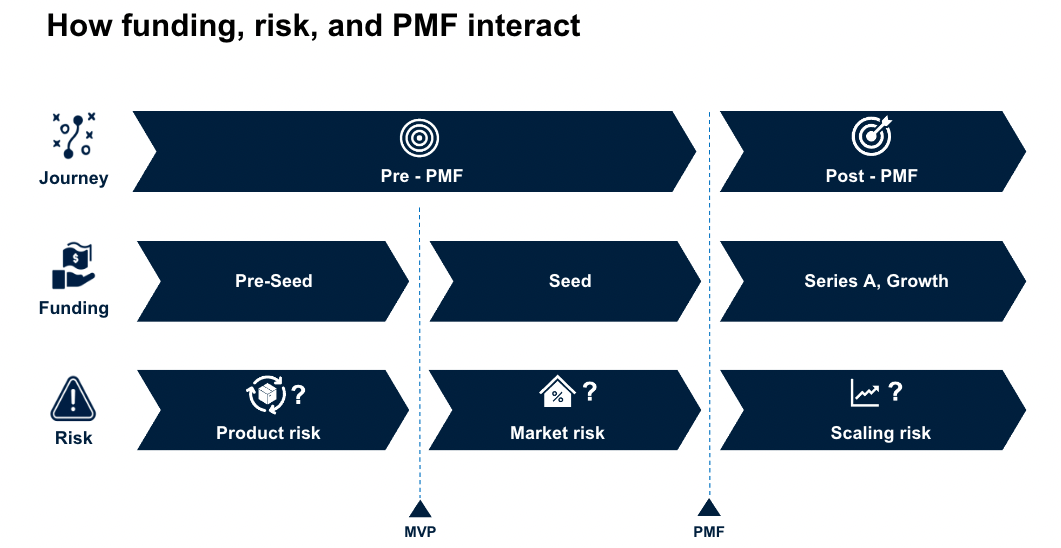

There are three risks that are being staved off and each (stage of) financing is to broadly cover a certain risk.

The preseed round is to cover product development risk.

Once the MVP or a basic product is created then you go to the seed or pre-Series A investment stage which is fundamentally where Blume operates. We are looking to cover the market risk. By the time you are ready to raise the next round, that VC is going to ask you if is there a market really, is there sizable market for the product. Is there a systematic way or playbook that you have discovered to tap the market? That is what we help you discover and broadly that is our promise to the founder too.

Last is the Series A and the growth guys and they will help you cover growth and scaling risk.

So effectively PMF has emerged as the gating mechanism for Series A and B, C folks to evaluate if it is the right risk stage for them to play in.

In life and philosophy, there are these statements like ‘know where you're going’, and ‘don't start running in the wrong direction’, right? Another is that before you press the accelerator, know that you are in the right direction. So, PMF is exactly that. You're making sure that before you throw in all that money, you are on the right track

Essentially VCs are saying: "Before you throw in all the money, I hope you're acquiring the right customer or aren’t acquiring the customers who don't need it or don't value it (and hence won't churn)"

