Imagine a startup with millions of dollars in ARR.

Now, make a hard pivot because you are convinced the future is starkly different from what you see today.

Give up almost all revenue. Rebuild the business brick by brick to tens of millions of dollars.

Now, do it twice.

Reach 100s of millions of dollars in revenue as a result.

And in the process, revolutionize how global retail behemoths manage warehousing and inventory management.

That’s the journey of GreyOrange, a robotics and AI giant and Blume Fund I company.

The company, led by CEO and co-founder Akash Gupta, has signed up Fortune 100 companies as customers, survived near-death experiences, and experienced almost everything in between.

Currently, they have more than 650 members across the US and India. Their revenue last year was ~$100 million, and they have 15,000 robotic agents deployed worldwide. Their customers include H&M, Adidas, IKEA, Apple, and Walmart, to name a few.

By all means, they are on track to become the first one billion-dollar ARR Indian deep-tech company.

But to know how far they’ve come, it’s important to go back to when GreyOrange was just an idea. Just a thought. Just an experiment.

Every big journey starts with a small step.

Or, in GreyOrange’s case, with BITS (Pilani) and atoms.

The BITS Boys

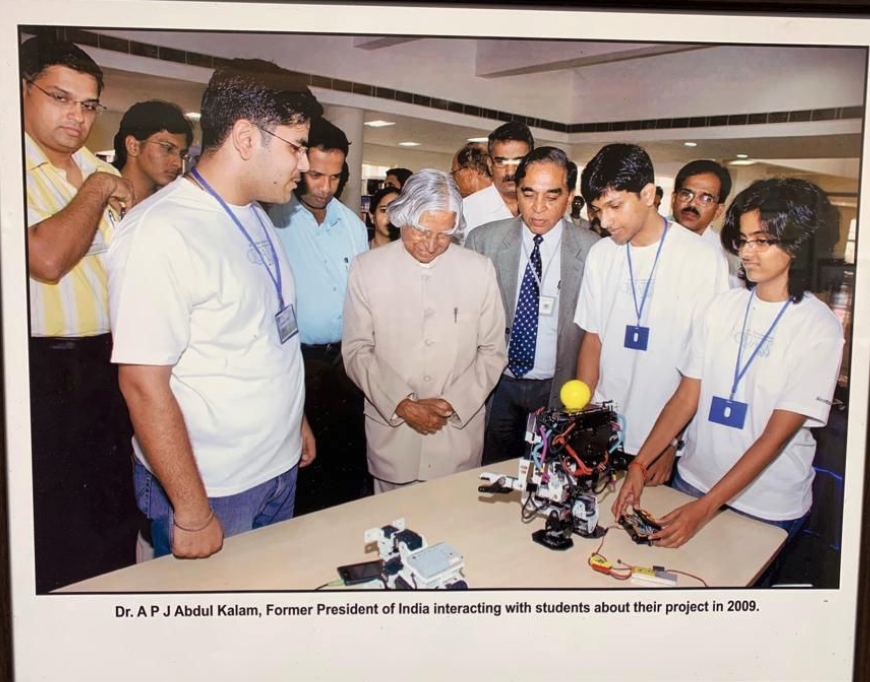

Samay Kohli and Akash Gupta were tinkerers at heart during their days at BITS Pilani.

They were instrumental in creating India's first humanoid robot, AcYut, which competed internationally and won several awards at the prestigious RoboCup.

Their first brush with entrepreneurship was a way to fund their humanoid project—they started organizing robotics workshops in colleges. These workshops, starting with their first at IIT Bombay, became very popular, laying the groundwork for their entrepreneurial path.

After BITS Pilani, they chose not to pursue their robotics workshops business despite its early success. Both of them also decided to opt out of placements at BITS.

That’s right. In a ‘placement-first’ country like India, they believed what they had discovered was special.

That’s when they ventured into product development under GreyOrange Robotics (later shortened to GreyOrange), initially creating white-label products for diverse industries in 2011-2012.

Their work ranged from medical devices to sonar stabilization systems. But soon, they realized that they were spreading themselves too thin.

Hence, in early 2012, they decided to choose one of three industries: oil and gas inspection, supply chain management, or railway track maintenance.

Initially opting for oil and gas inspection robotics, they quickly encountered the challenges of murky practices in the sector and abandoned their pursuit.

This decision marked a pivotal turn towards focusing on the supply chain, setting the stage for GreyOrange's future success.

It seemed boring and unsexy!

However, their early experiences experimenting with humanoid robotics and automation prepared them for a massive undertaking in the future.

The Flipkart Factor

The biggest early shot in the arm for GreyOrange was a college senior's introduction to Flipkart, which was also starting up and finding product-market fit.

