Thoughts On The Future Of Work – Part 2

- Published

- Reading Time

- 5 minutes

- Contents

A deep dive into the gig economy, and a look at Frapp

This is the second in a three-part series exploring how Blume thinks about the Future of Work. In the first, I shared the key drivers of the transformation of work underway, including the twin trends – emergence of a task or gig-based economy, as well as the decline of full-time employment.

In this piece I will dive deeper into the first trend – the rise of of gigs or short-term task based assignments. I will also share our thoughts on one of recent investments in this space, Frapp, which is building out an ambitious play in the gig space at length.

Trend 1: The relentless rise of gigs, microjobs, tasks for cash, spurred by smartphones, tech literacy and the app economy.

Over the past two decades, though especially the past decade, we have seen developments in the following

- Technology

- 4 bn smartphones today across the world, almost all of them more powerful than the computer aboard Apollo11

- Cheaper bandwidth

- Growth of easy to use fintech platforms that work at scale

- Human capital

- Rise in median education and literacy levels

- Comfort with smartphones and using it at lower income and education levels (tech literacy)

What these and the rise of the app economy spurred by venture-backed hyperscaling startups have done is to pioneer a new business model that is popularly referred to as the gig model, with work tasked through a smartphone (largely).

Historically in India we have had an equivalent of the gig model, where workers connect at prominent spots (called labour nakas) in cities and contractors approach to hire them for the day. This daily wager market looks like this – lots of men (and some women) standing around waiting to be approached.

As the penetration of cheaper handsets rise amongst these folks, and spurred by all that cheap bandwidth and the rise of rideshare and delivery apps, what you will increasingly see is more and more of these folks beginning to move from standing around to taking up jobs on these apps.

The Indian gig sector is growing, and creating a new lower middle class.

The gig economy is growing in size both at the bottom, lower-paid, task end – think Uber, Taskrabbit, Dunzo, Zomato etc., but also at the upper end – think Upwork etc. There is little research or well-estimated third party data on the India market numbers.

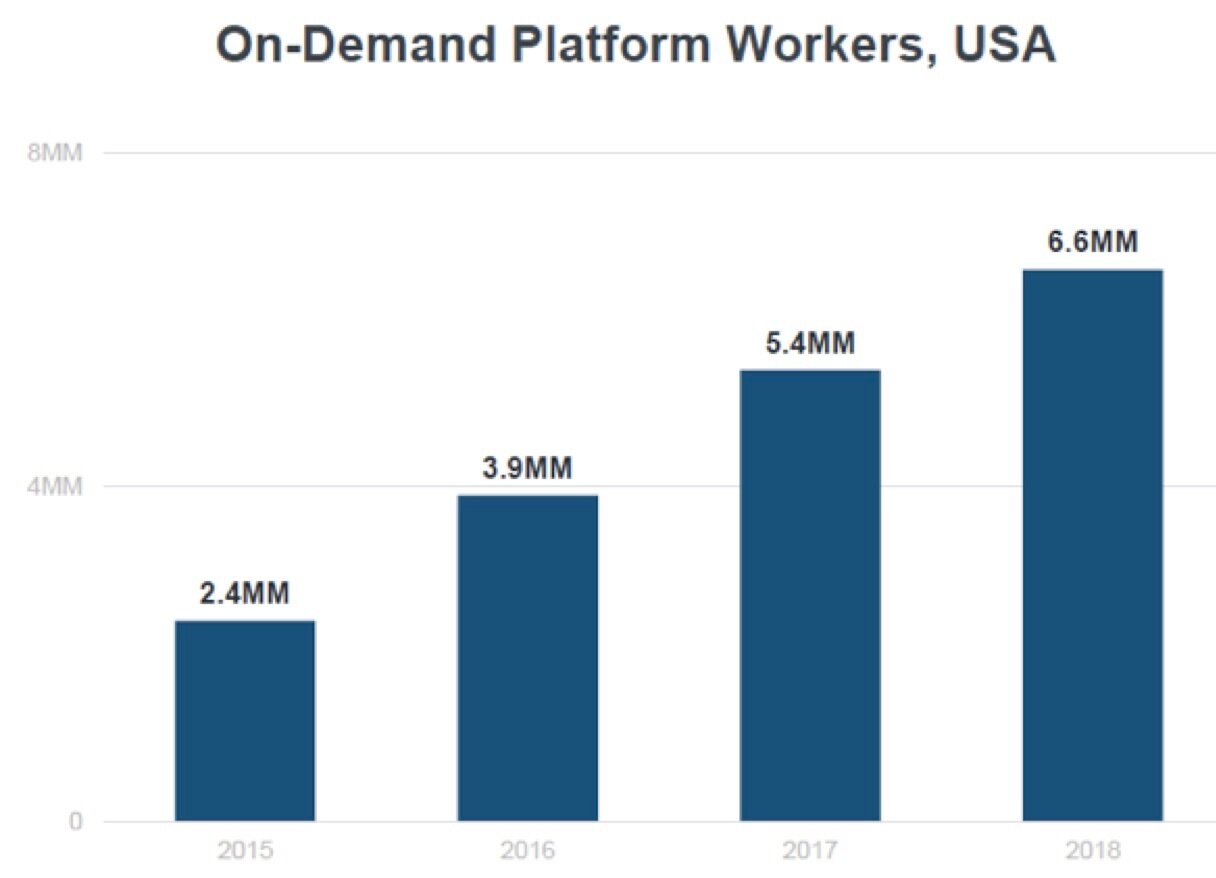

A contrast with the U.S. market is interesting though in this regard. The following is via Mary Meeker’s 2019 Internet Trends report

