We at Blume invest in private Tech and Tech-Enabled companies riding fundamental Technology catalysts. Over the last decade, the Internet has been one such major catalyst. As companies from this cohort grew and wanted to build multi-generational companies, they decided to list and be part of the Public Market. Many more will likely choose this path over time to come. Why this is the right choice is a separate topic to be discussed another day.

As these companies started getting listed, we were often asked how these companies have fared in the public markets. This question became more prominent after a few public issues started trading below their IPO price. To address this issue, we thought of building an Index that enables us to study such companies’ growth trajectory and performance. We call this the “India Technology Index”. It is a free-float market-capitalization-weighted Index that aims to capture the performance of most of the public companies in the Indian technology ecosystem.

My team and I went back to Dec’16 to start this index with four securities, and it now comprises 24 securities (as of 31st August 2023) across large-cap, mid-cap, and small-cap companies. These securities trade on the Mainboard of the Indian stock exchanges, with a minimum Market Cap of INR 500 Cr as of the date of inclusion in the index, post listing.

Of course, there are benchmarks such as the NIFTY IT Index and S&P BSE IT Index; however, they are more weighted towards the IT services giants and may not do justice to our focus on Tech and Tech-Enabled plays.

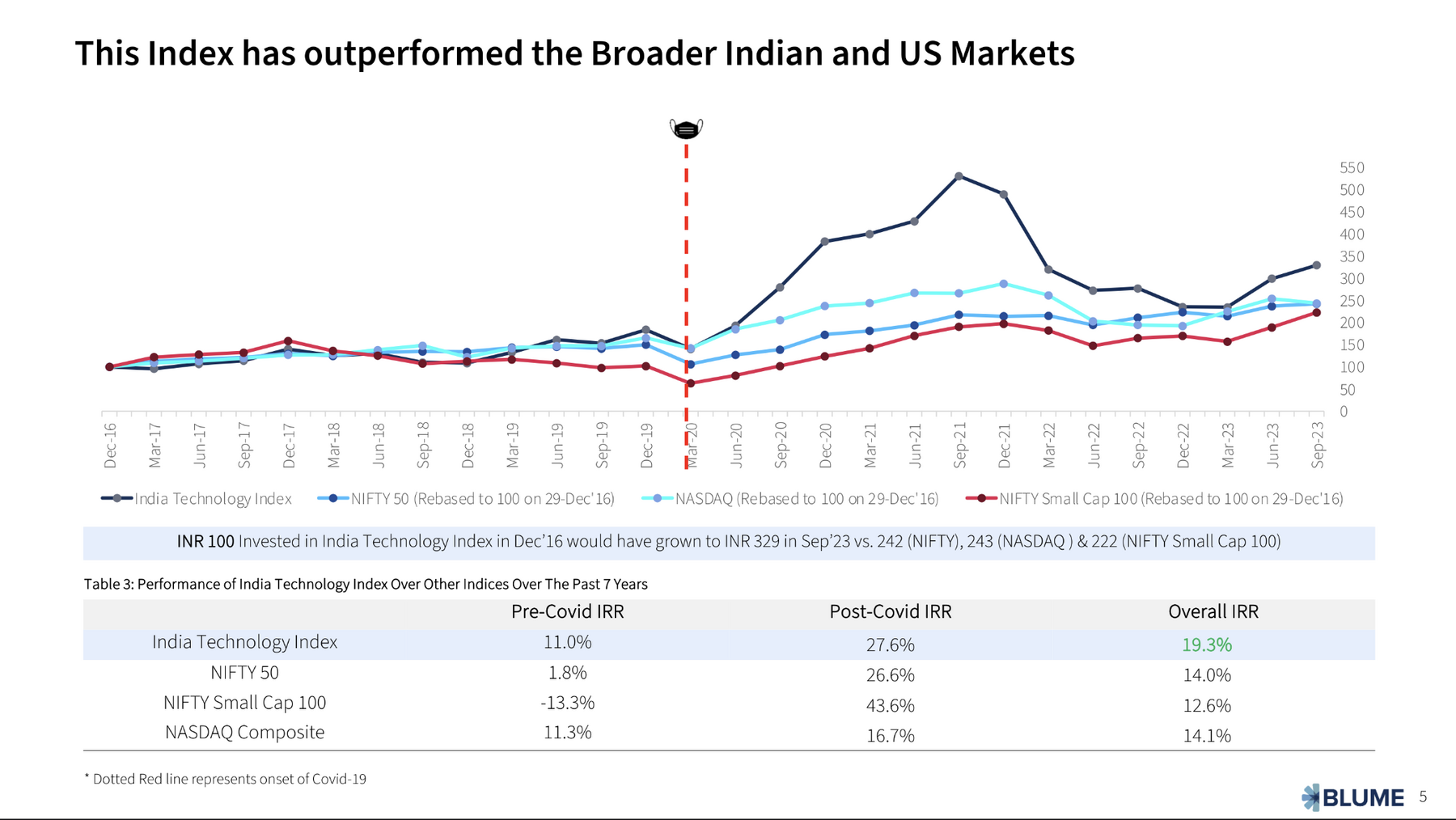

Although the primary objective of the index was to study the performance, it did provide a Smallcase idea as well 🙂 The India Technology Index has delivered an IRR of 19% vs NIFTY-50 IRR of 14% over this period.

