Product-Market Fit: Nail It Before You Scale It

- Published

- Reading Time

- 8 minutes

- Contents

I. Why Product-Market Fit (PMF) matters?

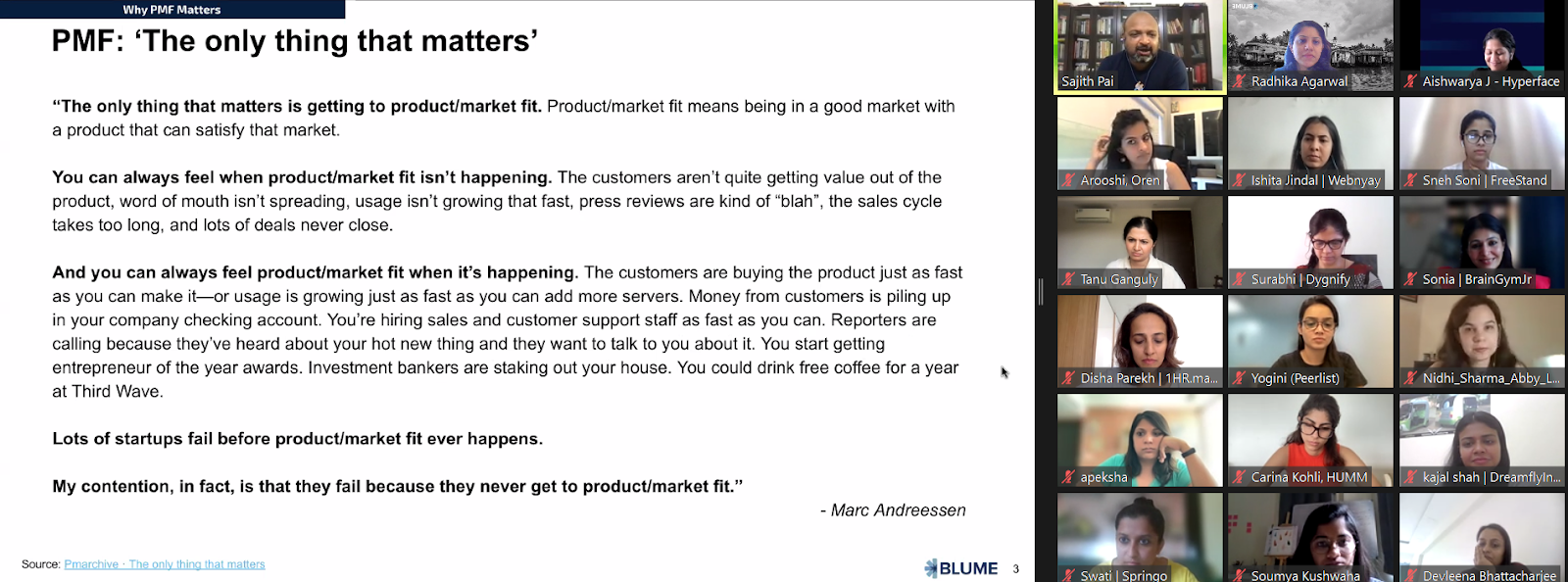

Marc Andressen formally introduced the concept of Product-Market Fit (or PMF as it is popularly referred to) to the startup ecosystem in 2005 in a post titled ‘The Only Thing That Matters’ stating that, for a company, the only thing that matters is getting to PMF. It is still considered to as one of the seminal pieces of writing on the topic.

Marc Andreessen’s definition is qualitative. Subsequent definitions have reiterated this aspect of PMF as hard to define, but you know it when you see it. Elizabeth Yin of Hustle Fund referenced this thinking in one of her tweets.

Andy Rachleff, the founder of the Benchmark fund as well as Wealthfront, is credited by Marc Andressen as coming up with the concept of Product-Market Fit. Rachleff says “I think that the single most important issue for an entrepreneur to succeed is to find product market fit. To me product-market fit trumps execution. You might execute really well but if the dogs don’t want to eat the dog food you’re going to fail. Conversely, you might be terrible at execution but if the customers want to buy your product you’ll be a great success.”

Why does PMF matter?

PMF is a concept defined by VCs, and over the history of venture, a convention has emerged that Series A is linked to the achievement of PMF. PMF has emerged as a gating mechanism for Series A. This is one important factor. The other factor is that without PMF, startups, even the ones that receive Series A funding, sputter and die from an inability to scale. PMF is the first point of scale. Hence, it matters.