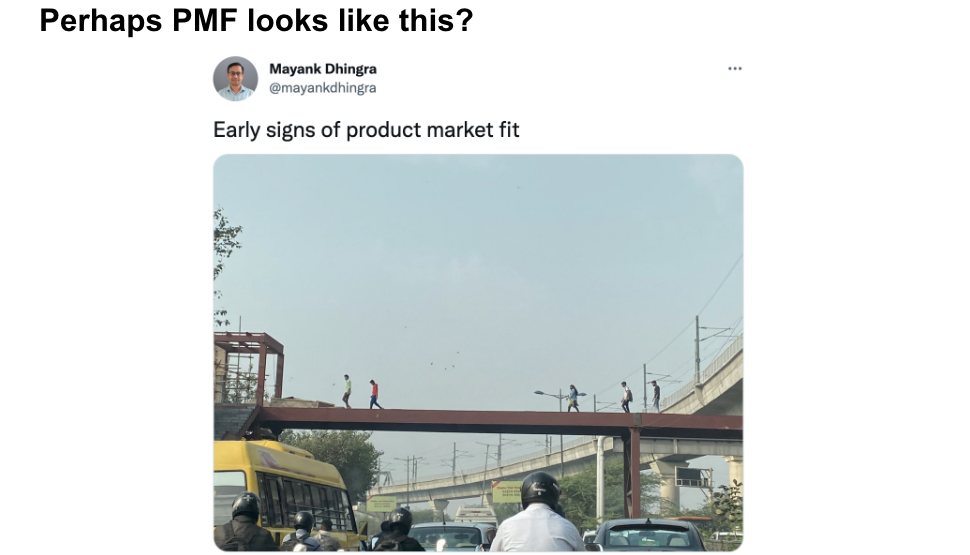

The tweeter calls it early signs of PMF. It's a minimum viable product, a bridge with nothing on the sides - so like an MVP - but people are so desperate that they're using it as is.

PMF is not what happens when five customers absolutely love it. That is product problem fit.

Conventional examples of product market fit would be like, “Hey, I'm getting most of my customers through word of mouth…people are reaching out saying when are you launching in my city. Then, customers who recommend your product, and so on.

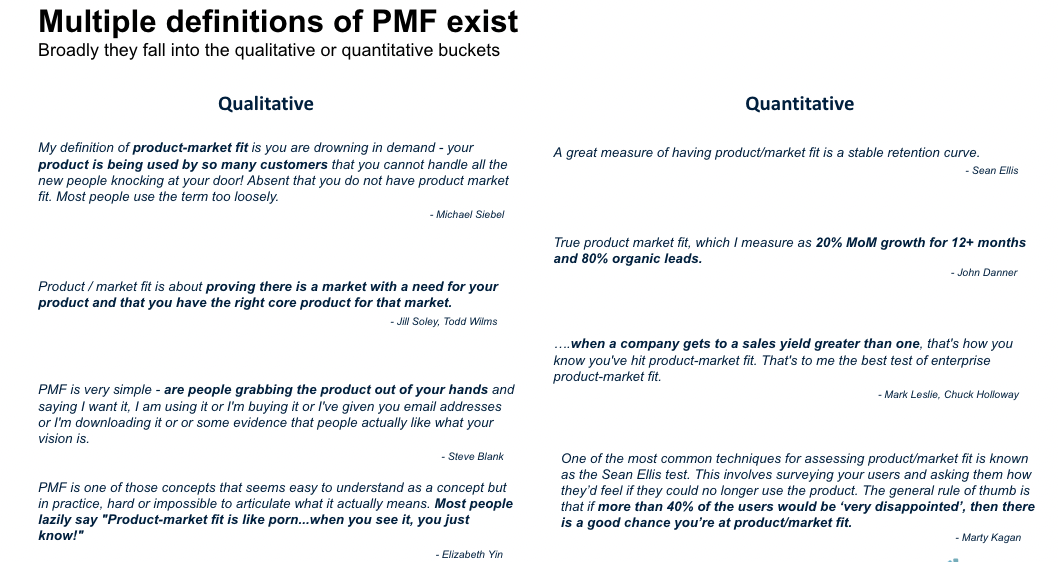

These are some of the definitions of PMF we see.

Some of these are subjective: are people grabbing the product out of your hands or drowning in demand, or it is like porn, when you see it you will understand. Some of these are quantitative like the stable retention curve, or the thumb rule is whether more than 40% of the users are very disappointed - this is the famous Sean Ellis test referred to in the article by the Superhuman founder – then sales yield greater than 1, so on and so forth.

