Scaling a cross-border SaaS startup from $0 to $1 million in annual recurring revenue (ARR) is a formidable challenge, yet it remains a crucial milestone for Indian SaaS startups.

In the following article we are going to talk about the US Software Market and the questions to answer as you get your product in front of the buyer.

Why target the US Market?

The United States stands as the target landscape for SaaS businesses, boasting a whopping $20.19 trillion GDP and an impressive $230 billion in global annual SaaS spend, with an additional $600 billion spent on cloud services.

A significant portion of this expenditure – nearly $195 billion – is reserved for enterprise solutions, while small and medium businesses (SMBs) contribute around $35 billion.

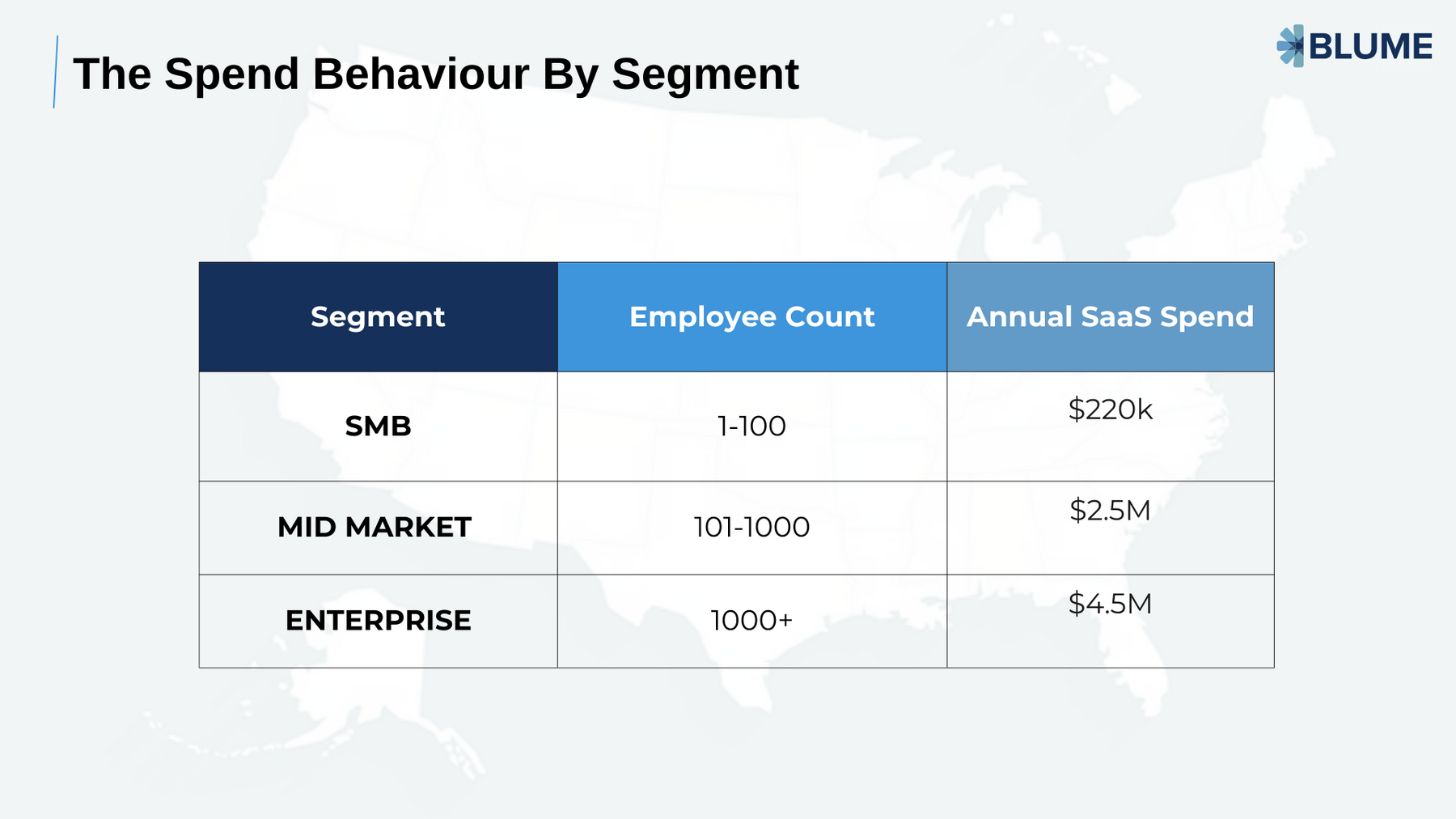

This spending behavior indicates a clear demand across diverse business sizes, with SMBs, mid-market, and enterprises spending up to $220k, $2.5 million, and $4.5 million annually per company on SaaS products respectively.

Before starting your Sales journey in the US market. We have to prepare some basics -

- Who is the Ideal Customer for your product?

- What persona in the company are you going to sell to?

- Have you considered Founder led Sales?

- When should you transition away from founder-led sales to a sales team?

- How can I design the sales motion to line up with deal sizes and target segments?

- What is Product Market fit?

- How do I validate the problem I have set out to solve?

- Do I get to choose to pursue PLG or SLG?

- How do I simplify my Sales Stages?

- What are some common mistakes to avoid?

Thinking through the ICP

Startups must begin by defining their Ideal Customer Profile (ICP), an archetype of the perfect customer based on company size, pain points, and even geographical locations.

This profile guides startups to tailor their solutions to specific needs, such as compliance issues or internal goals, and aligns with customers’ unique operational styles and technological stack.

The ICP extends beyond demographics, including organizational goals, role-based objectives, and how a product can drive success within the target company.

After you have a rough idea of an ICP then you need to define the Buyer Persona. This is the person in your ICP and their role in the buying process.

You will need to detail out what that individual’s challenges are, what are their typical roles in their orgs and how they can succeed in their roles by deploying their product.

Founder-Led Sales: The Startup Catalyst

The startup's sales journey should start with the founder. Known as founder-led sales, this approach is a blend of product marketing and management that's crucial in the early stages when both the product and market conditions are volatile.

At this phase, the founders are closest to the product's capabilities and market needs, allowing them to fine-tune the messaging, identify pain points, and differentiate their offerings effectively.

This hands-on involvement is critical for navigating the initial instability and laying down the foundations for future sales strategies.

The most common pushback I receive from founders is a version of “ I don’t have time to do sales. I am a Product/Tech founder, let the professionals do sales”

This is fine after you have achieved Product Market Fit and have found a repeatable sales motion that you can teach others to execute. Before you reach this stage there is just too much uncertainty.

- What is the Metric your product changes?

- Who is the user and who is the final buyer of the product?