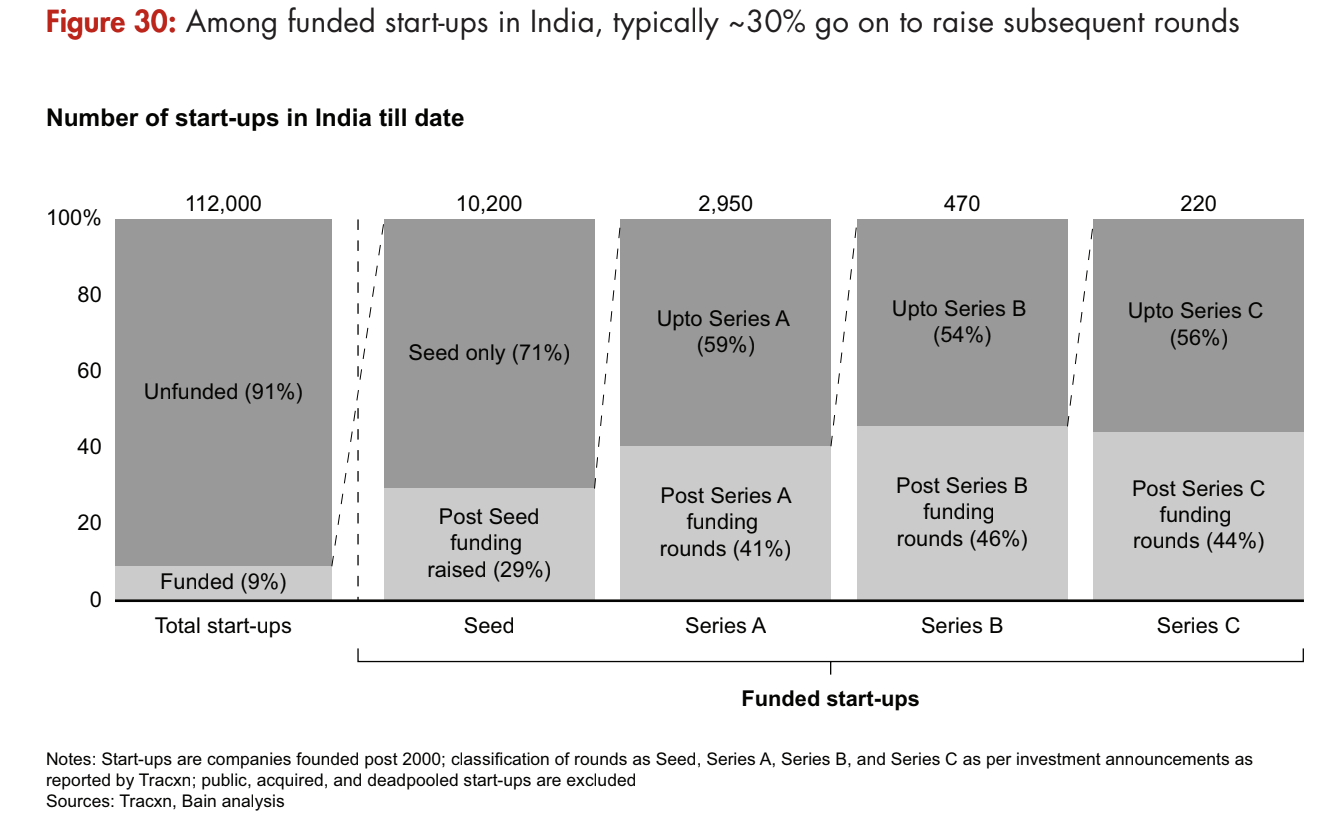

~10% of startups get funding (below chart from the Bain Venture Capital Report 2021) and of these only 30% get Series A, traditionally the indication of PMF. Effectively 10% of startups get funding but only ~3% of startups get PMF.

