Why ‘atoms’ businesses should adopt a Micromarket approach to geographic expansion

- Published

- Reading Time

- 10 minutes

- Contents

Sujay Choubey and Sajith Pai from the Blume Investment team, worked with Kartik Mishra (Head of Strategic Initiatives, Dunzo) to put together this detailed take on how ‘atoms’ or physical businesses should approach geographic expansion.

By studying how Dunzo and Yulu segmented geographical markets, and basis first principles thinking, they present a generalized approach for how a startup with an onground presence needs to approach opening up newer markets.

A Venture Capital fund succeeds when at least one of the invested companies grows very large, very fast. This is the power law of venture capital (VC), an iron clad rule. Venture Capital is thus a financial laboratory to run experiments – to see which experiments, or startups, get to rapid scale, and eventually to rapid scale with profits.

A startup that sells a purely digital product, that is, one that can be transacted and even consumed online (media, edtech, software; what we call Bits businesses) can scale rapidly, once it hits positive unit economics, by aggregating consumers from across diverse geographies. Geography is not a constraining axis for Bits businesses.

In businesses that involve consumption of a physical product (ecommerce, mobility; what we call Atoms businesses) there is a need to factor in geographical constraints e.g., your customers may be concentrated in a certain geography; distance from depots to your customers may influence profitability of the order, and so on. This means that for Atoms businesses, their profitability may not grow proportionately with scale.

Why geography matters

How does geography affect the ability to scale profitably? Broadly in the following ways:

- Aggregating demand – your ideal customer personas may be diffused across different geographic clusters.

- Aggregating supply – your fulfillment centres may not be located next to your ideal customer personas.

- Matching supply to demand: especially in marketplace businesses like mobility where you need to match riders to drivers, etc.

These three scale drivers need to be solved to ensure that the Atoms business can scale profitably.

Let’s take the example of Dunzo to illustrate how micromarket characteristics influence each of them. Since the customers are at the top of the (money) funnel, aggregating demand effectively is the key piece to think of first before you launch or enter a market; e.g. customers in a micro market must generate sufficient orders every day to provide a minimum threshold of business to both supply sides of the three-sided marketplace – delivery partners and merchants – in order for the micromarket to be self sustainable.

Then, you need to think of aggregating supply as per the constraints of the demand; e.g. an appropriate number of delivery partners must be onboarded to service the demand. Among stores, quality of supply matters more than quantity. A few popular or high-variety stores will contribute to better customer experience than a large number of mediocre stores.

(The above is when you think of launching a market. Actual execution sees the process inverted initially – aggregate supply (riders) and then announce / advertise to customers to aggregate demand – This holds true for all platforms be it a Oyo or an Uber or a Dunzo – solve supply first, else you can’t service the user. Once you launch then you need to continuously iterate supply and demand to make sure the system is working well.)

The final piece of the puzzle is thinking of how to bridge supply and demand in the most efficient way. Some geographical characteristics can enable an easy solution to this leg of the problem; e.g. the presence of stores within a reasonable distance (say, 2-3 km) of the demand region (say, a housing society) ensures that the delivery time is meaningful (under 30 minutes) and the customer experience is great. Distant stores increase both time and cost of delivery.

What is the minimum viable geographic unit of your business?

Each type of Atoms business has its geographic bias. Ecommerce companies like Amazon need large depots outside urban centres and can service the entire city or even a region. It sees a large number of customers buying infrequently. Grocery commerce startups such as Dunzo mentioned earlier, have much smaller coverage areas – because grocery is a high frequency purchase, typically purchased a lot by a certain set of people – typically time-starved younger couples or singles. Mobility startups have wider coverage areas than grocery startups, but see far sharper geographic clustering, and often at different times of the day.

Given this geographic bias, cities are thus an inefficient geographic unit for a vast majority of Atoms startups. They need far greater flexibility in selecting the minimum viable geographic unit to operate in. Ideally, one well below the scale of the city and which helps them optimize their unit economics. Additionally, each type of startup will need a different scale of geographic unit. One could do with twenty square kilometers and 200k people, while another needs half of that. Another may need density – a much smaller area with a larger population. We need a term that is flexible to stand for different sizes and types of urban areas. We propose micromarkets as this unit.

What is a Micromarket?

Traditionally, micromarkets tend to be defined at the neighbourhood or suburb level. Years of urbanization creates distinct social, economic and geographic characteristics in various neighbourhoods of the city. For e.g. Greater Kailash in Delhi is expensive, almost exclusively residential, with pockets of high-end markets. On the other hand, Lakshmi Nagar has a lower per capita income, higher share of commercial use in land use mix, and higher population density leading to greater pressure on roads.

