India is amongst the most credit-poor of the major economies. Our total credit to GDP ratio is 55% (versus the global average of 148%). China for instance is over 3x India’s ratio. Now while too much of credit isn’t a good thing, being underpenetrated on credit does mean that you will pay the price of slow growth.

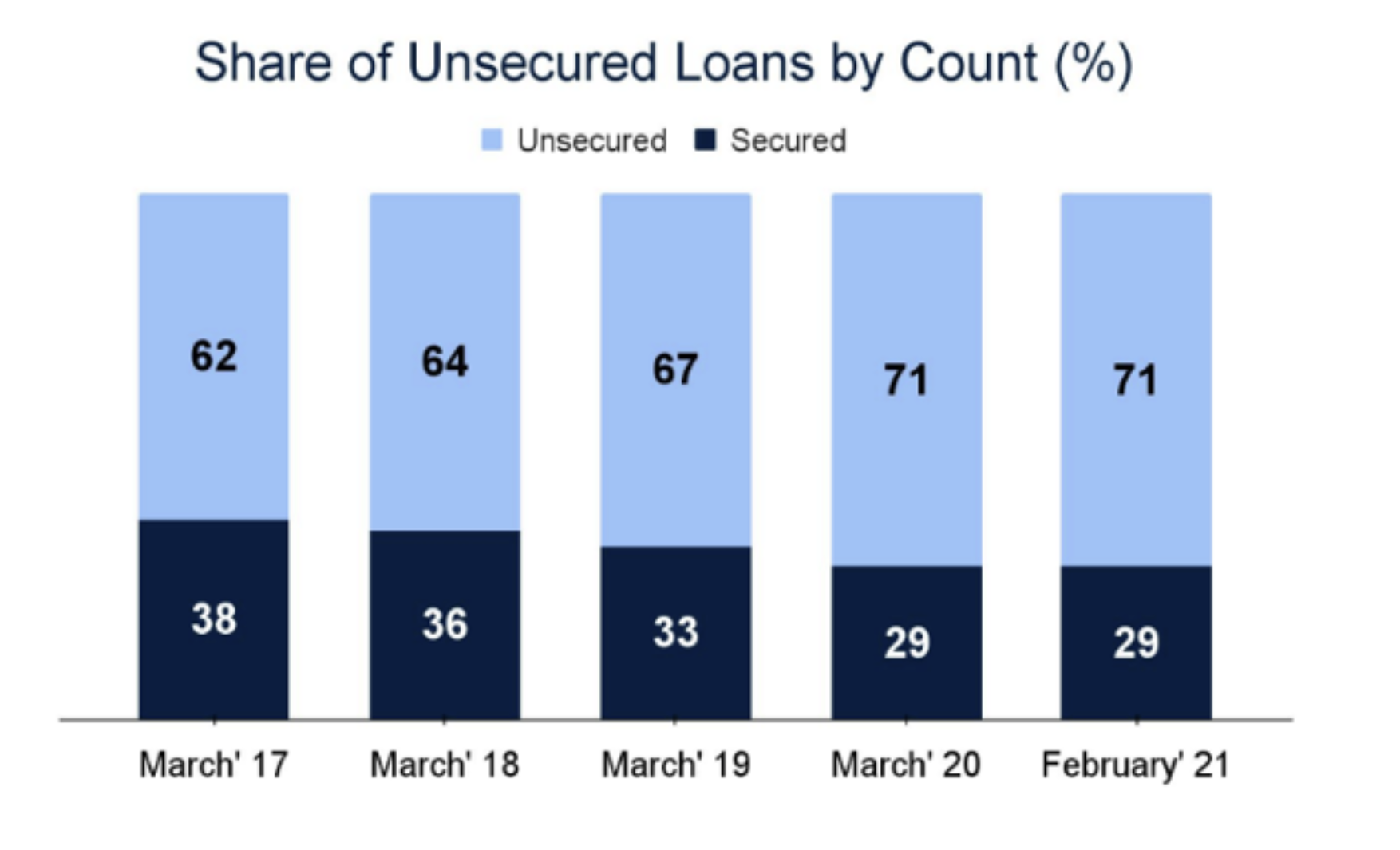

One of the key reasons for the low credit to GDP ratio is the nature of credit in India. It is predominantly asset-backed credit or credit secured by an asset – property, vehicle, machinery etc. In recent times, this has started changing, and the share of unsecured loans has risen.