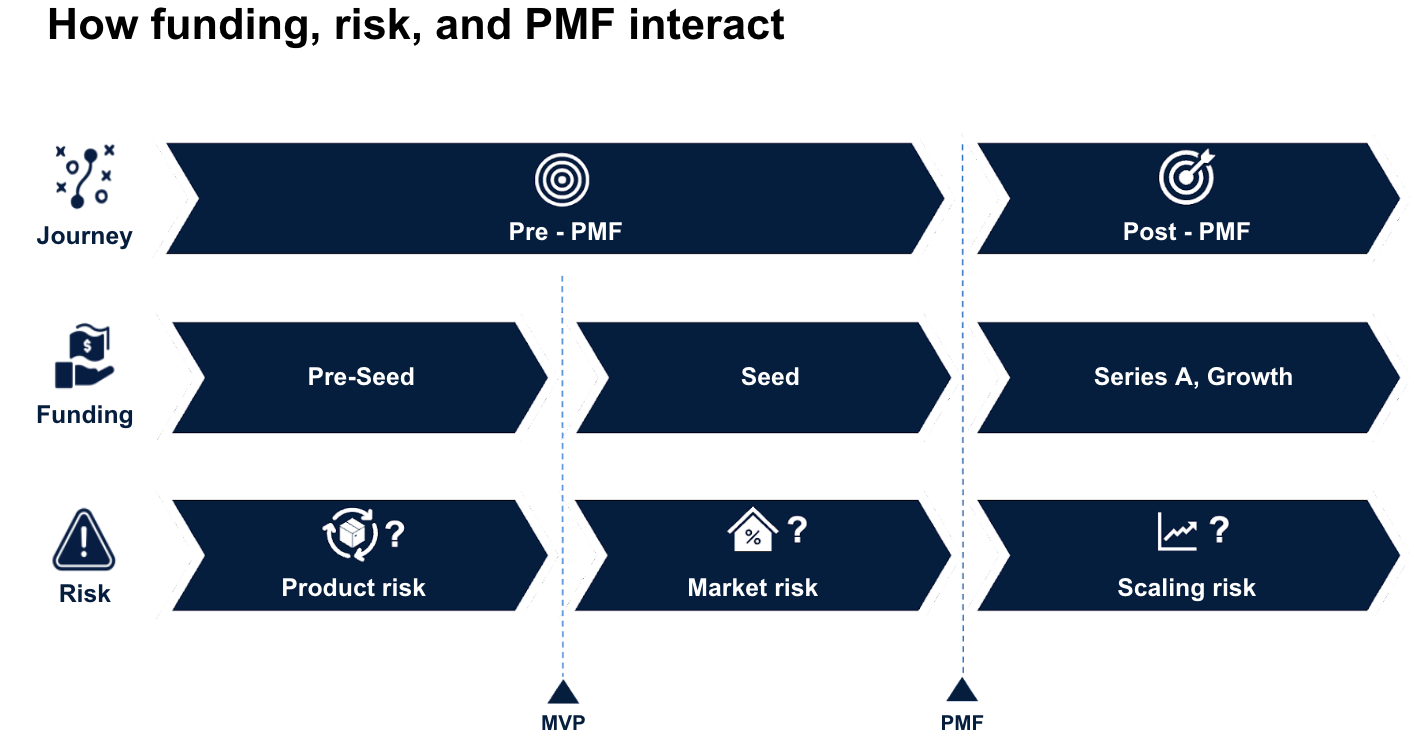

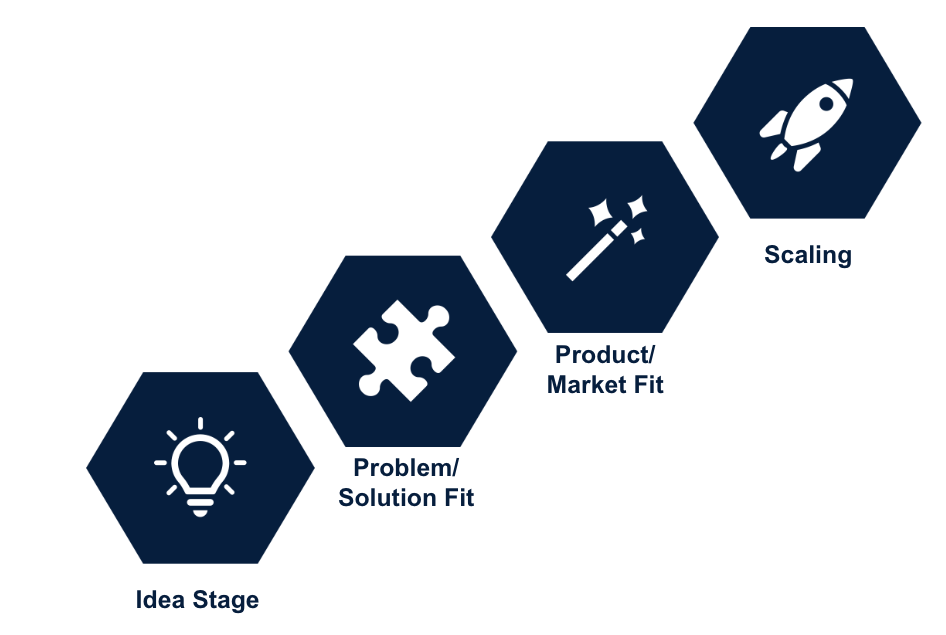

A good way to understand this is by viewing different stages of financing as each covering a certain risk. See graphic below.

To clarify

- Pre-seed covers product development risk. This stage is where angel investors or friends and family come in (now you see MicroVCs also in this stage).

- After attaining MVP, you typically raise a seed round. The seed VC comes in and helps cover market development risk and achieve PMF. At this stage, there is proof that a market exists, and that there is a playbook to achieve it.

- The final stage, post PMF, is the Series A+ stage going from early growth to late growth. Here the key risk is scaling risk. Capital here helps underwrite the risk of scaling to multiple channels or markets.

PMF matters because you need to make sure that before you throw in more money, you know you have acquired the right customers. This is why early stage VCs are concerned about user acquisition strategies like cashback, which can lead to the wrong kind of customers coming on board. PMF means determining genuine demand for the product and ensuring you have a systematic way of tapping this demand.

Before you go big, you need to get it right. This is what PMF is. It is a way of assuring yourself and your investors of the appeal of the product as well as a plan for growing it systematically. Post PMF, it is effectively a rinse and repeat strategy. PMF is effectively the nailing before the scaling.