- Is this the best segment/industry for this product, should I switch segments/industries?

- Is the feature request from my buyer part of my vision for this product?

Only the founder holds all the relevant information, the vision for the product and has all the equity/prestige/credibility in the startup to take hard calls. It is very unlikely that a sales employee can make these changes and decisions until you find PMF and a repeatable sales motion.

Transitioning Sales Leadership in Startup Growth

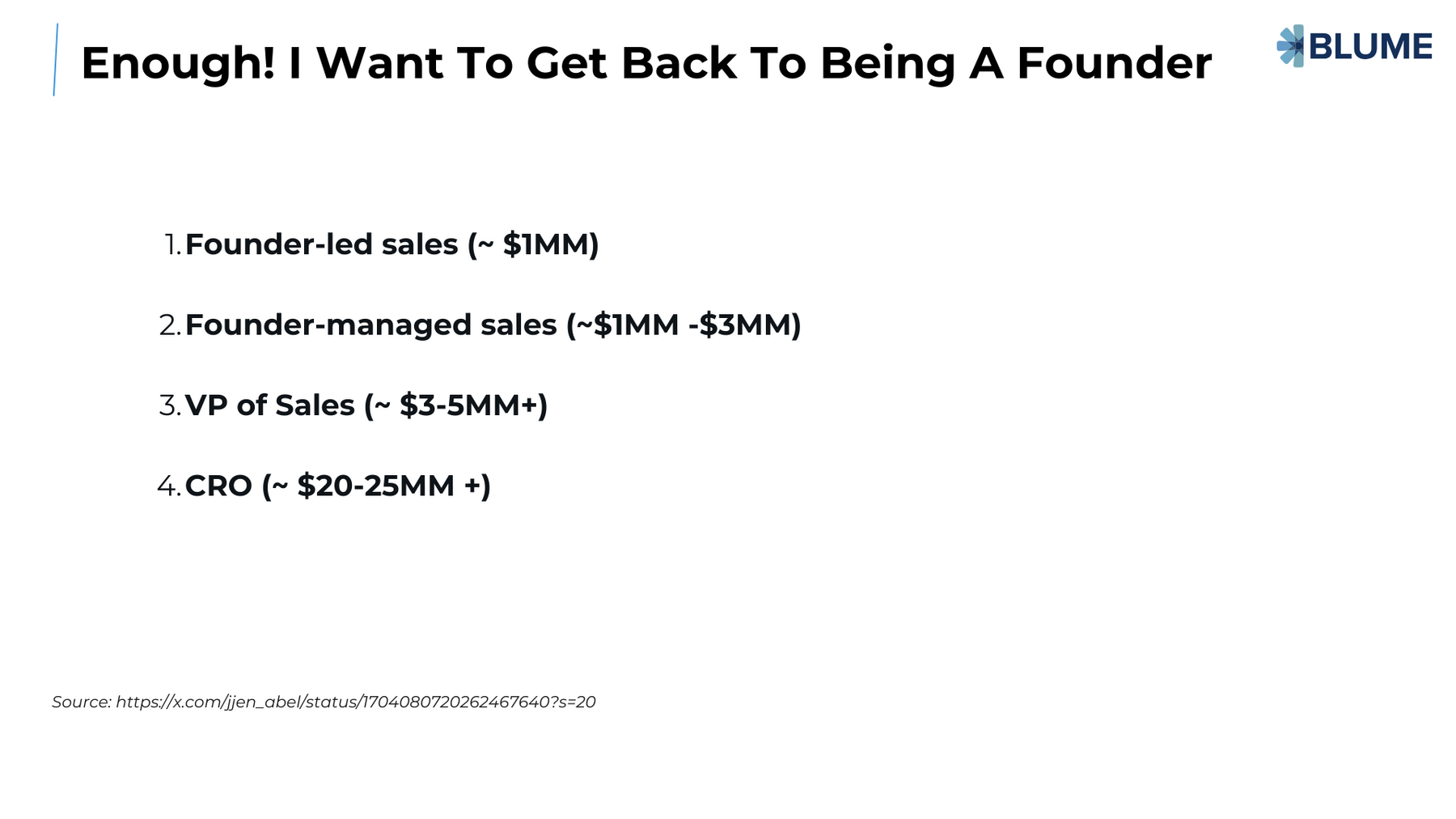

As startups surpass the $1 million ARR milestone, founders often shift from hands-on selling to strategic oversight, marking the progression from founder-led to founder-managed sales.

With growth towards $3-5 million ARR, the role of a VP of Sales becomes essential to manage the expanding sales functions. Eventually, at the $20-25 million ARR stage, a Chief Revenue Officer (CRO) is critical for aligning sales with broader company objectives, allowing founders to focus on overarching business vision and innovation.

