Online platforms like Amazon and Walmart, daily visited by billions of shoppers, have evolved beyond their traditional role as mere shopping destinations. They have leveraged their massive reach and engagement to manifest into powerful advertising ecosystems dubbed the ‘Retail Media Networks.’

With billions of daily visitors, these retail platforms have the ability to convert casual browsers into loyal customers. This shift towards retail media has disrupted the dominance of digital advertising giants like Meta and Google, with estimates projecting the retail platforms to capture $1.3 trillion in enterprise value by 2026.

However, these platforms face challenges in delivering a seamless experience to advertisers and ensuring that consumers get a great shopping experience. Automation, experimentation, and insightful analytics are crucial for retail platforms to capture advertising dollars.

In this article, I go deep into the potential of retail media networks, how they can provide top-notch ROI to advertisers, and deliver exceptional consumer experience.

Mining retail’s untapped digital real estate

Retail platforms have come a long way from their early days, where the highest ROI activity for them was to drive ecommerce sales. The real impact of these retail platforms now lies in the kind of reach and engagement they have. The world’s largest online marketplace sees 2.4 billion visitors a day, with 1.6 million packages delivered on average.

The “lookers” who visit an online marketplace without buying are no longer missed opportunities. Instead, they form a massive audience for non-linear and less intrusive ways of enabling brand discovery. Retail platforms like Amazon and Walmart have now found a way to convert these lookers into consumers who keep coming back for more. By doing this, they have evolved into robust advertising ecosystems called “Retail Media Networks”, a $100B industry where thousands of brands advertise with visually rich media.

Today, many customer journeys begin (and end) on marketplaces, given how search is hugely verticalized. Consumers prefer to search for products in one aggregated place, compare options, find what they like, and checkout with their purchased items.

The storm of online shopping during the COVID-19 pandemic further added to the surge of consumers flocking to e-commerce sites. For instance, one of the world’s largest fashion retailers sees ~250 million monthly visitors, with users spending an average of 20 minutes per session. This humongous number of eyeballs tuned in every day with shopping intent is, in fact, retail’s greatest power-play in the next leg of the digital advertising boom.

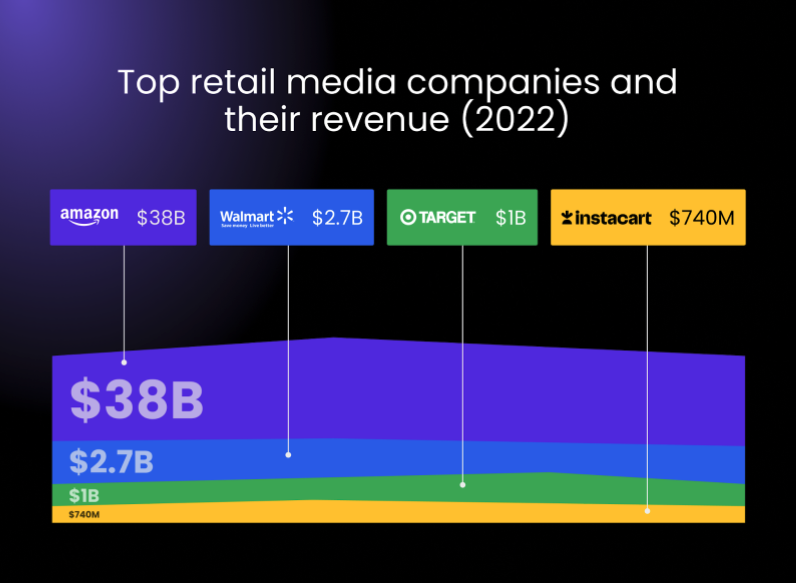

Aptly called the “third wave of advertising”, the retail media networks are driving ad spends away from the digital advertising duopoly of Meta and Google and are expected to generate $1.3T enterprise value by 2026. We saw how Amazon became the world’s fourth largest advertising platform in less than a decade, with over $37 billion generated in 2022 alone and boasting over 7x ROAS for many of their brand advertisers.