II. Defining PMF

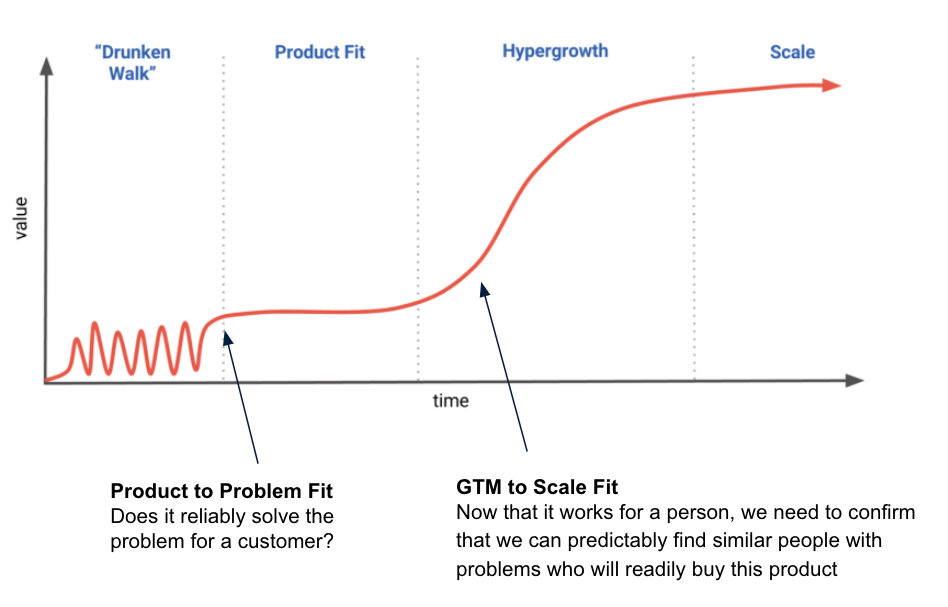

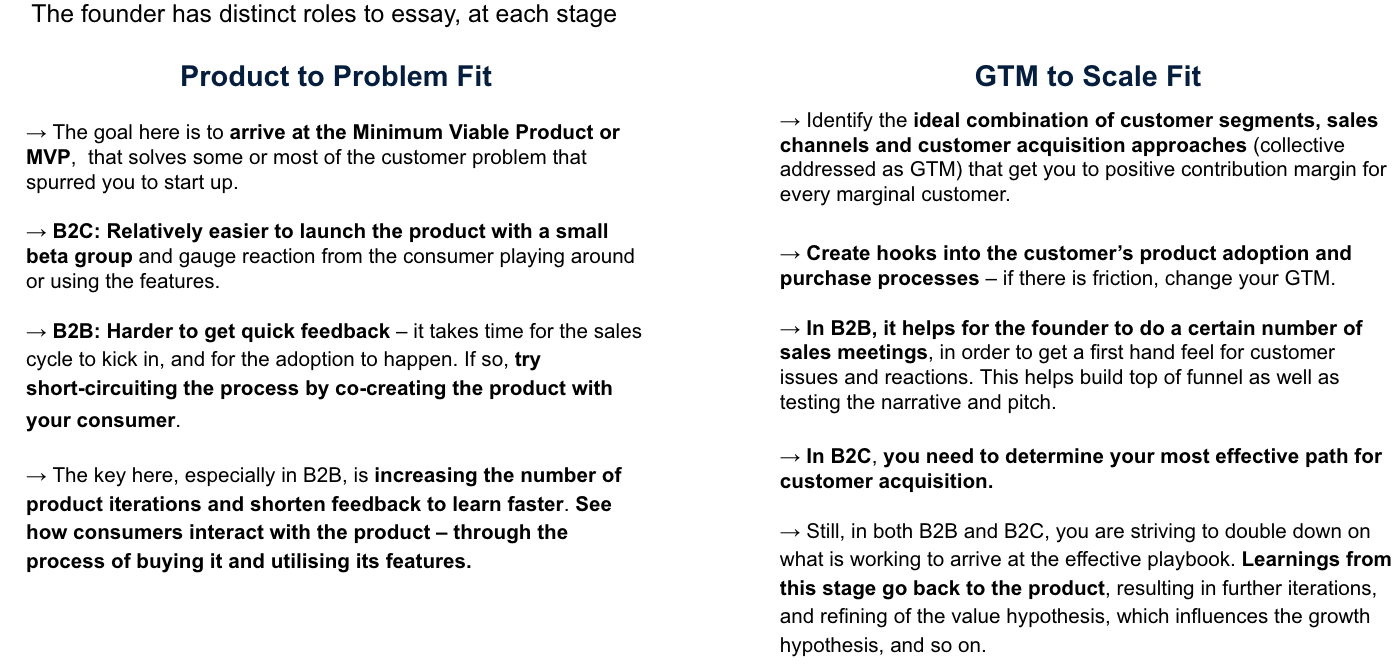

If you find that a few customers are satisfied or even delighted with the product, that’s not PMF; rather it is Product to Problem Fit or PPF. PMF on the contrary demands that multiple people are satisfied. So you attain PPF and then PMF.