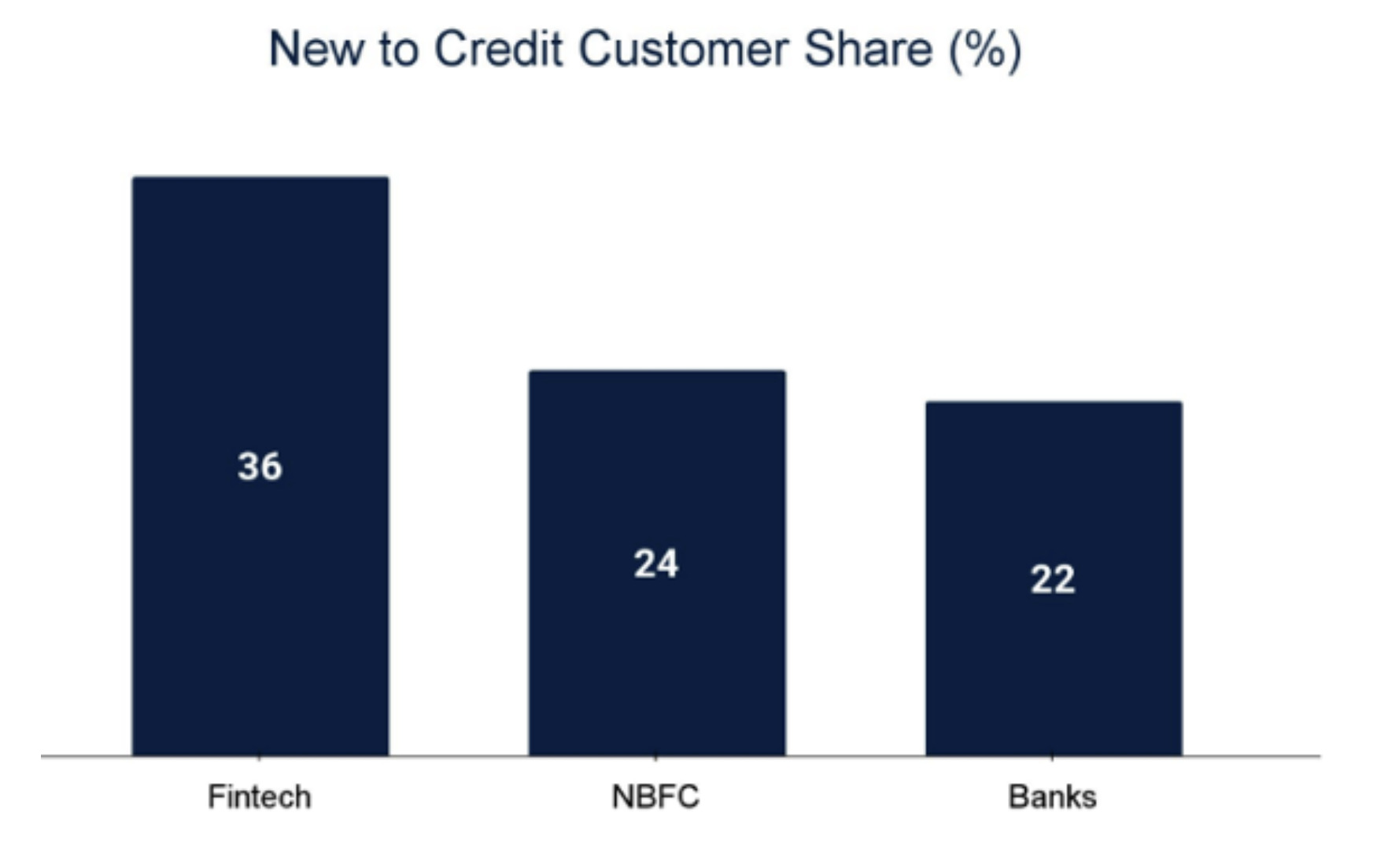

This is led by newer players (essentially fintechs like Kreditbee, Paytm etc.) who have seen unsecured loans as a space to play in with significantly less competition. Growth in supply of unsecured loans has attracted a number of New to Credit (NTC) customers. With more NTC customers comes collection risk, naturally, given these are typically lower income customers and usually do not have regular income.

Historically collections were handled by collection agents, who typically used a combination of voice and then field visits. Given that most secured loans were higher ticket value, there was enough margin to justify expensive field visits to collect. Unsecured loans have far lower ticket value and the margins don’t justify field visits. It demands an entirely new way of collecting.

