The Rise Of The X-Unicorns

- Published

- Reading Time

- 4 minutes

- Contents

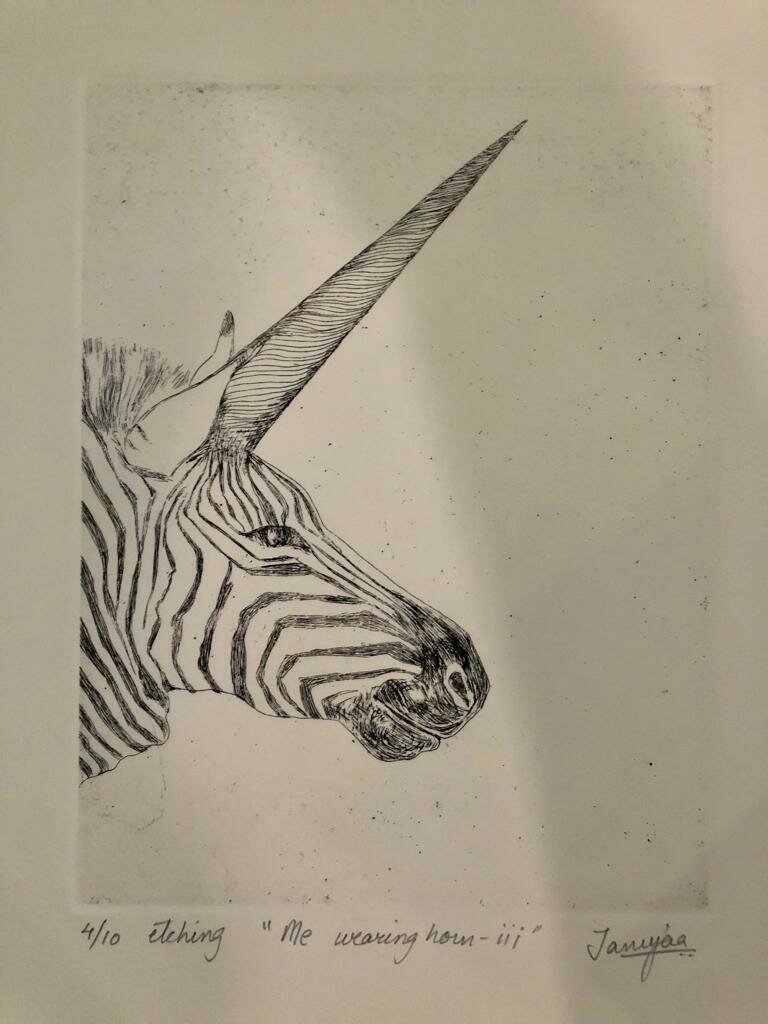

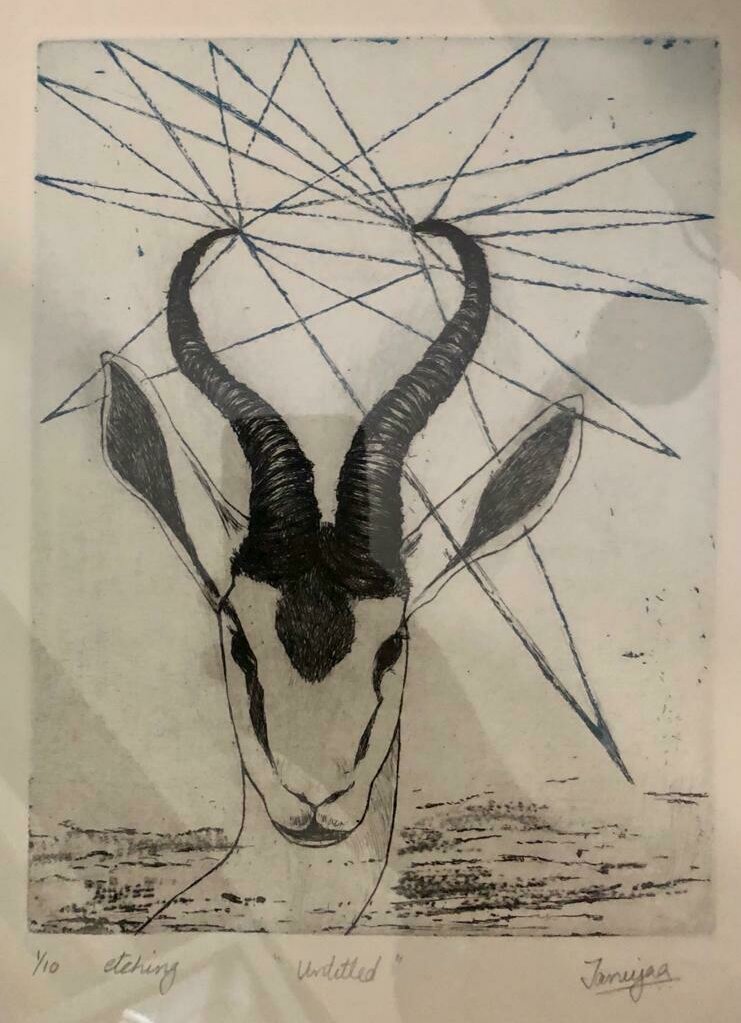

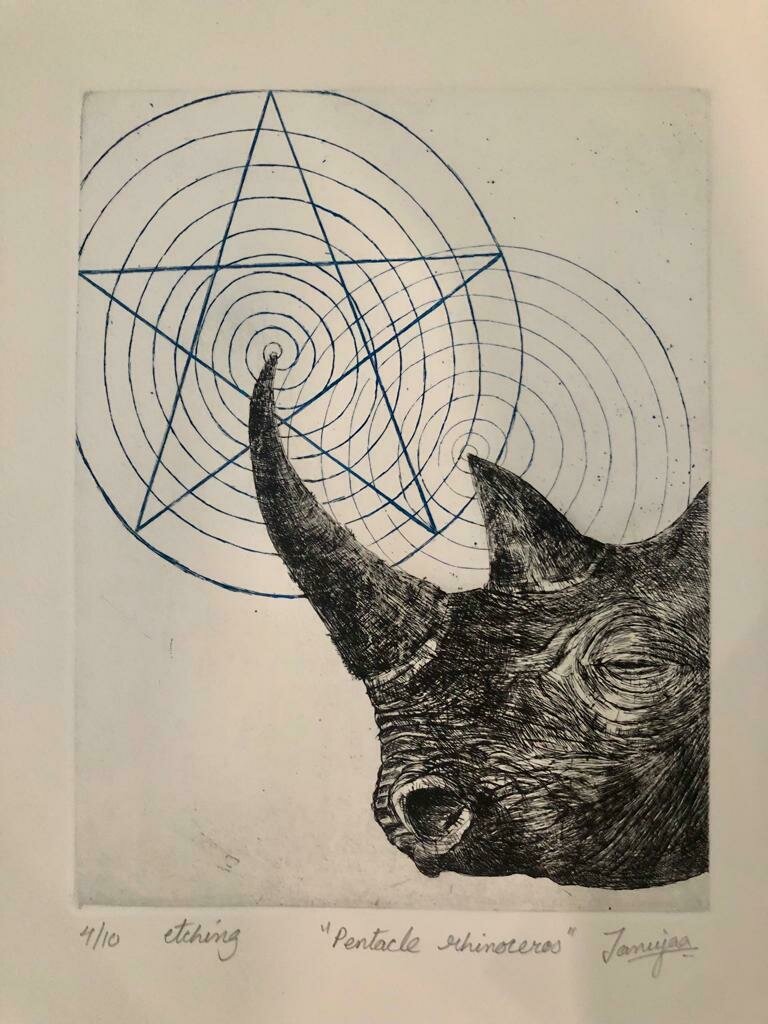

Artist: Tanujaa Rane; also in the Blume office collection now

Aileen Lee needs to get ample credit for indoctrinating the word “Unicorn” into venture parlance. After her KPCB years, she co-founded Cowboy Ventures in 2012, and her research around this animal pointed to an initial list of 39 companies. Each of them was less than 10 years old and over a $1 billion in valuation in the private markets. She called these venture-backed animals Unicorns.