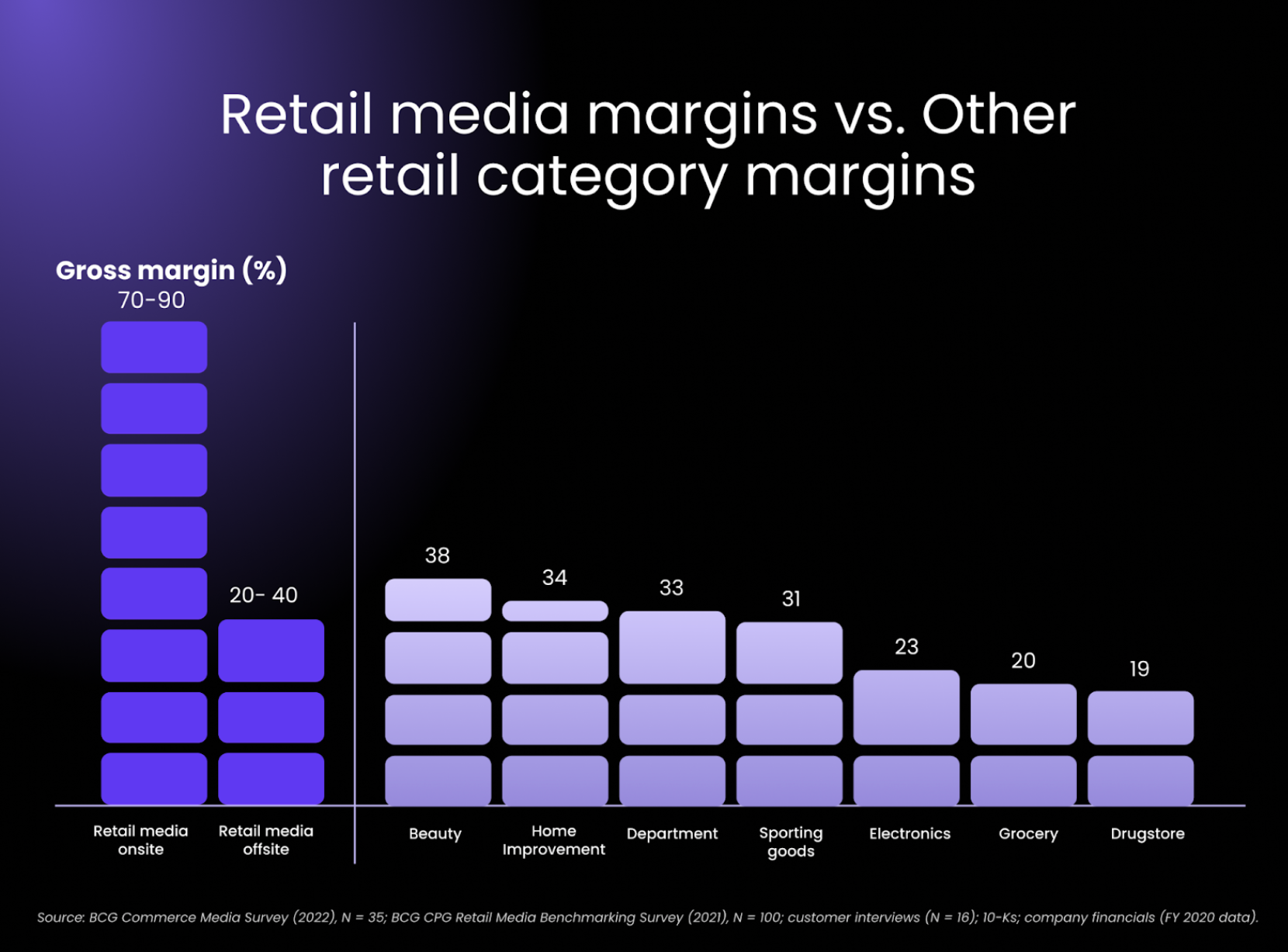

Retail companies are sitting on a treasure trove of untapped digital real estate, which could unlock new revenue streams for them. What makes this opportunity highly lucrative for them is that the digital ads revenue comes with a whopping 70%-90% gross margins, which is almost 2x to 3x of the gross margins in the popular ecommerce categories like beauty, electronics, and grocery.

