As talent attraction and retention becomes more competitive across the world, and as organizations grow beyond borders and adopt new ways of working, the HR function has become a priority for businesses.

Organizations today are starting to recognize the pivotal role that efficient HR operations play in achieving strategic objectives, and HRTech tools have become a must-have in the enterprise tech stack. With increasing interest and innovation in the HRTech space, we have used this thesis as a vehicle to delve into the field of HRTech, understand what makes for a strong product in this space, dissect opportunity areas, and uncover the right to win for HRTech startups.

Resources

- HRTech Thesis 2023 Google Sheets

- HR Tech Thesis 2023 pdf, 8 MB

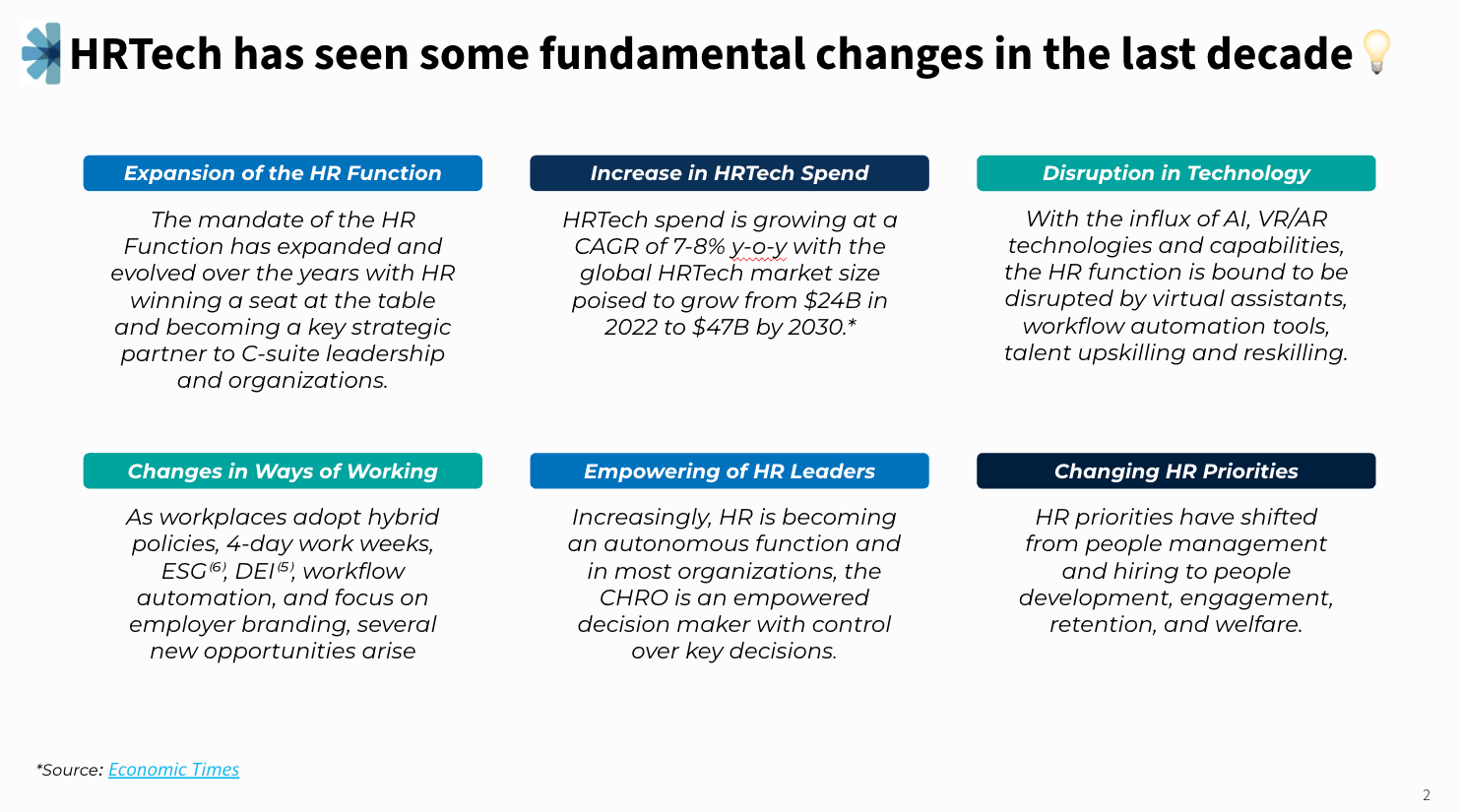

While HRTech has been around for several decades now - we are seeing strong tailwinds bolstering growth and unlocking new opportunities in this space.

