Direct-to-consumer businesses (D2C) often compete with the market leaders in every consumer product area. On Amazon, a search for "fan" would return twenty pages of results, the first few of which would be advertisements. Particularly saturated are horizontal markets like Amazon or Flipkart. These often tend to overwhelm buyers with hundreds of possibilities and sometimes leave them feeling less secure than when they began their search. Atomberg, a home appliances firm that just raised $90 Mn, has scaled to $100 Mn in annual sales while providing a product with a higher price point than others in its sector. We spoke to Arindam Paul, CBO of Atomberg, on how to differentiate yourself in a crowded market.

We put ourselves in the position of a D2C founder and tried reconstructing the questions that would come up at every stage of a company which is in the process of listing itself on a marketplace and put together the answers from our conversation with Arindam.

Why should I even list on a marketplace?

In most cases, marketplaces are a more profitable channel than others for most brands across most categories because you already have an existing customer base; you don't have to pay repeatedly to acquire customers there.

Also, the marketplace commissions are usually so low that they can never reach up to CAC (customer acquisition cost) you would have to spend on acquiring new consumers from scratch.

So let's say, for example, a user needs a fan. They would not go to Atomberg.com to buy one, for instance. They will search on Amazon for a fan if they’re not looking specifically for your brand. People specifically looking for your brand might come to you organically, but that number, as you scale, will be increasingly low. So, the skew towards marketplaces will always be there. If a user doesn't know what to purchase or which brand to purchase, they would go to a marketplace and search for the category rather than visit ten different websites trying to research different products.

Sure, but should I prefer the marketplace to my own direct channel?

It depends on category to category. But, even if you want to sell via marketplaces eventually, you should make your first sale of a new product through your channel. Feedback is crucial for developing a better product. This is why, before enlisting the help of a trusted alpha seller (premium large third party sellers which usually enjoy preference by the marketplace), it is essential to test the waters by selling the product directly to consumers via your own channels.

A high volume of sales is not necessary. Before releasing your product to the public on all marketplaces, you need a few hundred early adopters who can provide valuable feedback and suggestions for improvements.

For Atomberg, the seller account is up and running, and for the last three months, all new product releases get channelled via it.

After you have achieved PMF (product-market fit) and positive reviews, you may go forward with an aligned alpha seller. The 5–6-month sales data also aids in region-wise stock planning, which is very useful for the aligned alpha seller.

Okay, now I am already on board when it comes to selling on multiple channels. Should I change my pricing depending on whether you sell on your website or elsewhere?

Quite a few brands make that mistake. Having the same product sold at different prices through different outlets is bad because the customer will lose trust in the product. For example, you'll find the same price everywhere when you buy an iPhone. This would only change across channels for cheap brands. Any brand that is strong enough to stand on its own would always keep the same price across all outlets. A small change of 2% to 4% here and there is fine, but the price has to stay the same if the product is the same.

But don’t brands change pricing during the sale season? Should I change pricing to accommodate the different marketplace commission structures?

This is only relevant for categories such as apparel because you need to clear the inventory in six months or so. There is a huge misconception about this aspect of pricing. The difference is usually never more than 5-10% for everything else. Trends don’t really change that much outside of fashion.

On the second question, the commission rates of different marketplaces are never that different. If Amazon charges 10%, Flipkart cannot charge 30% for the same product. The difference is never sizeable enough to affect your pricing or determine your decision to choose one over the other. And if that is indeed the case, you should make different products for that channel, like how luggage companies have been doing it. On channels where it’s supposed to always have products at 50% off, luggage companies offer items significantly different from what they would often do elsewhere.

What is my biggest conversion lever in a horizontal marketplace for a brand?

Your listing is everything. You need to have an excellent listing. You need to communicate what you are going to deliver exactly. And you shouldn't offer too much or too little. You should say exactly what the product will do and how it will do it. This will show up in the reviews. For example, if you say that your fan doesn't make any noise when it really does, people will find out the truth and give you bad reviews. More than half of the brands say too much about what their products do, which is why the reviews don't work. So, it's important to let people know what the product does. You can’t game the reviews.

Some people would try to game the system by incentivizing reviews with discounts, but this often leads to disqualification by the platform once discovered.

