“Going IPO is not an exit. It's a completely new beginning. It's a reset, and once you're in fact going public and onboarding hundreds of thousands of investors, it's your responsibility to carry them through, build for them, and deliver value. So, if you're an entrepreneur who wants to sell and exit the business in 2-3 years, then going public doesn't make sense at all. If you want to run this business for the next 10-20 years and create a lot more value, then going public makes sense.”

The above lines were spoken by Nitish Mittersain when Arpit Agarwal, Director at Blume Ventures, asked him about his decision to go public. This was in a recent episode of X-Unicorns, a podcast conceptualised by Blume to bring out the unique journeys of startups which have taken varied paths to success.

Here’s the big question — why do companies go public? Going public brings advantages such as access to public capital markets for future fundraises, the ability to use publicly tradeable stock to acquire other companies, and the ability to hire better talent that comes with an elevated brand status of a publicly-listed company. For venture-backed companies, going provides an exit to the investors who have been backing it since its early years.

Whatever the reason— the first time that a private company decides to raise money from investors can be quite gruelling. The process requires time, effort, and appropriate resources to get to the other side of the fence. The substantial paperwork and the financial disclosures all add to the compliance overhead for founders.

Laying the ground

It is important to understand that an IPO would be relatively more expensive when compared to a similar private fundraise because certain costs are fixed. It is even more acute when this fixed cost is spread over a lower base when the size of the issue is smaller. For example, for an INR 300-500cr IPO, the costs would probably be around 5-7% of the IPO value. In comparison, a private placement would largely see costs, almost entirely bankers’ fees of 2-2.5% at the maximum. Moreover, despite reduced compliance and disclosure burden in a small issue, going for an IPO would require significant management bandwidth. So, when is it a good time to decide to go public?

Sharing his views on the subject, Prakash Chellam, Partner at Marathon Edge LLP, who previously in his i-banker avatar has taken companies public, shares that fundamentally, the decision to go for an IPO is a function of the maturity that one has reached as a company, and if there is a genuine need for that capital. On the former, he clarifies, that it is considered a good practice to avoid going public until a company has attained a certain level of maturity, for it is critical not to forget that “there’s a certain moral obligation that you have since you are after selling to a whole bunch of retail investors, who are not as sophisticated as financial investors.”

He says to ask yourself “if you are in a position where you have the maturity to indicate a certain growth trajectory, a certain set of objectives, and whether that is profitable or not?”

