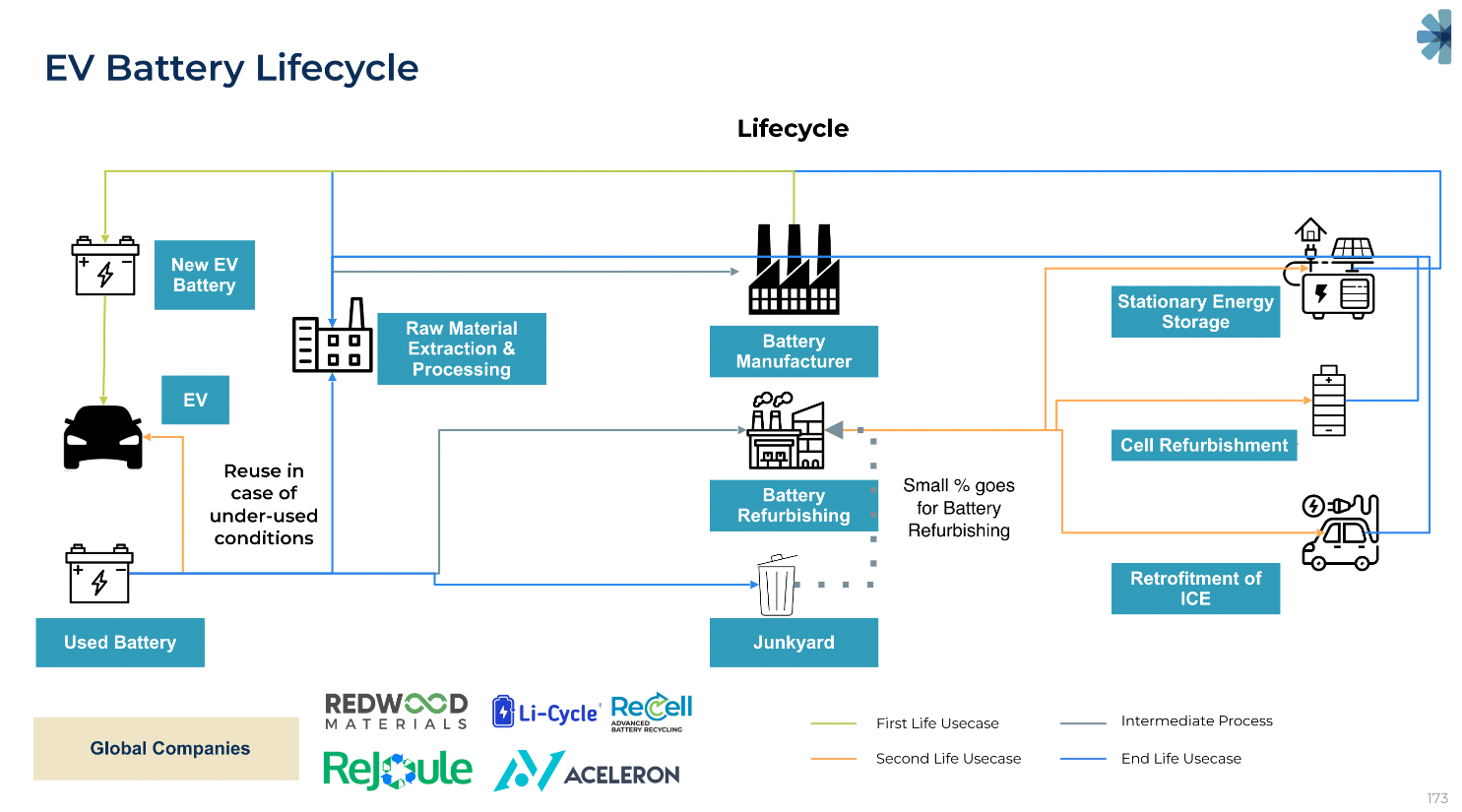

When Arpit and I first released our first-ever EV Primer in April 2022, it was driven by the need to summarise our learnings from being long-term investors in companies such as Yulu, Euler, BatterySmart, ElectricPe and Vecmocon. It allowed us to engage with the EV (and auto) ecosystem. With the release of the second version, we now aim to capture how the last year has been for EVs in the country regarding OEMs, charging, financing, and auto components. We added two additional sections on EV distribution and battery recycling for our latest edition.