Or rather you can see PMF as composed of two parts – the first is Product to Problem Fit (PPF) and then GTM (Go To Market) to Scale Fit.

Caveat: Marketplaces, SaasTra and media plays have two-stage PMF. For example, in the media business, PMF has to be effected twice, first for user acquisition, as you capture customers through content, and then monetization when you sell it to advertisers. So PMF has to be achieved twice here. Priority should be given to acquiring customers; only then should you focus on monetisation.

Typically in Marketplaces, there are two sides (buyers and sellers; users and providers etc). One is easier than the other to acquire and scale. It is an art to figure out which is harder to scale. Sometimes it is the one that pays though not always. For example, in Uber and Urban Company, the supply side is harder to scale. As a first principle, the side which has more options tends to be harder to scale.

For marketplaces, PMF is figuring a repeatable plan for onboarding the harder side. For example, imagine a daycare marketplace. Parents are desperate for day care centers (they become the easier side), but these centers are harder to onboard and scale (and this is the harder side). So you need a working playbook for acquisition of daycare centres. Monetisation is the second part, though it can’t lag too far behind.

Some signs of PMF are

- Willingness to pay for even basic features

- Inbounds without any marketing efforts (especially in B2B)

- When a customer can explain the product as well as the sales person (in B2B)

- When the customer comes back repeatedly, this is a sign. Retention is key to PMF.

- A stable retention curve. This means you know how many customers that have been acquired are being converted. This helps you determine the upper bounds of your CAC (Customer Acquisition Cost)

- Explosive growth

Broadly there are qualitative and quantitative definitions of PMF. Some popular definitions:

Qualitative

My definition of product-market fit is you are drowning in demand – your product is being used by so many customers that you cannot handle all the new people knocking at your door! Absent that you do not have product market fit. Most people use the term too loosely. – Michael Siebel

Product / market fit is about proving there is a market with a need for your product and that you have the right core product for that market. – Jill Soley, Todd Wilms

PMF is very simple – are people grabbing the product out of your hands and saying I want it, I am using it or I’m buying it or I’ve given you email addresses or I’m downloading it or or some evidence that people actually like what your vision is. – Steve Blank

Quantitative

True product market fit, which I measure as 20% MoM growth for 12+ months and 80% organic leads. – John Danner

….when a company gets to a sales yield greater than one, that’s how you know you’ve hit product-market fit. That’s to me the best test of enterprise product-market fit. – Mark Leslie, Chuck Holloway

One of the most common techniques for assessing product/market fit is known as the Sean Ellis test. This involves surveying your users and asking them how they’d feel if they could no longer use the product. The general rule of thumb is that if more than 40% of the users would be ‘very disappointed’, then there is a good chance you have hit product/market fit. – Marty Kagan

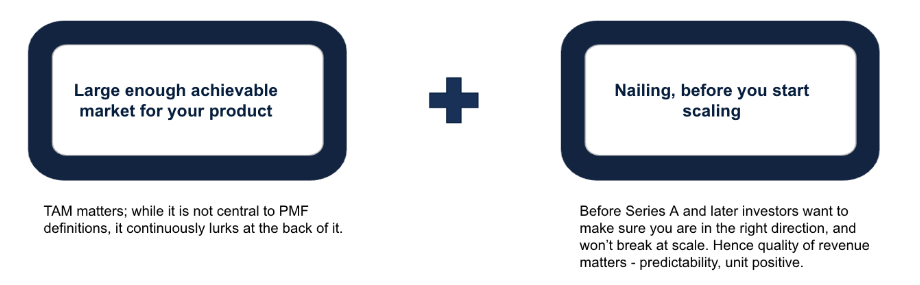

A great product, and significant traction are at the heart of PMF. While they are essential, they are in themselves not sufficient. The following are equally important.

