What does an average phone’s life look like? In most Indian households, the most tech-savvy person or the highest earning person in the family buys the most high-end phone. When an upgrade comes along, they pass it on to a member who uses the phone “only for calls” before it finally gets thrown out in the trash. Often, people would remember they have these phones only while cleaning out their drawers on Diwali.

Still, think how cool it would have been if that old Moto Razr you loved in college had gotten you some well-needed pocket money when you graduated instead of gathering dust at home. It couldn’t happen then but is quite commonplace now.

Coming back to the question with which we started this essay. Imagine if your phone could have a more fulfilling life. Mandeep Manocha and Nakul Kumar took a meandering route through scrapyards to build a solution that helps phones get a second life. On average, a phone can last for 4-5 years, or 2-3 cycles, before it hits the dumping ground. For certain brands like Apple, which have better build quality, it lasts 6-7 years as well. Cashify still sells iPhone 6S which was launched about seven years ago.

Value in a Wasteland

Mandeep’s father worked at a waste management company. And so, he spent his childhood watching people working in junkyards recycling waste metal. This was also when he realized recycling is not hampered by the technology that converts or extracts metals from waste but by the challenges in collecting waste in the first place. Indians just don’t Marie Kondo their electronics enough.

Why exactly was this a problem? As unfortunate as it sounds, most people who talk about doing the right thing often lack the intent to go through with it, even though their heart is in the right place. Do you support recycling? Yes. Would you please ship that old laptop to a nearby recycling centre? Soon (but not today).

“We learnt this pretty hard way by running campaigns with companies such as Nokia and HP. In an economy or in a culture where we sell our old newspapers, we sell our old dabba’s and bottles, asking people to give away their old mobile phones, chargers, batteries, etc, for free, is not going to fly easily,” said Mandeep.

We can’t blame anyone. If you’ve ever hitched a long ride to Delhi’s Gaffar Market to haggle with multiple vendors only to be handled pennies for your beloved first laptop, you’d know the pull of hoarding.

“People needed to know that this price was validated by at least some seller and hence the natural option for most people would be to go to OLX or Quikr to sell these mobile phones. But they had to invest their time and energy and the price was not very clear,” said Arpit Agarwal of Blume.

This was the cue for the founders to go to OEMs and work with them to bring old devices from people's homes. They called it ReGlobe.

While this was shaping up, the duo got swayed by another development. A friend running an E-waste recycling factory learnt of a new technology coming up in China: you can now convert scrap rubber and automobile tyres into oil. The chemical engineer in Mandeep was excited. After meeting vendors in China in 2011, the founders were now in the rubber-to-oil business.

They ran this profitably for two years before the tyres creaked to a halt. First, scaling a manufacturing-heavy business is hard when you go from 10 tonnes to 200 tonnes. Second, they were feeling FOMO at a time when their peers were starting digital-first businesses. Sure, they were making money, but building a lifestyle business at the age of 27 wasn’t their end goal. The business was sold in 2013.

One man’s trash….

And so they went back to the drawing board (or rather drawers) to flirt again with their initial idea of old electronics. They figured a huge opportunity in repairing, refurbishing and selling these assets as most people can’t afford an Rs.40,000-50,000 laptop, but are willing to shell out Rs.15-20,000 for one if it does basic tasks well enough.

To test the idea, they bought 100 laptops from Nehru Place, Asia’s biggest electronics market. They set up an ecommerce website to sell refurbished laptops online. With some basic search engine optimization and very little marketing spend, they sold the entire stock in a week. So they went back to Nehru Place to buy another 100-150 laptops. They did this 3-4 times before the vendors caught on and jacked up the prices.

But now the initial hypothesis was proven. The co-founders went to Amit Sethi (Cashify’s third co-founder), whom they had met at their old coworking office. Amit set

up a price calculator app where people can get their old gadgets evaluated, especially laptops. “We didn’t even know scraping. So we spent nights copy-pasting configurations from CNET and other databases. We must have done this for some 4000+ laptops in 7-10 days,” said Mandeep. Cashify was now in full swing.