We can also expand this to wider geographic units like South Delhi or East Delhi, etc. This is useful especially when you can aggregate contiguous areas with similar profiles and characteristics. Thus, viewing cities at a micro level reveals useful details about parameters such as demand profile, ability and propensity to pay, ease of acquiring supply, and ease of serving customers, which can be used to achieve the three scale drivers

- aggregating maximum demand at the lowest possible cost

- aggregating highest supply at the lowest cost

- matching maximum supply with maximum demand

Milkbasket and Micromarkets

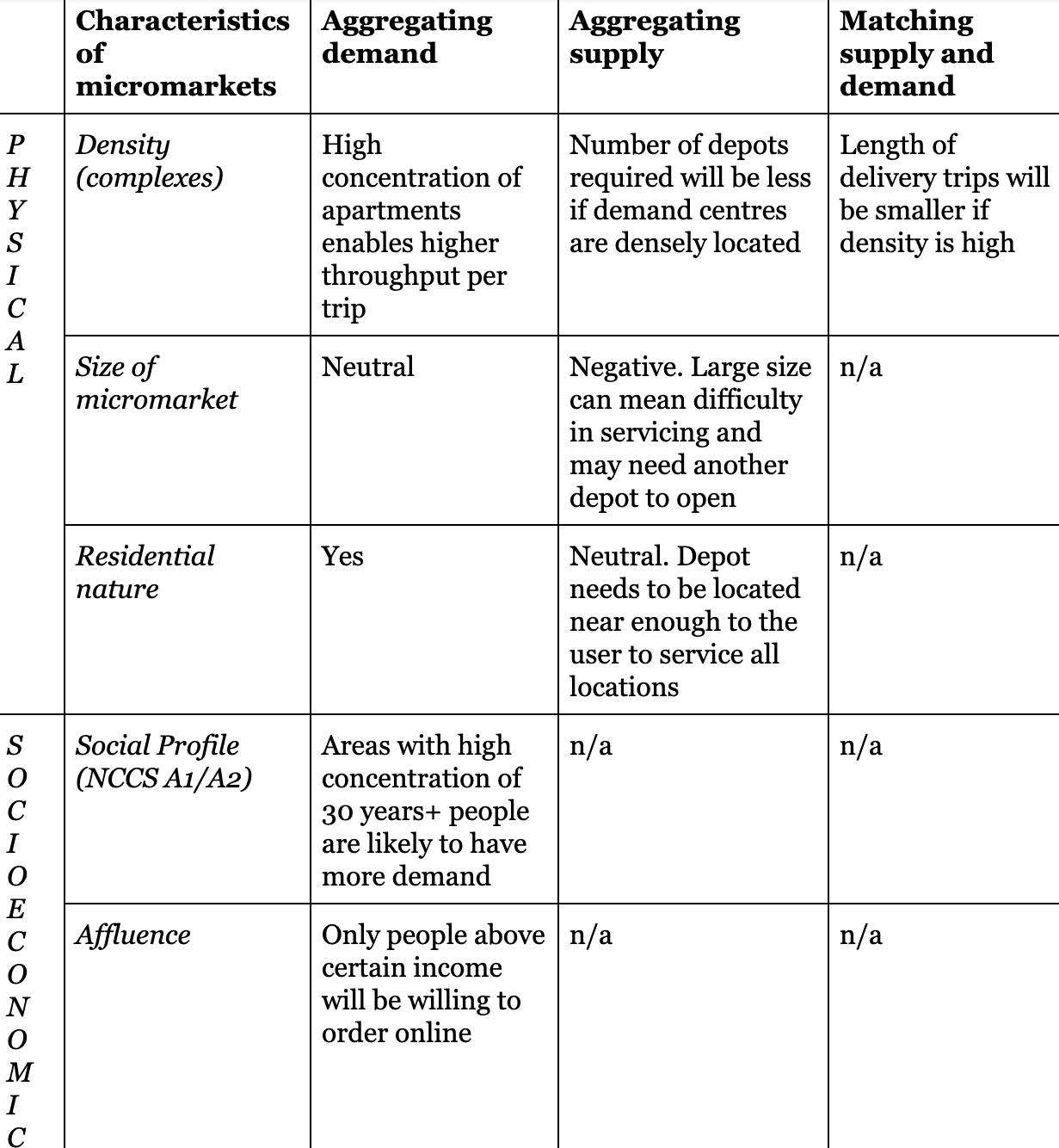

Let us take the case of a grocery commerce startup, Milkbasket, and see what characteristics of micromarkets impact these scale drivers. Very broadly, characteristics can be physical or geographic (density, commercial or residential) or socio-economic (young population, affluent, etc.)

Now Milkbasket has essentially one use case and one type of customer base. It delivers grocery products to households. Let’s look at Dunzo, which is more complex because it caters to not one but three broad personas – hyperlocal shopper, pillion rider, and the small business owner who uses Dunzo for local deliveries. What micro market characteristics impact the scale drivers for Dunzo?