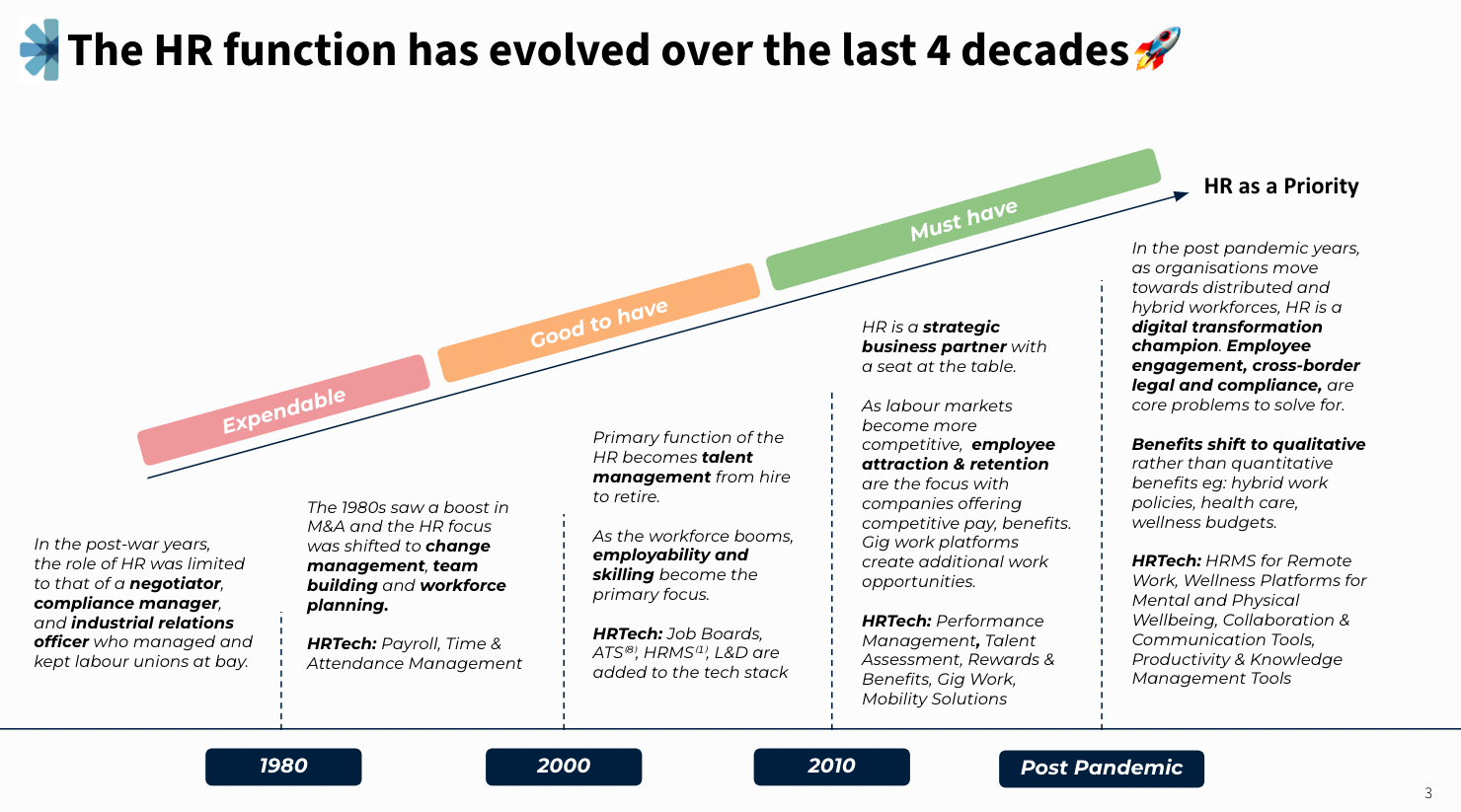

We have seen HR evolve and grow as an organisational priority over the last 4 decades, and with it there has been an explosion of new technology in the space. As the HR scope-of-work grows in complexity and importance, new sub-divisions emerge, resulting in a need for technology adoption to manage, coordinate, and support the role of HR teams.