What does all this mean in the context of a burgeoning Indian tech landscape?

When the term was coined, the realm of unicorns (as per the above definition) would probably be limited to InMobi and Flipkart in India. That’s all there was in 2013, that fit this definition.

Also, a lot of these initial rules have since been diluted. There are companies that cross the $1 billion valuation mark, but take more than 10 years to do so given how austere startup building was till 2016 (pre Jio). They get counted in too today. Companies go public nowadays! Yay! But they are happily left accumulated in the upward ticking counter. Should they be graduated into a Lifetime counter, while we maintain an Active Unicorn counter? Just semantics at one level.

Basically, unicorns were coined as the need to identify with a mythical animal, one that shouldn’t exist or doesn’t exist, but one dreams of seeing. It was apt for the era in which it was born, on two levels.

One was the idea that more and more companies were choosing to stay private much longer, not choosing to go public. This allowed startups to take the risk of these (usually profit-less + high growth) business models for much longer, as opposed to the need to show a predictable path to profitability and be subject to public market analysts’ scrutiny.

(Fun flashback: Amazon was at 256 employees, when they filed their S-1 to go public in 1997, with a quarterly revenue of ~$15 mill and raised $54 mill in their IPO that valued the company at $438 million)

The second, which has become mainstream knowledge now, is the rapid proliferation of large pools of private capital, taking risks seldom heard of prior to the 2010s. Tiger Global and SoftBank are the most common names for setting the pace and audacity of this end of the market, creating Unicorns by the dozens every month now. India’s tally of 35, and counting, in 2021 (as of Nov 10) is ample proof that the proliferation of the species has extended its reach beyond the shores of the US and China.

The natural outcome of all this: A wave of seeing the unicorn count expand at an unprecedented scale. The cited numbers are somewhere between 800 and 900 currently. And that’s a massive growth over the past 8 years (20x+ from when the list started). India is up to 8-9% levels of that list suddenly!

X-Unicorns: The mutants and variants

The new entrepreneurs and VCs look at these and everyone tries to follow a playbook, almost formulaic, and throw a whole bunch of capital at the opportunity. Capital + speed are seen as a one-directional path to building a Unicorn.

There seems to be no long-term regard for, nor acknowledgment, of the diversity of underlying business models and revenue streams. The underlying DNA of founders and teams and markets and the startups’ customers all contribute to the path of building companies from scratch to Unicorn.

The formulaic Unicorn-builders eschew these variables.

Silently, India (if not other markets) is also birthing X-Unicorns which don’t fit these norms but nevertheless will build phenomenal long-lasting companies. It doesn’t matter what the path to the unicorn is. It doesn’t matter when they go public. It doesn’t matter whether they have a body of a horse or any other creature in the animal kingdom. As long as it reaches there.

At Blume and our portcos, we have not had it easy, to simply sprout a single horn on a white horse. We tend to, therefore, disregard the sanctity of the Unicorn mantra a bit. For us as early stage VCs or our portfolio companies, grit and belief in the idea and founders shape a different type of journey.

After a decade at Blume, it is now becoming clear that our founders were building X-Unicorns, in some cases despite the lack of approval from the top Series A and B investors. When we look at these creatures that we have helped nurture, they don’t look like the typical unicorns.

If we apply a few possible criteria to classify the distinctions

- Have none of the top 5-6 mainstream India-based Series A VCs on their cap tables as they reach / cross into Unicorn territory

- Blume PortCos: GreyOrange, Slice, Dunzo

- Non-Blume Cos: InMobi, Dream Sports

- Blume PortCos: GreyOrange, Slice, Dunzo

- And / Or took 10 years+ to get there (or getting there soon)

