Thoughts On The Future Of Work – Part 1

- Published

- Reading Time

- 7 minutes

- Contents

Why companies exist, why the gig economy is growing, and what the firm of the future will look like

Future of Work is a big interest area for Blume. We have bet big on this space with investments in Squad, Frapp and a to-be-announced investment (in the flexiwork segment).

Why does Blume find this space interesting? Why have we backed these companies?

To address these questions, I share our perspectives on this space, including a look at two of the companies we have invested in, through a three-part series of posts.

The first of the three posts is below. In this piece, I look at how Blume defines Future of Work, including how work is transforming, the economic theory underpinning this, and the twin trends underway – emergence of a task or gig-based economy, as well as the decline of full-time employment.

In the second piece, I will take the first trend – rise of gigs or short-term task based assignments and delve a bit deeper into it. We will also take a closer look at one of Blume’s investments, Frapp, ambitiously building out a broad stroke, self-serve, gig platform – what we think could become the white collar Teamlease of the 2020s

In the third and final essay, I will address the second trend, the shrinking of full time roles in larger organizations and the implications and opportunities therein for flexiwork. I will also introduce our newest investment, a company that is rethinking the future of employment in India.

Part I – What does ‘Future of Work’ mean? How big is the opportunity?

Let us begin our journey with a simple but challenging question.

Why do companies exist? Why are some large, and others small?

In 1937, a young LSE graduate named Ronald Coase published an academic paper titled ‘The Nature of the Firm’. In the article, which is now amongst the most famous (and readable) Economics papers of all time, Coase questioned why firms exist, when instead they could all be one-person outfits each contracting with the other.

The reason, Coase said, had to do with transaction costs or the friction in contracting an economic activity (sales, manufacturing etc.) outside the firm. When the costs of such organizing or contracting were lower within the firm, versus the outside market, the entrepreneur would chose to bring it within the firm, hiring a person to do the job within the firm; else he would buy those services or products in the market. Thus a firm would expand to the point where the costs of organizing a transaction within the firm were equal to that outside the firm.

This seemingly now obvious but then revolutionary insight revolutionized the field of Microeconomics, introducing the concept of transaction costs. Surprisingly Coase hadn’t even studied Economics formally. He was a Commerce graduate. Coase would bolster his reputation further with a 1960 paper on property rights (again highly readable) revolutionizing the field of Law and Economics. In 1991, Coase won the Nobel Prize for Economics, with the academy citing these above 2 papers. Together they add up to just above 80 (highly readable) pages. Not sure if anyone in Economics has a better words to impact ratio.

Let us move ahead though.

Companies got larger and larger, and now they are shrinking – because, transaction costs.

The last 100-odd years of the firm have all largely been in a one-way direction. The average firm has gotten bigger and more vertical as it insourced more and more economic activity, thanks to lower transaction costs internally. Many reasons abound for this including the availability of a large talent pool on the back of improved higher education infrastructure, better communication technology, investment in training, but especially improved management practices.

However, this one-way trend is now ending. Firms are beginning to get smaller, not larger. Instagram was just 13-employee large when it was acquired for $1b and Whatsapp was 55-person large when acquired for ~$19b.

Thanks to tech infrastructure such as AWS, large libraries of portable code bases, software platforms and tools including API calls etc., much more today can be done by fewer people and clearly much faster. In addition recent technological trends are lowering transaction costs outside the firm faster than they are reducing it inside the firm.

Thanks to the above, and related economic trends underway including the growth of smartphones, cheaper bandwidth and the pressure to save costs we are seeing two broad trends getting underway in the Indian economy (and also other similar global or local middle-income economies).

The first is the rise of the gig economy. While the popular symbol of the Gig Economy is the Uber rider or the Zomato deliveryman, the gig economy is outgrowing its blue collar origins fast. There is a strong white-collar element to the Gig Economy now – from logo designs or content writing at the upper end to labeling pictures (for Machine Learning training data) at the lower end.

The second is the shrinking of full-time roles in large organizations leading to the rise in part-time / flexible work assignments. Let us call this flexiwork. While primarily led by the need to save costs, the trend is also reinforced by the phenomenon of (especially younger) people being open to exploring lower intensity engagements, and a growing recognition that part-time jobs can pay sufficiently enough (and give you the freedom) to have a more easy-paced life.