The Lifecycle of Sales: Understanding ARR and Closing Cycles

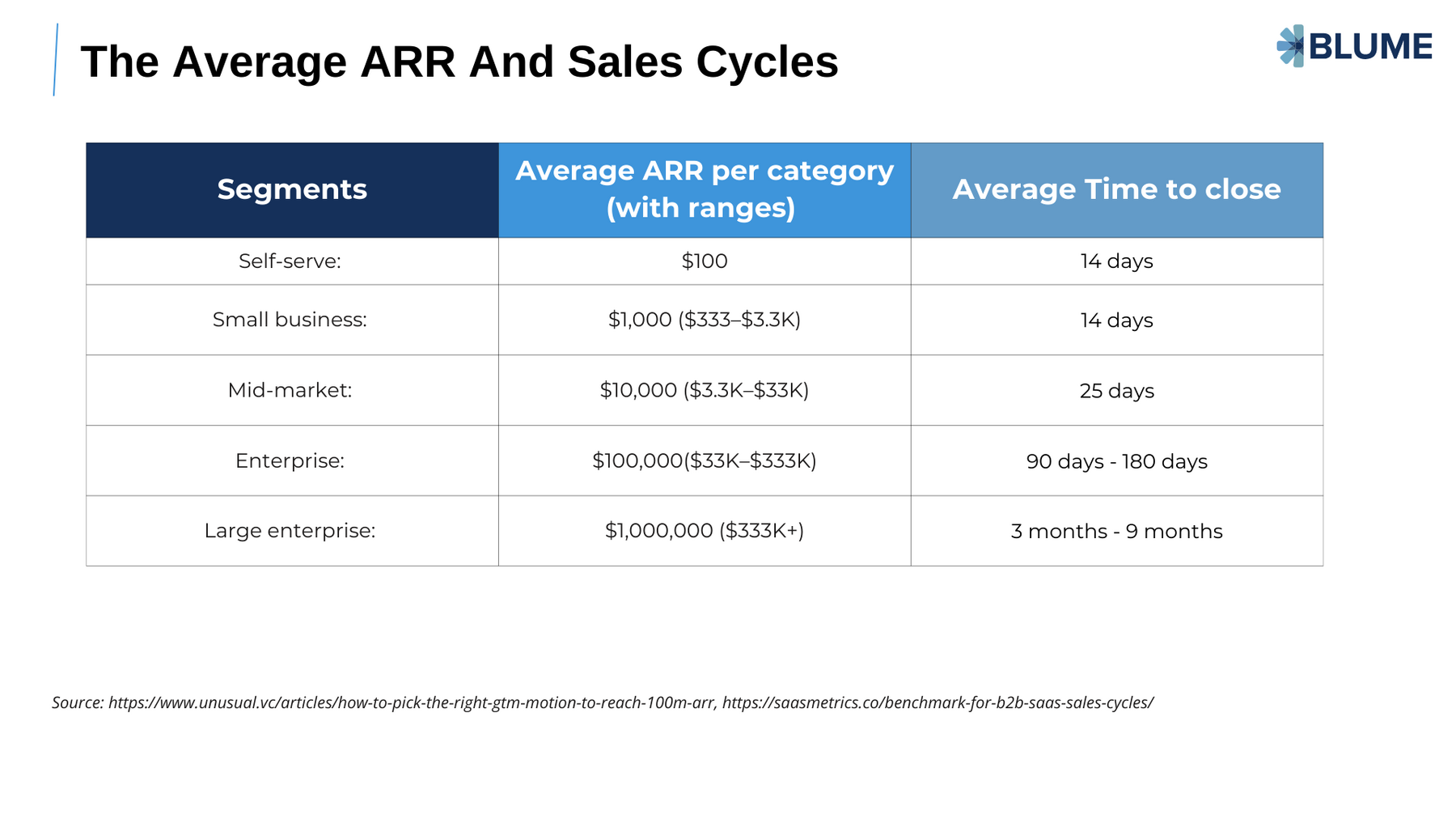

A startup's growth is also measured by its ability to navigate through various sales cycles and achieve consistent ARR across different customer segments. From self-serve models to large enterprises, the Average Contract Value can range from as little as $100 to over $1 million, with closing times varying from a mere 14 days to upwards of 9 months.

These metrics are vital for startups to set realistic expectations and tailor their sales processes according to the customer segment they are targeting.

Navigating Sales Complexity Across Customer Segments

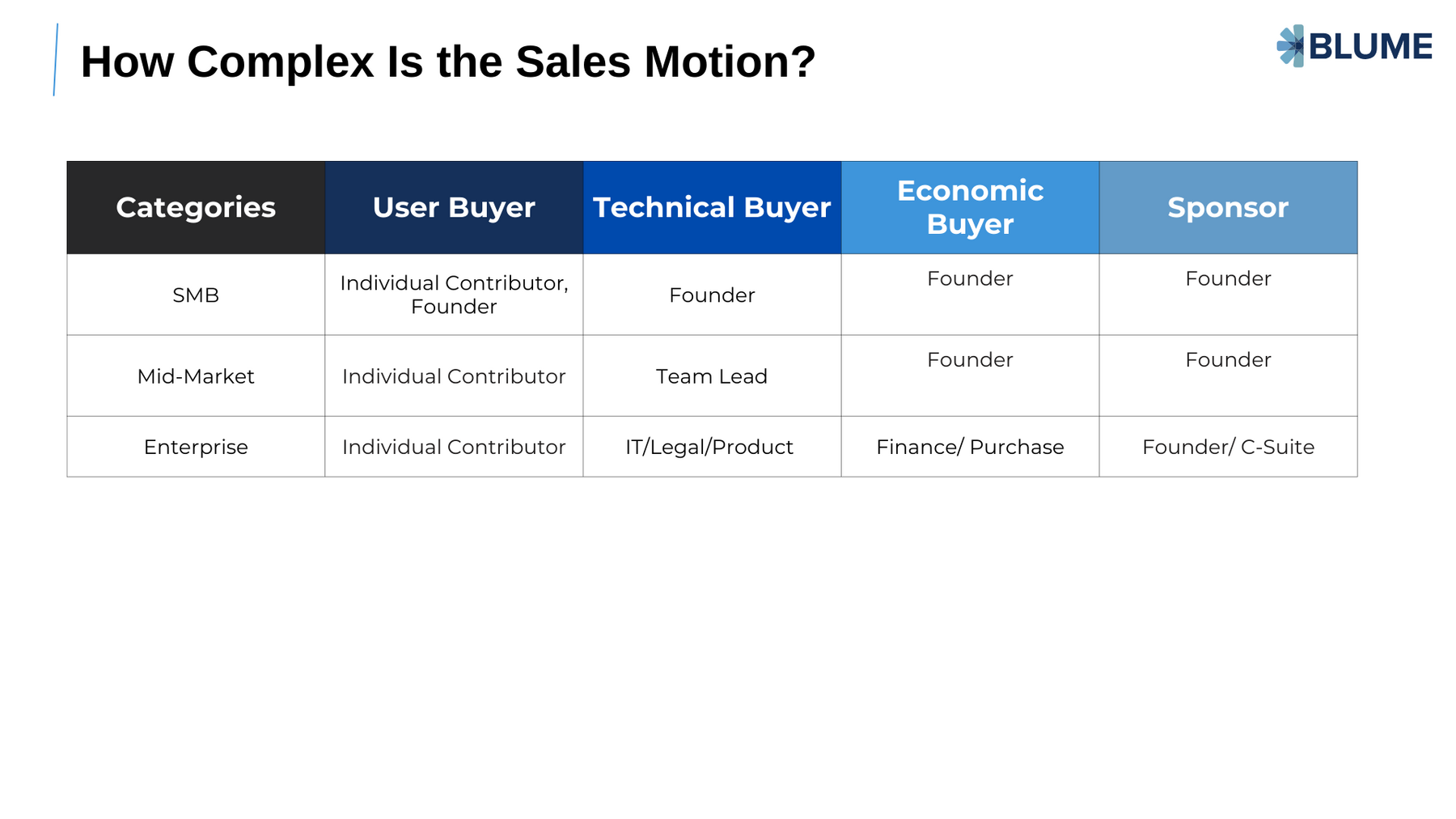

As a startup scales, the sales motion complexity increases, especially when dealing with different business sizes. In SMBs, the user buyer might be an individual contributor or the founder, while in enterprises, multiple stakeholders such as IT, legal, finance, and C-suite executives are involved in the buying decision.