- Blume PortCos: Purplle, Carbon Clean

- Non-Blume Cos: Gupshup

- Blume PortCos: Purplle, Carbon Clean

- And / Or had no new large VC fund lead a round for >3-4 years at a stretch

- Blume PortCos: Exotel, Spinny

- Non-Blume cos: BillDesk, Nykaa

- And / Or listing at ~$500 mill valuations or lower and blowing past the $1 billion mark sooner than later (within months sometimes of listing)

- Non-Blume cos: Indiamart, Nazaara

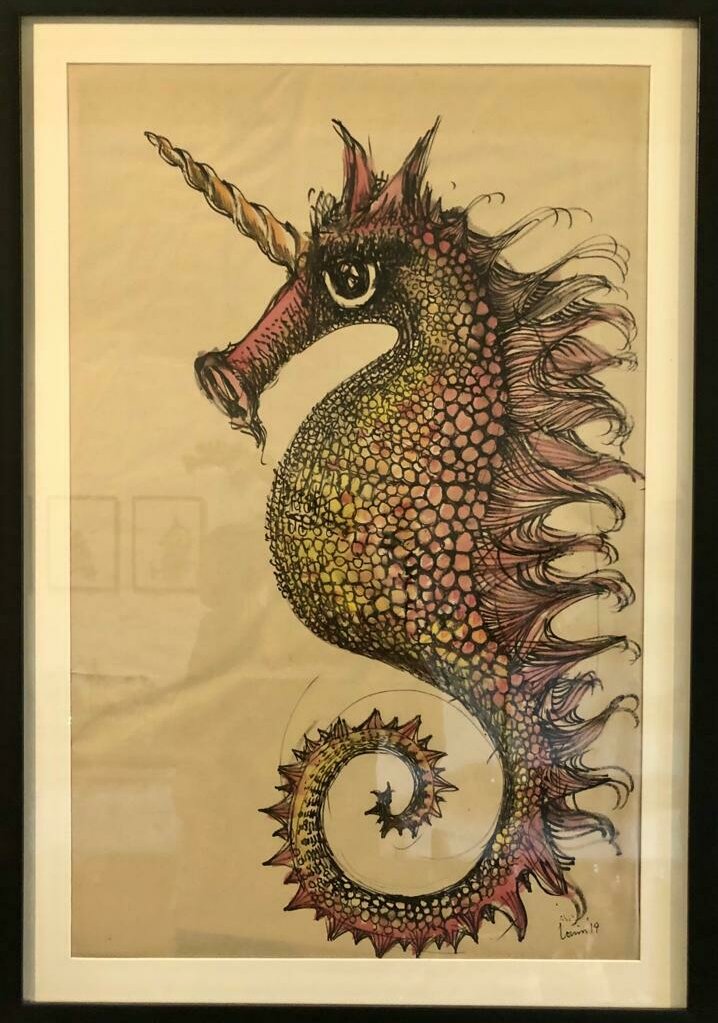

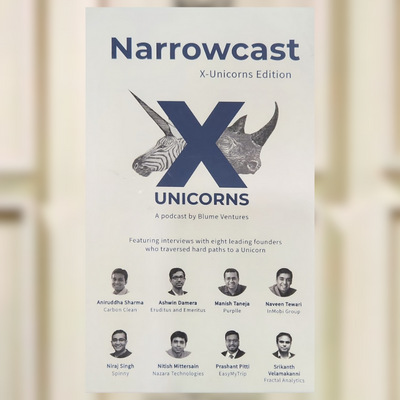

Artist: Thomas Louis; also in the Blume office collection now

The variants and mutants are suddenly in plain sight.

Some look like zebras and hippos, others rhinos, gazelles, seahorses. They look like they could be any shape or size as long as they have spouted a large single horn or even two for effect. And we want to look back at 2021 and celebrate the ones that are soon entering the X-Unicorn club.

Many of them were ignored / left for dead, but are today walking alongside some of the very best tech companies built in the country.

The singular formula that the ecosystem employs to classify unicorns therefore does their journeys injustice (and does not really hold water).

Unicorns are dated. They come in all shapes and sizes. The age of the X-Unicorns is upon us. Silently, they grow unnoticed and emerge valiantly into the limelight.