Still, I reckon around 1.5-2m jobs have got created under the (digital) gig model, over the past 5 or so years, especially at the bottom end. Most of this digital underclass ‘works’ for the big 6 gig ‘employers’ – Uber, Ola, Zomato, Swiggy, Urban Clap and Dunzo. True, some of them may not be new jobs per se, but we now have a ~2m urban lower middle class earning relatively decent wages, with their children likely to study in college and enter the middle class.

The rise of this digital proletariat throws up lots of opportunities for service providers to supply services to gigworkers such as lending (say, to smoothen their variable income – think Earnin but for India) or their employers such as verification (IDfy, Betterplace etc. – a Checkr for India).

Future Ideas, the insights arm of retail major Future Group, brings out a publication every year chronicling key trends and ideas. One of the ideas in this year’s publication was about India 1.5 – a class of lower-income urban, smartphone literate, English familiar (though not fluent), aspiring set of Indians. Think of your Dunzo or Zomato deliveryman, your Gold’s Gym instructor and your Sodabottleopenerwala waiter. The rise of the gig economy is driving growth in this India1.5 market. (Why 1.5? Well, this is a take on the India1, India2 and India3 classification that is a popular way to trisect the Indian market.)

The upper end gig worker emerges in India.

Allied to the emergence of the lower end gig economy, is also the rise of the upper end of the gig economy, which deals with white collar assignments. There aren’t too any specifically Indian marketplaces such as Upwork or Fiverr yet in India (though Upwork itself has a sizeable presence in India). Instead there are managed service providers who work with corporates to supply talent for specific gig roles – e.g., Cactus Communications or Yorke for content writing. That said the first stirrings of India-born marketplaces are emerging. I would put Frapp and Squad Platform, two of Blume’s investments and players such as Playment, Awign, GigIndia etc., in this category.

All of them operate presently via a managed marketplace model, and not a pure marketplace such as Upwork does. And at least three of them rely on students as a core category to shore up supply, thanks to the rapid adoption of smartphones by students. All of them allow demand to be fulfilled via smartphone or desktop apps and supply via enterprise sales (initially and then moving them to self-serve later).

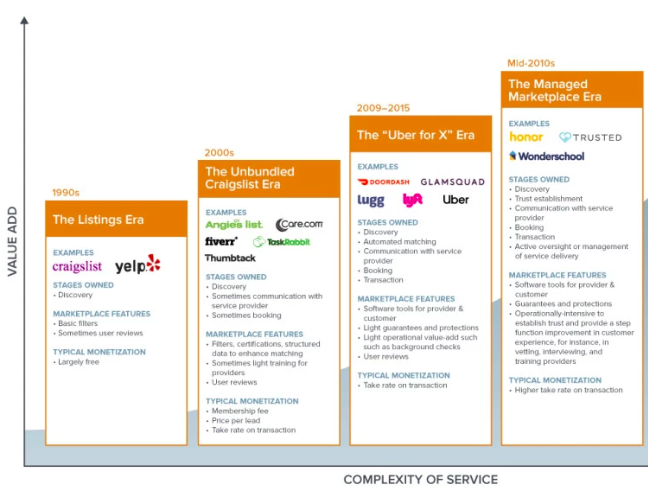

Unlike in the West, where the evolution is from pure marketplaces (Uber for X) to managed marketplace models (see chart below), in lower trust India, the movement is from a managed marketplace model to a purer marketplace model as Indian firms such as Awign and Frapp are showing. You need to build trust with corporates via a concierge model and then move to self-serve. Else you will be unable to have a critical mass of high quality tasks and clients.

This is an edited slide from a recent a16z note by Andrew Chen and Li Jin.

Let us take a closer look at Frapp, a portfolio company that I oversee at Blume, with ambitious plans to build out a large gig business serving all segments and usecases in India.

Frapp – Microjobs for Students, and soon Spouses and Senior Citizens.

