“I always wondered, 'Who copies someone else's makeup or look?' Then I spoke to 18-year-old Gudiya (name changed) from Calcutta. This call opened my eyes.

She said women over 25 usually go to a beauty parlor for family weddings. We're not allowed. We want to look good, too, so we apply our makeup at home, and your videos help us achieve great wedding looks.

I thought this could be our chance. We doubled down on makeup videos in Indian languages. That changed our trajectory from thousands to millions of views on our videos."

- Manish Taneja, Founder and CEO, Purplle

It’s rare to find companies whose purpose is summarized in their Instagram bio.

It reads “Har Indian ka Beauty Destination,” which translates to “Every Indian’s Beauty Destination.”

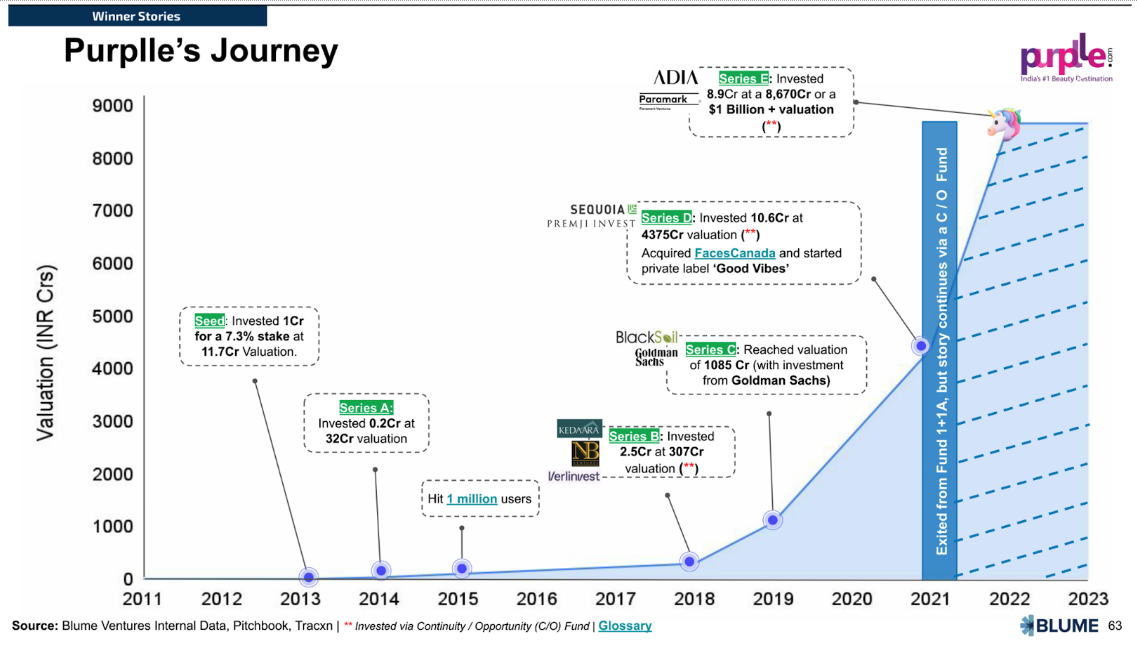

Purplle is part of Blume’s Fund I and is one of the top fund returners. They have other marquee investors on their captable - ADIA (Abu Dhabi Investment Authority), Verlinvest, Premji Invest, Kedaara Capital, Peak XV, JSW Ventures, and Goldman Sachs.

In the last 6 years, Purplle has grown from an annual revenue of Rs 60 crore (FY2018) to more than Rs 1300 crore (FY2024), growing at a staggering CAGR of 67%.

More than the numbers, what’s remarkable about Purplle is the impact they’ve created. Purplle helps 8 million+ Indians achieve their skincare, beauty, and wellness goals every month and employs 4000+ direct and indirect talent across the country.

We caught up with Manish at Purplle’s Mumbai office to learn how the company became a unicorn, what surprises him about the Indian consumer, and why he thinks building a beauty business has ‘high margins and even higher satisfaction.’

Finding Beauty

Inspiration comes from unexpected sources.

In Purplle’s case, the seeds of entrepreneurship were sown by Sunil Bharti Mittal, founder of Airtel.

Mittal sponsored a lab at Manish’s college, IIT Delhi, and gave a rousing speech as the chief guest.

Manish: “He said something that resonated with me. In 2003, when Reliance Infocom launched with CDMA tech, everyone advised Airtel to quit. He mentioned that they had never done any other business, so they didn’t know how to excel elsewhere. The leadership team went for an offsite to Agra, and 2-3 days later they came back resolved to fight it out. Today, Airtel is still the market leader and the country's most premium telecom service provider.”

While Airtel was an inspiration, Manish wanted to build an internet-based business.