DPDzero

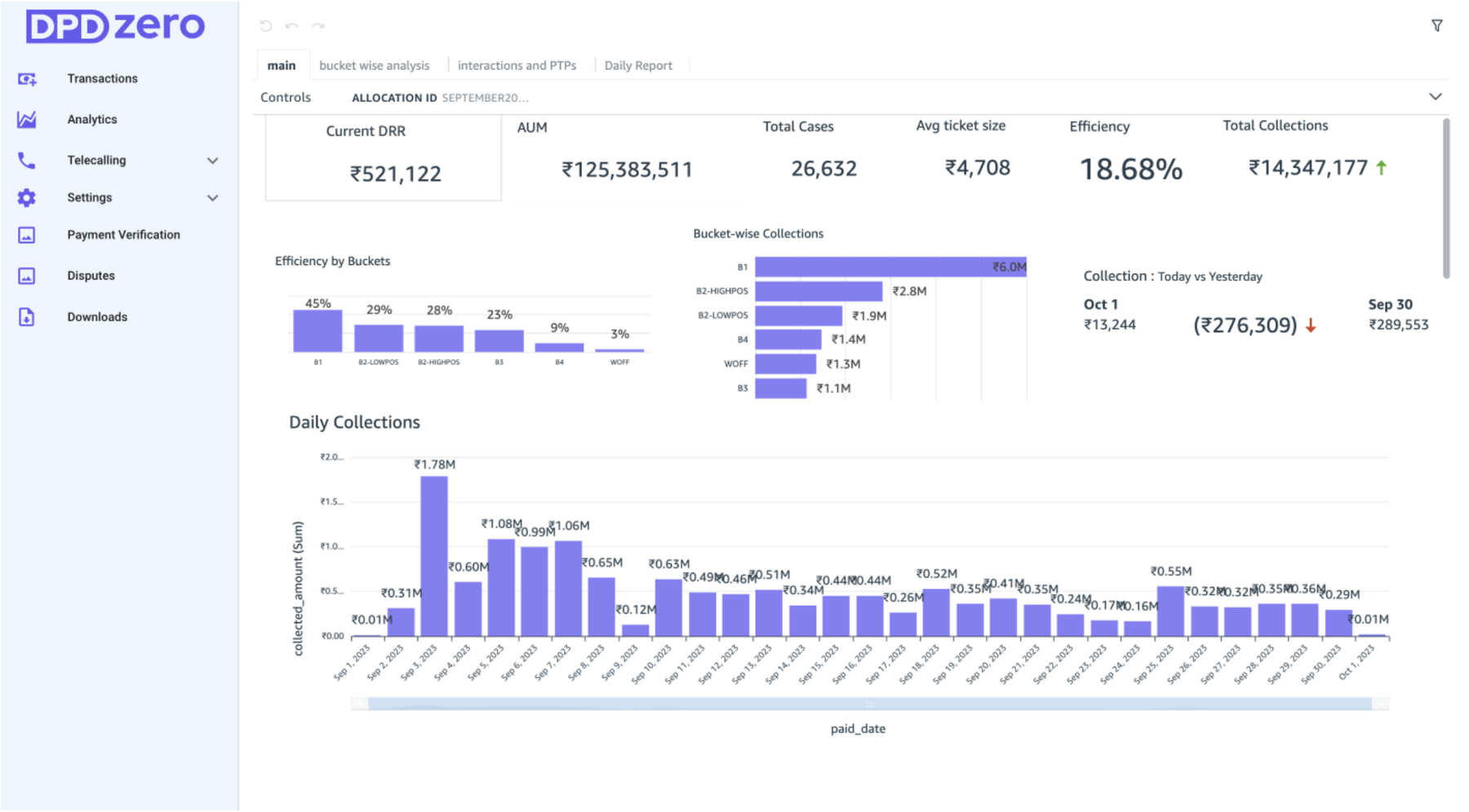

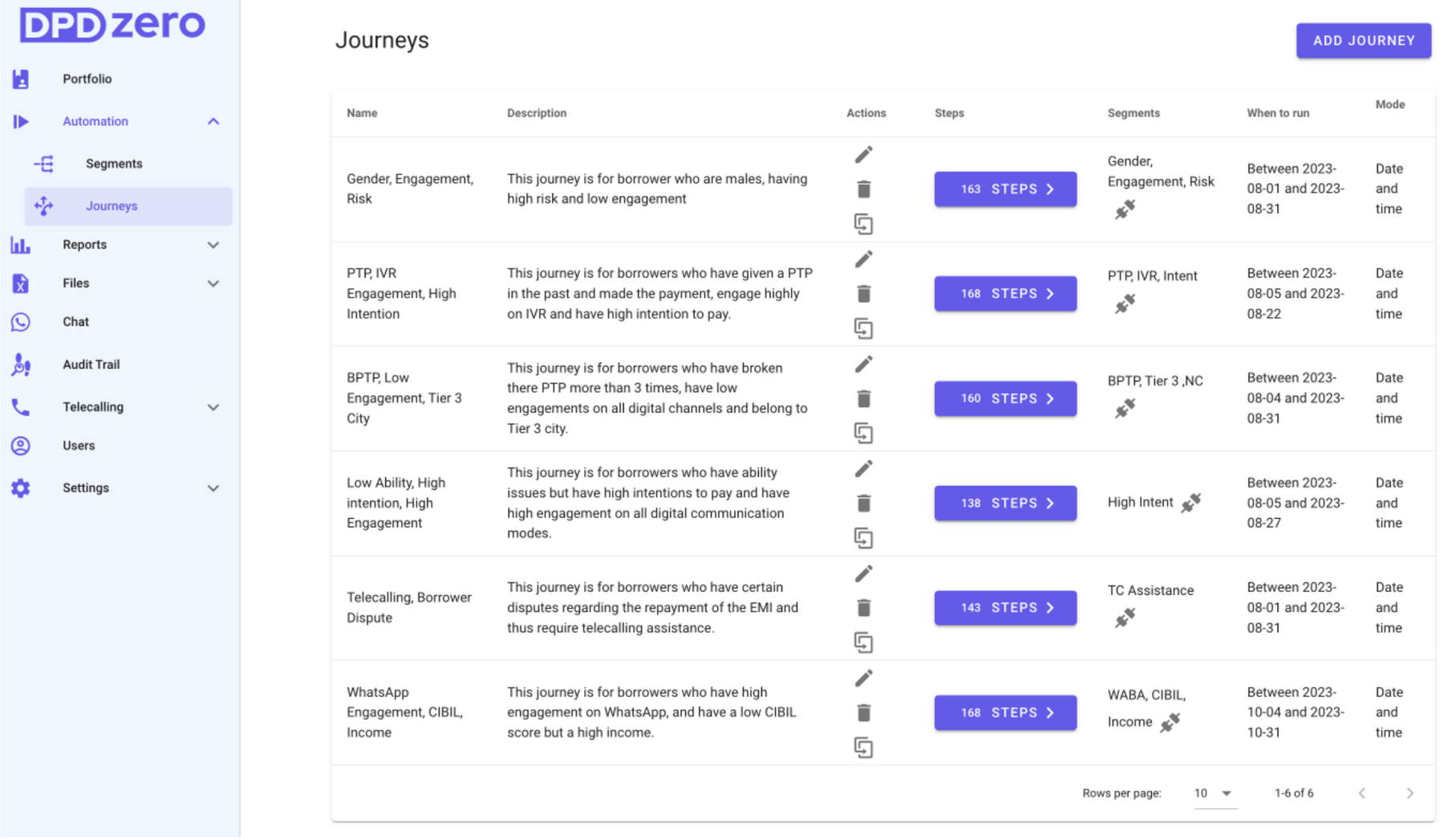

That is where DPDzero comes in (DPD = Days Past Due or industry lingo for how many days after the payment due date). They have pioneered a digital-first light touch approach built predominantly around digital nudges via sms, whatsapp, and voice calls (for enabling settlements).

Here is a quick view into the DPDzero product.

DPDzero’s product puts every customer on a unique collections journey. They have built an exhaustive library of journeys, each of which has its own combination of nudges and negotiation. Through these journeys, each backed by leveraging data, customer segment and real-time A/B testing, they deliver great collection efficiencies leveraging channels like whatsapp and voice calls, spurring the customer to pay. While the collections are digital-led, they also have a complaint tele-calling setup for customers who need human intervention.

DPDzero started out by focusing on new age fintechs who have a large number of NTCs in their portfolio, but then NTCs are widespread across NBFCs and banks too. They have begun to work with NBFCs and initiated pilots with banks as well.