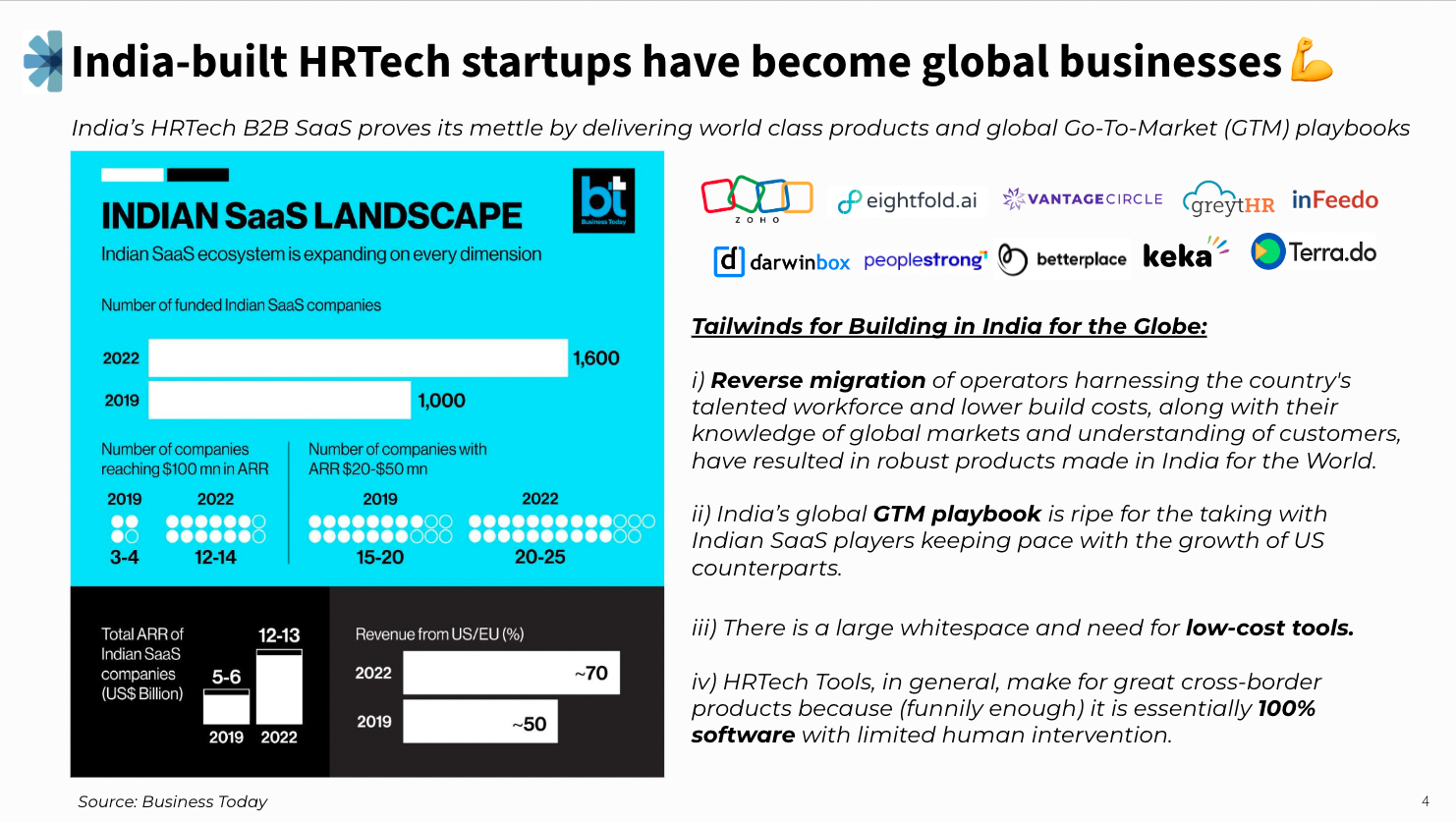

With strong service level quality, and a proven global GTM playbook, India has become a mighty player in the global HRTech arena. The reverse migration of seasoned operators, the need for low-cost SMB tools, and the availability of a software talent pool within the country has us incredibly excited for the next generation of HRTech products poised to be built out of India.