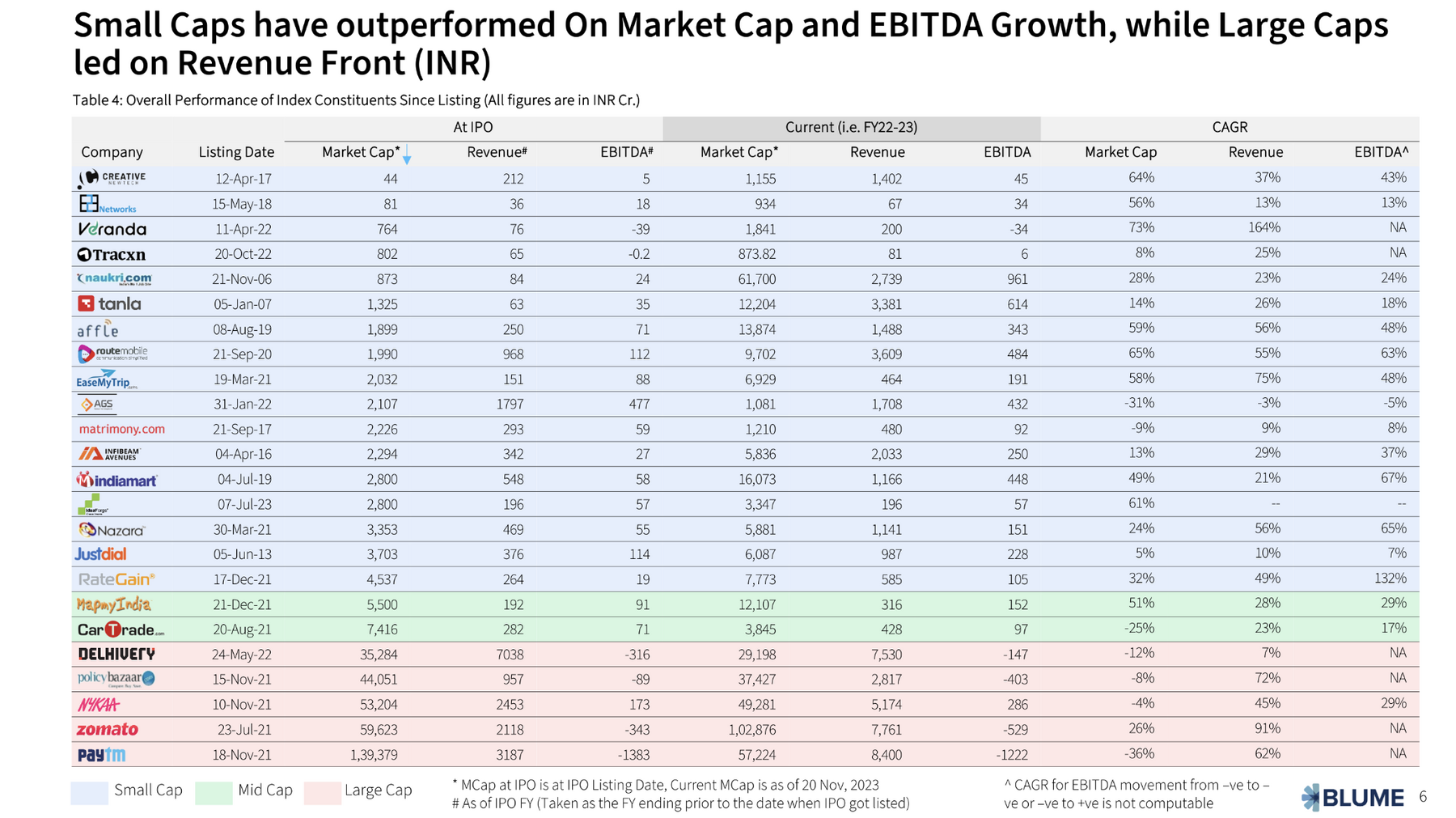

It was also interesting to see that the group of companies that did IPOs with a market capitalisation of less than INR 5000 Cr (US$ 625mn) performed better than the rest of the companies.

Of course, this analysis is based on datasets from a limited period. The performance will keep evolving as these companies improve their performance and new companies from this space list. But the broader points I want to leave with,

- India Technology has fared well over the last seven years despite short-term hiccups post-2021. The private markets will continue to bring more such companies to Public markets, resulting in a broader basket to pick from.

- No magical no for “ideal market capitalisation to list” exists. Various companies across buckets have excelled; however, companies with <5000Cr market cap performed better.

I invite you to read our India Technology Index report and share your feedback/ suggestions/ questions with me on Twitter or LinkedIn. You can download the full report here.