You should also put considerable work into finding out where your customers are making purchases to create the ideal listing. If customers make a purchase through an app, you must interact with it in the same way. Which features of a mobile app are crucial? The six or seven pictures at the very top would represent the most important knobs. You should describe the product's form and function and emphasize the product's advantages above its characteristics. Having high-quality content is also crucial. You must find out how best to use static and dynamic content in your listing.

Check for the following pointers to ensure A+ content: Avoid content errors; pay attention to image size and resolution; proofread your content before uploading; emphasize your product's unique selling proposition (USP); keep your content brief and to the point; combine images and texts; capitalize on product reviews

And the second lever is the value proposition. Why? Because when you go to a market, you can compare ten different things. So, if someone else sells a product for INR20 and you sell something for INR100, you must explain very well why your price is five times higher. If you can justify that, you will have a critical mass of consumers coming and purchasing your category.

What’s different about selling on Flipkart as compared to selling on Amazon?

Flipkart is a browse-led platform. If you need jeans, you would not search for chocolate. You'll go to the categories tab, then go to the clothes as a category, and then browse what all products are there. That's what a browse-led category means. Your CPM (cost per impressions) advertising take on added significance in the Flipkart setting since around 60% of purchases occur through category-level browsing.

Flipkart is a channel that usually works once existing demand for the brand exists. So say, for example, if you're starting out today, till the time there is existing demand, and you've already reached a certain scale, you should not try to scale Flipkart too much because then the economics will not work out.

In contrast, Amazon is search-led. If, for example, you need a pair of jeans, you might go to Amazon and search for jeans on the search tab. It's a lot like Google search for your search ads.

The same rules apply to a search platform for e-commerce, just like they do for Google search and Google SEO. This also means that if someone searches for something, and your ad comes up, but people do not click on it, or people click, and people do not convert, you end up start paying more for those keywords.

The same thing would apply to Amazon search as well. For example, if you’re selling a ceiling fan, but you start showing ads on the table, fan keyword, it'll not convert and as a result the CPCs will go up significantly. The same thing would be applicable to Amazon search as well.

If you're showing ad that doesn't convert, platforms can penalise you and make you pay more for the same keywords, which means your quality score decreases. So incorporating the right negative works is also very important here.

How can I get the most out of Amazon?

In the case of Amazon, A10 algorithm (its own proprietary search algorithm) is the hub of the Amazon compounding flywheel, which includes advertisements both on and off the site and user reviews and ratings.

To begin, you'll need a flawless advertisement with all of the proper details included. Since neither the page nor the brand are yet well-known, organic discovery will be low initially. But because Amazon has a significant number of searches and a high-intent audience, advertising on Amazon is a terrific approach to get new visitors to your site.

You may boost traffic and sales on Amazon using off-platform strategies like Google/Facebook advertisements and influencer marketing. It's possible that paid traffic conversion rates will be modest at first, but as sales of the SKU grow, the quality of ratings and reviews will rise, and the effectiveness of the advertisements will decrease.

However, there’s one caveat here. The only thing to track here is your brand searches that happen on both platforms. If your brand searches are increasing, that means whatever you are doing off platform that is working for you. It’s a mistake that people try to do is try to measure conversions that happen from Google and Facebook ads on Amazon. That cannot happen.

The different types of Amazon PPC (pay per click) Ads are Sponsored Product Ads, Sponsored Brand Ads, and Sponsored Display Ads. To start with, allocate a budget the business can afford, and start with small budgets.

Launch a Sponsored Product campaign with auto-targeting (where Amazon’s algorithm does relevant ad placement for you) and let it run for a few weeks. Run the search term report for the campaign and segregate the converting keywords into three buckets and launch three manual campaigns: generic keywords, brand keywords, and competition keywords. Optimise and scale the campaigns by regularly monitoring high-performing and low-performing keywords, and scale them by allocating more budget or improving the bid. Keep adding keywords regularly based on auto-campaign results and your own category understanding. Once you reach a certain scale, introduce Sponsored Brands and Sponsored Display Ads into the mix.

As the SKU's sales history gets better, it starts to get found by general keywords, which speeds up sales, gets more reviews and ratings, and leads to better conversions. Repeat searches, strong word-of-mouth, and off-platform branding efforts all lead to more brand searches.