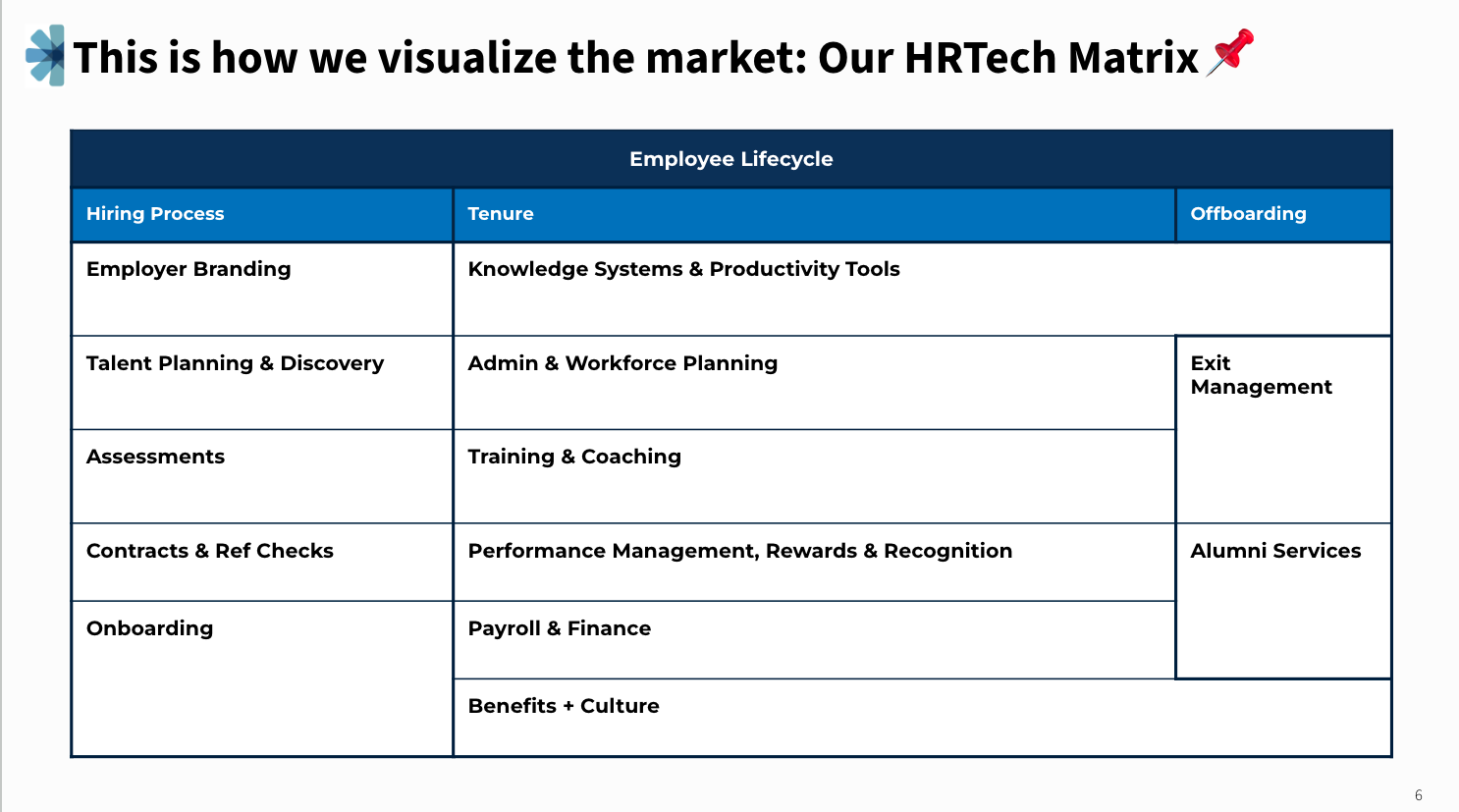

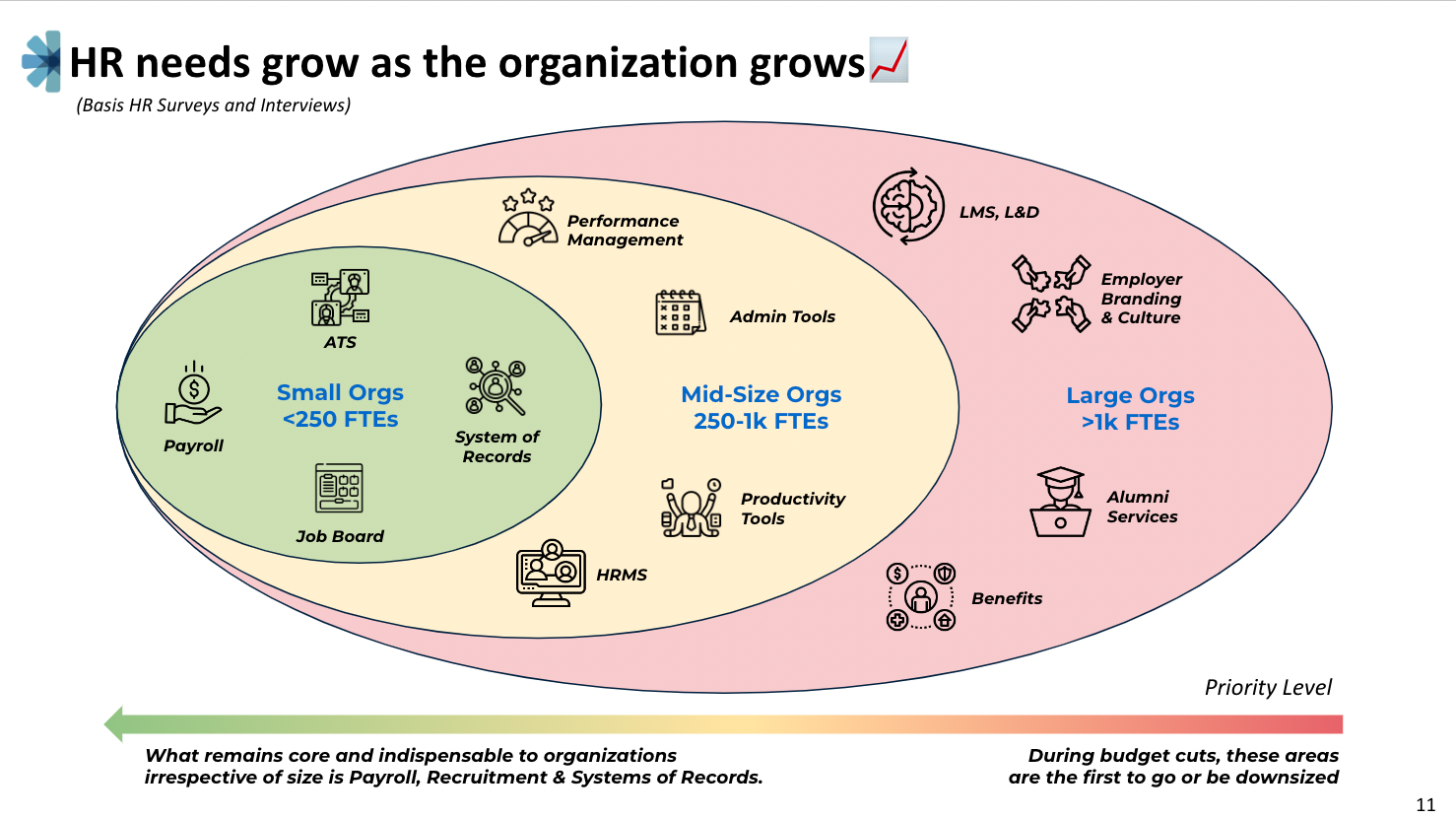

Based on our understanding of the HRTech function and needs of employers, we sketched out how we visualize the market today and sub-segments within it.