As you will also see in the table above, while enterprise ACV is the highest, closing enterprise deals is the toughest with multiple decision-makers in the mix. Each of those decision makers might me in different cities or countries, have divergent incentives and competing priorities.

This is why an enterprise sales motion is compared to passing a bill in the Parliament!

This is also why most SaaS startups start by selling to Mid-Market companies. They are a good mix of high software spends, simple and direct sales motions and short sales cycles.

Understanding these dynamics is critical for startups to customize their sales approach for each segment effectively.

Validating Product-Market Fit Before Scaling

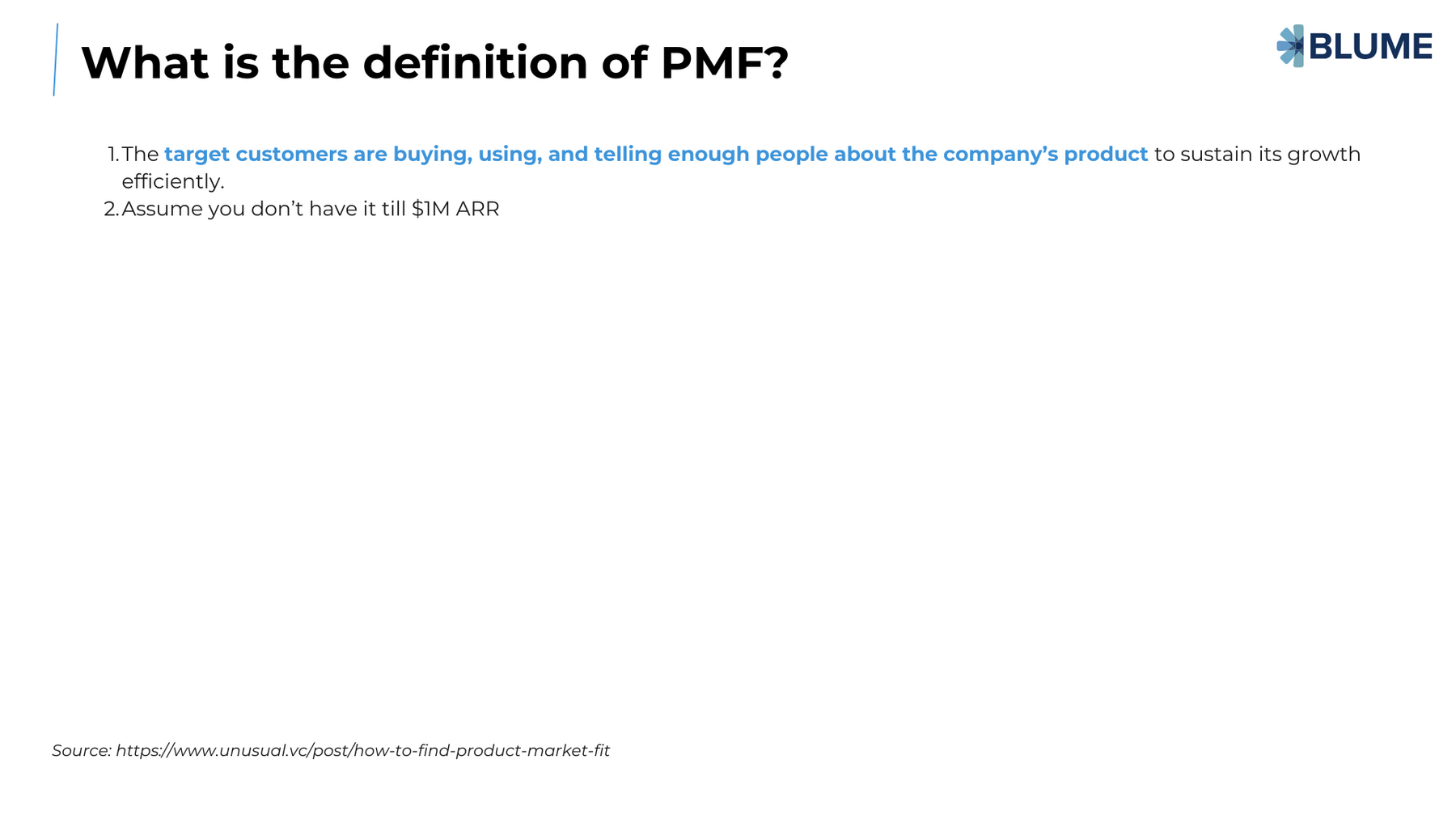

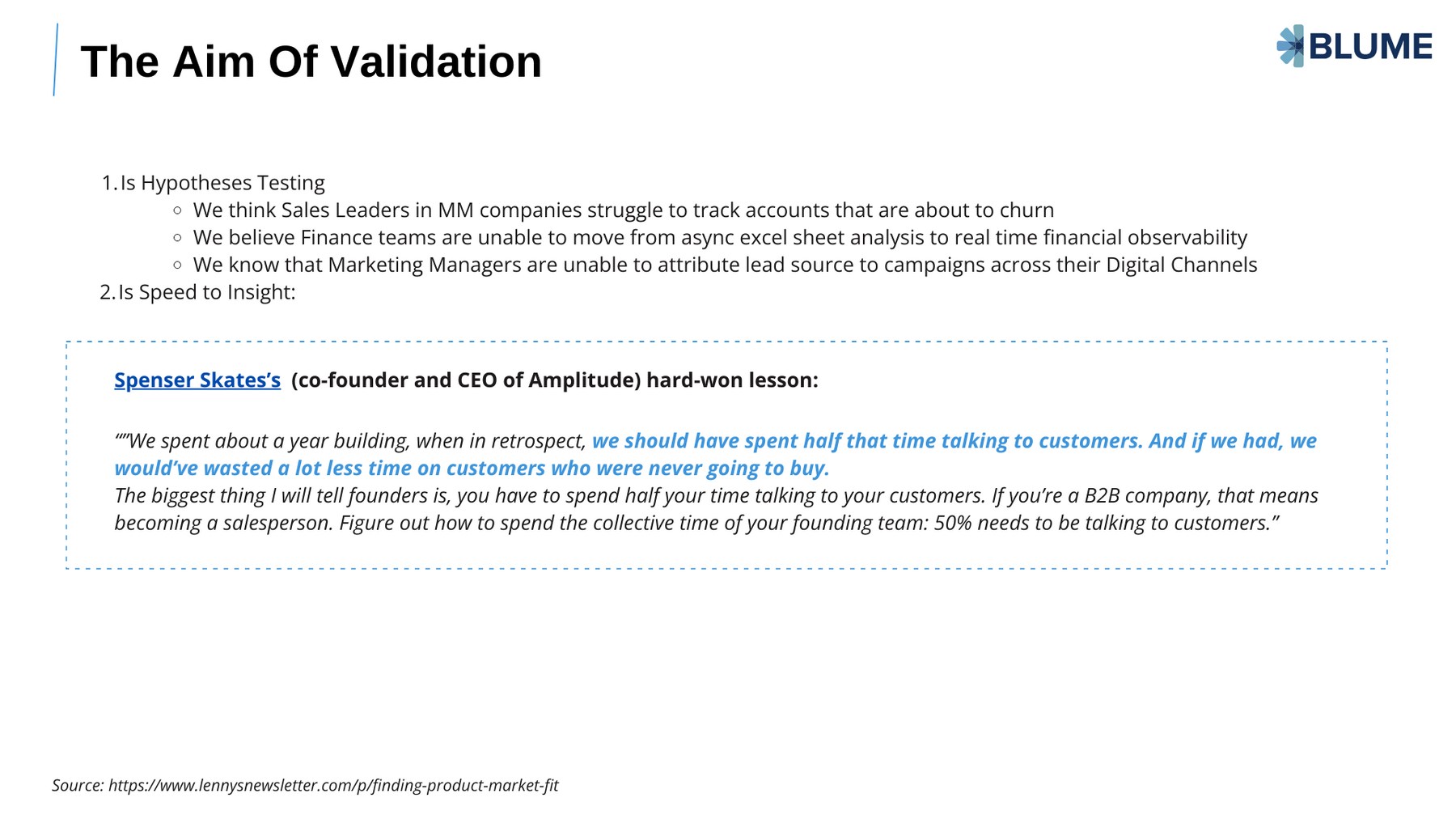