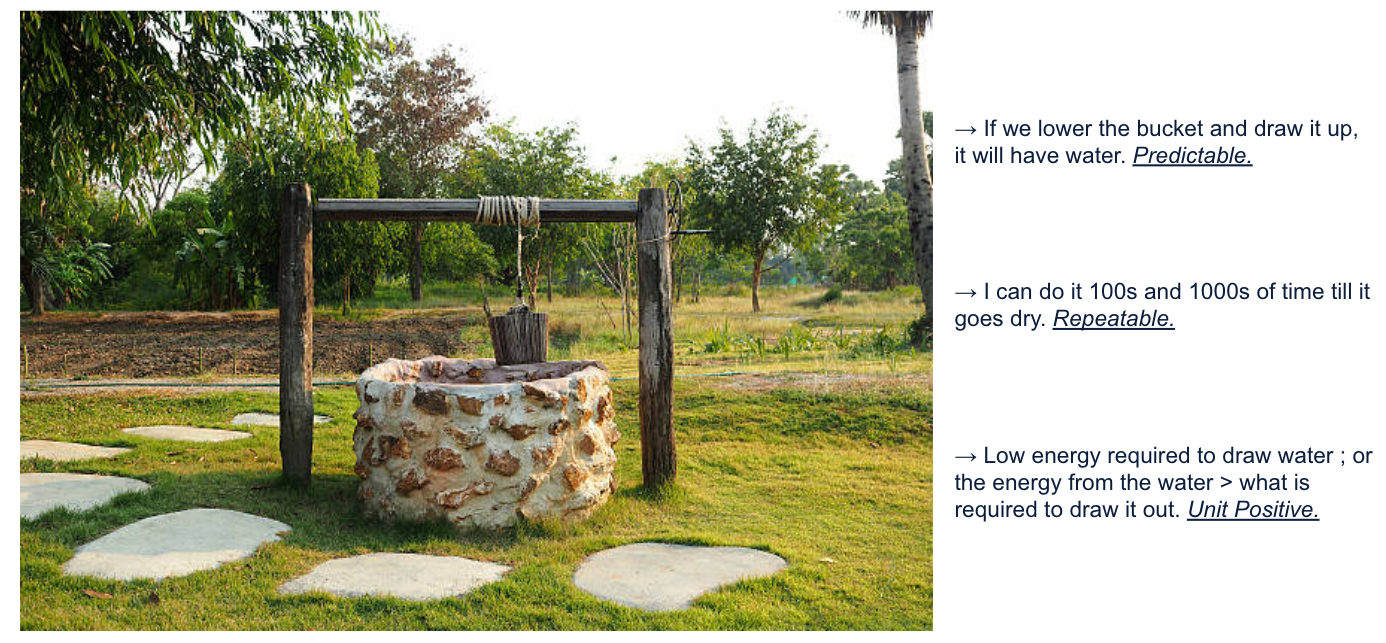

Basis the above, I propose the following definition of PMF: ‘Scalable GTM (Go to Market), enabling Predictable, Repeatable, Unit-Positive (or CM2 positive) Customer Acquisition.’

Here is how I define each of those underlined terms –

There is a popular joke in the startup world that the first time founder thinks product while the second time founder thinks distribution. A better way to put this is that the best founders do not think of product and distribution in isolation; rather they think of product and distribution as joined in the hip. They think about distribution at the time of product development. Importantly they look to identify a proprietary or untapped distribution channel. One where they have a distinct advantage, and one where channel saturation is unlikely (or at least some time away).