Dunzo and Micromarkets

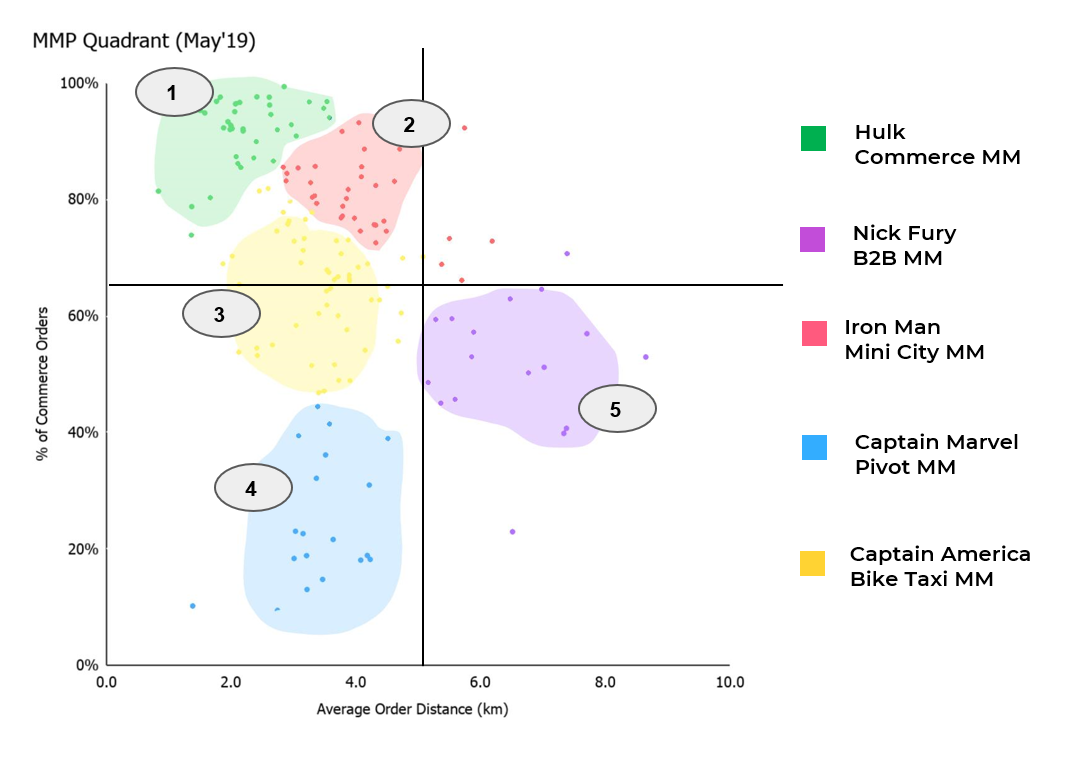

Dunzo starts off by mapping micromarkets on a 2×2 matrix of % of commerce orders (on-demand grocery, consumables etc.) and the average order distance.

#1 is a residential zone – high percentage of commerce orders and very low order distance. (Indiranagar, Powai, etc.).

#5 sees long range order distance and low commerce orders as percentage of total orders. This is an area which has a lot more SMBs and the use case is Logistics – leveraging Dunzo’s pick & drop feature (Chickpet, Andheri East, etc.).

We thus have five broad types of micromarkets – to win in each you have to have a specific strategy for reaching profitability.