It was 2012-2013, the e-commerce boom had just started, and the number of SKUs had exploded.

Soon, Flipkart launched the ambitious Big Billion Days sale, which put a lot of pressure on the Bengaluru-based startup. This pressure would naturally spill over to GreyOrange, too—but in a good way!

Akash: “I remember at the peak, we had to install more than 40 systems. And before that, we only had 4 systems. So, we scaled rapidly from 4 to 40+. By 2015-2016, we had installed sortation systems in any place that you could in India. You could name an e-commerce company or a courier company, we had a sortation system installed there.”

Getting Flipkart as a client meant GreyOrange started working with companies like Delhivery and Jabong. Indians were opening up to shopping online, and GreyOrange powered much of the magic behind the scenes.

Funding The Dream

Building a business like GreyOrange, especially in its early days, required CapEx.

Let’s not forget that we’re talking about the early 2010s when the venture ecosystem was starkly different from what it is now. There weren’t too many VCs, and capital flow was limited. What made matters tougher for Akash and Samay was that robotics was not a particularly ‘investable’ business for most.

While the two started working out of Samay’s basement in 2011-2012, they shifted to their first office in Gurgaon shortly after. Soon, they met Wolfgang Holtgen during one of his India trips, who became the company’s first angel investor.

A few months later, Akash and Samay were introduced to the Blume team at an event at BITS, where budding entrepreneurs were pitching to investors. Sanjay Nath, co-founder and partner at Blume Ventures, trusted the fledgling founders, who had already garnered an impressive track record.

Akash: “I think it was totally crazy for somebody to believe in GreyOrange in 2012-2013, because nobody cared about supply chain. Until of course, Amazon proved that if you really have a good supply chain, it can increase your top line. But this happened just four or five years ago. So I think it was bold of Sanjay and Karthik to look at us fresh graduates and trust us to build an automation business for the world.”

Karthik Reddy, co-founder and partner at Blume, says, “One of the most interesting parts of early-stage investing is to find something ground-breaking in frontier technology that can challenge the status quo. Sometimes, this includes the audacity to be a global start-up from the backroads of Gurgaon, and that’s what we saw in the ambition and potential of the GreyOrange founders. It was considered impossible by investors across the world and still is.

"Multiple folks highly recommended the GreyOrange team, including one of our advisors and mentors, Raju Reddy. He had built a large company and was a fan of the latest tech coming from BITS Pilani. He referred the team to Sanjay, who instantly fell in love with the problem they were solving and the boldness and ambitions of the founders. They had the audacious dream of replacing Kiva Systems, acquired by Amazon, in terms of what they can do for large-scale warehouse automation.

"In those days, that meant starting with a risk check of Rs one crore. So if you can’t make the bold decision of investing a crore in something that’s so audacious, then what else would you take it on?”

"Today, if at least 20% of our capital in every cycle is not dedicated to funding frontier technology and crazy ambitions coming out of India, why even bother with early-stage venture capital?

Interestingly, because of the Flipkart factor, funding became slightly easier as the company gained its ‘street cred’ in the ecosystem. In fact, when GreyOrange raised its Series A from Tiger, they sent its research folks over to GreyOrange’s sites to observe the technology being used!

Pivot. Build. Repeat.

The funding helped GreyOrange look beyond the Indian shores. They went outside India after realizing the market was not mature enough to scale the business.

They explored Japan, Europe, and even Chile. However, expanding to far-flung markets didn’t work out well for them because of the cultural differences in the manufacturing process.

Akash: “In general, at that time, Indian manufacturing processes and the level of attention to detail were still missing. Only the companies driven by Japanese and Koreans could boast high-quality manufacturing. If you looked at general manufacturing in India, it was fairly lackluster.”

Akash even has an interesting anecdote about the Japanese market.

Akash: “I remember we shipped the first batch of 70 robots to one of the customers in Japan. And in Japan they do a white room analysis where you keep the bot in a white light and look at it. Soon we received a long email with a picture of every bot and things like, “here is a scratch”, “this bot head seems to be a little bit damaged,” and more. That’s absolutely next level of attention to detail.”

Soon, they realized that instead of spreading themselves thin across so many markets, they should go to the one market that mattered - the US. The retail and ecommerce market in the US is the largest in the world, and retail companies have an extensive network of massive warehouses.

But it was far from easy.

Akash split his time between India and the U.S. for about 18-24 months, a grueling schedule, but essential for understanding the local customers while the team was back in India.

“Those were two very tough years,” he remarked.

Their first major project in the U.S. involved deploying 300 robots in a warehouse in partnership with GXO Logistics, where they learned a crucial lesson that later guided them to a full-scale pivot - having robots up and running is one thing, but ensuring they actually improve warehouse operations is another beast altogether.

