Understanding The Mental Health Landscape In India

- Published

- Reading Time

- 3 minutes

Over the last few years, there has been a growing focus on Mental Health in India – more millennials are openly talking about their experience with therapy, more employers are providing mental health benefits, more managers are being encouraged to undergo coaching, and more celebrities are sharing their experiences with mental health conditions. As the need deepens, the delivery of these services is moving more and more online – in the form of teleconsults, AI led apps, and online support groups.

This brings us as VCs to the question – is there an opportunity for something in this space to rapidly scale and both serve a million (or even better, a billion) users and make a handsome return on investment? The western world VCs would reply affirmatively with examples of Calm, Headspace, Lyra and more, but the situation in India is a little different. We still struggle with stigma, limited quality supply of mental health professionals, and tough economics. To answer this question in the Indian context, our team member Radhika Agarwal took a deeper look into the space.

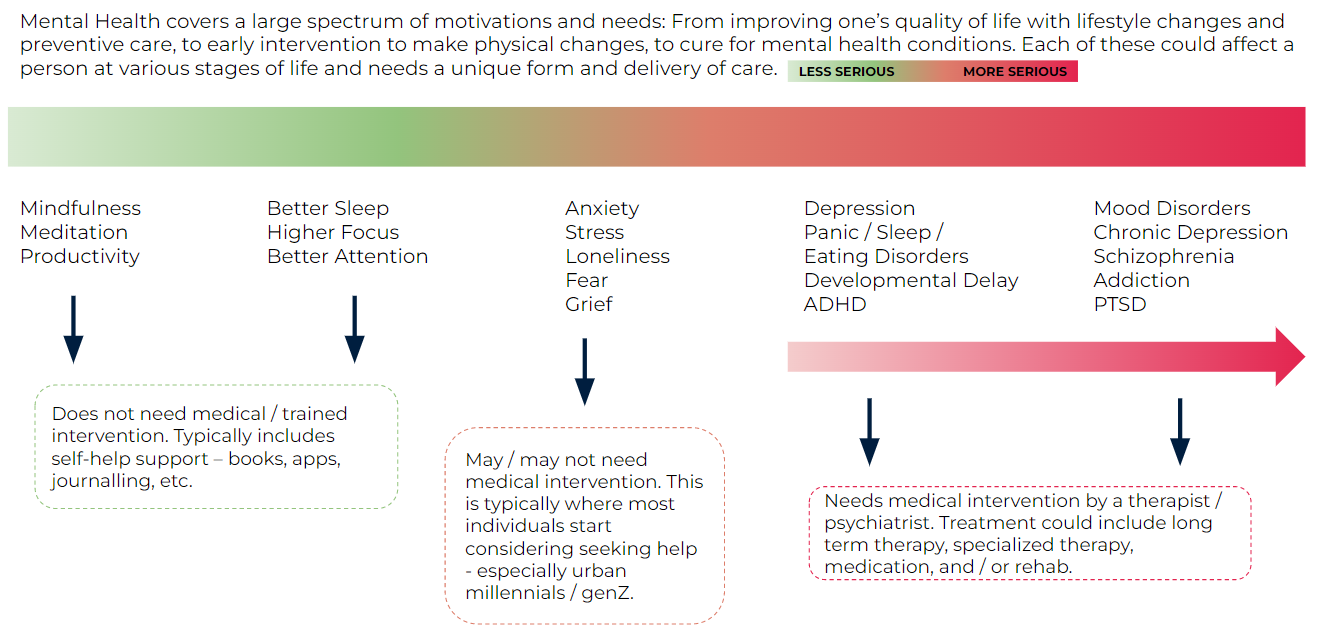

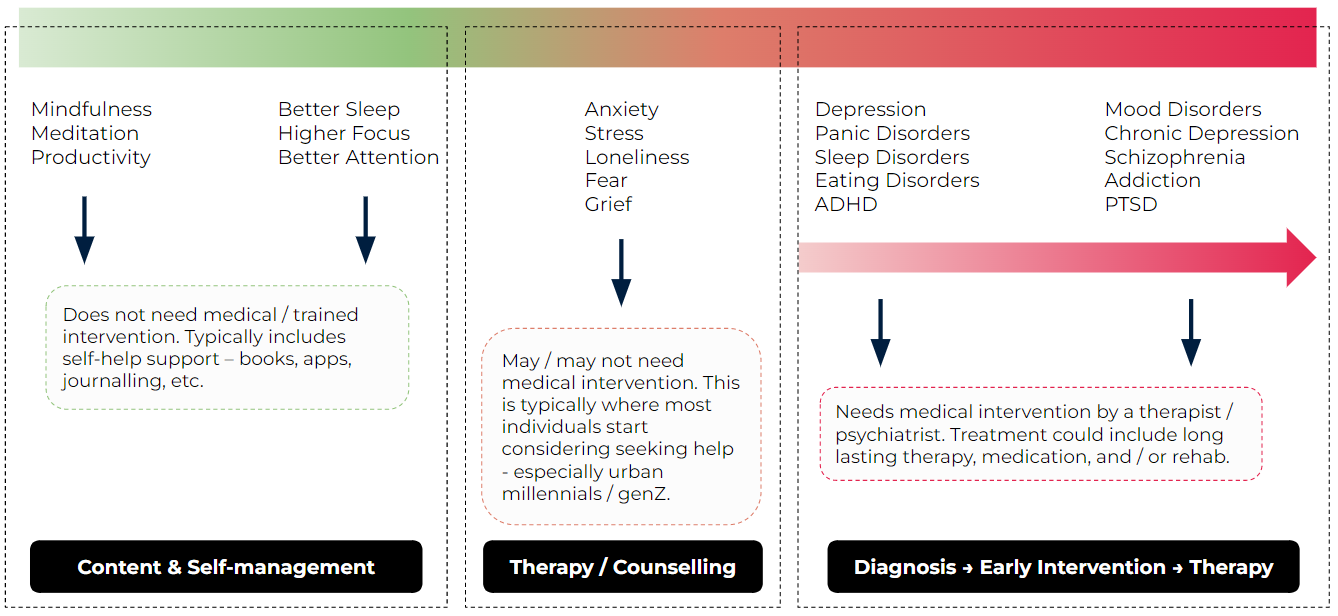