Validation is a crucial step before you decide to go full throttle, and it's typically achieved when target customers not only buy and use the product but also advocate for it, fueling organic growth.

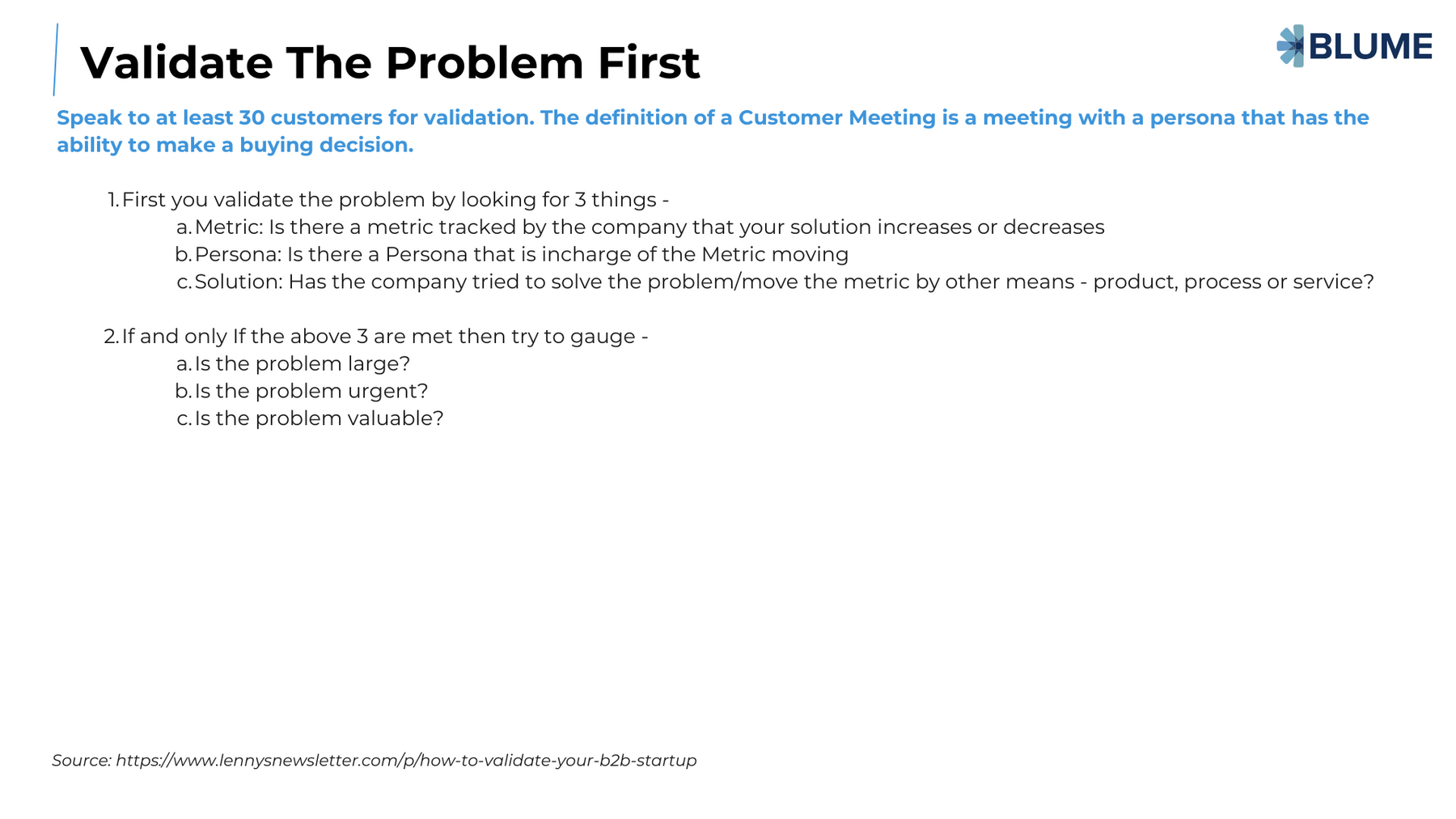

Startups are advised to validate the problem first by speaking to at least 30 customers who have the authority to make a buying decision, ensuring there is a significant, urgent, and valuable problem to be solved.

A good thumb rule for startups is to find a Metric that is tracked by the company (not one you make up or believe that your customer should use) that your product can move. Then find the person in the company in charge of moving that metric. Finally in your customer interviews ask what has been done in the past to attempt to move the metric and if it worked.

If the answer to these three questions are positive then you are working on a problem that at least exists.