The great thing about the cycle is that as the SKU starts selling and getting ratings and reviews, it gets more and more attention on its own, and you have to use ads less and less.

You could get results in a month or so for a fast-moving item. If it's a slow-moving item, you’ll need to get the critical mass in some time. But in most cases, you should understand whether you have a decent product market fit in that channel by the time you get a hundred reviews.

If you have PMF, you can sell it on Amazon in a way that can be profitable and repeatable. So, keep improving your ads and making more sales that don't come from ads. However, if these measures don't improve every month after the sixth, you don't have a product-market fit, and no amount of advertising know-how can fix that.

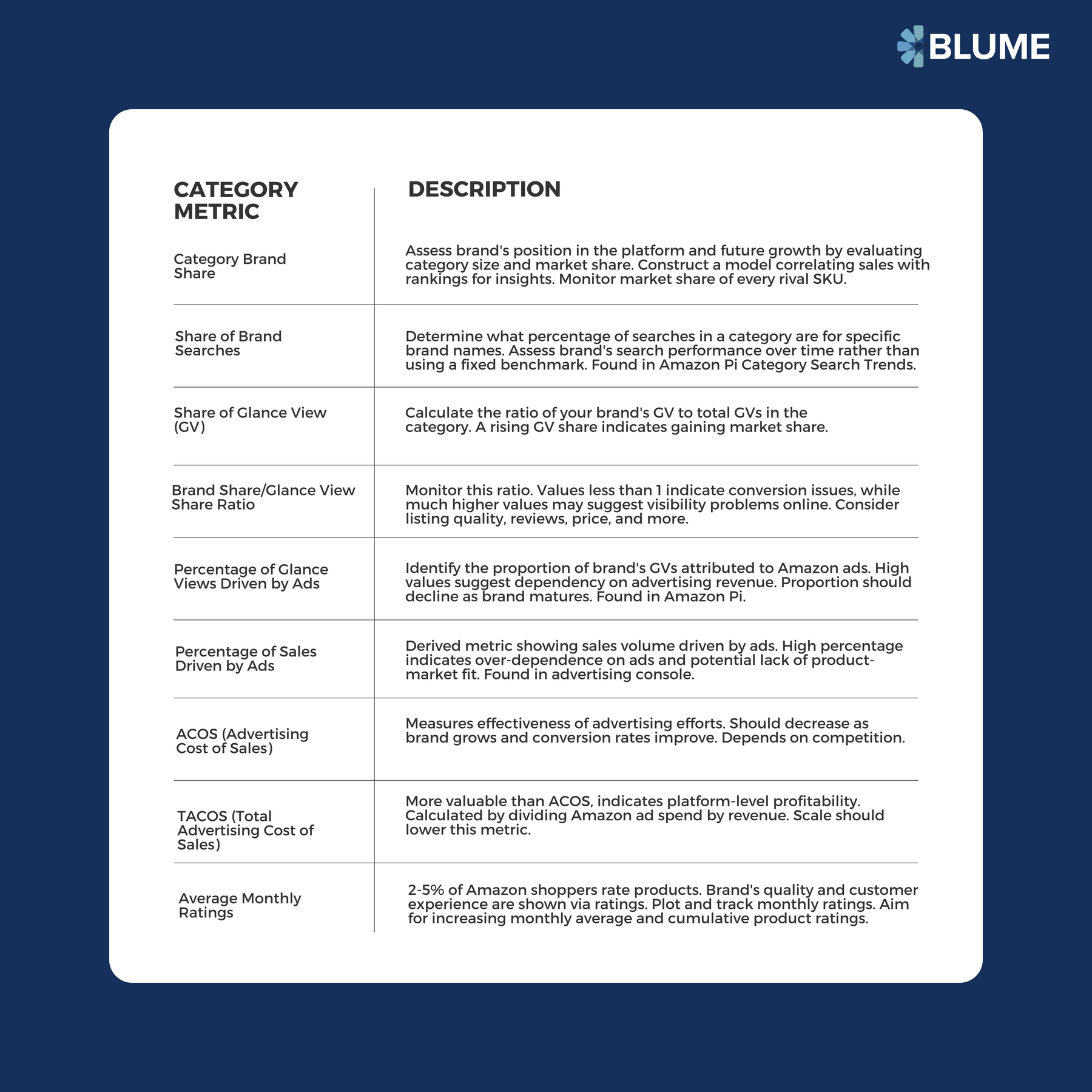

How do I track the health of my brand on Amazon?