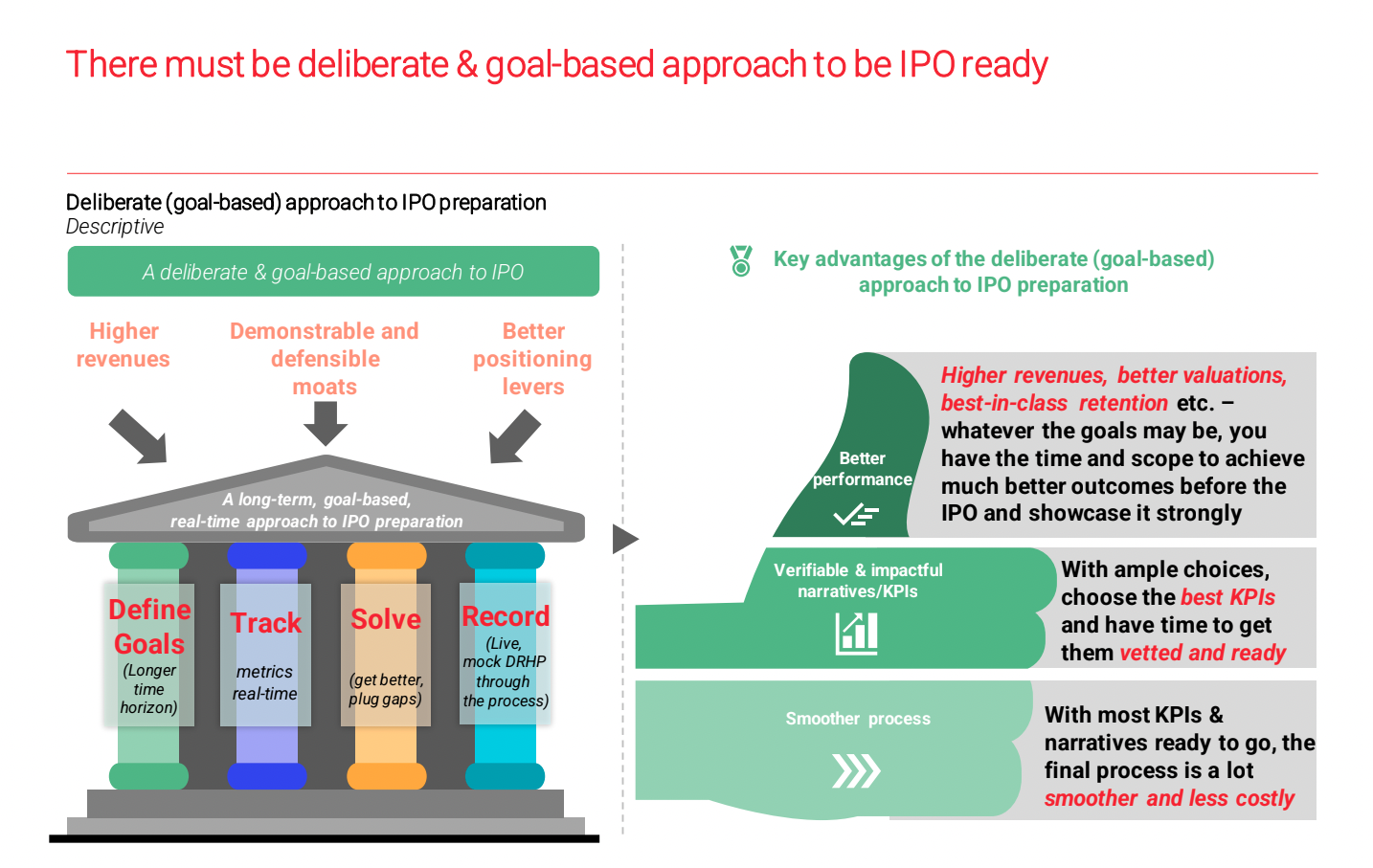

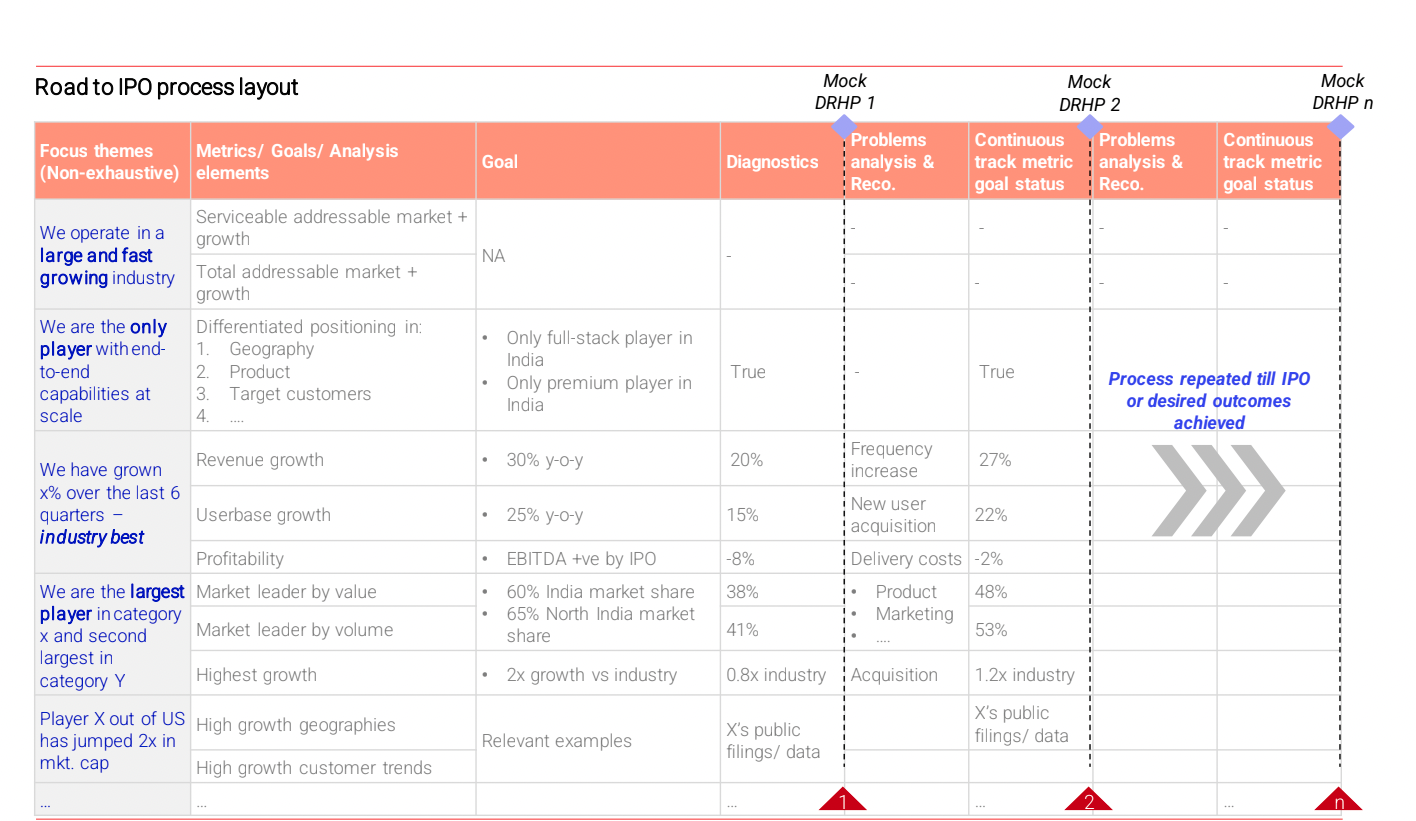

Another important factor to consider, believes Chellam, is to ensure that the USP that the company talks about reflects in certain metrics. This will work as a differentiator, making them stand out from their competitors and bear testimony to their claims.

As someone who has already tasted success in this journey, Nitish Mittersain of Nazara Technologies is of the view that going for an IPO must happen if there’s a minimum scale in the business, predictability in revenue and a tangible part to profitability and cash flow generation.

“If you're able to define why you want to go public, and if you check the box, that governance is in place and accounting books and all are clean, think that is the time you can go public,” he added.

Neha Singh, co-founder of Tracxn, who describes her journey of deciding to go for an IPO in the 100X Entrepreneur podcast said that they had thought about listing the company at the time of its inception, which is also why they intentionally set up the HQ of Tracxn in India, despite being a global platform. “It was at the end of 2020 when we started working on the listing process seriously because the markets looked conducive. By the time you finalise, you start working on the listing process by dealing with a set of intermediaries, especially a banker, then the legal counsels, etc. That was done by March 2021, after which it took us 3-4 months to do the DRHP filing, and then move to the NDS accounting format.”

Post the approval of DRHP (Draft Red Herring Prospectus, essentially a detailed offer document with information about the company as well as the offer construct) by SEBI (Securities and Exchange Board of India, which regulates public markets), a company can hit the market in the next 12 months. For Tracxn, after receiving the nod from SEBI in November 2021, they took their time to go public. In the initial part of 2022, given the Fed rate hike, the market condition wasn’t as favourable, and in the middle of the year, when they saw the opportunity, they started preparing to hit the market by updating the June financials.