‘Mental Health’ is a broad term – as broad as the wide range of needs and issues humans struggle with. We like to think of it as a spectrum of needs from maintaining a healthy mind, to improving lifestyle, to actively seeking help.

Resource

Each of these buckets is becoming a large opportunity area because of rising demand from users (despite expensive and non-scalable supply). This rising demand is further exacerbated by:

- COVID-19 led lockdown which left people socially distanced from others and lonely

- COVID-19 led anxiety around family health, death, grief

- Increasing number of nuclear families leading to a breakdown of natural support systems

- Increasing cases of developmental delays as women have children later in life / with poorer urban lifestyles (science shows a strong correlation here)

- Increasing impact of social media on body image issues, peer competition, bullying

Further, the increasing awareness around mental health on social media (as evidenced by the surge in Reels on mental health) is encouraging more people to seek help when they feel they need it.

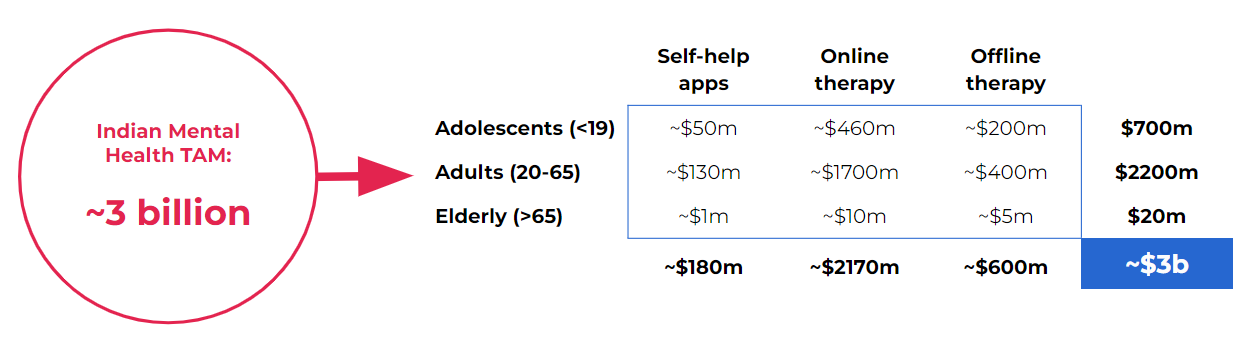

Based on this demand, we estimate that the potential market size of the Indian Mental Health care industry (including online and offline) is ~$3b.