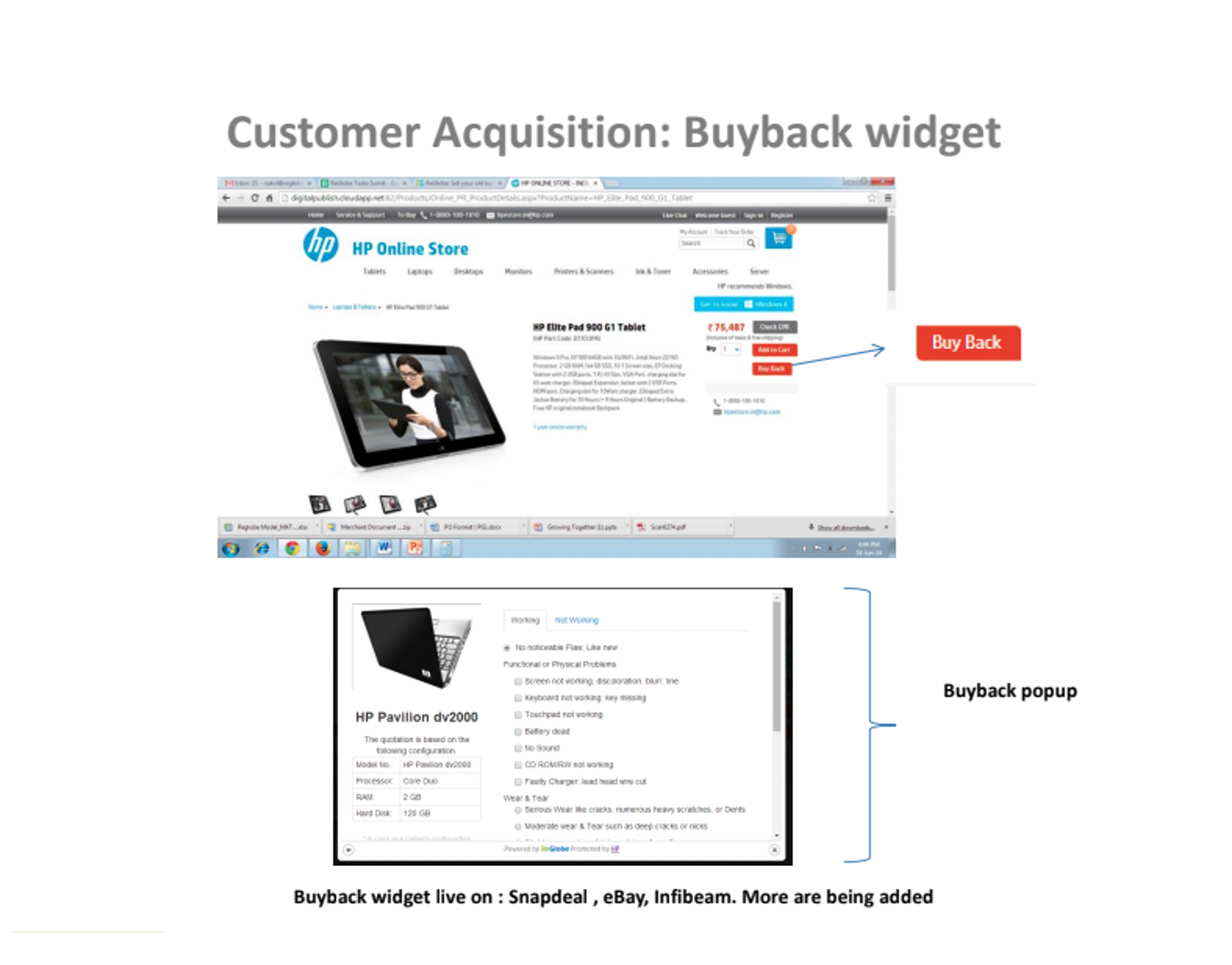

The company started the first exchange program in the country in 2014-15. They created a widget that sat on the Snapdeal website. Every time a user came to Snapdeal to buy a laptop, they would see an option to sell the old device. The journey was not as seamless as you see today (but then, the first steps are never the steadiest). You had to pay the full value of the laptop, and then Cashify would pick up your old device later.