The best way to determine what works is the PMF product market channel fit. But there are many ways to measure your ad reliance.

As you scale, your ad dependency should decrease. Your conversion rate, organic discoverability, ratings, and reviews should improve over time. Metrics can assist. Some examples here of metrics below:

TACOS is a better sign of determining whether your marketing function is effective rather than comparing one channel's ROI to another, as we suggested in a previous post. For example, increasing your hero product's user base and attracting a new demographic of consumers may both be accomplished via separate means, but TACOS will give you the overall picture.

Does my approach change on Flipkart?

Flipkart is like a contemporary trade store where you explore shelves rather than asking the shopkeeper to show you a category. Because it's browse-led, display advertisements matter as much as search ads. Targeted display advertisements have worked well for those who looked at the category competitors.

Also, Flipkart's target is generally not the top 1% households. Flipkart lets you generate demand beyond the 1%. In fact, Flipkart's supply chain is particularly robust in Northern and Eastern India. But try not to discount a lot. If you're a luxury company that values its prestige, you shouldn't go crazy with the markdowns.

Also ensure your product selection is to be distinct. The category team owns several category page assets and likes to highlight exclusive products where they collaborate with businesses to discover a category pain point, address it, and create an exclusive solution. This solves the customer's problem and prevents them from leaving the platform to purchase the goods. Still, don’t go overboard with numerous exclusives.

If you're a fresh, premium brand, Flipkart is hard to earn from. Off-platform efforts like Google or Facebook brand/performance campaigns or ATL on TV are crucial.

Scaling with Flipkart requires category team involvement and alignment. Identifying long-term objectives without competing KPIs is necessary. For example, Atomberg's goal was to build the Flipkart ceiling category and boost its ASP. In the case of category managers, you should collaborate closely to develop the brand despite temporary tensions over marketing expenditures, promotions, etc.

Speaking of category managers, what’s the best way to work with them on platforms?

Understand the category's goals. Each category has a manager with annual goals. Increase the category's average selling price, for instance. If fans cost INR1500 now, they may seek to charge INR1800 next year. What's their interest? They have the same logistical cost. Thus, higher ASPs boost profit margins.

But align long-term goals. You cannot have competing aims since the category objectives will always win.

Currently, I just have a seller account. Should I collaborate with a Flipkart/Amazon seller?

At Atomberg, the decision was made simple because our supply chain had become too complex. Everyone wanted one-day delivery for this product category, and that wasn’t possible to do from 24 differently placed warehouses. So going with an aligned seller was a no-brainer.

But it hasn’t have to be that way for everyone, and there one needs to weigh the pros and cons before arriving at this decision. Some of the upsides of teaming up with an Aligned Alpha Seller (like CloudTail) are as follows:

Replication and Storage: Amazon gives all of these businesses a lot of warehouse space. They also guarantee that your products are at all warehouses, allowing most pincodes to be delivered within 24–48 hours. This is a major factor in making sales. These allied Alpha merchants also receive preference on Big Billion Days when warehouse space is scarce because they can better regulate customer experience.

Demand Forecasting: Amazon and Flipkart utilize complex models to estimate regional demand. As a result, the possibility of running out of stock (OOS) in any given location is reduced, and conversion rates are boosted.

Accounting: Invoicing upon stock departure makes for more streamlined bookkeeping. And instead of thousands of customers, only one receives a bill. All returns are consolidated and sent to one location, making the return process simpler.

But there are drawbacks as well:

- Pricing Control: Losing pricing control and relying on discounts is a slippery slope.

- Cost of Doing Business: This is usually higher by a sliver (1-2%) was compared to being a seller.

- Payment: Sellers get T+7 payments usually. But here, payment terms are normally 45 days following invoice. Due to various factors, payments may be delayed too.

- Data: As a seller, you have access to a lot more information, like the hashed Ids of your buyers, which you can use to try to get product reviews. When you work with an alpha seller, you can't do this.

All other traffic drivers (ads and native traffic) and conversion drivers (content and reviews) stay the same.

Arindam Paul’s collected observations: