Do we have a problem in the way many startup founders think about IPOs in India?

As we talk to founders, we have noticed that many of them believe that to build a highly valued company over the long run, they need to take their companies public at least at a billion-dollar valuation.

In my humble opinion, they have voluntarily chained themselves to this notion, without realising it is a man-made goalpost and that a highly valued public company can be built even without the unicorn listing. To understand why they are in this mindset, let’s look at how things have changed in the startup landscape over the last decade.

Before the rise of private markets in India in the 2000s, going public to raise capital was the norm. Companies raised money from public markets to fund their growth story. Infosys, TCS, HDFC, ITC, HUL, Sun Pharmaceutical, and Vinati Organics, among many others, are a testament to this.

But as alternative sources of capital became available through VCs and PEs, companies started staying private for longer, which was how things were in the Western markets. Then came along the concept of unicorns. The term was coined by venture capitalist Aileen Lee in 2013 for private companies valued at over US$1 billion. Over the years, probably many founders got anchored to the unicorn status way ahead of business metrics and fundamentals supporting that valuation. This notion got even more deeply ingrained in 2021 when 44 startups entered the country’s billion-dollar club.

Investors, too, backed companies with rising valuations to build unicorn portfolios. Many companies were then taken to public markets at higher-than-expected valuations. However, some of these companies struggled to meet public market expectations of underlying business performance and hence the stock price was punished. This led startup founders to question the entire concept of IPOs. Although markets shifted in 2022, the billion-dollar IPO remains an important goal for many founders.

However, I believe if a founder has the conviction in their company’s mission and is ready to dedicate multiple years to the business, they can list at a sub-US$ 1 billion valuation and eventually mature into a billion-dollar (INR 8,300 crore+) company and beyond. Many successful founders have listed their companies without waiting for this artificial billion-dollar mark and created immense value in public markets.

Online B2B marketplace Indiamart made its public debut in 2019 at a market capitalization of about INR 2,800 crore (approx. US$335 million), which has now soared to about INR 16,000 crore (US$2.1 billion). This growth has come not only on the back of earnings growth but also the market rewarding them with multiple expansions—its PE multiple has risen from around 35 to over 45.

Another example is consumer intelligence platform provider Affle, which went public in 2019. Since the listing, its market cap has expanded from nearly INR 1,900 crore (US$228 million) to over INR 14,000 crore (US$1.68 billion). Meanwhile, its PE multiple has jumped from around 39 to beyond 186.

What stands out here is that their founders/ promoters retained a majority of shares even after the IPO. They eventually created multi-billion dollar companies and generated enormous wealth for their shareholders as well as themselves. This value creation would be mostly in line with or exceed, what they would have achieved with a billion-dollar listing (mostly after waiting for many years).

Common Misconceptions about Smaller IPOs

Making a market debut is the ultimate milestone in building a long-term credible business and creating liquidity. But when it comes to listing, particularly at lower valuations, there are many apprehensions and misconceptions. Let’s take a look.

It is better to list at a minimum billion-dollar valuation

Founders prefer to go public with at least a billion-dollar valuation so that they can create wealth for their stakeholders and enter the league of big companies. This ambition isn’t wrong. However, the way founders believe they can achieve it is limiting.