If a company has decided to go public, there are certain prerequisites that must be taken care of. A PwC report has a piece of advice – “While the planning process for an IPO can start the day a company is incorporated or as late as months before a public offering, we recommend that an orderly plan be executed over a one-to two-year period. This window gives a private company time to build the capabilities to think, act and perform as a public company.”

Checklist

- At least months before you file the DRHP, start your housekeeping. It is critical to review all the agreements, transactions, websites and any legal compliance to figure out or address any recurring issues before going public. Other important aspects like securing intellectual property must also not be neglected.

- Be prepared with three years of audited financials compliant with Indian accounting standards (Ind AS). Hiring an internal audit firm is a decision company must not delay at any cost.

- Have a robust business plan in place supported by an MIS.

- Having a single-class share structure is more beneficial; so convert all preference shares to common stock before the sale.

- Onboard specialists including a company counsel, underwriters, and legal professionals at least a year before going for DRHP filing, since a lot of heavy lifting is required at this stage.

- Speaking of the ‘sweet spot’ for an early IPO in India, Abhishek Goyal, co-founder of Tracxn, says, “As you grow larger, if your float is more than let’s say a billion dollars, it gets tough for the Indian market to absorb it in today’s context. I think a sweet spot of entering the market is between $200-500 million valuation, where the Indian market can attract a company.”

Choosing the right book runner or lead investment bank, is an underrated tip, but highly important. The book runner, or the lead underwriter, takes charge of the issuance of any new equity, debt or even securities. They coordinate with other stakeholders and navigate any risks or challenges the company will likely face. In the case of IPOs, the book runner takes the lead in evaluating a company’s financials as well as the market conditions to zero in on an initial value as well as the number of shares that must be sold to private parties.