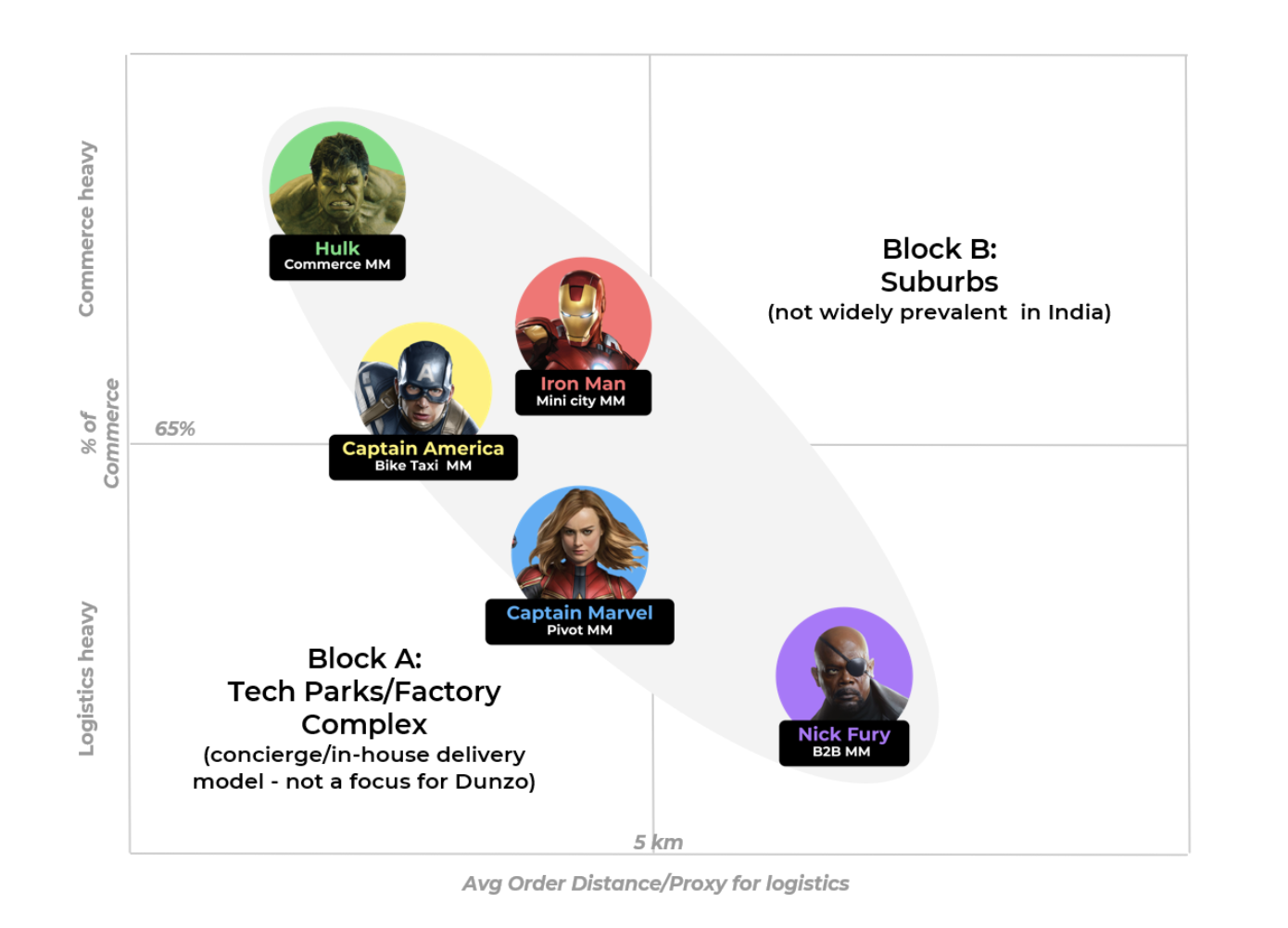

Let us now look at what characteristics of micromarkets impacts Dunzo’s scale drivers. Fun fact: Dunzo represents each micromarket as a Marvel character (visual representation below).

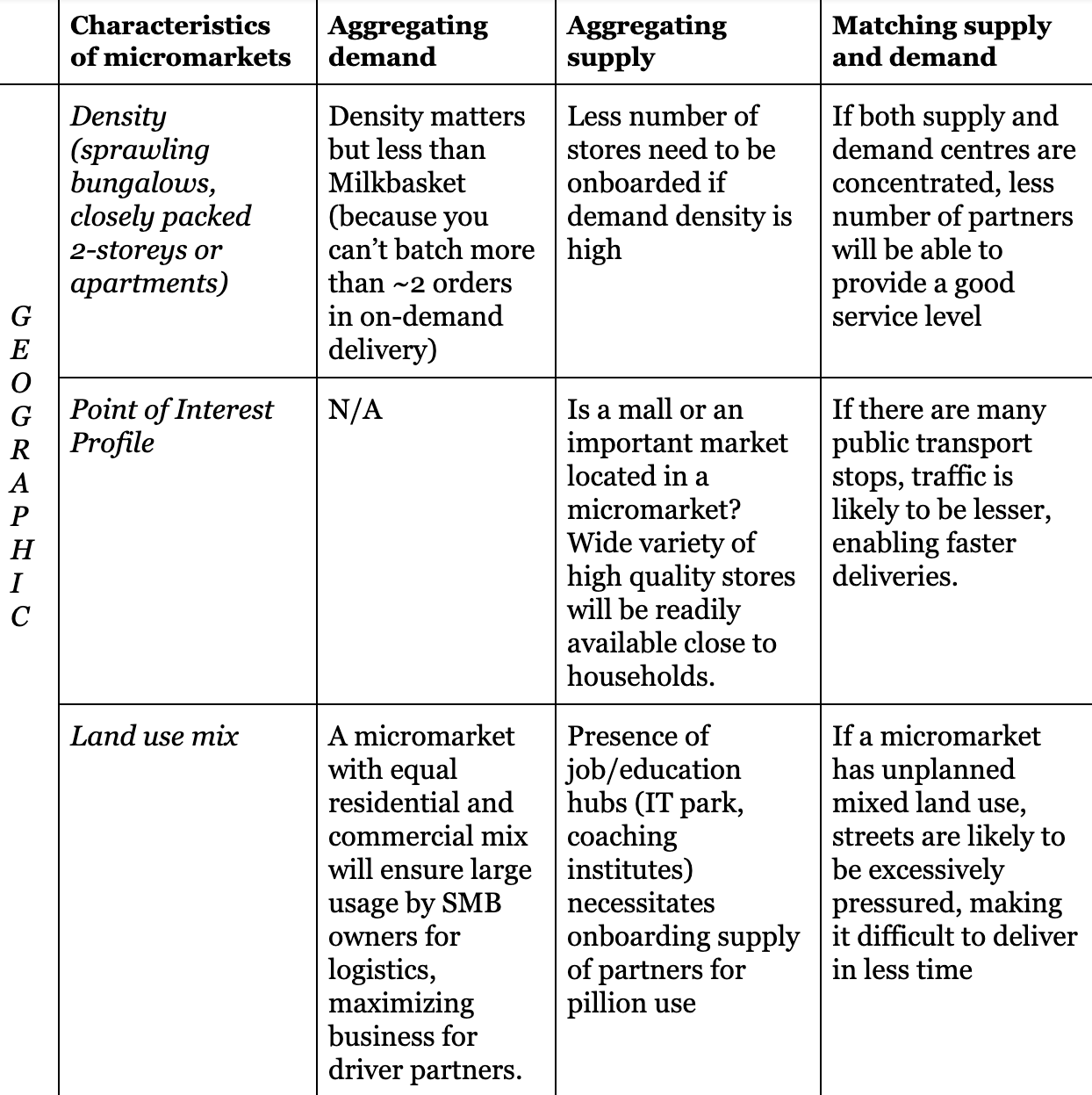

Remember – characteristics can be physical / geographic (density, commercial or residential) or socio-economic (young population, affluent etc.). Also, Dunzo is more complex than Milkbasket in that there are three stakeholders – consumers, riders and merchants. We will in this table try and share how these characteristics impact two of these stakeholders – consumers and merchants.