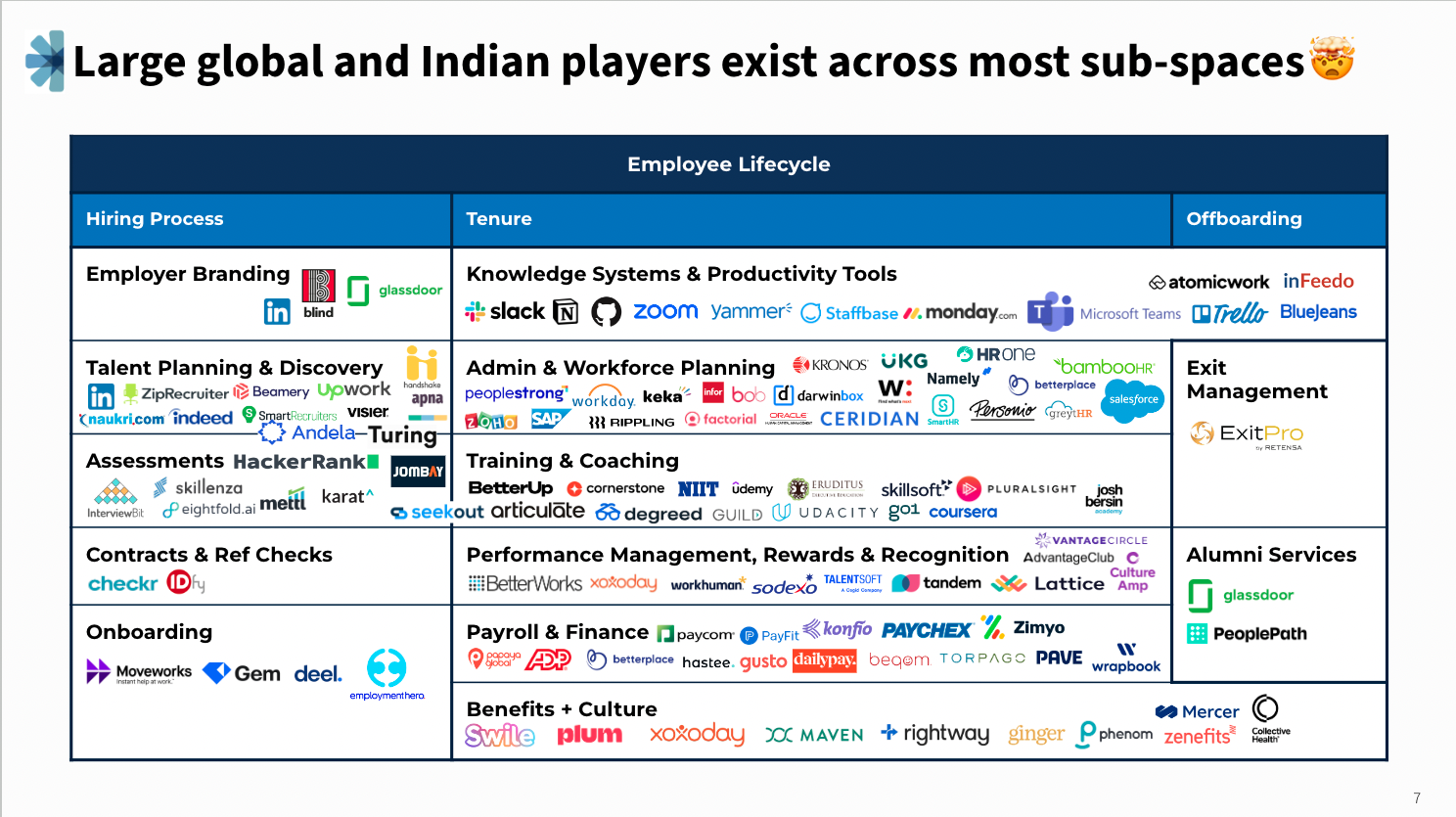

To better digest each subspace, we plotted some of the biggest HRTech players (from India and the globe) in our market map. As you can see, some sub-spaces are significantly more crowded than others.