Safe to say that the retail media network is not just the new cool kid on the block, it could very well be the digital destination for every retail company. Despite the current monopoly that Amazon holds (77% share of retail digital media ad spends), the gap with other retail media networks is slowly closing. Being an early adopter of retail media and getting it right can change the game for many retail companies that are yet to hop on the bandwagon.

Display as the brand-building channel of choice

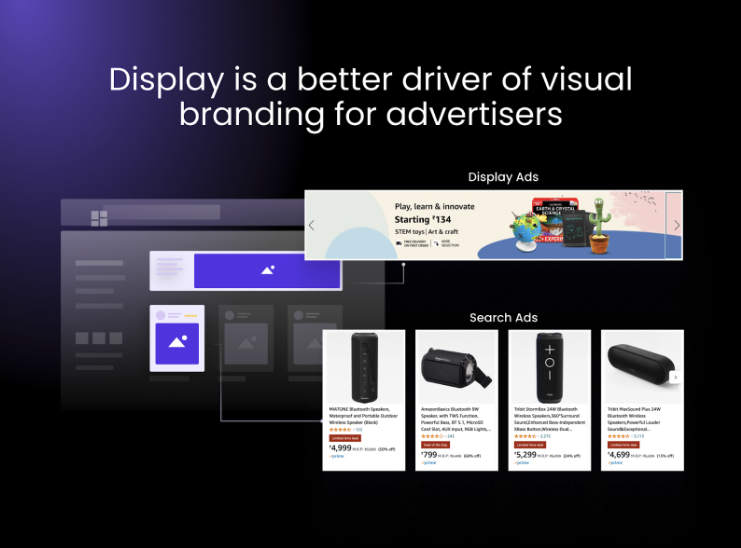

While search ads are effective in driving purchase, they are limited to the bottom of the funnel consumer search and show up only when customers show specific search intent. Thus, for retail platforms, it becomes crucial to offer advertisers ways to engage with billions of lookers at every stage of their journey. And here’s where display advertising in the form of rich media images and video ads comes in as they are not only the perfect way for brand discovery at the top of the funnel but also draw the attention of audiences at every stage of engagement - awareness, interest, and desire to finally influencing action.

While display ads are great for branding, they’re more expensive and complex for advertisers to manage because rich media creatives need designers to create and adapt them to hundreds of media sizes across different platforms. On the other hand, retail platforms need the right technology to scale operations to meet the creative requirements of thousands of brand advertisers.

Four pillars to build successful retail media networks

Retail media networks are a relatively new advertising medium, and many advertisers aren’t sure of how much they need to spend on them or if they want to spend at all. Unlike Meta or Google, retail platforms cannot just walk in, take a check, and leave. At least not yet!

A 2023 survey showed that 77% of marketers find it challenging to adapt their creatives to retail platforms. 80% of them felt that navigating different tech stacks made advertising on retail platforms complicated. Clearly, advertisers are having a hard time keeping up with platform nuances and technical requirements.

While 70% of marketers say that they got better returns from retail media networks compared to other media, the cost per thousand CPMs to advertise on a retail media network is in the range of $20 to $50, making them one of the most expensive digital advertising channels. This places a significant burden on retail platforms to ensure a high Return on Advertising Spend (RoAS) for their advertisers.

How can they achieve this?

Good performance is a combination of enough experiments, watertight operations, and analytics on what’s working and what’s not. Let’s break this down further.