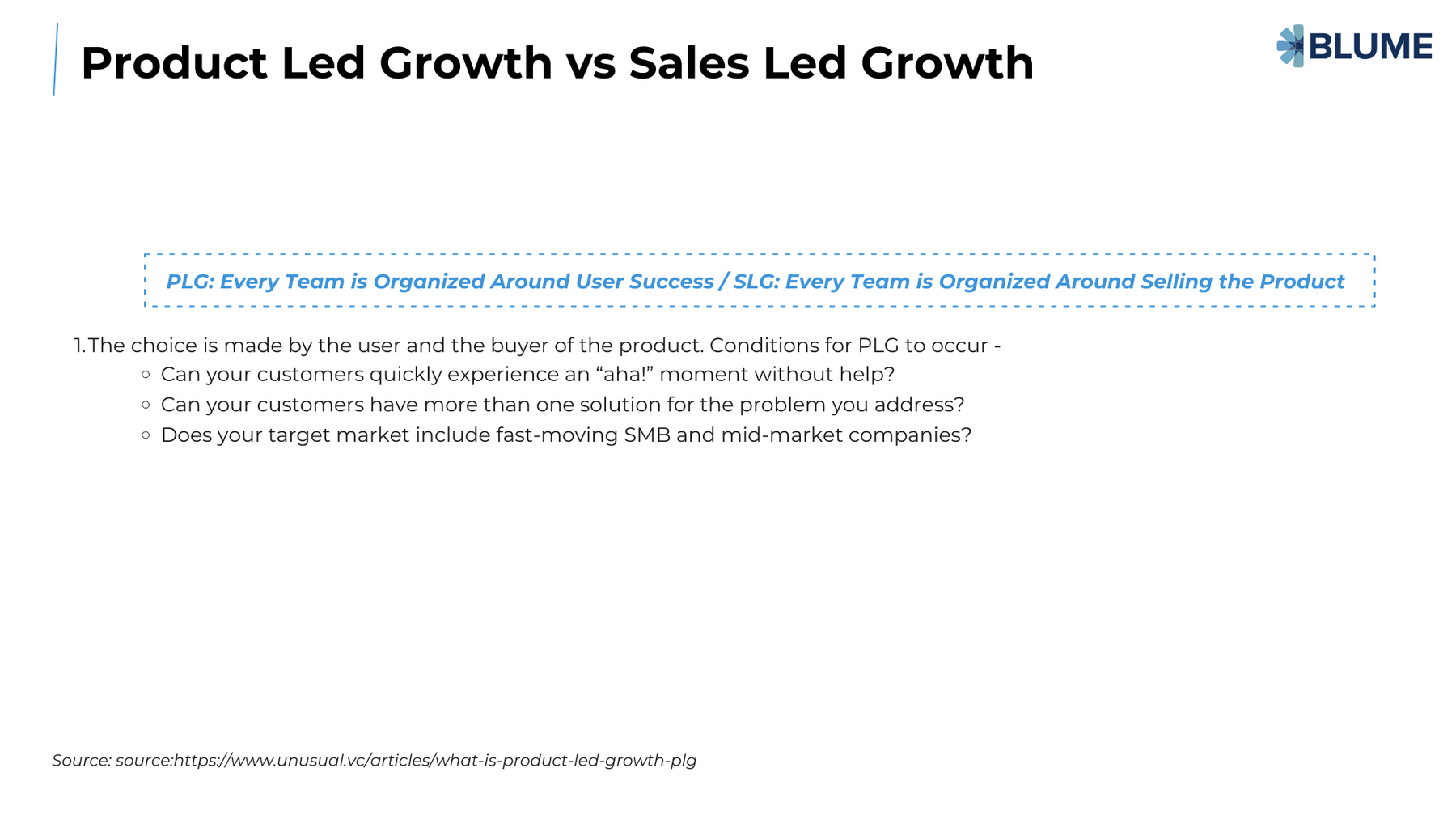

As startups move from validation to scaling, they often face the decision of adopting a product-led growth (PLG) or sales-led growth (SLG) strategy. PLG relies on the product itself to drive customer acquisition, with a focus on user success, while SLG emphasizes direct selling.

The suitability of either approach depends on various factors such as the ability of customers to reach an "aha" moment independently and the nature of the target market like if the customer can make a small purchase that tries your product in parallel with their current solution without disruption.