And boy, did their steps get steady! When they first started, Cashify had an internal target of selling 1000 laptops per month The team told themselves that this will be the milestone when they can safely say they have arrived. The company sells 150,000 devices a month now.

The parts that makeup Cashify

Cashify’s business can be divided into two parts: one is buying devices, and the other is selling devices. In between this sits a layer of repair and refurbishing. To source devices, Cashify buys directly from Chroma, Vijay sales, Apple stores etc. Besides these channels, when Flipkart and Amazon run exchange programs, Cashify buys old devices from them.

Cashify’s own app/website contributes 60% of the devices it gets. Buying from consumers through partnerships (OEMs and large format retail chains) is another 35%. The remaining 5% are purchased from Flipkart and Amazon. Two years ago, just Flipkart and Amazon would pull in 60% of the devices.

“We've consciously made efforts over the last few years to de-risk ourselves from supplier concentration and built channels to buy devices directly. Think of any OEM in the country, be it, Apple, Samsung, OnePlus, OPPO, or Vivo, we run their trade-in and exchange programs,” said Mandeep.

For most of these OEMs, Cashify does almost 100% of their volumes, except for Apple, where it is about 75-80%. For Reliance too, it stands at 100%, coming down to 45-80% for Chroma and Vijay Sales. OEMs know that offering exchange is important to get new customers as all their existing customers now have a smartphone. So instead of offering a cashback or a discount, they’d ask the customer to bring back their old phone and upsell them to a new one.

Selling to aspirational buyers

Once you have the phones, Cashify sells them through three channels: the offline market, its 190-owned stores, or its website and app.

Devices sold directly to consumers make about 15-25% margin while those distributed through offline channels earn about 5-10% margin. Cashify’s average selling price on the e-store & retail businesses is about Rs 20,000 and for offline distribution is about Rs 10,000.

Now that we bifurcated Cashify’s business, let’s do that for its users as well. The user who sells the phone to Cashify can be categorised in two ways: one is a premium user who may have bought an iPhone or OnePlus and now doesn’t want to haggle in the second-hand market. Such a person will simply park the phone in a forgotten drawer. The second is the value-conscious customer who is using his old phone as a currency to buy something new.

A customer buying a refurbished phone does so for the aspirational value of the brand that they otherwise can’t afford. And this is evident in the numbers on Cashify’s website - more than 50% of Cashify’s search volume on the platform or in retail stores is for an iPhone.

Cashify is now focussing on showing itself as the preferred way of buying a new phone. Why is this important? To build enough demand to be able to liquidate the device inventory that you bought quickly enough to make money. Keep in mind that phones are depreciating assets and in this business, you can’t be sitting with an inventory without selling it for months.

“What we've clearly identified is people want to improve social capital by purchasing these branded smartphones at a much lower cost. And that is what we are now focusing on in our communication,” said Mandeep.

Sometime last year, Cashify elevated Siddhant Dhingra as its co-founder to beef up its leadership for this next growth phase. He handles alliances & OEMs with retailers for the company.

Next steps

Acing this communication is one of the biggest barriers to entry into this space. One half of the battle is perfecting the sourcing channels by building partnerships with OEMs and incentivising consumers to sell instead of hoarding devices. The second part is communicating to the user that your company is a trusted brand from where they can buy a second-hand phone and not worry about it conking off within a week.

“Today, we have a program running at Reliance, which is a roughly an ecosystem of about 2300 stores. It took us three years to get the ball rolling with Reliance. That’s how much time it takes. That lead time is a big advantage we have over new players. It is difficult for them to build very strong relationships with large format retail chains quickly,” said Mandeep.