Manish: “We understood trading well - We buy at Rs 70, sell at Rs 100, and the profit of Rs 30 covers our costs. We needed the internet to be integrated into our business model to do this at scale. That’s how we arrived at e-commerce.”

Manish believed vertical e-commerce was a strong entry point for later expansion into offline retail.

Manish: “We decided to enter a large market where, by capturing 10% market share we could create a sizable business, not just a lifestyle business.”

The large total addressable market wasn't the only criterion.

Manish: “We wanted a category with good gross margins because low gross margin categories don't make money for any player. Why would we be an exception?

Thirdly, we wanted a category with repeat business. If you acquire a customer once, they have more transactions over the next 3-4 years.

Lastly, we wanted a less competitive category. Beauty fit our criteria well and was a well-thought-through choice.”

For context, in 2011, e-commerce was a nascent market in India. Flipkart was launched barely four years ago, and there was no successful vertical e-commerce playbook. On the contrary, vertical beauty businesses like Sephora were making a mark via offline retail in mature markets like Hong Kong and the US.

He wasn't going to do this alone.

Manish lucked out finding his co-founder in his flatmate, Rahul Dash, who was brimming with excitement about starting an internet business.

Soon, Manish and Rahul left their comfortable full-time jobs to build an internet business and were joined by Suyash Katyayani as the third co-founder, who arduously built Purplle’s tech infrastructure, which became the backbone of the organization.

Capturing the Beauty at India’s Heart

Manish: “Every weekend, we'd visit beauty stores in tier 1, 2, and 3 cities to understand the market. How do they make ends meet? How much gross margins do they make? How do they look at their average order values? How do they upsell and cross sell? What's the difference between wholesale and brand stores? What is the experience in a tier 3 versus tier 1 cities?”

The founders found interesting insights.

Manish: “We had a consumer from riot-stricken Manipur.

She said 'I go to Kohima to order products and bring them to Imphal since we weren't delivering in Imphal due to riots.'

I was amazed. I asked her, 'What products do you buy?'

She said post-sun care. I thought she’d say lipstick or a simpler product, but post-sun care makes sense. They live high on the hills with intense sunlight.

She also shopped for hair color. She said funky hair colors are liked by people and it's not easily available here. I spoke to hundreds of such customers to realize that the beauty buying experience was primitive, except for a few metro stores.”

Ashish Fafadia, Partner at Blume Ventures, shared his perspective on the challenges of capturing the pulse of Tier 2 markets.

Ashish: “The market size may seem obvious now, but it wasn’t back then. The big internet draws were Astrology, Bollywood, Cricket, and Dating. While apparel, gadgets, and beauty were markets with large potential, e-commerce was horizontal.

We could see that the mid-market was emerging, with consumers who previously lacked access to these products. A company could start small but find success by serving underserved customers. Everyone focused on the top 2-5% of consumers, leaving hungry customers in Tier 2, 3 cities and what my colleague Sajith Pai termed "India 2" in the 2021 Indus Valley report, which also includes underserved parts of major cities.

However, it was tough to focus on Tier 2 markets initially. Potential Series A or B round investors questioned the right to win for a vertical commerce business, followed by questions on the beauty vertical.”

In 2017, Purplle achieved a breakthrough by using data science.

Manish: "We trained our systems using machine learning to understand the benefits of salicylic acid, retinol, and hyaluronic acid to teach it the beauty dictionary."

The proverbial ‘killer app’ was understanding the science behind the products, consumer needs, and Indian languages, which enabled Purplle to launch exclusive, owned brands tailored to Indian consumer needs.

Manish: "We'd been thinking, how can we make our app very local? India is a continent. Preferences change every 100-150 kilometers. We had data from all across the heart of India.”

This deep dive into regional nuances shaped vernacular content strategy across languages and dialects.

Manish: “We can create content in Bhojpuri and Awadhi Hindi. We have expertise at the dialect-level."

This tailored approach captured the heart of the mass-premium ‘belly of the market.’

Purplle launched private brands like Good Vibes, DermDocs, and NY Bae. These brands began as single products before becoming full product lines.

Manish: “They weren't meant to become brands, but niche products, fulfilling consumer needs. But then we saw traction and demand from different customer groups, leading to line extensions.”

Purplle strengthened its portfolio by acquiring brands like feminine hygiene label Carmesi and makeup brand Faces Canada in 2021.

Manish: "Carmesi founders are still with us in larger roles. Carmesi is now 25 times what it was when we acquired it.”

Owning this end-to-end value chain of brands is a differentiator for Purplle in the mass-premium beauty market.

Manish summed it up neatly, "Our right to win is our ability to create exclusive products that consumers love as they get way more value than the price.”

Ashish Fafadia added, "The Purplle story hinges on four pillars: tech, product relevance, data, and their ability to focus and evolve, which gives them a competitive edge. Their substantial tech prowess is key to their achievements and future progress.