Streamlining the Sales Process: The MEDDPICC Framework

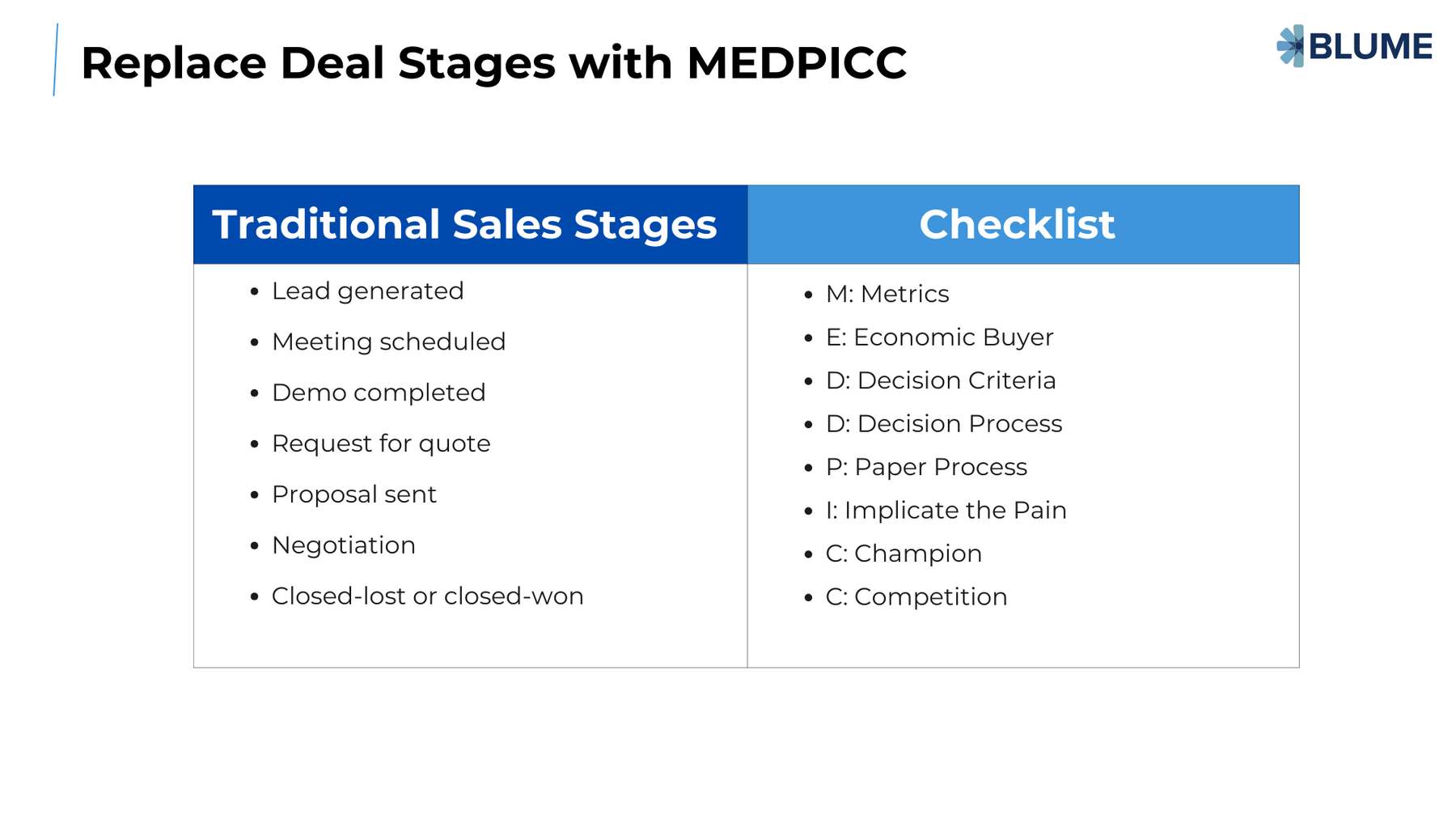

Spending time to come up with perfect sales stages to map your sales motion is unnecessary in the early stages of your journey.

Just choose a checklist approach. Startups can adopt the MEDDPICC framework, which provides a checklist focusing on metrics, economic buyer, decision criteria, decision process, paper process, pain implications, champion, and competition.

This approach keeps the sales motion simple and focused on essential factors that influence a successful sale.

The Road Ahead: Avoiding Common Pitfalls

The journey to $1 million ARR is fraught with common pitfalls. Avoiding these mistakes is paramount for sustainable scaling.

- Choosing Inbound or Outbound tactics

Should a startup prioritize an inbound motion (writing blogs, doing SEO etc) vs an outbound sales motion? This is a false choice. You have to start with outbound reach outs and on the basis of your conversations you discover pain points, priorities and the language your buyer uses.

These are then fleshed out into blogs, tweet storms and other content that enable similar buyers to find you. Outbound first, quickly followed by inbound.

- Falling in love with a few Design partners

A lot of technical founders find 2-3 design partners and then stop all new sales activities in the hope that a perfect product will emerge by serving these design partners.

There are a few challenges with this.

- Sales is a lot about momentum. If you stop sales activity after finding design partners it will take a lot of effort to regain momentum.

- A small number of design partners also present concentration risk. They can start engaging with you for internal reasons of their own like shifts in their product roadmap. Better to have a large pool of prospects you are building for than a small set of design partners.

- Design partners often give a false sense of security, without skin in the game, they treat you like an extended team to try out new ideas. Who doesn’t want to talk to a smart founder, give feedback and try new products without spending much money and time.

- Hiring a sales team before hitting $1M ARR

If the founder is hiring senior AEs or a VP of Sales before $1M ARR then the founder is giving up on raw feedback from customers. These are vital signals that can affect the future of your product roadmap.

The founder is now spending that time doing deal reviews and managing the onboarding, education and sales careers of the new hires.

- Selling to Enterprises early

Enterprises are tricky beasts. They present large targets. A single sale can double or triple your startup's revenue. But there are significant risks.

- Enterprises dance to their own beat

Your buyer can leave to a different part of the org, be fired or have her priorities changed. No fault of yours.

That entire division can be laid off or have their product shutdown. Nothing you can do about it.

- Immune rejection

Enterprises have entire departments designed to protect them from overpriced, unreliable and unsafe vendors and partners - IT, Legal, Compliance and Purchase are some of these.

These are good people doing the job of protecting their employer.

Large sales teams of established companies like Microsoft, Oracle etc have the margins, manpower, brand and relationships to navigate these departments.

Startups often do not have the runaway to answer every question, tick every box or be compliant with obscure laws.

5. Treating Product Market Fit in India as Product Market Fit in the US

The US Market is just too distinct to treat any other market in the world like it. If you find that Indian payment or insurance companies are using your product that might indicate that US payment or insurance companies would consider your product. But it in no way means that your sales motion simply can be copied and pasted in the US. Or that your current product will work.

At the risk of broad generalization there are a couple of points to consider

- The US buyer expects higher level of product finesse

- In exchange the US buyer pays a higher price and is willing to self-sign on or read documents to get started

- The Indian buyer expects hand holding and a higher level of services support to get started

- The Indian buyer would prefer you monetise via transactions rather than directly paying for software

So if you are launching in a new geography like the US just assume you are restarting your PMF journey.

6. Conference hopping before PMF

A new trend in the startup scene is early stage Indian founders moving to the US in the months of September and October to hop among various conferences.

Conferences are a valid channel to meet buyers, especially enterprise buyers. But founders visiting tech conferences in the US before finding PMF seems like an extravagance that actually shortens your runaway.

Unless you are attending a conference that gives you access to some small niche like government or spacetech buyers most conferences are not good sources of your first customers.