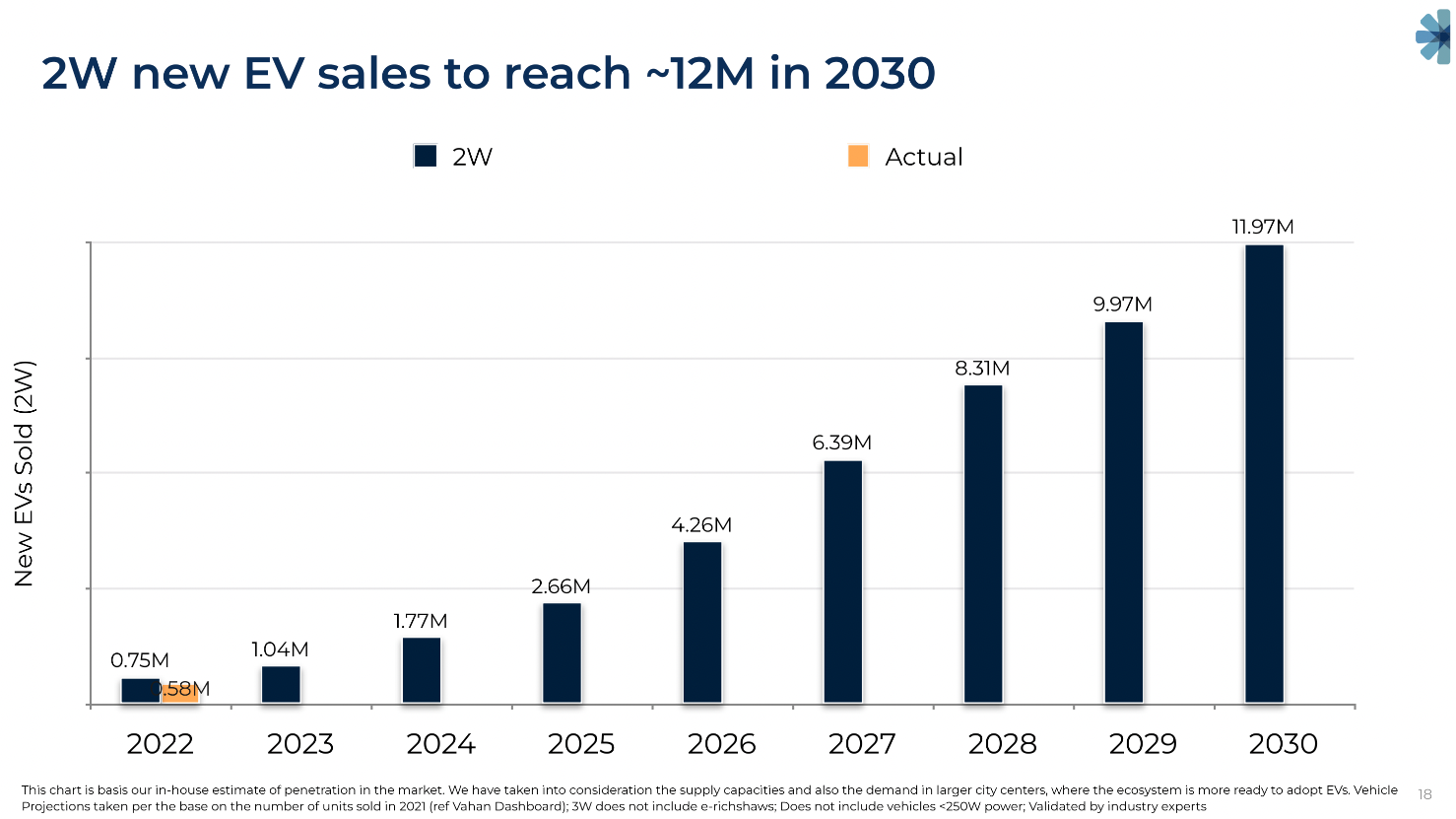

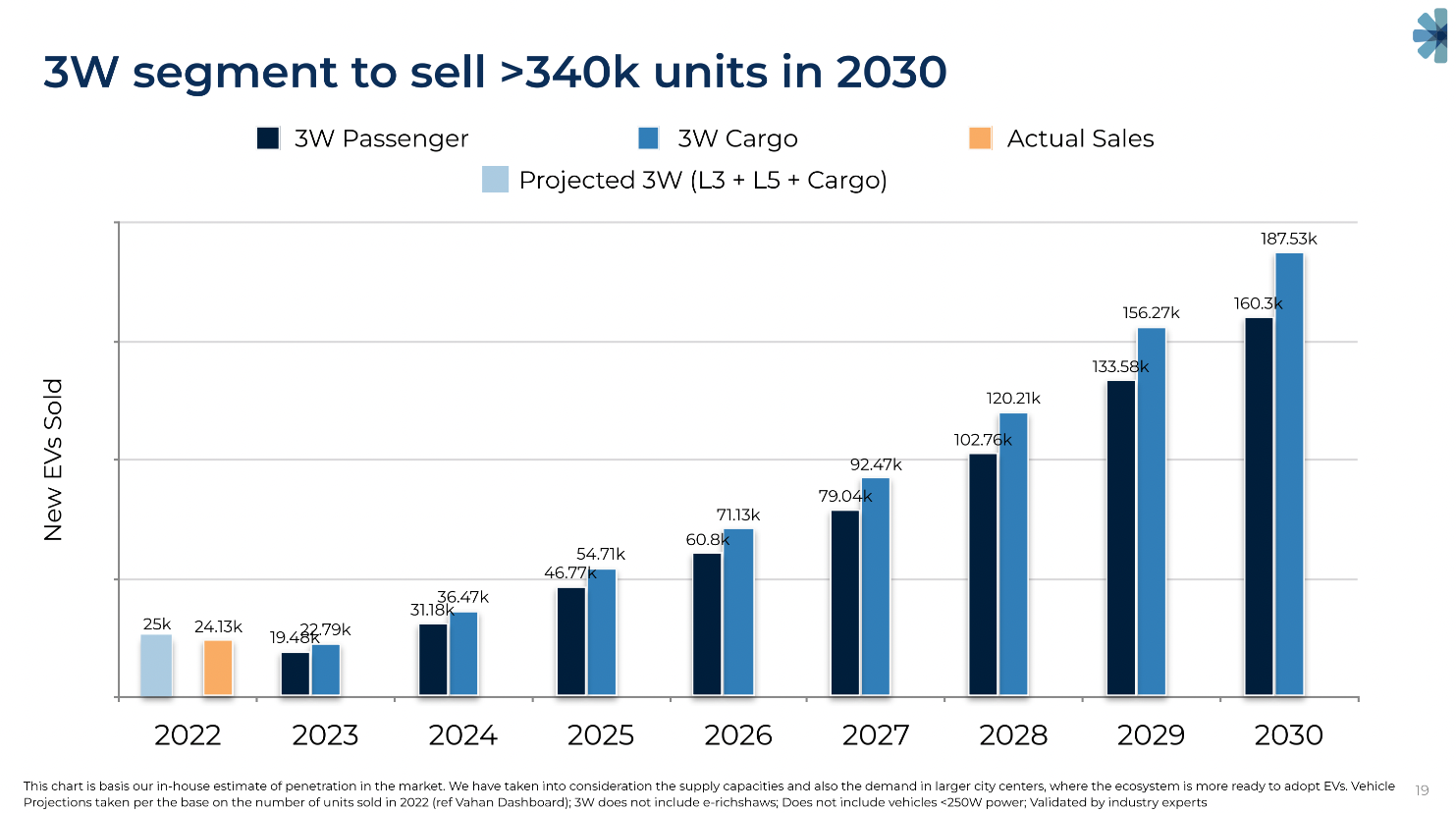

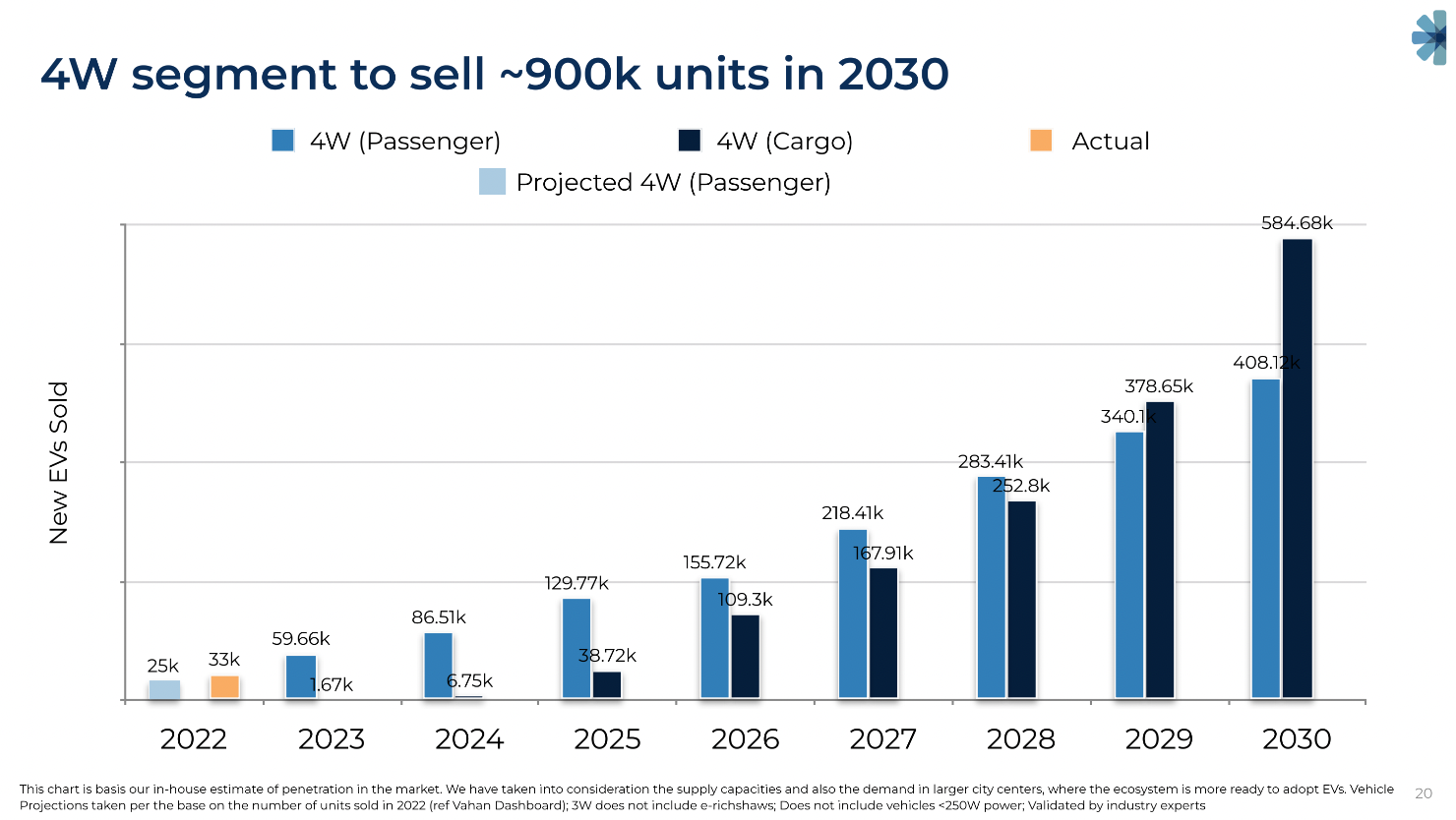

Let’s start with some good news. Our estimates for 2W, 3W and 3W sales have been 77%, 96% and 68% accurate! However, in some instances, we have rationalised our EV sales projections across some segments due to feedback from the ground.

Evolving Ecosystem

A few key things have happened over the last year in the EV industry:

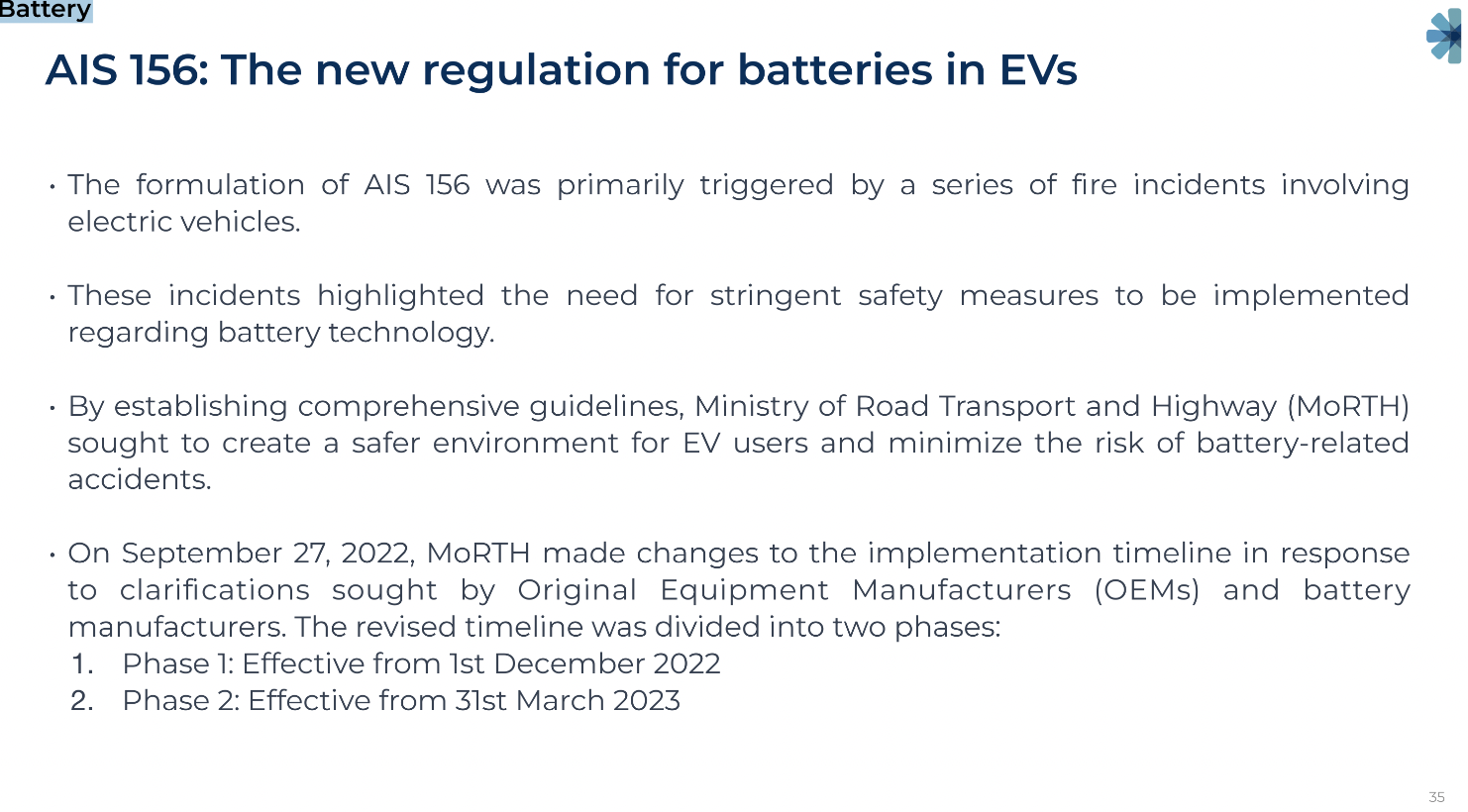

- Introduction of AIS 156 standard;

- Reduction of FAME II subsidies for 2Ws (starting June 2023),

- Spike in Li-Ion battery prices in 2022,

- A drastic change in the availability of suitable vehicles, components and financing for EVs.

While the AIS 156 aims to increase vehicle safety, it has led to OEMs having to design their vehicles, build new partnerships and further re-certify them! This phenomenon has led to a prolonged growth of EV sales in the first half of 2023! FAME II subsidies have now been reduced starting June 2023 for 2Ws, leading to May 2023 recording 1L+, the highest number of 2Ws ever sold in the country.

Except for buses, all of the segments of EVs are now TCO-positive, which means we should expect a very high penetration rate going forward. Ather vehicles are now available with interest rates as low as 5.99% from large banks such as IDFC First. It has been one of the most significant positive changes, which makes us believe there would be further reduction in TCO across other segments.