Understanding customer needs at the ground level is another crucial lever. They’ve ingrained data-based decision-making in the company's DNA.”

How to Fund This Beauty?

Manish: “In 2015, we tried to do what potential VCs wanted. My biggest failure was not following our conviction, but doing things for investment. In hindsight, it's ridiculous and I wouldn't do it again.”

Despite its success today, Purplle’s journey was far from a fairytale.

According to Manish, the first five years were spent learning the ropes of the business, including tech, logistics, supplier relations, and customer support.

The funding cloud was always looming above their heads.

Here’s Manish, in a fascinating conversation with Siddhartha Ahluwalia on the Neon Show.

Manish: “We had a term sheet withdrawn, and our competitor got funded. Those six months were unforgettable. Rahul and I would wake up to see our negative cash balance and deposit our money in bank accounts to avoid payment defaults. I’m grateful to our employees who stayed with us, even when their salaries were delayed, and some had EMIs to pay. That gave us a loyal group of employees who are still with the company.

2016-17 were formative years for us. Despite being cash-strapped, we invested in our technology stack, which I call our Beauty Intelligence Suite. When we were almost out of cash in 2017, we tried to monetize this data. One of our investors had worked at a data company and inspired us to monetize data. We tried, but time was running out.'

In 2016, they got a breather by raising a million dollars from JSW Ventures.

Manish: “Given our scale, this wasn’t a large round, but it kept the company going. We had to balance short-term and long-term really well. Our first large institutional funding was in 2019 when Goldman Sachs invested ~$35 million, then in 2021, we raised $110 million from Premji Invest and Kedaara Capital. Almost 95% of our capital was raised in those two to three years."

You read that right. Almost 95% of Purplle’s capital raise occurred between 2019 and 2022. Investors saw the potential of Purplle’s reach and business model as online shopping became a habit across demographics.

Before we continue, it’s important to understand a key aspect of Purplle’s DNA: frugality.

The Beauty of Frugality

Purplle's early days were defined by a capital crunch that forced the founders to adopt a frugal, resourceful mindset from the start.

Manish recounted, "We never had too much money in the bank for the first eight years. This bred frugality."

Their backgrounds reinforced the frugal ethos.

Manish: "Rahul used to work at Tata Sons. Suyash’s previous startup didn’t do well. I came from Fidelity, known for value investing.

With limited funds, they made prudent choices, like avoiding discounts.

Manish firmly stated, “Good businesses with terminal value aren't built on discounting. It's a race to the bottom.”

Hiring was another area where they remained efficient.

"You don't need to keep adding people. You can use technology interventions to reduce the need for more and more people," Manish explained.

This allowed them to have a sub-100 tech team even at scale. "I think our people cost would be less than half of our competitors at a similar scale because at our core, we operate like a tech company," Manish said.

Maximum City. Maximum Beauty.

While Bengaluru is the tech capital, Purplle’s founders decided to build a unicorn in India's financial capital.

Manish: “Being in Mumbai has its advantages. All CPG companies are here, so buying and selling products was easier early in our journey.

We are very tech-led, but there are other essential functions as we deliver and manufacture products. That talent exists in Mumbai more than any other city. We have great tech talent in Mumbai, and while we have ~100 tech folks in Purplle, it is not difficult to build a much larger tech function.

What works well for us is that Mumbai is the Karam Bhoomi for many. People in Mumbai are straightforward, hardworking, and punctual despite long commutes. It's the most professional city in India.”

Other reasons were more closely aligned with the founders’ personalities.

“We're all introverts. We like people who don't flaunt wealth. In Mumbai, there are many wealthy families but you don’t know them because they don’t talk about their wealth. People quietly build their businesses. This means less noise and more focus on business.”

Blume + Purplle = Beautiful

Purplle is a superstar of Blume’s debut fund.