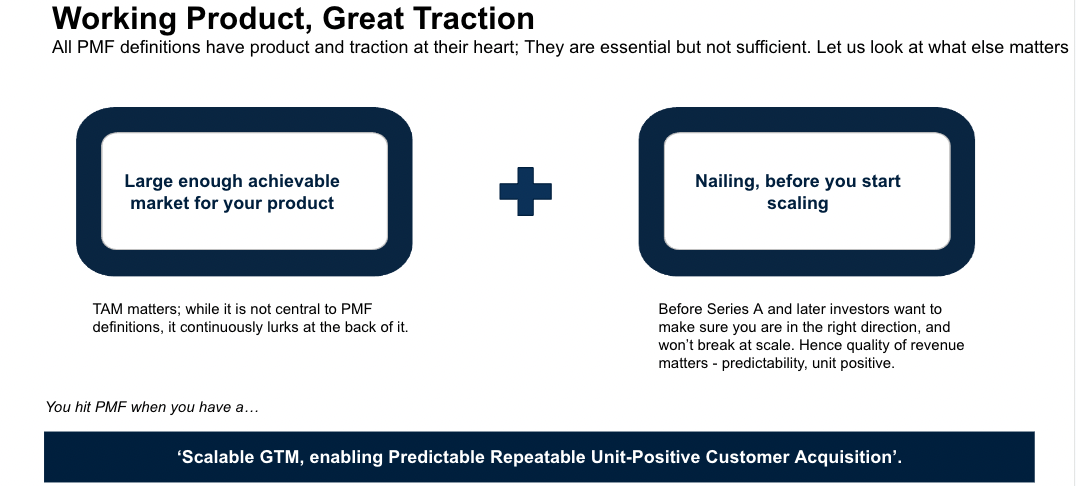

It is critical that PMF demands a working product and good traction. Apart from that, broadly investors are asking, is there a large enough market? Then they are saying that before you pour in all that money, just make sure you're on the right track.

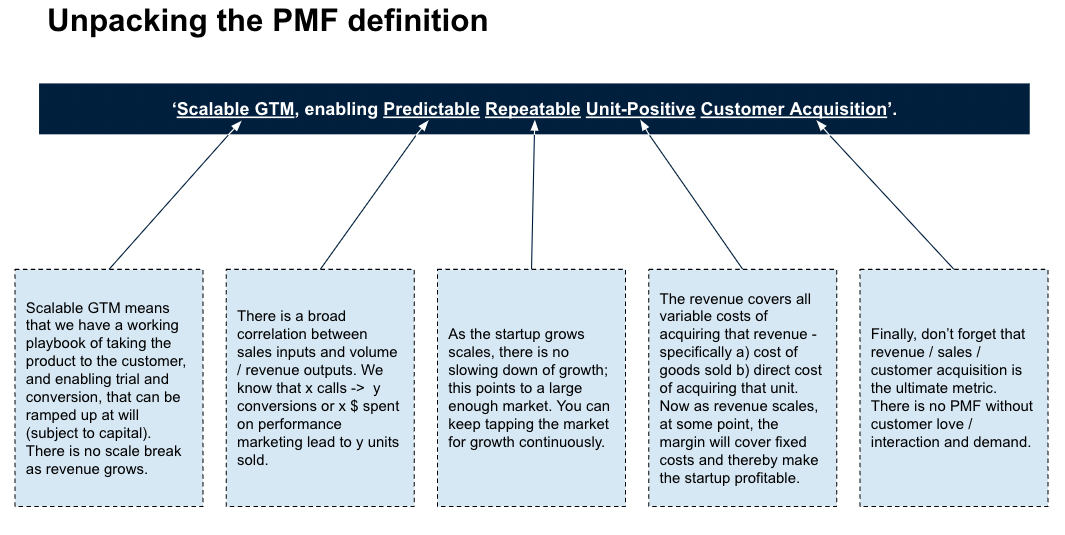

An ideal definition of PMF would be: scalable go to market, enabling predictable, repeatable unit positive customer acquisition, or CM2 positive customer acquisition.