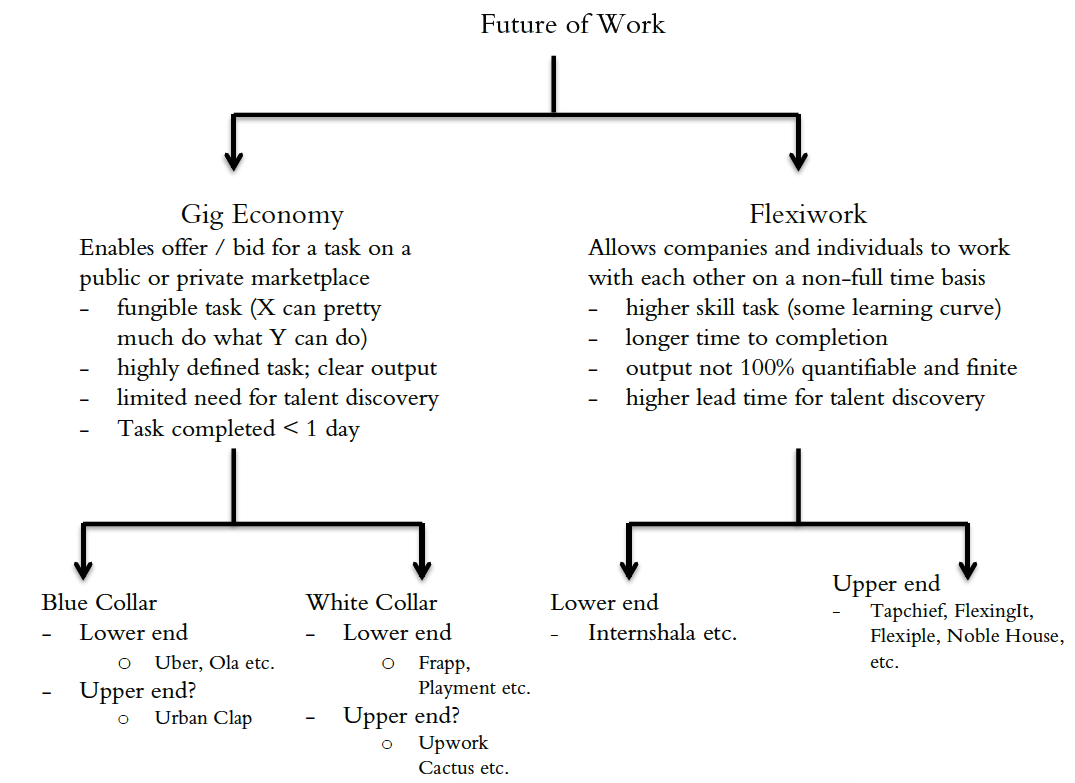

Together the gig economy and flexiwork constitute what is popularly referred to as the Future of Work. This is Blume’s framework. Other organizations may chose to define it differently. Indeed in some reports, the terms Future of Work and Gig Economy are used interchangeably.