Interestingly, partnering exclusively with GXO for their US go-to-market strategy caused some internal strife.

Akash: “Within GreyOrange, it was a fairly debated decision whether an exclusive partnership would tie our hands forever in the US. But I think it was a pretty good decision. The adoption cycles are fairly long in the automation business, which made GreyOrange and GXO very committed to each other. In a couple of years, the overall relationship grew really, really fast.

“In hindsight, it was a good decision because if both companies had not been committed, we wouldn't have grown that fast in the US. I think they committed a $100M business to us in the first three years, and we have pretty much reached that mark.”

By 2019, GreyOrange was doing well revenue-wise but shifted from selling their software outright to a subscription model.

This was a strategic move for long-term growth, but it immediately caused their revenue to dip, as subscription revenue takes time to add up.

Not many have the audacity to change their business model at such a crucial stage in their company’s growth

Akash: “It's almost like you are doing well, and then suddenly, you are going into the valley of death. But it's a good decision because you get a fairly large recurring revenue base, which is a lot more valuable and sustainable, eventually.”

Since each site took roughly 6-7 months to get started, there was a huge gap between starting the project and receiving the first dollar of payment. But it was worth it.

This was a hard pivot for the company. They essentially rebuilt the company from the ground up, shifting focus from only robotics to a combination of software and robotics solutions.

Akash: “We literally built a company to the point of achieving break-even and then completely ripped it apart. In 2019-2020, we literally started building it again because, if you look at the revenue now, nothing comes from those regions and business models that gave us revenue in the first five years.”

But just when you think you’ve prepared for everything, the unexpected comes knocking.

The COVID Tailwind

Akash: “The irony of the automation business is that nothing happens very fast. Unlike e-commerce businesses, you don't see revenues rising or dropping fast, but in COVID, of course, our customers saw crazy growth. So, there was a bump in our business overall.

“Executing it still took time because you had to add more human bandwidth. One thing that worked really well, and today has brought us a lot of business, is that we were already building GreyMatter, our fulfillment platform, on the concept that omnichannel will become very relevant.”

COVID turned out to be not just a disruptor but a great accelerator. The world of supply chain management and warehousing went through massive shifts.

Akash: “Within a week of COVID, we were able to reconfigure the software for our customers to help them make steep changes in channel mix ( retail to e-commerce), and that was a satisfying moment for us. We were building GreyMatter for an omnichannel environment with the hypothesis that channel mixes would change. COVID, of course, accelerated it by 5-10 years. The channel mix changed overnight.”

The second-order effect of the pandemic and the change in user behavior coincided with GreyOrange’s focus on omnichannel. The pandemic brought in tailwinds to their business, and GreyOrange’s ability for agility won over their customers.

GreyOrange also understood during this time that owning the whole factory-to-customer journey and not just a part of it is important.

More Software, Subscriptions, and Revenue Streams

Despite financial pressures, including a challenging period in 2022 when investment capital dried up, GreyOrange persevered. They expanded their partnership with GXO and started working with big names like Walmart, H&M, and Adidas, showing significant growth and customer success. They also unlocked newer revenue streams.

One such strategic decision was to open their GreyMatter platform to third-party robotic technologies, avoiding the costs of developing new robot types and enhancing their system's capabilities. Through this, they went further down the path of becoming a platform and introduced Robot as a Service (RaaS).

They also started building gStore, an inventory management product for retail stores, aiming to speed up the adoption of GreyOrange solutions. This new product line is a part of their strategy to connect every point of the consumer-to-manufacturer cycle and is already at ~$10M ARR.

Building these newer products and growing the revenue streams over the next few years means GreyOrange needs staying power and additional capital. GreyOrange is well-funded, having raised $135M in their latest round, led by Anthelion Capital, and ready to take on newer challenges.

Karthik Reddy adds, "GreyOrange is one of India's proudest deep tech exports. Despite a massive shift in how warehouse automation is being adopted in the US, GreyOrange is nimbly shifting its business model for the best Fortune 500 retail and commerce companies and winning market share and customer confidence."

GreyOrange has really come a long way from creating sorting systems for Indian e-commerce companies. Throughout the journey, it has redefined what innovating for the globe is.

Pivots are hard. Pivoting to a foreign country is harder. And pivoting your base while changing the business model is the hardest.

These pivots have earned GreyOrange a place in the global market.

Akash: “GreyOrange’s right to win is that we are a bits and atoms company, and we understand bits as well as atoms, which most companies don’t.”

And while it may seem impossible and even crazy to you when we say GreyOrange is ready to be the first $1B ARR deeptech company from India, we would leave you with this Nike ad slogan: “It’s only crazy until you do it.”