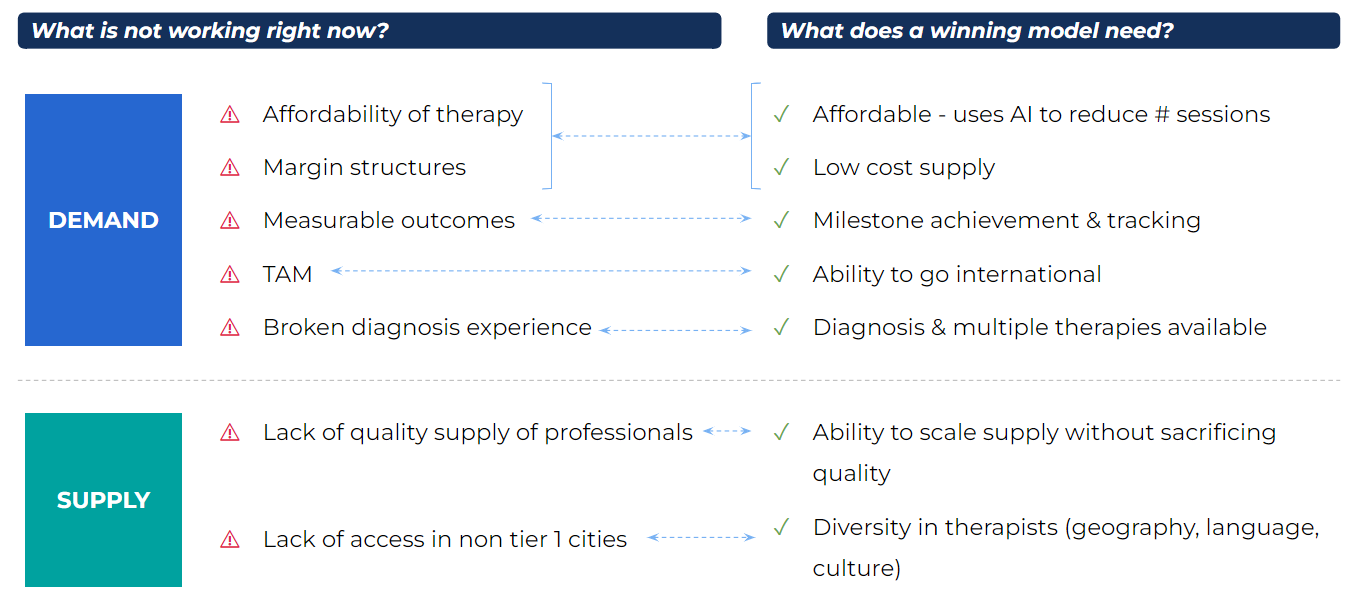

Now that we have established that demand exists and a possible opportunity exists, let’s look at what the major constraints in building a business here are:

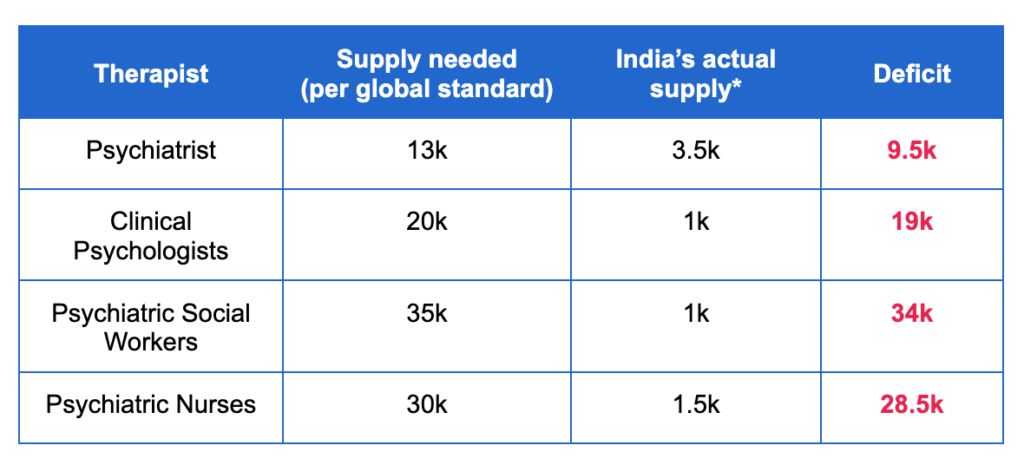

- India lacks the supply needed to service it’s population: Based on WHO standards, India should have ~20k clinical psychologists and ~35k psychiatric social workers to service a population of our size. However, our actual supply of accredited professionals is well below that.

Even if we increase the number of therapists, quality will always be a concern. In India, you can apply for a clinical psychologist license as soon as you graduate from an accredited and approved degree program, and begin practicing as a clinical psychologist In most developed countries, to qualify for the clinical psychologist license, you need to work under the supervision of a licensed clinical psychologist, be in therapy yourself, and undergo continuous quality and ethics evaluation. India’s broken process to qualify as a clinical psychologist (largely because the industry is not well regulated) means that quality and experience level of the current supply pool is limited.