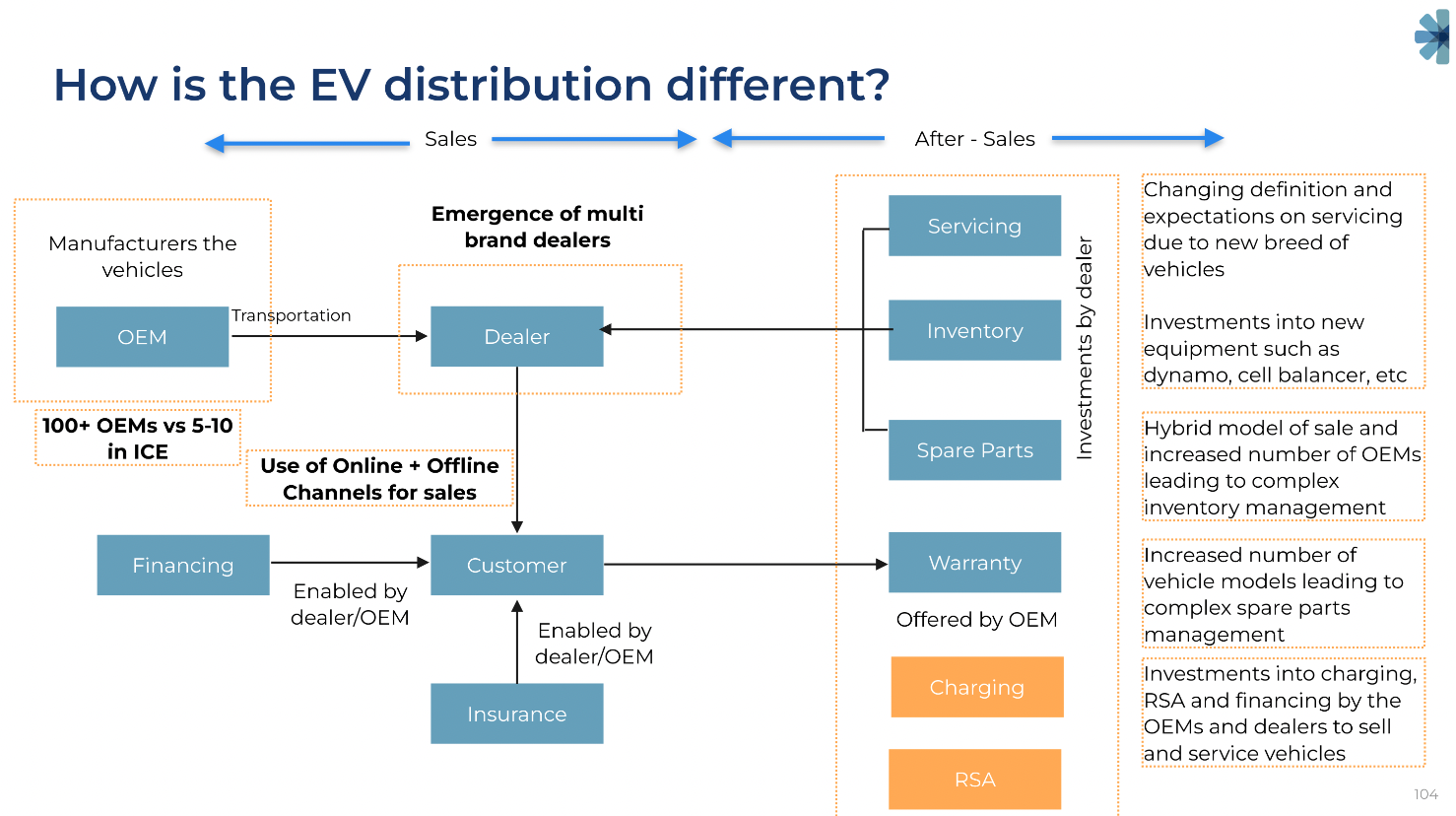

EV distribution businesses are a key focus area

We are observing a rise in EVs' new-age distribution models. Given the software-first approach and mix of channels, the EV distribution business is very different from ICE distribution. Multi-brand outlets and enterprises have emerged. A key differentiator is the enhanced focus on servicing.

Arpit and I have been bullish and optimistic about the rise of EVs in the country. Slowly, steadily but surely, EVs will be mainstream throughout the country! We hope the second version of this report helps any founder, VC, or industry stakeholder navigate the complexities of multiple business models!