Section 3: Narrowing Down on Opportunity Areas

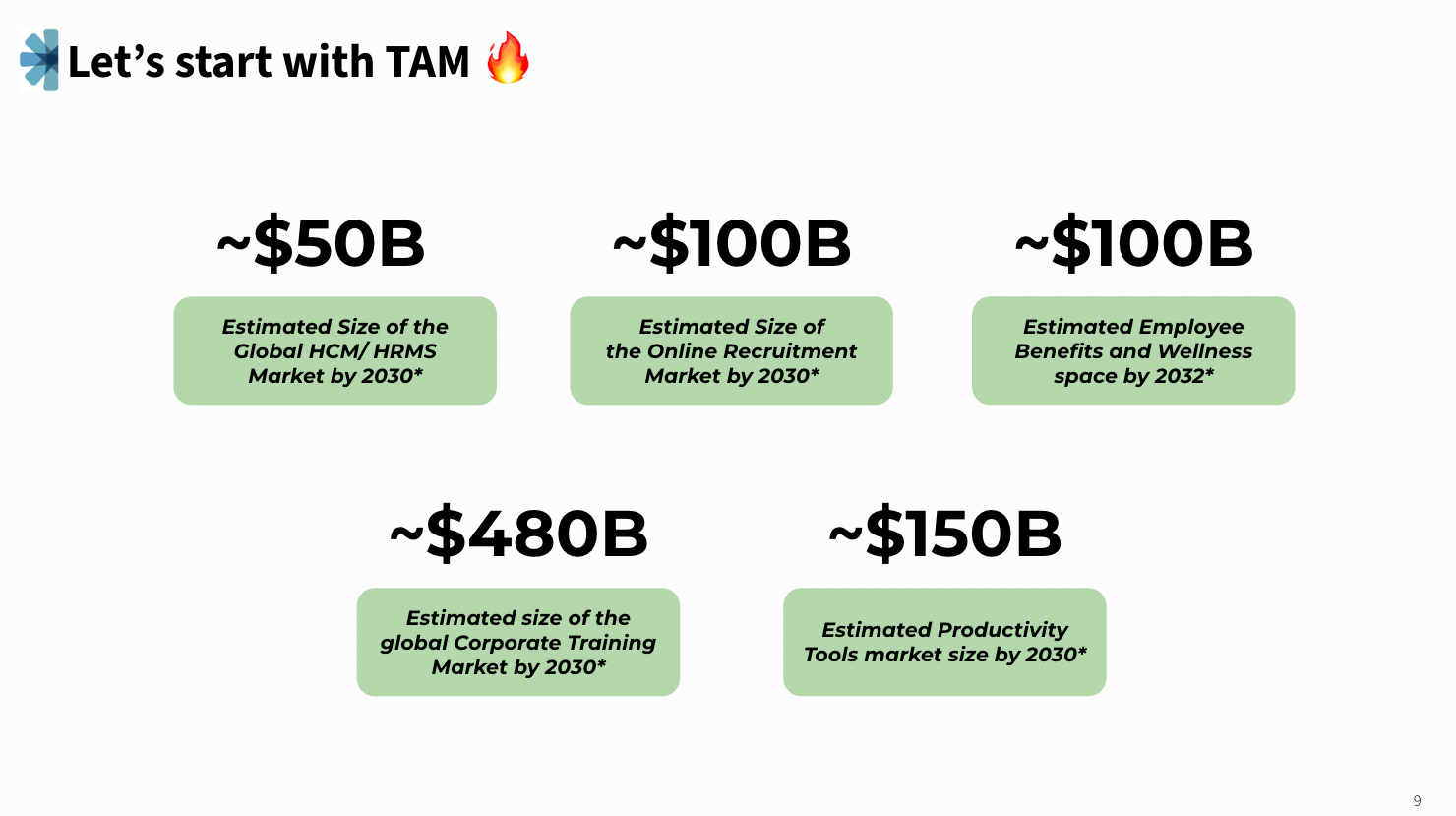

On observing the market map, we realized HRTech is a rather crowded space. To narrow down on investible sub-spaces we studied TAM, organizational priorities, ICPs and decision makers within enterprises, and any available whitespaces or wedges for the taking.

Starting with TAM, the bottomline is that each of the subspaces present a large enough opportunity for several players to compete and build multi-billion dollar outcomes. Certain spaces like Recruitment & Staffing present a trillion dollar opportunity but for the scope of this thesis we are focussing only on online recruitment tools, which encompasses job marketplaces, ATS, Assessment & Interview Tools. We have gone into deeper detail on this, in our thesis.