- Therapy is expensive

Traditional therapy continues to be very expensive (on average, a one hour session costs ~1-2k INR and users are encouraged to take at least 1 session per week for a few months, if not years). Also, the best therapists and counselors are typically based in Tier 1 cities, making traditional offline therapy less accessible for users elsewhere.

- High-quality services are hard to scale

Traditional therapy is very hard to scale given its dependence on 1:1 sessions and highly trained professionals. As you try and scale this service (by bringing in group sessions, AI, self-help), you tend to lose out on quality. There is a fundamental contradiction in Mental Health between scalability, quality, and affordability.

- Mental Health records are not digitized or standardized

While there is an active push to digitize health records across the country to deliver better medical services, Mental Health records are far from being digitized, making it harder to provide high quality support or transition from one professional to another seamlessly.

- Stigma still exists in large parts of the country and in most social structures

While open conversations about Mental Health have most certainly started, most social structures are still plagued with stigma around Mental Health conditions or seeing help.

Given these constraints and the rising demand, what does the market landscape and opportunity set look like?

While the market can be broken down into buckets from maintenance to medical treatment, each bucket has its own set of opportunities, viable models, and constraints. For maintenance or basic lifestyle improvement, content and self-help apps have proved successful (assuming the user is self-motivated and consistent). As you start moving towards improvement (whether basic or deeper), models around therapy and counseling are more common. And finally, the deeper the concern, the more the requirement of medical rigor in the form of clinical diagnosis and medical treatment.

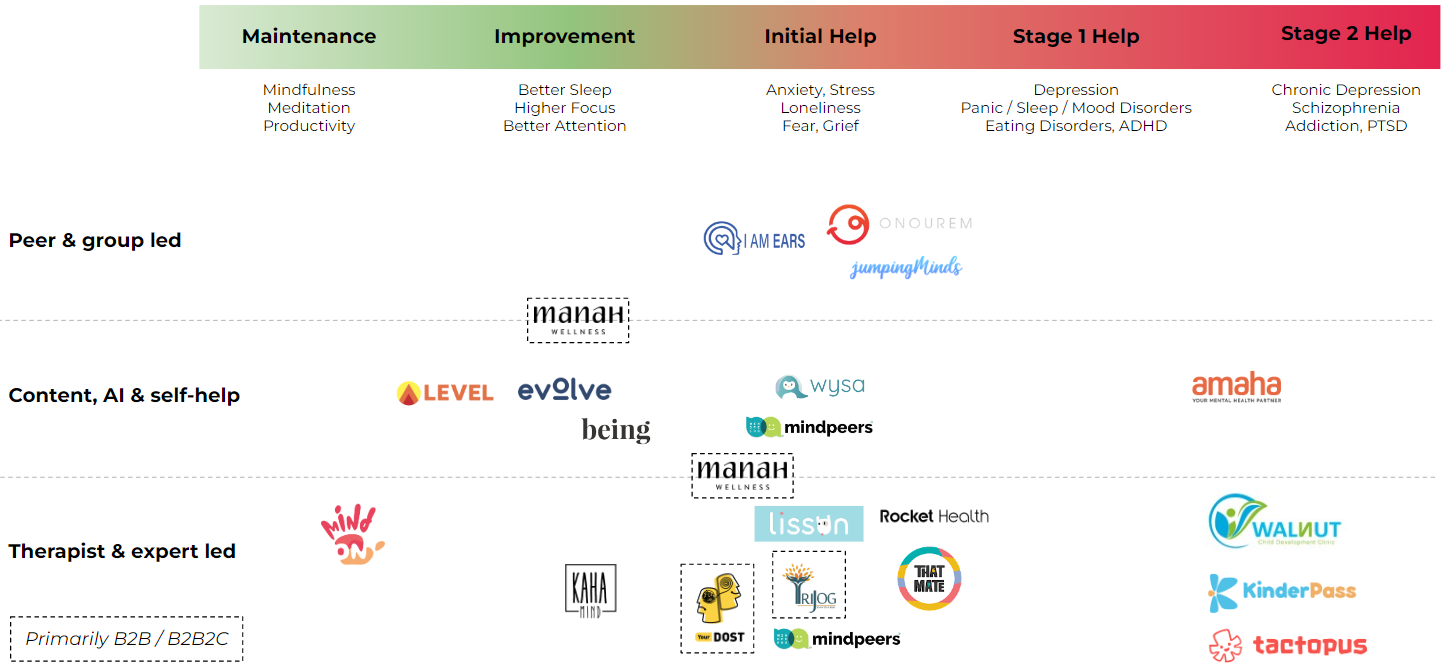

We’ve seen a number of different models that could be used to deliver these services – automated AI led apps, human led online therapy, peer support groups, social networks with a support system goal, content, journaling, meditation, and group therapy. Broadly, you can classify them into 3 buckets:

- Content and self-help

- Peer and group led

- Therapist and expert led

Each of these models can be used to deliver services across the spectrum of Mental Health (albeit with different levels of efficacy). Based on this lens of user need x delivery model, this is what the India map broadly looks like.

