We released the first draft of our opinions on the circular economy in May 2023. Almost a year later, we identified an opportunity for investment in Bambrew that fits well with our thesis.

Our initial thoughts on the circular economy led us to explore white spaces across sustainable raw materials, platforms for the formalization of waste collection, new recycling technologies, traceability tools, and marketplaces.

While multiple problems can be addressed to enable a circular economy, many don’t have a large enough market or are rightly timed for market adoption. However, sustainable packaging solutions emerged as a promising theme.

Why?

- Packaging is a huge market

India’s packaging industry is $80B. This includes primary, secondary, and tertiary packaging across plastic, paper, and other materials. This large market is significantly fragmented with little market concentration. Uflex, which specializes in manufacturing flexible packaging solutions, had a revenue of Rs 14,700+ crores in FY23, with <3% market share.

- Global and Indian brands are embracing sustainable packaging

Major FMCG and QSR companies are leading the charge toward sustainability by integrating recycled plastic and other eco-friendly materials into their operations. For instance, ITC has announced plans to shift to paper bags for its "Aashirwaad" product line. Starbucks is replacing coffee cup covers with paper alternatives, reducing reliance on single-use plastics. Brands like Coca-Cola and Pepsico also embrace recycled plastics and alternative materials where possible. Emerging direct-to-consumer brands, including Licious, prioritize sustainability, aiming for plastic neutrality through recycled plastics and reduced packaging. Even online marketplaces like Flipkart and Swiggy facilitate the transition to sustainable materials by offering cost-competitive packaging options. A survey by McKinsey highlights Asia, particularly India, as a key driver of the global shift towards sustainable packaging, indicating a growing market trend in the region.

3. Government Regulations such as EPR are acting as additional tailwinds

Extended Producer Responsibility (EPR) is a mechanism designed to either incentivize or penalize manufacturers, compelling them to prioritize the production of recyclable goods and take responsibility for managing the recycling process after consumption. With the continual surge in demand for plastic packaging and products, EPR mandates plastic product producers and brand owners, including FMCG firms, to actively increase the incorporation of recycled materials in their product lines. This becomes especially crucial considering that over 80% of plastic waste originates from single-use plastic items such as bags, bottles, and wrappers, many of which are recyclable. Despite the potential engagement of producers and brand owners in plastic recycling efforts, challenges persist in collecting, sorting, and processing plastics, presenting significant obstacles. Consequently, opting for non-plastic sustainable packaging solutions is a more feasible choice for brands operating within this landscape.

4. Primary Packaging is hard to solve for

Primary packaging is the innermost layer directly interacting with products, such as toothpaste tubes, chip packets, and chocolate wrappers. Perishable food items are particularly sensitive to temperature, humidity, and external elements such as water, air, dust, and sunlight. Detergents and beverages with different chemical compositions and temperature requirements present challenges to packaging integrity. Plastic has traditionally been the preferred solution due to its abundance, affordability, and effectiveness in product protection. Paper-based alternatives often lag behind plastic, lacking protective qualities or being expensive. Bioplastics such as PLA and PHA are promising alternatives, but their compostability often depends on industrial setups, requiring collection and processing centers and reverse logistics infrastructure for recycling.

5. Bambrew is an innovative solutions provider

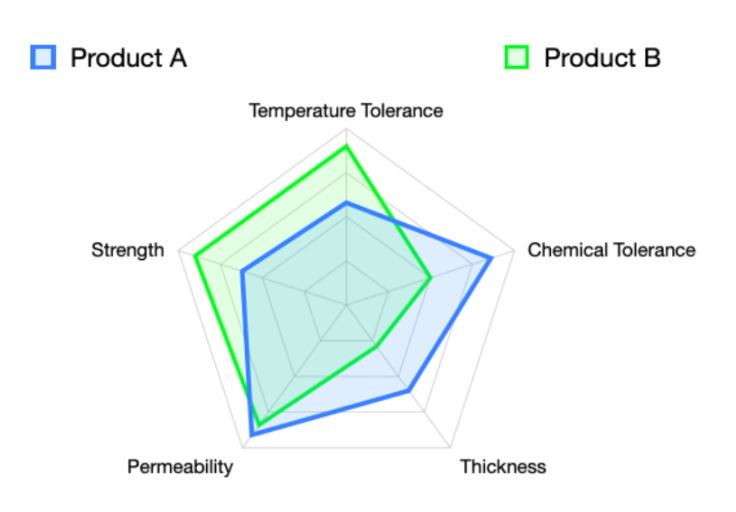

Each client's unique products demand niche innovations for designing sustainable packaging solutions that truly work. Off-the-shelf products won't suffice and innovation is essential when addressing diverse products and use cases. For instance, a paper-based solution suitable for detergent must withstand high chemical content, whereas one for bread needs optimization for permeability and temperature.

The chart below illustrates the variability of sample parameters across different product requirements.

Few companies offer comprehensive solutions for primary packaging in India.

Bambrew stands out by deeply innovating its home compostable solutions. The team has established in-house manufacturing capabilities to meet demand at scale and minimize raw material usage. This dual strategy of solution development and manufacturing capability sets Bambrew apart in the industry.

A significant opportunity and growing acceptance exists for sustainable packaging solutions. Vaibhav and his team are extremely talented, demonstrating their ability to innovate at every step. The team deeply understands the customers’ mindset and has been able to solve the problems while keeping the products affordable. They draw inspiration from all design aspects around them to deliver a superior product that is functional and aesthetically pleasing. We have been amazed at their deep understanding of packaging and truly believe that they possess the potential to make it big.

Additionally, India's burgeoning manufacturing landscape and focus on innovation and sustainability offer an ideal platform for disruptors like Bambrew to thrive.

While packaging is merely a segment of the circular economy puzzle, it's a substantial one.