Small teams + automation = speed

In the quest for a great advertiser experience, retail platforms end up building large support teams. However, large teams come with elaborate processes that bring down efficiency and cause campaign delays. So, it’s important for retail platforms to ensure that internal operations move fast with small teams.

This is possible only by bringing in automation at every step of the campaign – right from asset creation, creative production, review, brand compliance checks, and post-campaign insights for better planning. In a recent collaboration with Rocketium, a top 3 retail giant enabled automated brand compliance for thousands of brand advertisers and saw creatives published 10x faster than before.

Tech stack that allows experimentation

Now, coming to the power of experimentation. Advertisers love to try new things in their desire to stand out. They love the freedom to experiment with placements, layouts, formats, and best practices to improve performance. For retail platforms, new format launches are a great way to drive media buying from advertisers who are keen to try a new ad format and break the clutter. With the right ad tech stack and agile creative operations support, retail platforms can successfully use experiments to attract more advertisers.

Leverage first-party data to unlock insights

Unlike other marketing channels, retail platforms are in the unique position of seeing the full consumer journey from awareness to purchase. Moreover, given their completely digital setup, retail platforms have the advantage of providing unique insights to advertisers beyond the usual performance metrics like clicks and conversions.

From brand lift insights that capture the full spectrum of consumer lifecycles to creative decisions for brands, retail platforms can add powerful intelligence layers to set themselves apart.

CreativeOps partner - the missing link in success

For many retail platforms, a major challenge is keeping up with the immense scale of creative operations needed to launch and track thousands of creatives and campaigns, especially during seasonal sales spikes. Sharing insights with advertisers to help them optimize campaigns at such a scale is even harder. Consequently, advertisers start seeing campaign performance drop due to delayed go-lives and creative decays, which brings down ad spends on the platform.

To avoid such pitfalls and create a cohesive advertising experience, retail platforms need to adopt operational partners that set them up for success. For example, a CreativeOps partner can provide deep insights into how creative elements such as font, color, text, and imagery impact campaign performance to advertisers. By providing a combination of past campaign insights, and industry and competitor intelligence, retail platforms can give their advertisers an edge by helping them plan better campaigns, make more impactful design decisions, and optimize campaigns at scale.

Finally, nothing can replace a great consumer experience

In the offline world, consumers overwhelmingly prefer clean stores with good lighting and neat shelving. Similarly, in the digital world, they prefer aesthetic content over a clutter of banners and ugly designs. Things like very high ad load, inconsistent branding, low-quality copy, and unappealing designs can bring down platform standards, causing consumers to avoid the retailer altogether over time.

Naturally, retail platforms have apprehensions about how adapting a retail media model would impact the consumer experience. While ad revenue is great, it should not compromise the shopping experience. The trick to making retail media work is to keep every piece of advertising content relevant and attractive to your customer base.

Ads are intrusive no matter how we spin it. That is why placement (where they are seen) and ad load (how many of them you see in one session) are important. Retail platforms should play around with both options to see what leads to the best outcomes. But shoppers forgive intrusiveness if the ad is relevant and actually helps them discover something useful. This is where retail’s first-party user data, such as location, frequency of purchases, brand affinity, and co-purchased products, become their biggest assets. Many industry leaders in the retail media space are now talking about personalized content as a core offering.

With growing digital spends, the role of retail media networks in advertising is only getting bigger. This unlocking of retail’s potential as an advertising engine is redefining growth for retail companies – who thought that window shoppers could create so much revenue? That’s retail media for you.

About the author: Satej Sirur is the founder and CEO of Rocketium (Ex-Amazon, Cornell University, ISB). Rocketium is a CreativeOps platform that powers visual communication for top global brands and retailers. Successful retail media companies like Amazon and Walmart are already working with Rocketium to power their creative operations for building a great advertising ecosystem for advertisers and consumers.