Most NBFCs and banks have their own collections team for telecalling, and work with outsourced agencies for field visits. They have not focused on digital-first collections and hence for unsecured loans, they have unviable cost structures. DPDzero is particularly relevant in such contexts. Further, past incidents by agents of the field sales agencies has created illwill amongst customers and has invoked displeasure from regulators. DPDzero’s digital approach is welcome given that it is unlikely to spark such incidents and provides a 100% digital trail.

Our bet on DPDzero

We were introduced to Ananth and Ranjith, the founders of DPDzero, by our friends at Untitled Ventures mid’23. They had been part of the convertible note DPDzero had raised the previous year led by Better Capital. The thesis we had on collections being a key leverage point to the growth of the credit market was clearly a starting point. We then spoke to over a dozen industry participants, previous startups in this space (and their investors) and customers to validate DPDzero’s digital first proposition. We saw that collections was emerging as a key stress point, and DPDzero’s digital first approach was well suited for the trends we were seeing. In the U.S. market too, we had seen True Accord and January raise rounds on the back of solid growth. So there was some validation from global trends too.

Ranjith BR (left) and Ananth Shroff, the cofounders of DPDzero

We were also impressed by Ananth and Ranjith’s approach to product-building. They had also built their company frugally, and in fact when we first met them, they were actually profitable! Ananth brought hustle and biz dev skills, while Ranjith, renowned for his rapid prototyping skills, was able to interpret biz needs to iterate the product fast. Their past experience at Setu clearly put them at the intersection points of finance and tech, with a deep understanding of user pain points. Strong founder-market fit, a compelling product and the large addressable market potential made it a winning proposition for us.

We are excited to see DPDzero work closely with India’s fast-growing lenders and help address their collection challenges! Onwards!