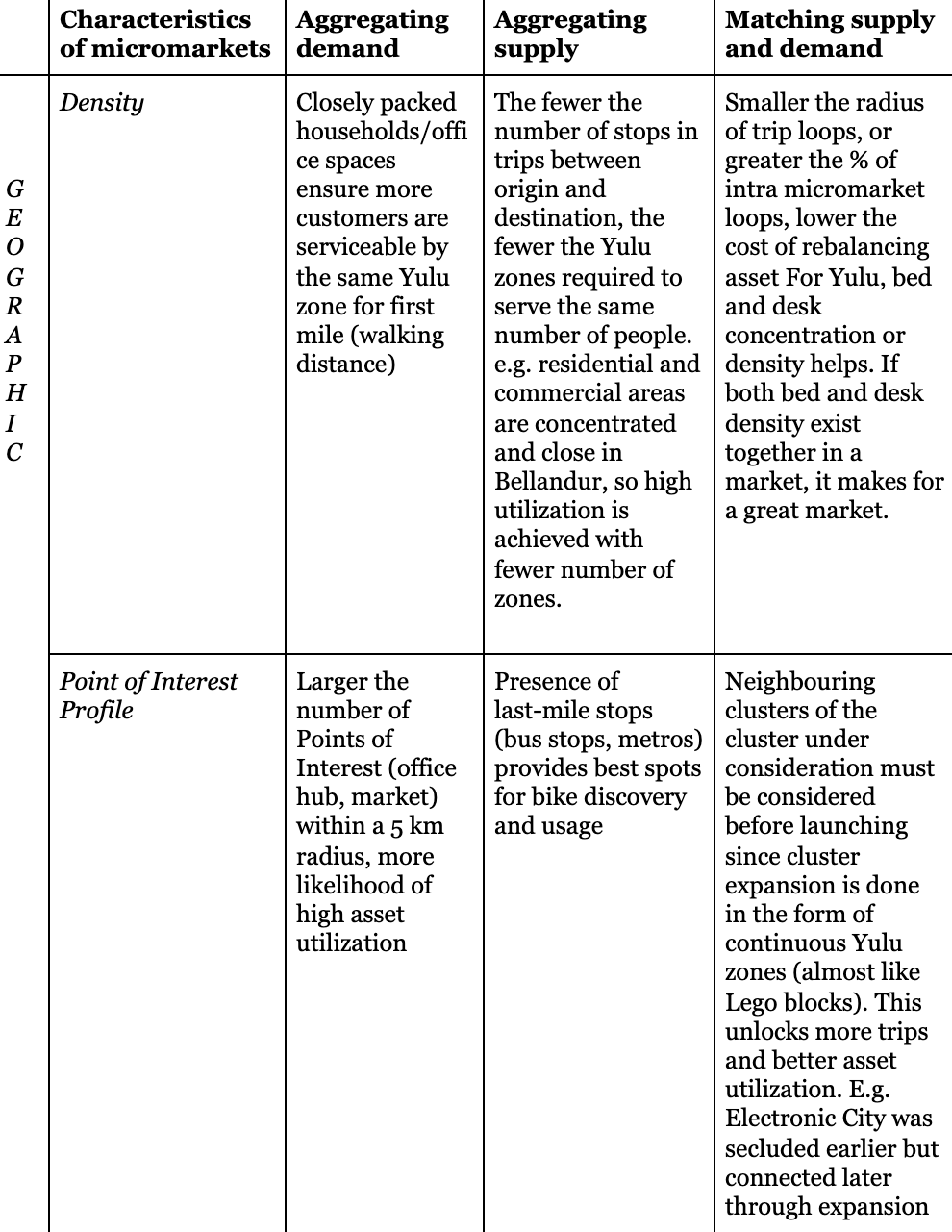

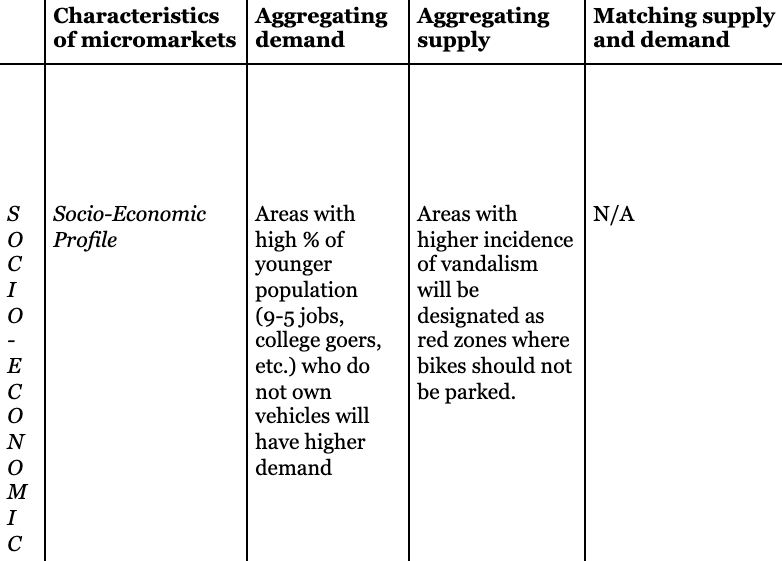

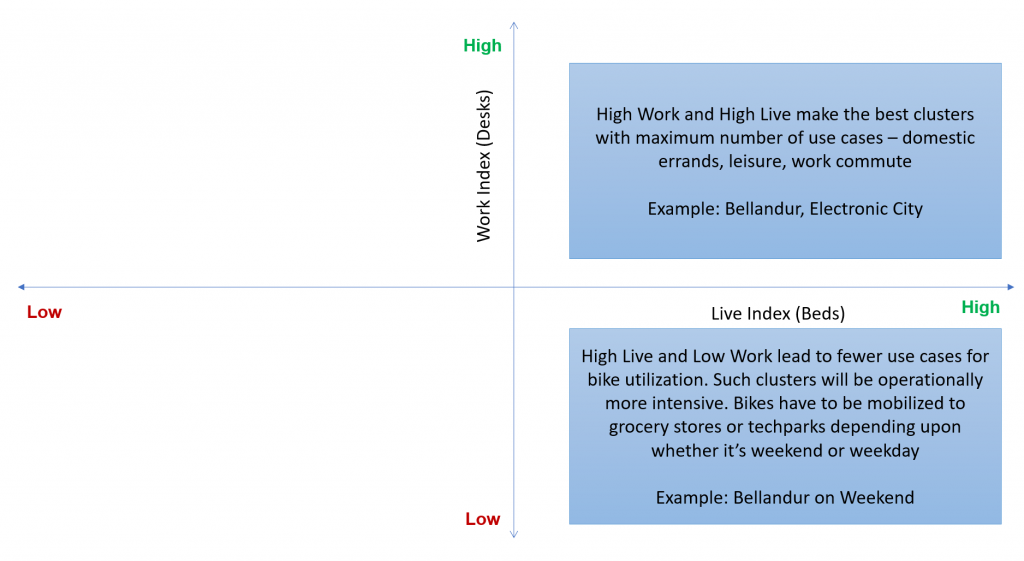

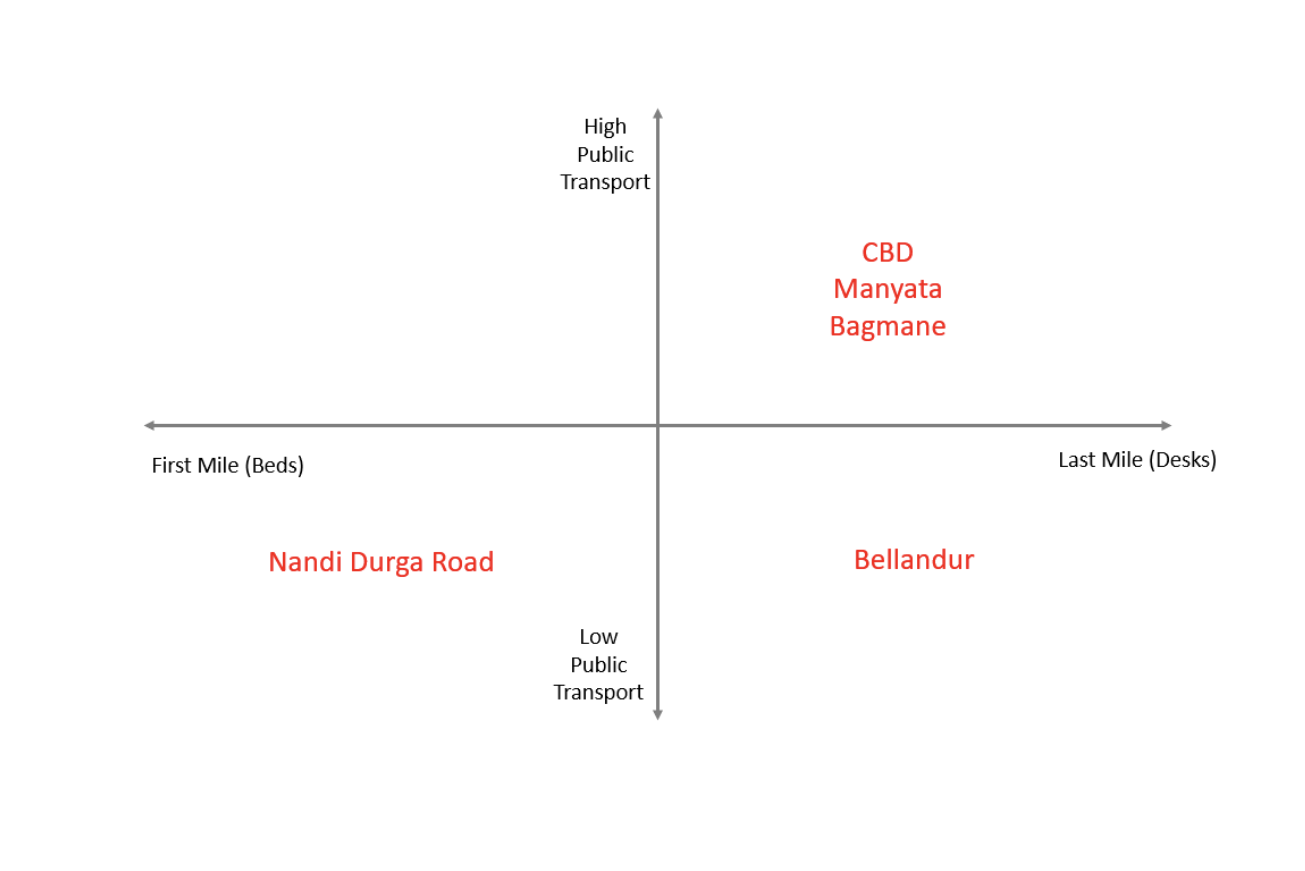

Yulu and Micromarkets

The implications of various geographic and socio-economic characteristics would be slightly different for a micro mobility startup such as Yulu. Yulu’s business model has fewer moving parts. The consumer and the platform are the only 2 stakeholders involved. Cost is more or less fixed and the objective of business is to maximize revenue (i.e. bike utilization). So the piece of matching supply and demand translates to the asset rebalancing function – optimizing the number of Yulu bikes across all Yulu zones.