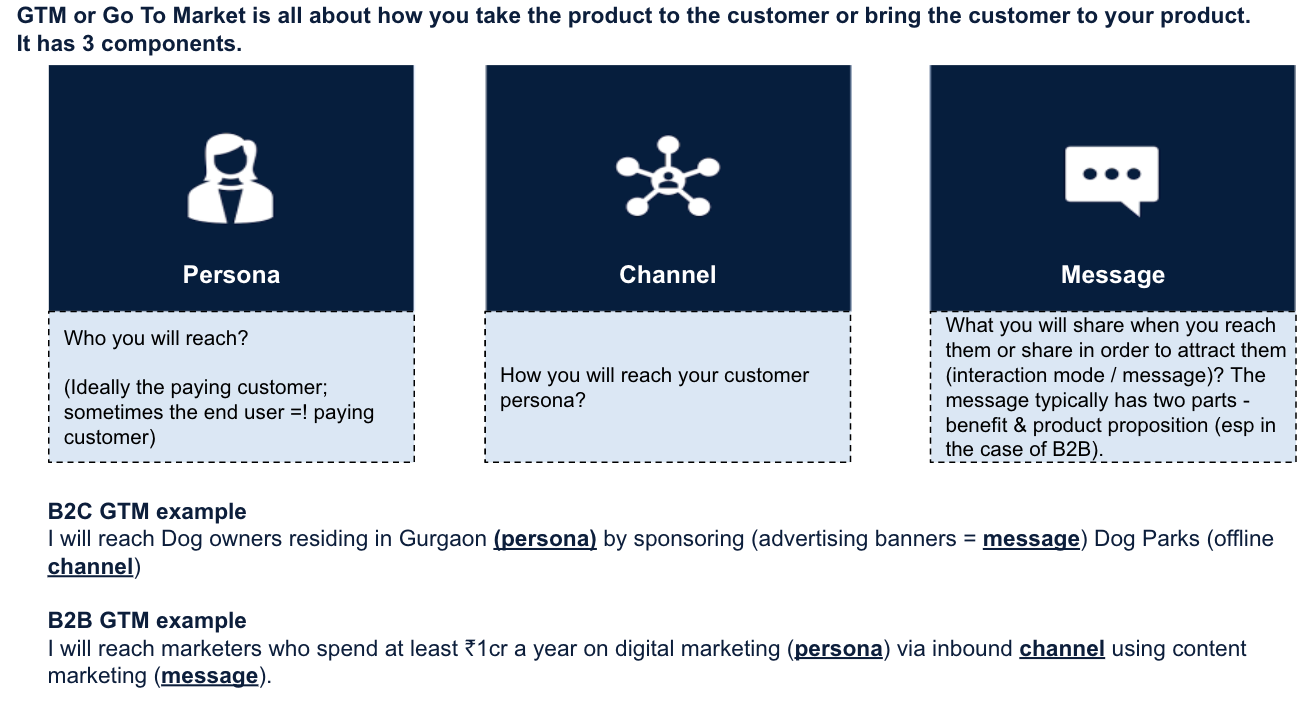

Let us understand GTM or Go to Market better.

Understanding PMF through the well analogy.

III. Achieving PMF: What to do, what not to do

Seek the largest market for your product, not the best product for a market. As Andy Rachleff says “Most successful new markets begin with a market-sensitive technologist recognizing an inflection point that enables a new kind of product. The next question becomes: who wants to buy my product? Start with the product and search for the market as opposed to vice versa. The truly great technology companies are the… result of an inflection point in technology that allows the founder to conceive a new kind of product. The question then is, “Who wants to buy my product?” So you start with the product and try to find the market as opposed to starting with the market to find the product.”

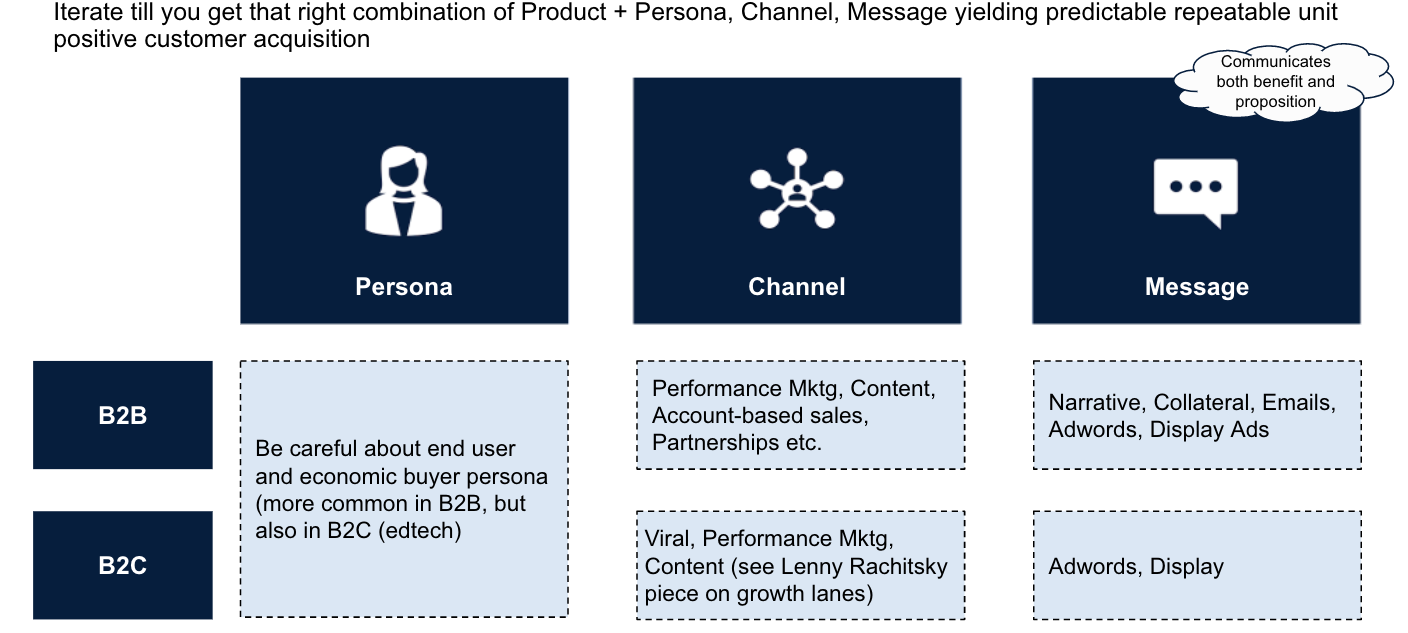

First, arrive at the persona, then the channel to reach them, and the message that will help you describe the product.

If something is not working, then change the message. Then channel (which is harder). Then and only if that is not working should you consider changing the persona you are trying to reach. With this your entire GTM also changes. Do note that product and persona are somewhat integrally linked.With the change in persona, the product configuration and feature set may have to change too.

How should the founder think through his / her role?

- At the pre-PPF (Product to Problem Fit) stage, focus on garnering rapid feedback from the customer.. You need multiple reiterations. At the early stage, the cost for changing the product is not very high.