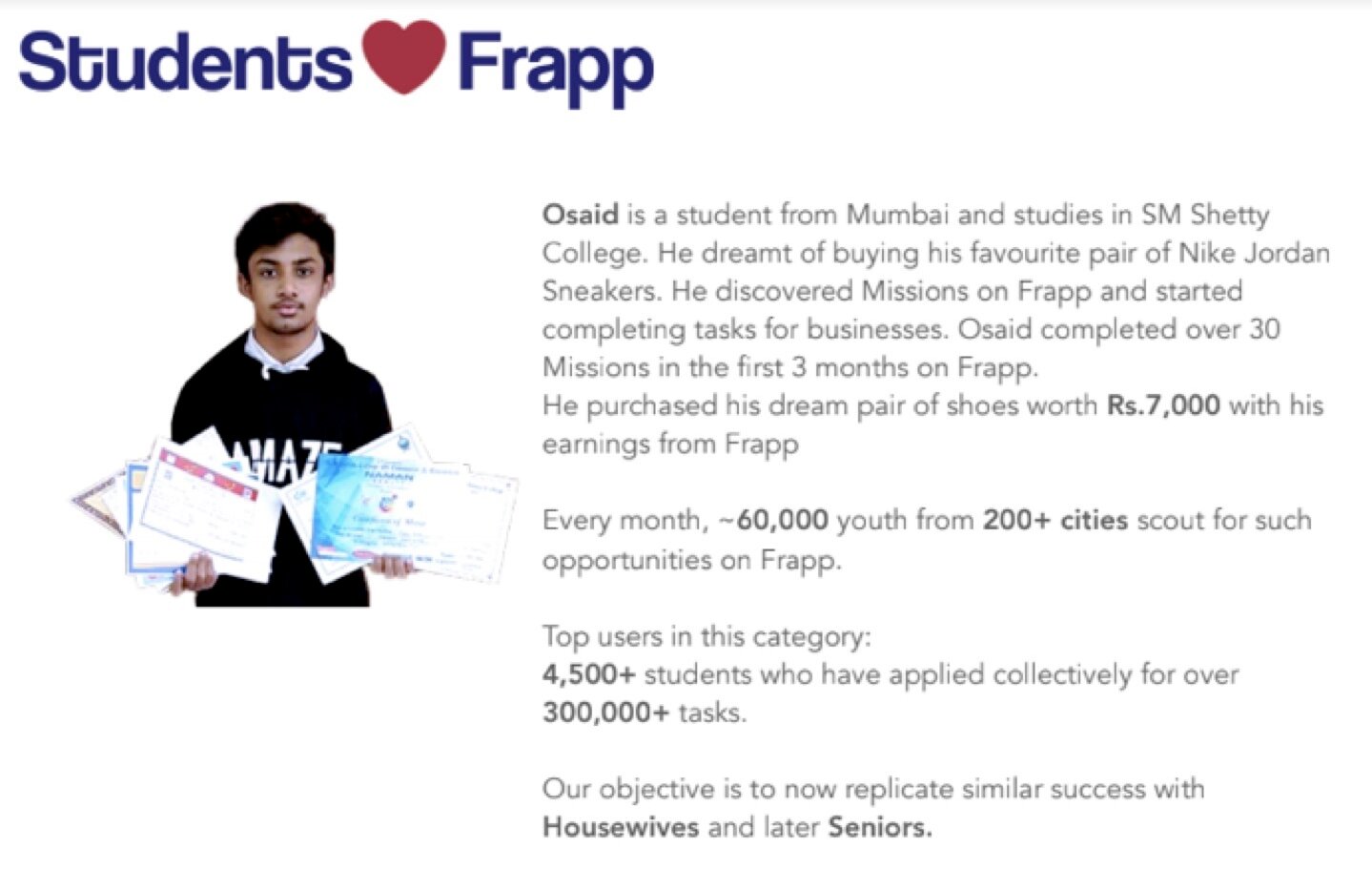

Started by two NMIMS graduates, Niranjan and Armaan, Frapp started with students as a supply segment and marketing tasks as a demand segment. These marketing tasks, either offline but more commonly online tasks included such tasks as content creation such as user generated video and later distribution of content via social media. Other types or categories of marketing tasks included sampling, offline promotions etc.

Having tested their product for this market segment – enabling corporates such as Samsung, HUL by recruiting students for short-term market, via a concierge + marketplace model – Frapp has created a self-serve product now. This is to enable smaller corporates to recruit students and to enable more long-tail gigs to emerge. They have also started to expand their task list beyond marketing into mystery shopping, translation services etc. Accompanying this is a plan to expand to two other talent pools – educated housewives (spouses) and senior citizens (silvers) – to shore up supply.

I am impressed by how Niranjan and Armaan have turned a passion project – Frapp started out as a college project trying to do interesting stuff around curating students as a community – into something extremely ambitious, an all out attempt to build the Teamlease of the 2020s. I am also a fan of how frugally they have done it. They had a small angel round from some big name media execs including Sameer Nair of Star/Balaji, followed by a seed round from Blume in 2017 to test out and nail the student segment. They are hitting the market now, to bring aboard investors who have a strong thesis on the Future of Work / Gig space, looking for a scrappy team to build out a large business in this space.

To sum up

Smartphones, tech literacy and new business models are transforming attitudes to gig work both amongst corporates and workers, across skill levels, in India. We are seeing the offtake of gigwork both at the blue collar end and the white collar end, including amongst categories such as students who were outside the economy thus far. Capitalizing on these trends are a whole host of startups, aiming to build the Teamlease of the 2020s.