Two major ways in which Yulu looks at any micromarket are illustrated in the following charts. All the residential names given in the below two charts are for localities in Bangalore.

Physical and Socio-economic characteristics determine Micromarket attractiveness

From the above study, we can view each micromarket as a function of physical and socio-economic characteristics.

- Physical: What is / are the core(s) of the micromarket (Locus) and what is its spread (Radius) – this is of course the size but defining the locii help – for Milkbasket it is the depot; for Dunzo it is the market since that is the point from where riders have to procure goods; and for Yulu, the Yulu zones. What does the land use mix look like? Is it purely residential (lots of gated societies)? Are there many commercial establishments mixed in residential areas (think, coaching centres run on 1st floor, shops opened on ground floor, flats on third and fourth floor)? Are there central business hubs (tech parks, factories)? What is the average lot size (sprawling settlements or densely packed flats)? How sparsely or closely are amenities (shops, malls, parks) located?

- Social and Economic: What is the per capita income profile of inhabitants? What is the ability and willingness to pay? What do people’s lifestyles look like? What kind of products and services do they buy or want to buy? What kind of activities are the people engaged in (9 to 5 jobs, students, businessmen)?

Distinct combinations of micromarket characteristics create unique micromarkets. For example, a combination of physical characteristics such as high density, clustered complexes and socio-economic characteristics such as young and affluent office goers gives you micro markets like Bangalore ORR or Noida/Gurgaon, which are ideal for Milbasket. On the other hand, a combination of mid-range density, mixed land use, and young and affluent population gives you micromarkets such as Indiranagar, Malviya Nagar, and Andheri West which are ideal for Dunzo.

These distinct physical and socio-economic characteristics, result in a certain demand opportunity size for the micromarket as well as a certain cost of servicing it. The interplay between size of prize and ease of winning results in different states of profitability for the micromarket.

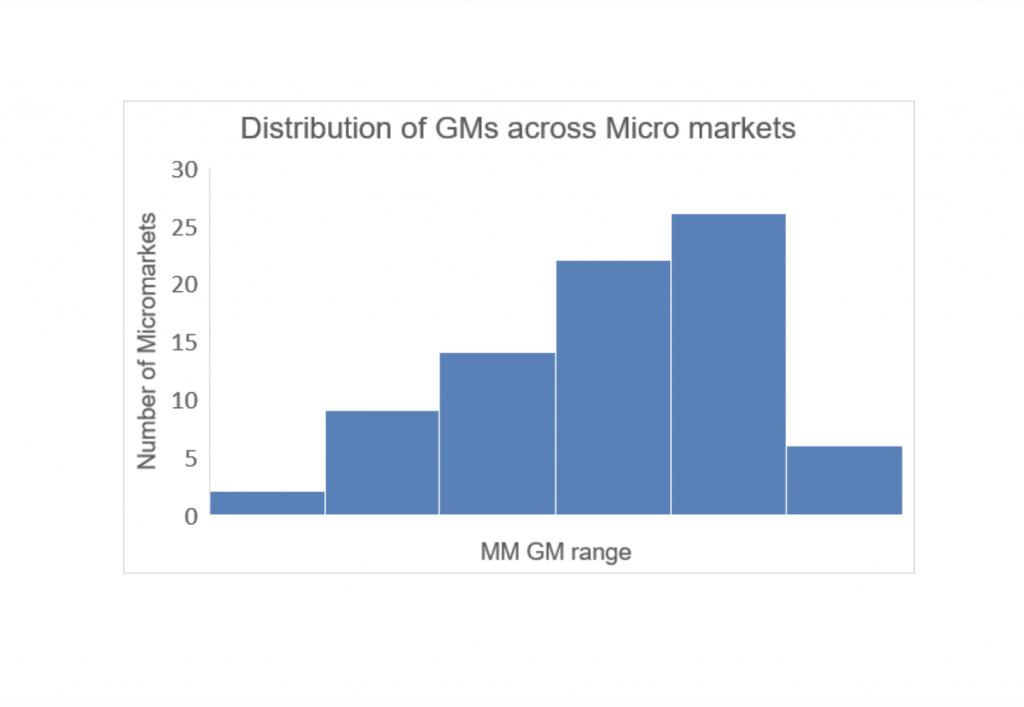

Here are Dunzo’s 79 micromarkets in Bangalore ranked on gross margins – across these 79 micro markets in Bangalore. As we can see, the gross margin (proxy for profitability of a micromarket) varies widely.

How Dunzo plans new geographies

Mumbai is an interesting example of how Dunzo has leveraged the above learnings to create a micromarket strategy and a playbook. It started with Powai, and has expanded to a couple of other high density pockets like Andheri but has eschewed seemingly attractive but low density pockets like Bandra West. This strategy has helped it keep higher gross transaction value per rider and thus higher margins in Mumbai. The success of this strategy means that Dunzo will never look at a city by city expansion but instead at a micromarket by micromarket expansion. Of course, there is a minimum city set up cost. If the next new micromarket is in a new city then the city set up costs have to be factored in.

Dunzo’s micromarket strategy seeks to understand each potential micromarket it can enter into, in terms of the potential gross margin it can command. To estimate potential gross margins basis the micomarket’s characteristics, it created a micromarket index.