Further Reading

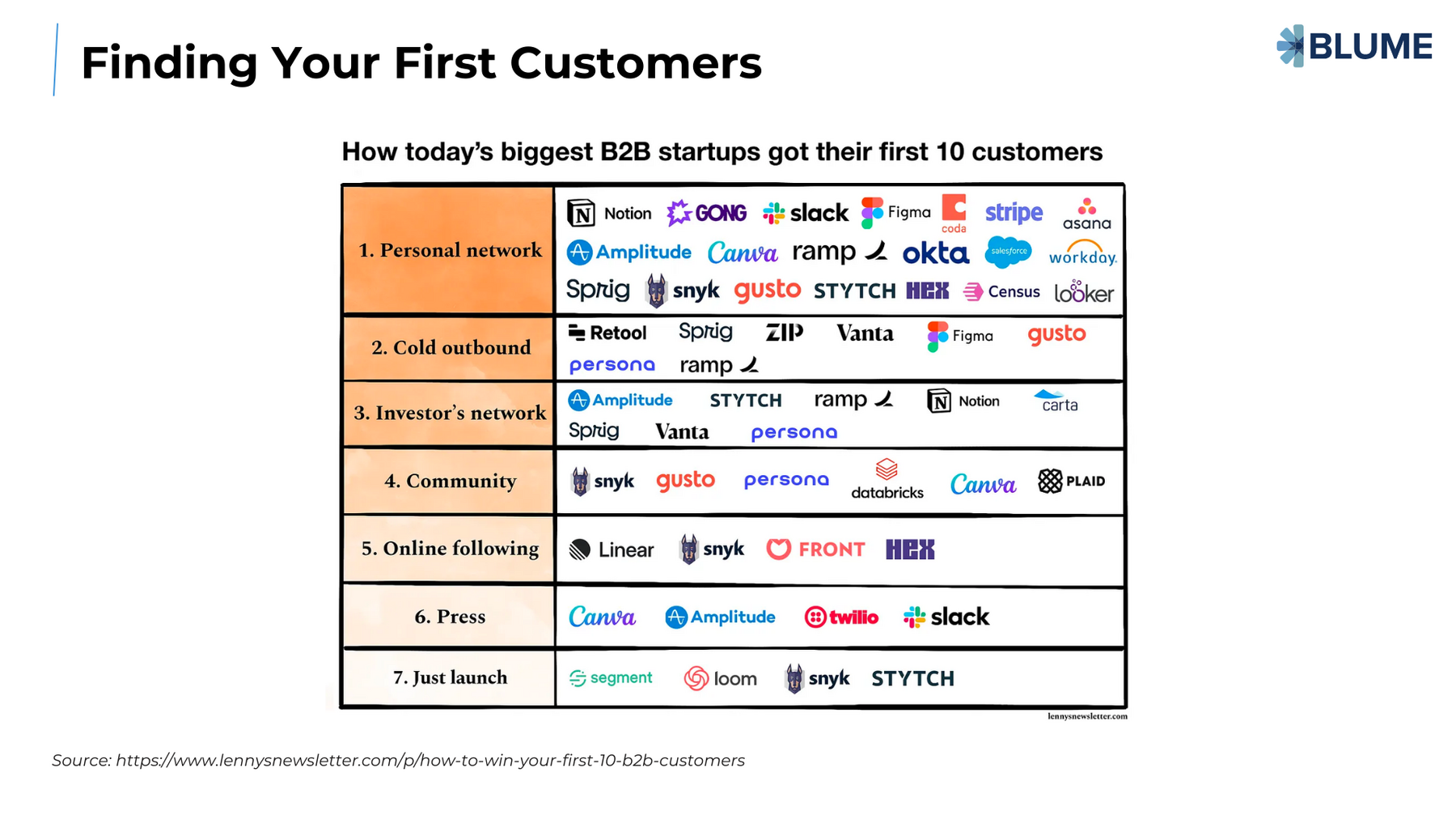

https://www.lennysnewsletter.com/p/how-to-win-your-first-10-b2b-customers

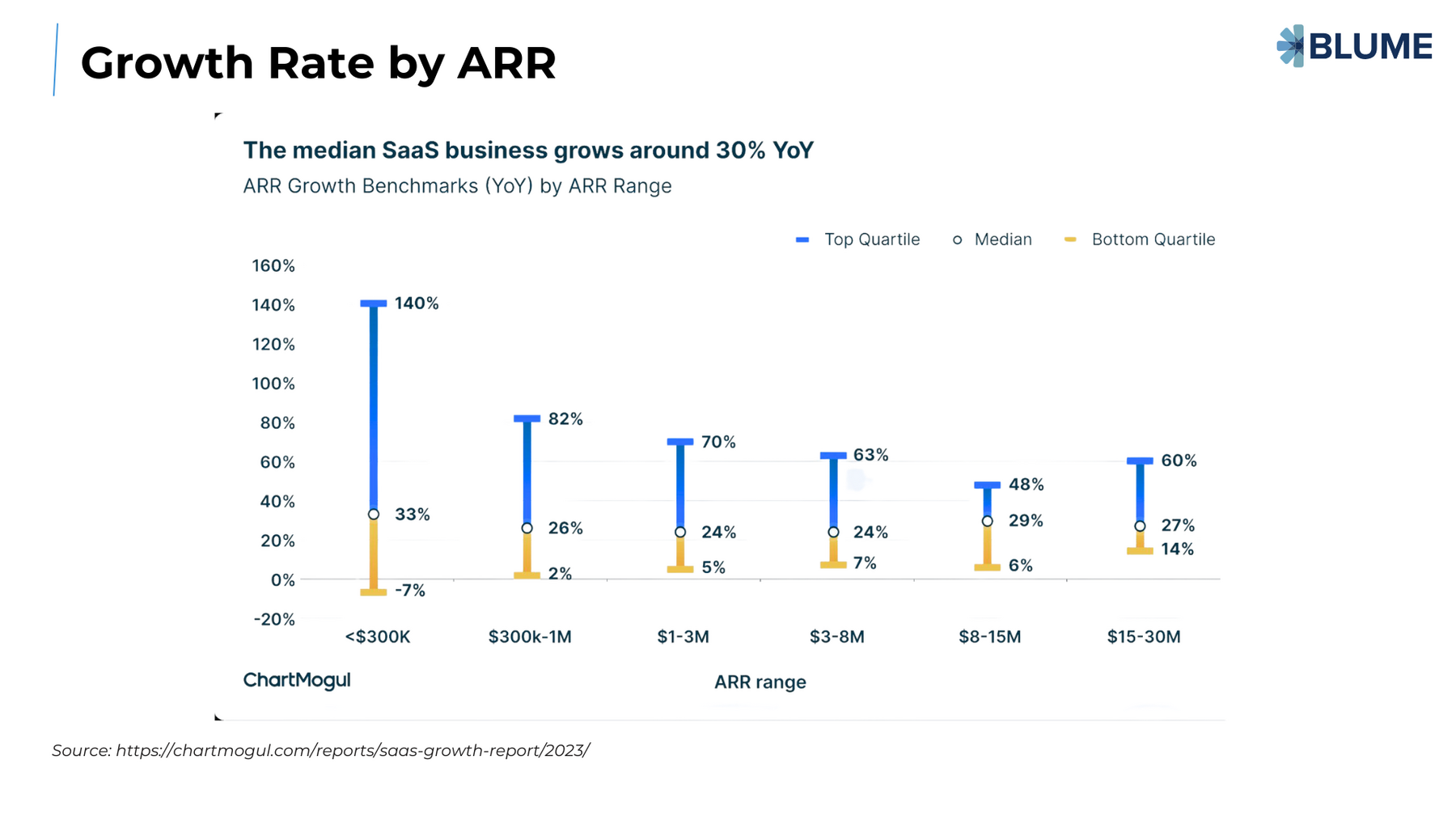

Understanding SaaS Growth Rates Across ARR Ranges

The growth trajectory of a SaaS company can be quantified by analyzing annual recurring revenue (ARR) benchmarks. For a median SaaS business, growth is around 30% year-over-year (YoY), with those in the top quartile often outperforming the median substantially. For instance, companies with less than $300K in ARR can see a staggering 140% growth in the top quartile, whereas businesses in the $15-30 million ARR range may experience a more modest, yet significant, 60% top quartile growth.

These figures underscore the variable pace of scaling in SaaS industries, highlighting that while smaller companies may have higher percentage growth rates, larger firms often contribute substantial absolute growth in revenue terms.