Since the role of a book runner is so critical, it is important to choose a partner whom you are comfortable with. While the time prior to filing an IPO is significant, there’s also post-market support that’s needed; find someone who can help you there.

In addition, look at how important the deal is for them. Are the fees from the transaction material to them? Are they putting their best teams on the job? Is the lead partner or CEO taking time out for conversations with you? Do not go with a lead investment or book runner for whom your issue is not meaningfully material.

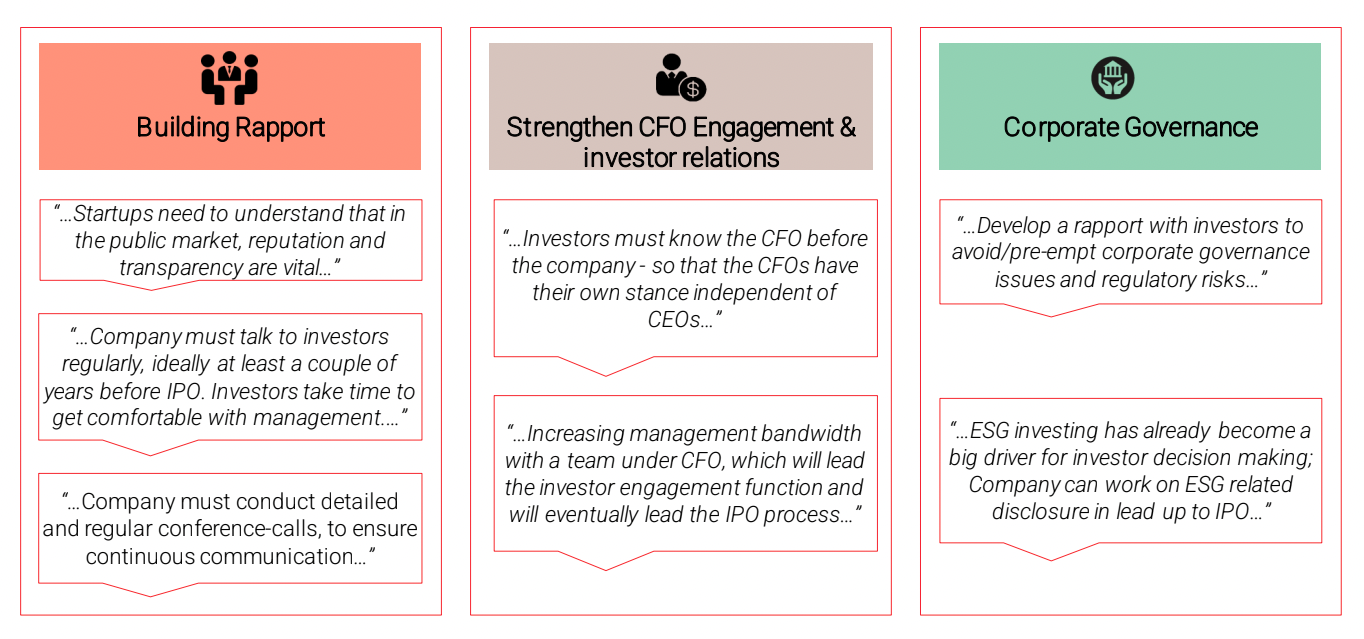

“If one were to think about the public market transition, obviously, if you’re profitable, that’s great. But if not profitable, it should be clear as to what it will take and by when you can become profitable. The second aspect is that there is a certain scale at which more and more excitement builds up around the assets in the public market space. So, you do need to have some level of scale for people to invest their energies and to think about you as a company, for you to drive volumes. Third, which is also a very specific nuance between public and private is corporate governance,” shared Rohan Agarwal, Partner at Redseer Strategy Consultants.

Into the IPO

In this phase, a founder’s job is to maintain the investors’ trust and guide them through the journey. During roadshows, even if some investor doesn’t commit to investing in the IPO then, they could come in later after observing the company’s performance for a few quarters post-IPO.

As a listed company, the broader the research coverage the better, hence it is a wise decision to educate analysts. Make sure your narrative is clear and the prospects for growth are well-understood – the easier you make it for them to understand the business, its revenue model and future growth drivers, the more interest you will get and the greater the possibility of more analysts covering the stock, and thereby greater investor interest.