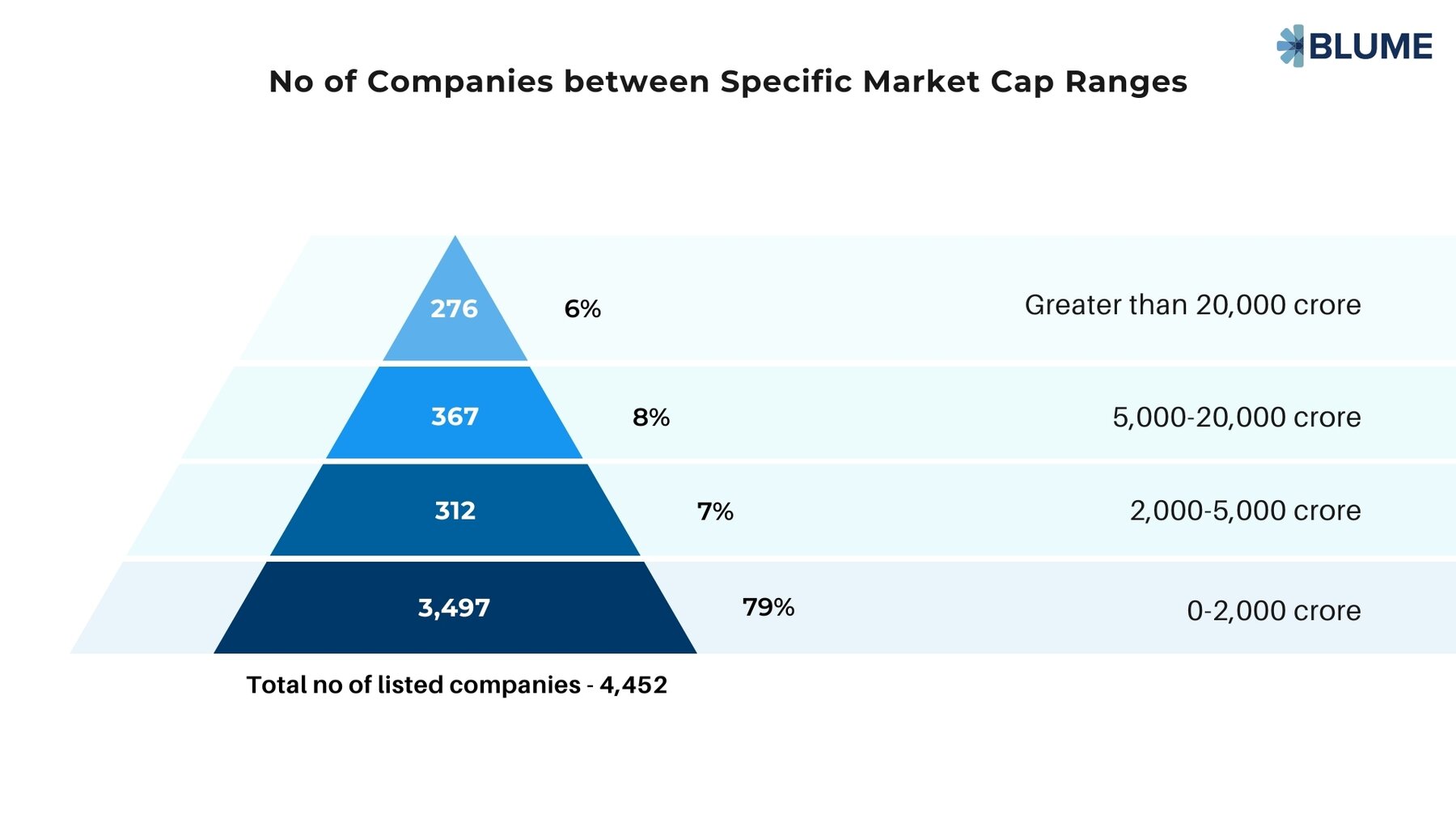

India has about 4,450 listed companies on the main board, of which nearly 10%, or over 450 companies, have a market cap of more than a billion dollars, while about 950 companies have a market cap of more than INR 2,000 crore.

So even if a company lists at INR 2,000 crore, it will still land in the country’s top 25% of publicly traded companies. Once listed, it can climb up to become a mid-cap (approximate market cap of INR 5,000-20,000 crore) and then a large-cap company (approximate market cap of INR 20,000 crore+). For instance, in three years since its listing in September 2020, Route Mobile increased its market cap from around INR 1,900 crore to over INR 9,500 crore, jumping swiftly from small cap to mid-cap bracket.

Source: Screener.in

Raising money is difficult post-IPO

I have heard founders ask, " Will I be able to raise more money after going public? " The answer is absolutely YES! In fact, a public company with growth and profits is better placed to raise capital than a similar private company.

Naukri’s parent firm Info Edge has raised money twice after listing through the institutional share sale—INR 750 crore in 2014 and INR 1,875 crore in 2020. Indiamart has done the same. In 2021, it raised INR 1,070 crore through qualified institutional placement.

Public market investor and capital base is far wider and deeper than that of the VC-PE world. A company's ability to raise debt also increases once it is listed, as its credibility in the market shoots up drastically.

Founders need to spend disproportionate time on Shareholder Management post-IPO

Life does change after going public, and founders need to be mentally prepared to adapt and find ways to handle those changes. Even as a private company, your roles and responsibilities in shareholder management evolve as you grow and raise different rounds from Seed to VC to PE investors.