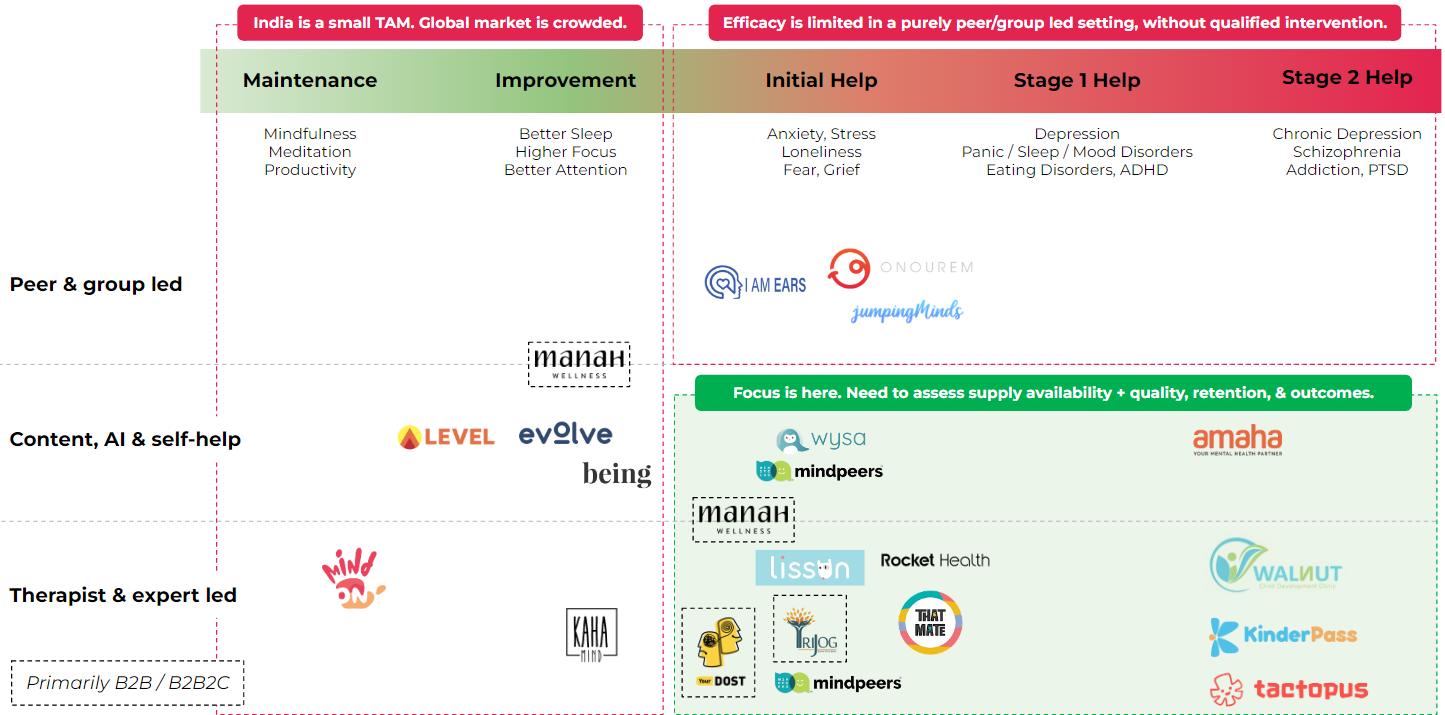

Based on the market size, the constraints we found easier to solve for, our learnings from several industry experts and users, and our own gut on how demand will evolve, we broke down the map further to describe what areas we would like to double click on.

But even within these spaces, we see certain features that are necessary but not sufficient to build a large business, which also help us form our ‘criteria’ when we evaluate startups in the Mental Health space.

While we believe we have considered all possible scenarios, the possibility of errors and blindspots is never zero. We are happy to discuss the report and learn from your experiences and knowledge. Additionally, if you are building (or know someone who is building) a Mental Health startup that aligns with our thought process, or if you have data or conviction to change our view, please reach out to radhika@blume.vc!