Cashify is also benefitting from the tailwinds of the smartphone parts becoming expensive, driving up phone prices. This is making second-hand phones attractive and more people are willing to buy a second-hand device at say 30% to 40% discount.

The pricing engine was the most important hook, and still is! Every second-hand phone has hundreds of different combinations of things that could be wrong with it, which makes it complex to determine the price of an SKU. But Cashify cracked this through a sophisticated algorithm, quickly becoming the industry-leading standard. So much so that offline shops often use Cashify’s price as a base price to offer to their customers. Think about how people compare prices online for a cab or for clothes before they make purchase at a physical store.

“In this phase of growth, reorientation of strategy is required to be able to orient more towards higher margin categories. For example, liquidation to consumers is the highest margin business. At the same time, they have to make sure that they are not losing their edge in the market on the B2B side because there will always be devices which need to be liquidated,” said Arpit.

Cash for Cashify

Joseph Sebastian of Blume believes there are two ways of looking at Cashify’s business. One is from the perspective of it being a marketplace 2.0 story, an evolution of OLX, Quikr, and similar marketplaces. And the second is a unique emerging economy problem where you solve for reliability in a trust-deficit society.

OLX and Quikr started with efficient information discovery. They allowed you to figure out where a second-hand phone is available close to your current location, and the price at which you can interact with the seller, a significant step-up change from the earlier system of classifieds.

But when Cashify came in, there were a bunch of companies taking on some of these categories and building verticalized platforms for them. Think Spinny or the furniture players. And underlying that trend is the realization that in a low-trust market like India, the big friction point is not discovery.

“There is an economic theory called the Market for Lemons by George Akerlof. It's about information asymmetry, which lays out how a second-hand market for goods, cars, mobiles, etc., is driven to market breakdown or a significant reduction of price because nobody can assess the real quality of what is being sold,” says Joseph.

This lack of trust is where Cashify’s opportunity lies.

Even then, it's just not a sexy business. Buying second-hand mobile phones is not something that you think of every day. If you see all the major action that has happened over the last 6-7 years, it has been in high frequency-of-usage businesses like cabs ride-hailing, food delivery, or grocery delivery. A used mobile is something that you think about once a year. It's a low-margin business. If you just do the trade arbitrage, if you don't repair, refurbish on your own and sell direct to consumers, it's a single-digit margin business. So, it does not attract a lot of people.

For the longest time, there were no billion dollar comparables in the US or any other markets. There was Aihuishou in China (and now BackMarket in Europe), but for investors it was tough to believe these could be replicated in the Indian market.

“If you can't relate to a product, you can't invest in the company. In 2015 there was a limited group of VC is in India. So for them to relate to this problem became a big challenge,” said Arpit.

Finding the true picture required going a few levels deeper. “I had connected them to a few investors, but when those investors weren’t interested, I asked myself, why don’t we do it?” said Arpit. “I discovered that the number of businesses engaged in the used phone business in 2015 or 2014 end was already more than 10,000 SMBs across India. So simple estimate could be applied and this was easily looking like a USD3-4Bn opportunity.”

Blume first invested in Cashify in 2015 and has since participated in subsequent rounds as well. “I think what we did right back then was that we did not wait for the market to discover the opportunity and led the seed round. Throughout these eight years, our entire platform has played an active role in helping founders shape the company to fulfil its true potential, whether that is via introductions to investors or acquiring talent or giving prudent financial advice,” said Arpit.

Now the people thronging the new Apple Store at BKC in Mumbai might be fanboys of an extremely high degree, most phone enthusiasts wouldn’t be that crazy and will be happy to get an iPhone at a reasonable price (it’s just cooler that way). Now we wait to see the company’s cash-for-trash strategy play out and how Cashify becomes the preferred way to buy your next aspirational phone.