Here's how we would think of the individual constituents that make up the definition of PMF.

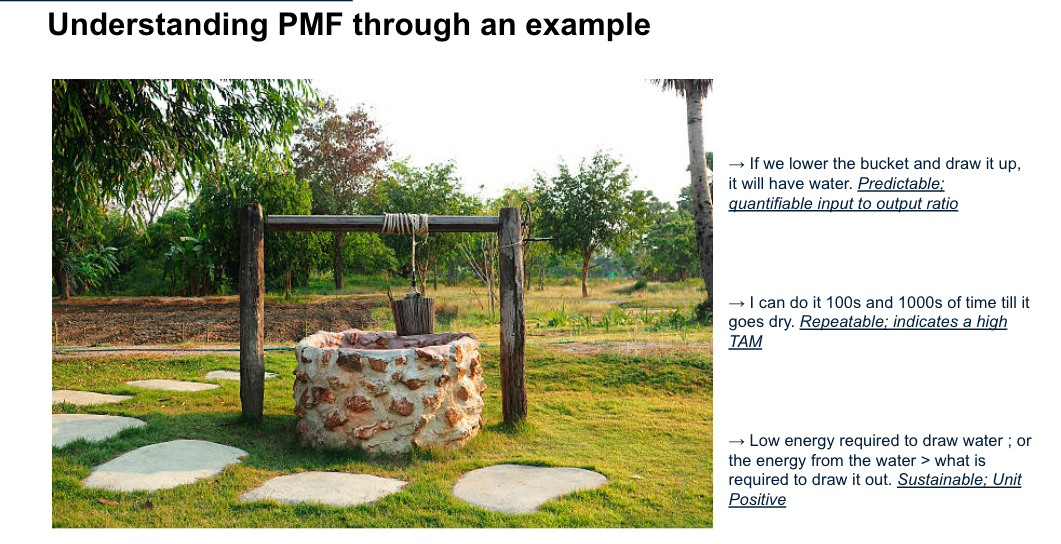

Let us understand it through the example of a well where to get water from the well, you lower down the bucket and bring it up. Clearly, there is predictability, that if you do this action you will get water.

If you can do this many times, and get water, it is a well that doesn't go dry, so it is repeatable and indicates there is a large TAM.

Then the energy required to bring the water up should be less than the energy you get from the water. That stands for CM2. If you have to put in much effort to take that water out that by the time you take the water out, you don't have any energy left, then it's not a good sign.

So this is the example that I give to illustrate PMF; it is predictable, if you lower the bucket and draw it up, you get water. It is repeatable. You can do it hundreds of times, and three, the energy required to get the water out is not that high.

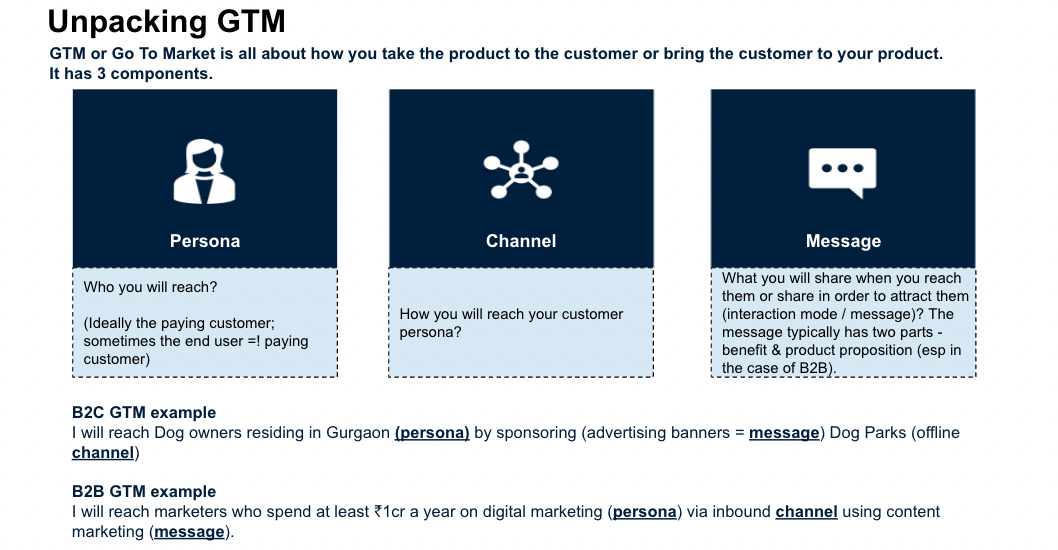

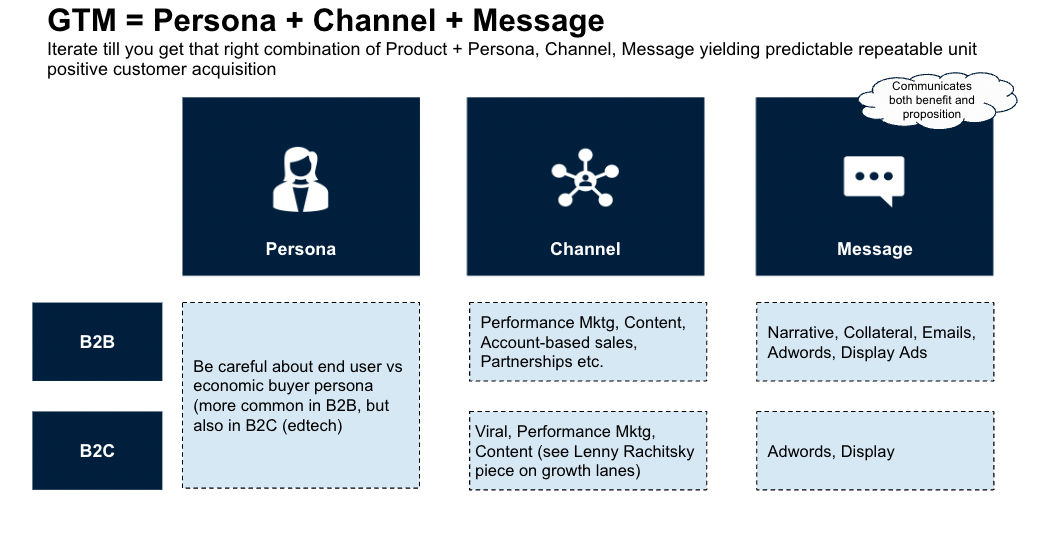

Be very clear on who your persona is. It is very critical. At the early stage, ideally have only one persona to focus on. This is typically the paying customer, but for example, if it's a children's product, the mom, is actually the most important person influencing, as well as the paying customer but not the end user.

Channel is how will you reach the persona. Typically for a consumer product, advertising or performance marketing becomes the channel. You can also have content as a key channel where you say I will start by creating great content and get inbounds, or you catch them offline. You can put camps in housing societies, and acquire customers there.

The last is the message, or what will you share when you reach the persona. What does the customer see? In certain cases, the customer will see the product say on TV in an ad, or she may see the product in a store say during a promotion.

Typically, the message has two parts; one the clear benefit that they get, and second, the product proposition.

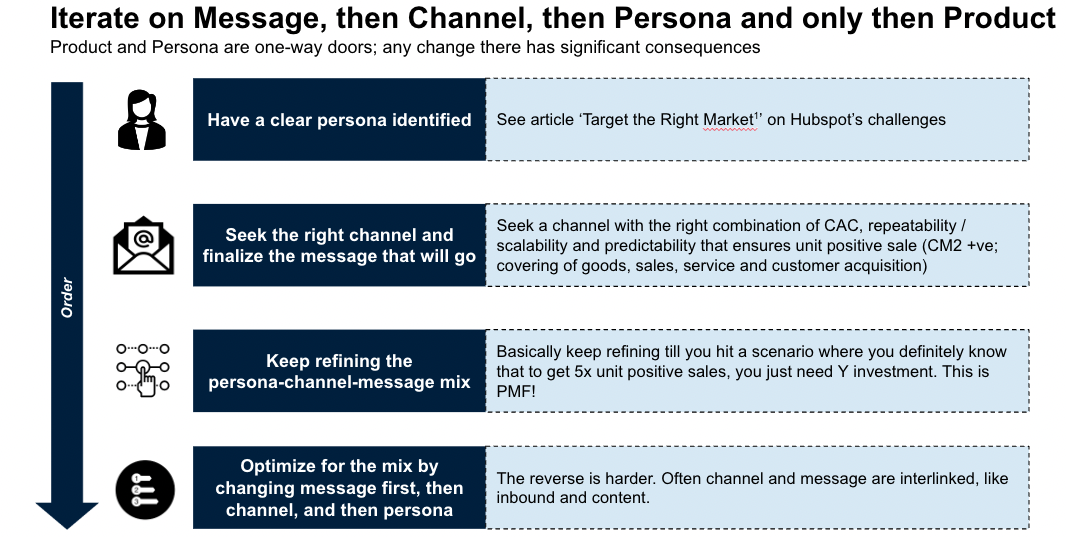

There is a hierarchy of iteration in GTM.

If something is not working on the GTM front, first change the message. Try a new message, if that's not working, then change the channel. Typically there is a channel message combination that is right for the business. If that's not working, now that's significant, then change the persona. This is getting harder. Sometimes you may need a different channel also for a new persona. If that is not working and you change the person, that means your entire GTM has changed, because channels go with personas. Now you need a new channel for the new persona (usually).

Channels and messages are not necessarily one-way doors. They are two-way doors. You can change these, though channels are a little bit harder to change than messages. The message is easier to change.

To iterate on GTM, first change the message, and see if you are getting better customer acquisition outcomes, then if that is not working look at different channels, and only then relook at the persona, and if all of this doesn't work then you have to take a look at the product. Remember that a change in the person will usually mean changes in the channel and message as well.

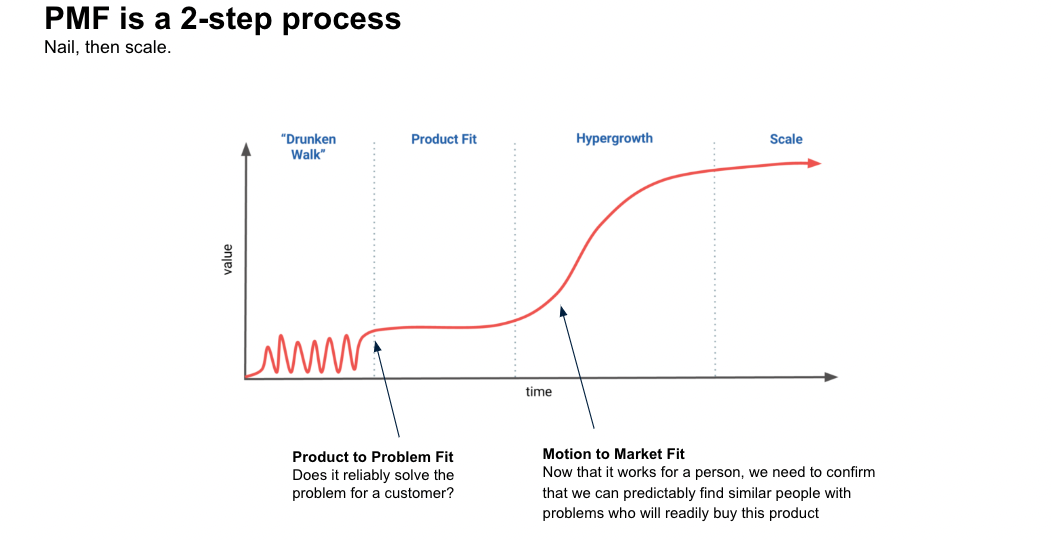

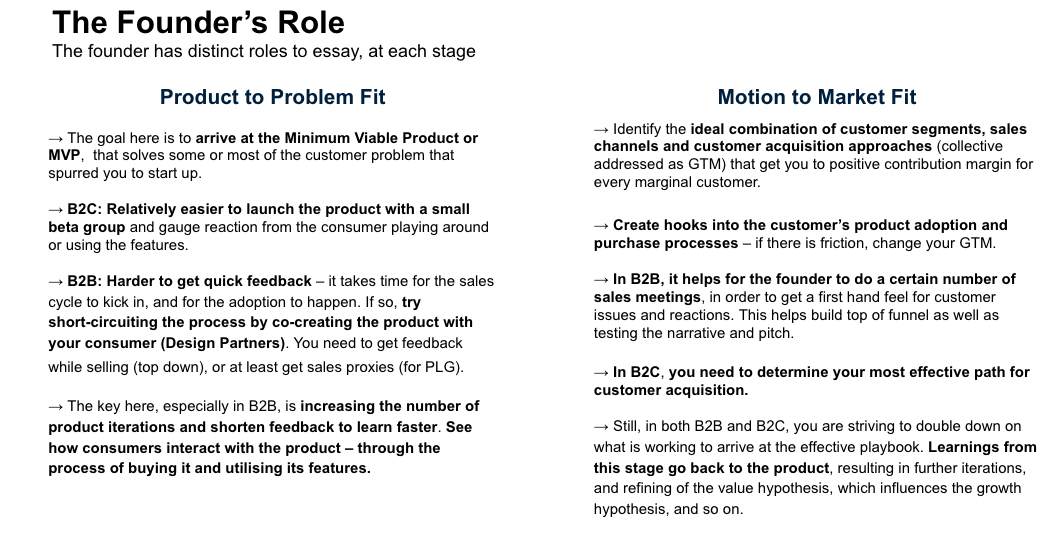

PMF is comprised of two fits: PPF and MMF. PPF is Product to Problem Fit and MMF is Motion (as in GTM Motion) to Market Fit. They are sequential in the sense that you need to hit PPF first and then hit MMF, but sometimes you can hit true PPF only if you have initiated your GTM or MMF search too.

Now, the chart. PPF or product to problem fit: lots of iterations to get to that. Once you get the product to problem fit, you need to discover if there is a market for your product. So the second stage is when you have product fit and you are discovering if there is a market.

MMF or Motion Market Fit is when you find the ideal GTM motion that is able to help you reliably find more and more people like that with similar problems.

To really succeed, your product has to solve a big problem or has to demonstrably give benefits like painkillers (as opposed to vitamins).

So a great metaphor is "hair on fire". If your hair is on fire you will use anything to put it down, including things that don't look like fire extinguishers, such as a blanket that could cover the fire.

Each business has a certain slant to it or slope. If it is downward sloping, then you just need to put the ball and the ball will roll down with minimal effort, but if you are upward slanting then you need to put in the effort to roll the ball up.

So pick businesses with slants and tailwinds. Don’t pick businesses with headwinds and upward slants. In a way what your search for PMF does is to help you discover the right combination of product + persona, channel and message that enables slant.

As a founder, you need to be very clear about what you're optimizing for at every stage. At the product to problem fit stage, you're fundamentally saying to arrive at all of the right settings of the knobs and dials which lead to a delightful customer experience, be it packaging or after-sales experience is an issue, following up, etc.

Focus on getting feedback. Don't adopt the cave woman approach of going into a cave building something for months and coming out. Fundamentally focus on quick feedback and product iteration.

You learn from three people or stakeholders. You learn from your investors early on, you learn from your customers, you learn from hiring (prospective) employees.