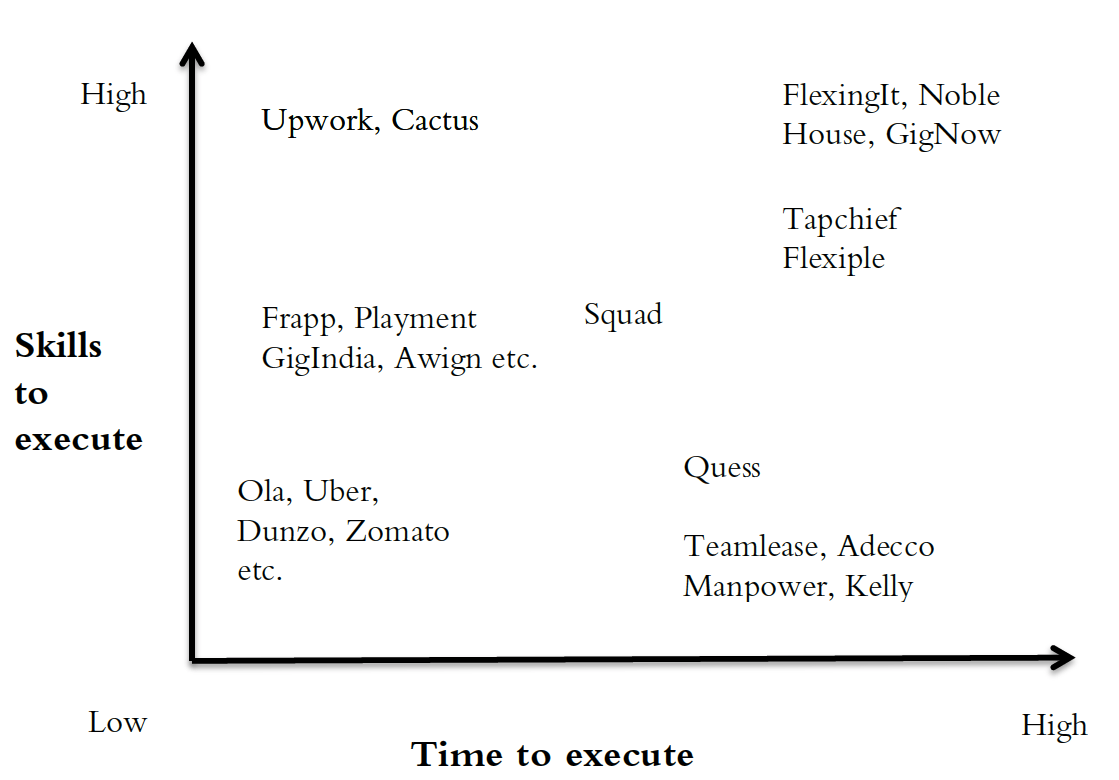

How we think about the Future of Work -- 2 charts that illustrate how we view Future of Work.

From our learning, it is clear there is a clear gap in the mid-skills market, especially the white collar mid-end skills market which is beginning to get filled with the likes of Frapp, Awign, Squad, Playment etc. The other gap, which is now getting filled, is that of technical talent, led by the likes of Tapchief, Flexiple etc.

I don’t see the above as a static chart, or even the positions as even entirely representative of what the firms do. Tapchief has microjobs and Upwork has long-term assignments and so on. But this is a good way to understand the opportunities and market landscape.

One point to keep in mind is that I have not included players such as BetterPlace, Idfy, Paypal or other enablers / service providers to the Future of Work segment. Over the next few years innovative service providers will emergein India (as seen in the U.S. with Earnin, Checkr) to smoothen frictions and capitalize on niches.

How big is the opportunity? What is the TAM for Future of Work?

There is no ready available estimate. There is a line which floats around in multiple articles that “the gig economy in India has the potential to grow up to $20-30 billion by 2025”. I couldn’t verify the source nor were there any calculations to estimate this.

Still let us try to estimate a number.

The private corporate sector accounts for about a third or so of the GDP. There is some debate and controversy around this, but let us stick with it for this piece.

Hence 1/3 of $2.6tn = ~$900bn.

The size of wages as a percentage of private corporate sector sales is 12%.

Hence 0.12 * $900b = $110bn

According to McKinsey Global Institute, ~160m or 20-30% of the total workforce in U.S. and EU-15 are independent workers. I couldn’t find a similar estimate for India, but given that India has an undersized formal economy, and is seeing rapid uptick in growth in the gig / freelancer economy, I wonder if we will see a similar number in India as well. At the least, let us say in 5 years, it will hit 20%.

The spur to have more and more gig / freelancer workers executing tasks for the company is led by the fact that gig / freelance workers are far cheaper. An industry survey by manpower provider Kelly found that near half of the companies they surveyed claimed a 20% reduction in labour costs while using gig workers. Academic Diane Mulcahy, in her book The Gig Economy found savings of a quarter in replacing a full-time with gig / freelancer workers.

We then get the following Gross Service Volume

$110bn * 7%growth ^ 5 years = ~$155b

Assume 20% share = $31b

Less 20% (savings due to using gig / freelancers) = ~$25b in FY25.

Firms operating in this space will essentially realistically get a certain share of this (referred to as take rate) – Upwork has ~15%, Fiverr has ~25% (closer home Teamlease, Quess have much lower numbers – 5% or so operating margins per recent numbers). Given that Future of Work includes marketplaces as well as service plays, and is across gig and freelancers, I think it is fair to assume a take rate of 10-15%.

This means 10-15% of ~$25b = ~$2.5 to ~$4b Total Addressable Market by say FY25.

Some related data points (while both data sets refer to gigs, they are used in the broader sense, interchangeable with the Future of Work segment)

– Mastercard released a survey recently which estimates the Indian gig market gross value to double by 2023 (doesn’t give the absolute amount though!). It estimates the global gross service volume at ~$200bn in 2018.

– An interesting allied data point is a recent BCG survey, which found that 8% of respondents claimed gigs to be their primary source of income in India. This is the 2nd highest after China, which is at 12%.

To sum up

In the next piece, we will take the first trend – rise of gigs or short-term task based assignments and delve a bit deeper into it. We will also look at one of Blume’s investments, Frapp, which is building out an ambitious play in the gig space at length.