There are time-tested playbooks for working with public market investors, such as hiring an investor relations person or team to engage with them and having an experienced CFO, who has run publically listed companies amongst many other things.

Institutional investors aren’t interested in smaller IPOs

Depending on the sector, size of your float, and market size, various institutional investors do want a share of an amazing company. They would surely not touch very small companies. However, if you are a great company with sound fundamentals, I believe that doing an IPO at INR 2,000 crore+ market cap would attract good institutional investors.

For instance, when fintech firm Zaggle went to IPO in September 2023 at a market cap of INR 2,002 crores, it saw institutional investors such as LIC MF, ICICI MF, Kotak MF, Morgan Stanley Asia(Singapore), Societe Generale, and Goldman Sachs (Singapore) participating in the IPO.

Similarly, drone manufacturing company Ideaforge, which did an IPO earlier this year at a market cap of INR 2,800 crore, attracted big institutional investors such as Pinebridge Global, Nomura, HSBC, Goldman Sachs, Mirae, Motilal Oswal, Axis MF, HDFC MF, and ICICI MF, among others.

Public markets might value your company differently

Public markets may offer your company multiples lower than private markets, depending on your business performance. However, if public markets are the eventual truth for your company and they have a set of rules and benchmarks to value your company, one should accept that. In fact, founders who want to build long-lasting companies need to keep these public valuation benchmarks in mind, while setting up their expectations for private market valuation, capital raise, and infusion.

For example, if the best OEM in public markets is valued at 4X revenue and you were able to raise your private round at 15X revenue, you should not expect that public markets will give you a 15X multiple. They may reward you for higher growth and IP your company has in comparison to the competitors but mostly not four times the market’s standard multiple.

On the other hand, public markets highly value companies that meet or exceed the P&L guidance that they provide. They reward companies that consistently deliver promised growth for 8 to 12 quarters post listing, with higher multiples, which automatically leads to a share price increase. It’s called the maturity premium. This is probably the most overlooked benefit of getting listed.

When PolyCab went for IPO four years ago, its PE multiple was 16. After performing continuously for a few years, its PE multiple has expanded to more than 45. This steep increase in the multiple also reflects a sharp rise in its share price.

Overall I think, public markets are the right place for committed founders to create value for everyone—for themselves, existing investors, new investors, and employees. VC and PE firms could also expand their Multiple on Invested Capital in public markets (many of them already do that).

Are you ready for an IPO?

I wouldn’t advise all companies to go public. If you are a high-growth company expanding at 70-80% per year or/and you are in the process of gaining market share for which you are burning a lot of money, it isn’t probably the time for you to list in India yet.

However, you can go for an IPO if you are a company that checks these boxes:

- Has achieved certain critical revenue

- Is either profitable or profitability is in sight over the next two to three quarters and the burn is already on a downward trend since the last few quarters

- Has a predictable growth model and can predict revenues with high certainty

- Is growing steadily—north of 25%

- Has decent capital on the balance sheet to fund IPO expenses

Let’s say you want to be in the country's top 25% of public companies. For that to happen, you have to list at a valuation of INR 2,000 crore. Assuming you are a tech company at that scale, you might be able to get a 12-month forward EBITDA multiple of 25 to 40. That translates into an estimated INR 50-80 crore of EBITDA in the next 12 months. If you have that kind of visibility, you are probably ready to go public.

However, the most important requirement to go public is the founder's mental readiness. You need to be mentally prepared to deliver predictable sustainable growth, persist despite market situations and shoulder a myriad of responsibilities that come along with steering a public company. Going public with your company is an internal decision first, and external second. You have to be committed to building a company that outlasts you and have a mindset that doesn’t let you bother about what happens in the short term.

In Conclusion

Many early-stage founders take IPO as the end game when they start building their company. It is not! In building a large multi-generational company that can exist for decades to come, public listing is an important milestone in India, one that signifies the beginning of sustainable value creation. Once you reach that milestone, you set yourself on a journey to keep building for the next milestone (A startup listing as a small-cap company would want to become a mid-cap company and then a large-cap company).

In this journey, whether you make the market debut at a billion dollars or not doesn't matter. Even if you IPO at INR 2,000 crore in India, you can get into the top 25% of public companies and attract good long-term investors.

More importantly, you need to be mentally prepared to do what it takes to lead a public company. As founder/s, you should think of going public only when you and your team are ready for an IPO and have a hold of the business to grow it predictably.

All the Best!