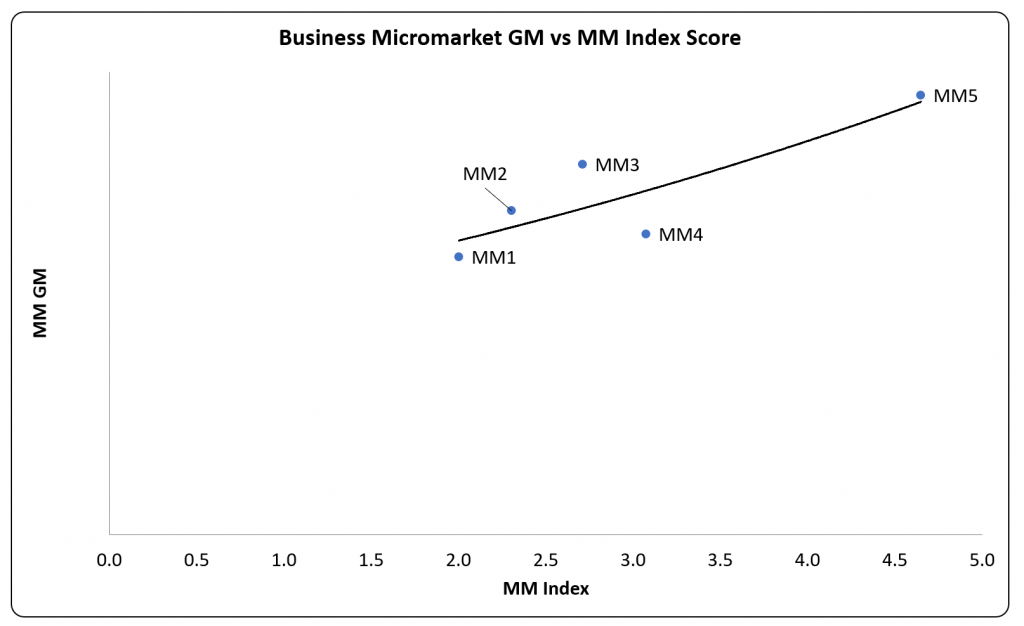

It started by analysing the Bangalore data to identify and extract four characteristics related to the micromarket – density, affluence, age distribution, and business concentration. These are elements of physical (density, business concentration) and socio-economic characteristics (age, affluence). They arrived at these four characteristics after a fair amount of time spent doing first principles thinking as well as statistical trial and error calculations. Then it derived the blended index score from a weighted combination of these four characteristics. Mapping the profitability of various micromarkets against their score on the micromarket Index confirmed direct correlation of the micromarket index with gross margins. They did this for both categories of micro markets – Commerce (Indiranagar, Powai) and Business (Chickpet, Andheri East).

The implication of the above is that Dunzo now has a reasonably effective micromarket or expansion playbook. It can look at all of the potential micromarkets open to it, and rank order them basis their score on this micromarket index, and decide. Now this isn’t a perfect solution, but a satisficing one.

Stack ranking of Micromarkets

The above playbook is one that more startups, especially those in the Atoms business, should adopt consciously. Many already do, but intuitively, often using proxies such as markets where Domino’s is present or moving to, or where Starbucks or PVR is present, and so on. But now there is a systematic way to approach expansion, by rethinking the basic unit of geography that you serve, trying to make this as granular (smaller) as you can and then stack ranking these in terms of opportunity and cost.

A Series C startup like Dunzo has the resources and past data to build a more evolved micromarket index. Now if you are a young business or 0->1 startup, then you won’t have access to past data. In such cases, rank order the micromarkets basis the size of the prize (demand opportunity) and ease of winning (cost of serving). If you can do this, and feel free to use rough proxies such as density and total cost of delivery to determine the demand opportunity and servicing cost, then you have pretty much approximated what Dunzo has done.

An important benefit of having rank-ordered data on micromarket profitability is that you can use this to:

- explore interventions where you can try and reduce servicing costs and thereby improve gross margins. This could be by introducing dark stores, or delivery charges beyond a certain number of kms, etc. This helps you improve profitability in high demand but high cost of serving type of markets, which actually pull your margins down.

- Showcase to investors that while your overall margins are low, you have certain markets that are super high margin, and that you have a playbook to expand into new markets that mimic your high margin markets, as well as plan interventions that help you improve margins in your middle or lower margin markets.

TLDR – every Atoms business should generate a ranked list of the 100 – 200 leading micromarkets in India that are ideal for its growth and margins, and expand in those micromarkets instead of expanding city by city.

The objective behind writing this is to share our learnings with the fast-evolving Indian startup ecosystem. There are enough distinct characteristics of our market that make it very different from Silicon Valley. Often, all we have closest to a playbook is the writings that come to us from Silicon Valley. Now this is not always relevant for us. Hence we need to do more at our end to create a culture of publishing and sharing learnings from within the Indian startup ecosystem. This article is driven by that very spirit of sharing and enhancing the startup quotient in our small but fast-growing ecosystem.

We would like to thank the Dunzo team (especially Kartik Mishra), and Yulu (especially Amit Gupta and Mamta Bhatia) for their assistance. Please feel free to reach out to us with your comments and feedback at sujay@blume.vc (Sujay Choubey) and sp@blume.vc (Sajith Pai). We would love to hear from you and learn.