- Post PPF you have an MVP. Now you want to test if there is a playbook for tapping into a large market for your product. This stage gives you a sense of whether there is a market, and also if there is a scalable playbook to tap into this market. This is the prePMF stage.

- During both these stages, a founder primarily learns from three sets of people – customers, investors, hires. The customer is typically the most important source of learning. In B2B, the founder should be the first sales person, for the key objective in the early stages of taking the product to market is to learn, and not earn necessarily. The founder will know the exact issues and be exposed to all sorts of customer signals.

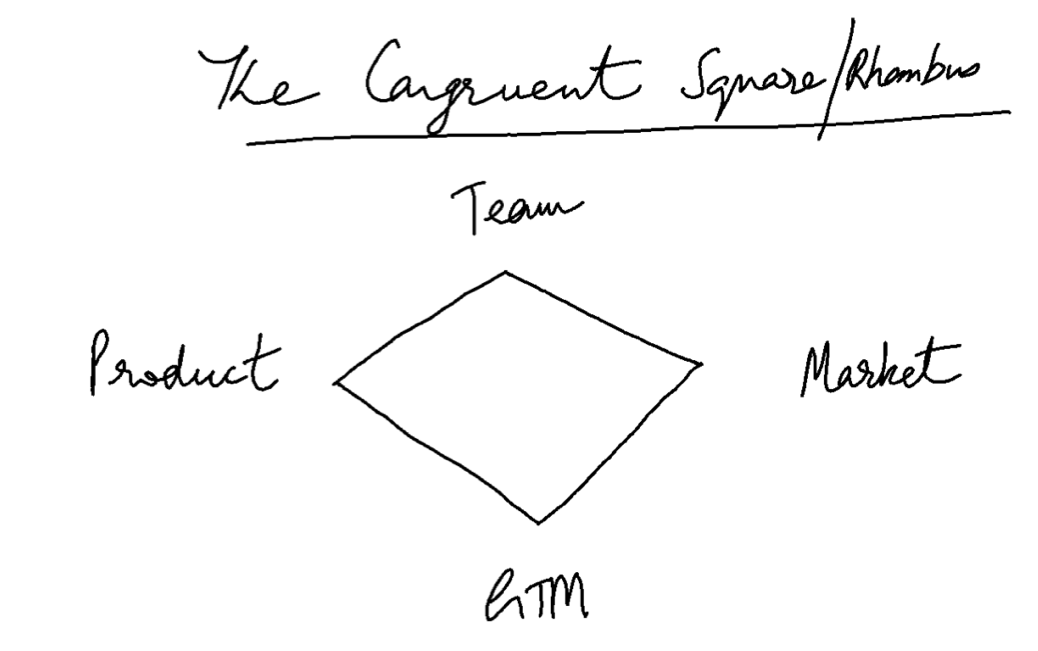

There are two frameworks that founders should keep in mind in the journey to PMF.

First is the Congruent Square. Congruent Square says there has be a broad alignment / congruency in the product you are taking to market, the team that is taking it there, the consumers / market that will consume your product and finally, the approach you are taking to get the products in the hands of the customer (Go To Market or GTM) – the four mechanisms of the startup org / machine. More details in this post.

The second framework is around the triangulation between business goals, metrics and incentives that are needed to drive behaviour towards desired outcomes.

- Business goals will differ depending on the stage, but the most important distinction is between end goals and enabling goals; e.g, revenue is an end goal but number of pilots or trials is an enabling goal.

- Metrics can be North Star metrics (which help track end goals) or controllable input metrics, e.g., north star metrics can be minutes spent on app, or number of API calls etc. Controllable input metrics track the desired actions that enable these North Star Metric. There is no luck or dependency on an external player here e.g., # of pilots won every month can be a North Star Metric, but the number of emails sent (which hopefully lead to conversions) is a Controllable Input Metric.

- Incentives should be linked to the achievement of end goals or north star metrics, or even achievement of controllable input metrics. In general the earlier you are, and if you are prePMF, then it is better to focus on enabling goals, and incentivize the desired behaviour, i.e., controllable input metrics. Because there are many factors that are behind PMF not happening (could be product issues, could be a wrong persona etc), it is better for founders to incentivize desired behaviour that predicate desired outcomes. If they reward outcomes, then there is a possibility that your executives may game outcomes through discounts or freebies etc.

This writeup is a summary of a presentation made by me to Lead Tribe cohort II founders on 23 April 2022. The presentation covered why Product-Market Fit (PMF) matters, what it really means and the mechanics of PMF and achieving it. Getting to PMF is akin to an art, and the presentation detailed the key iterations and triangulations needed to perfect this art.

Supportings

This writeup is based on a presentation made to Lead Tribe cohort II founders on 23 April 2022. Link to the presentation made at the session. Link to additional readings.

Acknowledgments

A special thanks to Amal Vats for putting together the presentation, and for Disha Sharma who helped edit and shape this note.