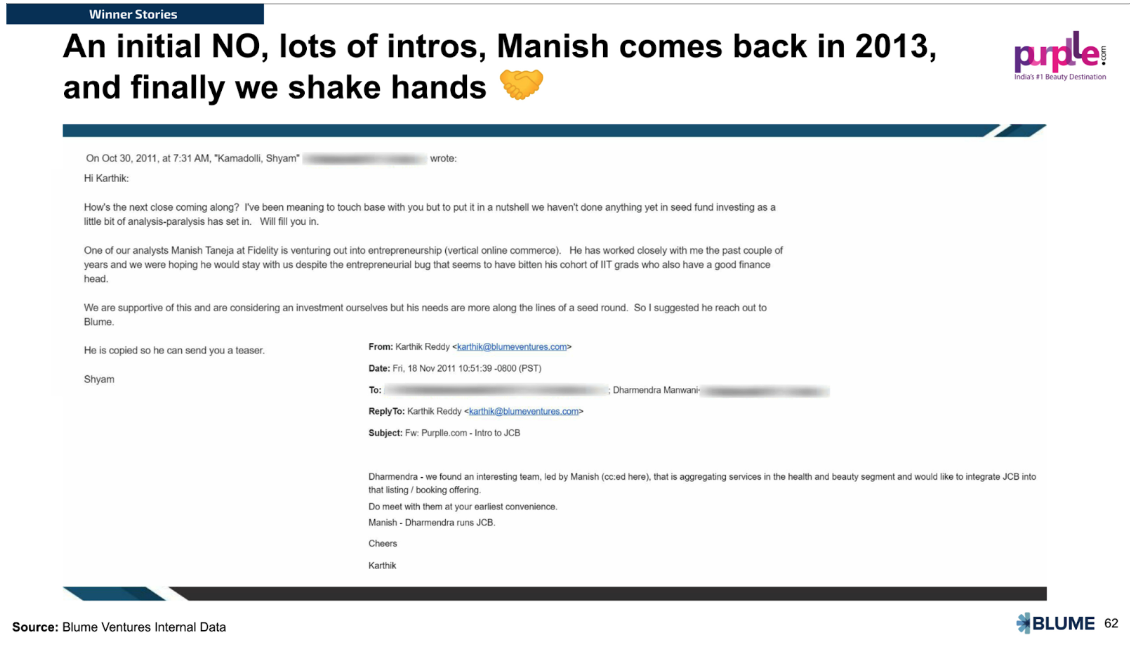

Manish recounts how Blume got onto Purplle’s cap table.

Manish: “I met Karthik at Salt Water Cafe in Bandra. He liked the idea but wasn't sure. Then I met Sanjay at his home. We didn't take money since we were just starting. One and a half years later, when we were into our gig, I reached out to them again. Blume was one of the fastest investors to commit capital. I spoke to Karthik on Jan 28, 2013. On Jan 31, he called saying, 'We're in, let's go fast.'

Karthik and Ashish have been one of our best supporters. Once, a later-stage investor said no after a soft commit. Karthik got upset and called them to say he hoped Purplle would become their biggest anti-portfolio. Truth be told, I never had that sort of confidence in myself. Ashish has been a friend for 12 years, and I've taken his advice for many things. He is always available, even if he is unwell.”

Ashish Fafadia recalls Blume’s journey with Purplle.

Ashish: “Purplle is the only funded beauty company remaining from the 2011 vintage. While Nykaa and others came later from a D2C lens, Purplle is the sole surviving vertical commerce business.

From 2011-2017, Indian consumer tech was about burn and land grab for customer wallet share by companies like Amazon, Flipkart, Snapdeal, and Paytm through discounts. However, Purplle's founders never played that game, building their company frugally with clarity of purpose.

Their ability to stay grounded is rare in the Indian startup scene. Despite the adulation, they remained focused, avoiding crazy burn or unsustainable 100% yearly growth. These qualities have led to Blume doubling down in virtually every round raised over the last 12 years.”

It’s a Beautiful Road Ahead

Purplle has displayed single-minded focus and grit throughout its journey to pursue growth through innovative solutions instead of conventional paths.

Manish stresses " build (ing) responsibly"—avoiding excessive hiring and firing, acting responsibly towards shareholders, and staying focused on your business goals amidst all the noise.

Manish: "We build with blinders on. Among the founders, we spend less than 1% of our time talking about competition.This tunnel vision is matched by a capital-efficient, tech-driven operational model.”

Underpinning this growth mindset are the founders' core values of humility and personal responsibility.

Manish: "We believe in being humble. We love being an underdog, working harder, and being nicer to everyone, more than anyone else."

When asked about what it felt like when Purplle achieved unicorn status, he said:

“It mattered for five minutes and then it didn't. We went back to building mode. It's not a metric we were chasing. Being a unicorn helps attract talent. But if you're building for 30-40 years, these are just small milestones.”

Purplle's journey hasn't been easy. But even with new 'D2C’ brands crowding the market, the Mumbai-based company has held the fort and continued to grow rapidly.

Purplle has cracked the code of sustainable, responsible growth without compromising ambition. With a $1.1 billion valuation and a clear IPO roadmap, the early days of struggle are now far behind, and Purplle is poised to become a consumer brand juggernaut.

As the hip-hop star J. Cole said, “There’s beauty in the struggle, ugliness in the success.”

Purplle doesn’t just sell beauty.

It helps millions of girls like Gudiya find beauty, making their lives a little better everyday.

In doing so, it finds beauty for itself, its employees, and its stakeholders.

Download Omega Files | Episode 1 here: https://bit.ly/BVTheOmegaFilesV1

Link to the Neon Show episode featuring Manish Taneja: https://www.youtube.com/watch?v=jNzzu1RaTVM