Checklist

- Preparing a prospectus that highlights all the important information pertaining to the investment decision, as well as about purchasing shares in the IPO. Incomplete or wrong disclosures can end up with negative consequences for the company and its leadership. Your lead banker or bookrunner will help draft this.

- If you have no clear competitor while doing a peer review, look for local comparables followed by global, and then local allied markets, followed by global ones.

- If your story and business are very new and unique, get a consultant like Redseer, Bain etc., to prepare an industry report and explain and dumb it down. You have to actively collaborate with them and explain the model, the players, and the addressable market. Break up your business into relevant metrics that are easy to understand.

- Ensure you have a strong corporate secretarial function in place. There is a ton of paperwork involved, and missing documents can derail the entire IPO.

- Post drafting the prospectus, it must be submitted for review to SEBI (in the case of India). The risk factors and audited financial data are rigorously reviewed — the information submitted is also publicly available on the SEBI website.

- Once the prospectus is approved by SEBI, the banks are responsible to identify the right investors, as well as determining the pricing of the IPO in consultation with the company.

- If not already profitable, the company should have shown reducing losses in the past 5-6 quarters and should be able to turn profitable in 4-5 quarters post-listing.

- Diluting more than 30-35% in an IPO is not preferred.

- If the company has been a loss-making company in the last 3 years, 75% of the capital raise has to come from institutional investors (local or global).

Recalling her experience in the run-up to filing an IPO, Neha Singh of Tracxn shares, “I think this is the most rigorous part of the IPO – you end up meeting more than 50 investors and eventually hope that between five to seven good investors come and work with you. And if you were to ask me before starting the roadshow, who are your top tier names, some of them would clearly be on that list.” Essentially use the roadshow to get good anchor investors to back you during your IPO roadshows as it allows better book building.

Life post-IPO

While it may appear that IPO filing is the end of the road for a business, instead, it is the beginning of a new life cycle. As Nitish Mittersain of Nazara rightly puts it across — “there’s a lot of filing, a lot of hygiene work that needs to be continuously maintained. The good part is that Indian markets are quite well-regulated.”

India’s statutory regulatory body, SEBI, has a range of compliances that must be adhered to after a company has been listed as an IPO. These can be on a monthly, quarterly, and annual basis. For instance, once a company has been listed, it must remain silent from the end of the quarter to 48 hours after its quarterly financial results have been announced. This is termed the blackout period when no one associated with the company can trade in its securities. In case any employee of the company or individual associated with them leaks the unpublished information accidentally, they could be investigated.

There are also some other things to keep in mind, says Neha Singh of Tracxn. “Not a lot of people actually know that if you raise primary capital in the IPO, you have to use it in the next one to two years and that is also monitored. So, you have to give the use of proceeds initially, and unlike financing the private market, you cannot just keep it for unallocated items initially, and then use it. At some point in time, you have to actually expense it in the next one to two years,” she adds.

“The second thing is if you’re a profitable company, and you don’t have a lot of CAPEX requirements (because you don’t have to set up large factories), it’s an asset-light model. So, there aren’t a lot of avenues where you can deploy it. Say if you want to buy an office building, but that’s not something investors would like you to lock your capital in,” says Neha.

If you ever want to raise more capital post IPO, a Qualified Institutional Placement, or a QIP, is a relatively easy route. These do not need SEBI approval, but an intimation is required. For instance, Info Edge’s first QIP was done in five weeks flat.

Rohan Agarwal of Redseer has another input — if there’s a certain messaging or projection that one has been delivering to the investors during preparing for an IPO and while going public, it is important that you are able to follow through on those promises. Second, it is important not to keep people in the dark, and continue being transparent to give them enough visibility about what is happening out there.

Wrapping up

On another note, there are alternative avenues to list as well, such as the SME Exchange. However, these platforms lack trading depth and come with constraints such as minimum application size and minimum trading lot (Rs. 10 Lakhs for both), thus limiting investor participation. "Do keep in mind that even if you go the SME listing way, ultimately the ambition should be to ensure that when the company is upgraded to the main exchange,” said Ashish Fafadia, Partner at Blume Ventures.

There are several benefits to going public, albeit it is done with caution while following the right protocols. In 2021, 63 companies mobilised Rs 1.19 trillion (US $17b) through IPOs in India – which is four times the amount raised in 2020. On the home turf, there’s a positive outlook – nearly 80 startups are likely to go public in the next five years per RedSeer Consulting. But it’s important to have a deliberate and goal-based approach to be IPO-ready so that businesses taste success.