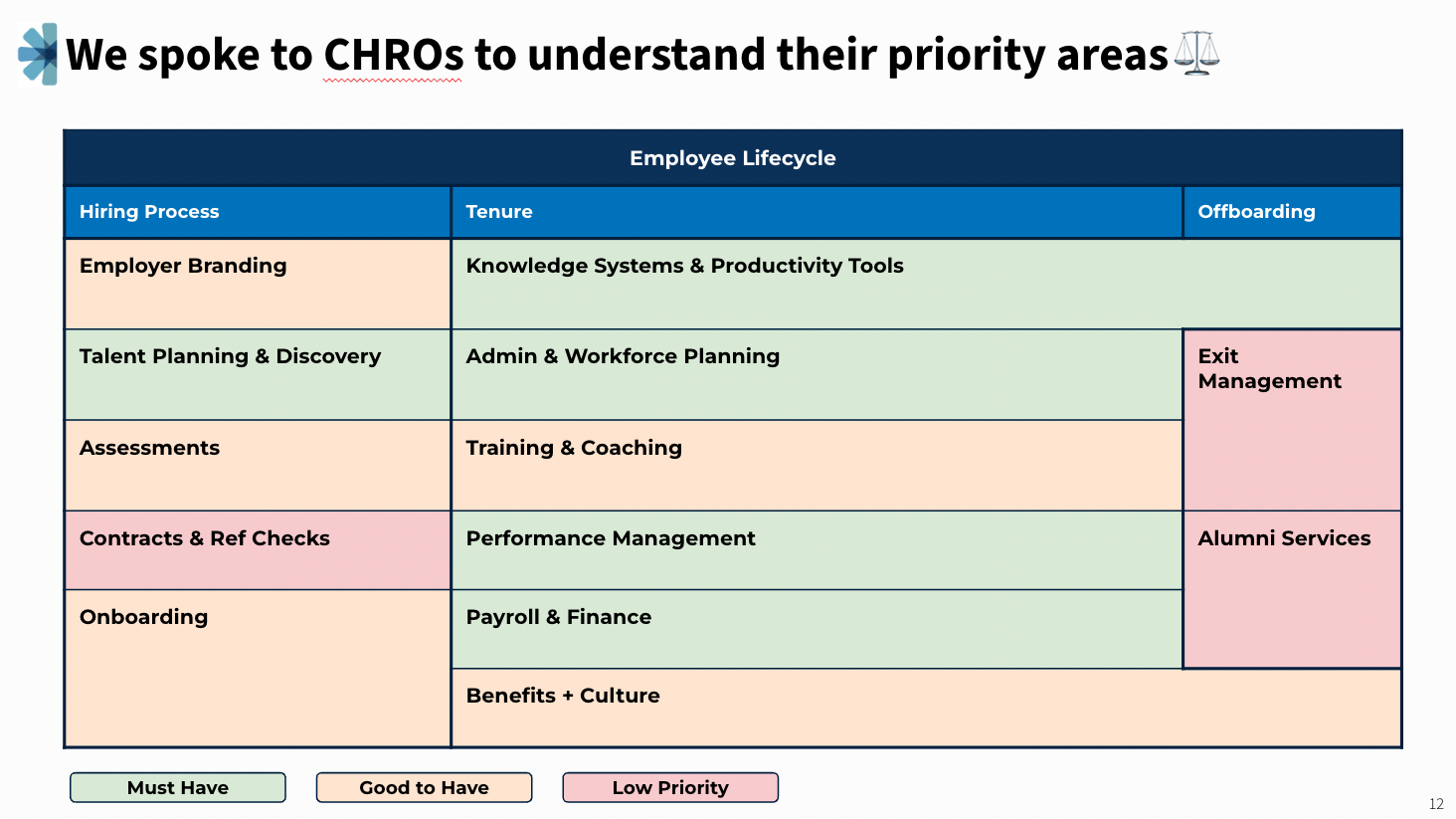

After exploring TAM, we spoke with CHROs and HR Leaders to try and understand how these sub-segments rank in their list of priorities.

Our broad learning from CHRO conversations has been that at the centre of the HR Tech stack is Payroll, Recruitment Tools, and a System of Records (as an organisation grows this is upgraded into an HRMS). Everything else is built around and on top of this integral foundation.

From our conversations with over a dozen HR leaders, we discovered that these priority areas are most likely to see budget allocation within an enterprise.

Our CHRO conversations also meant that it was time to take a deeper dive into understanding ICPs and relevant organization decision makers.

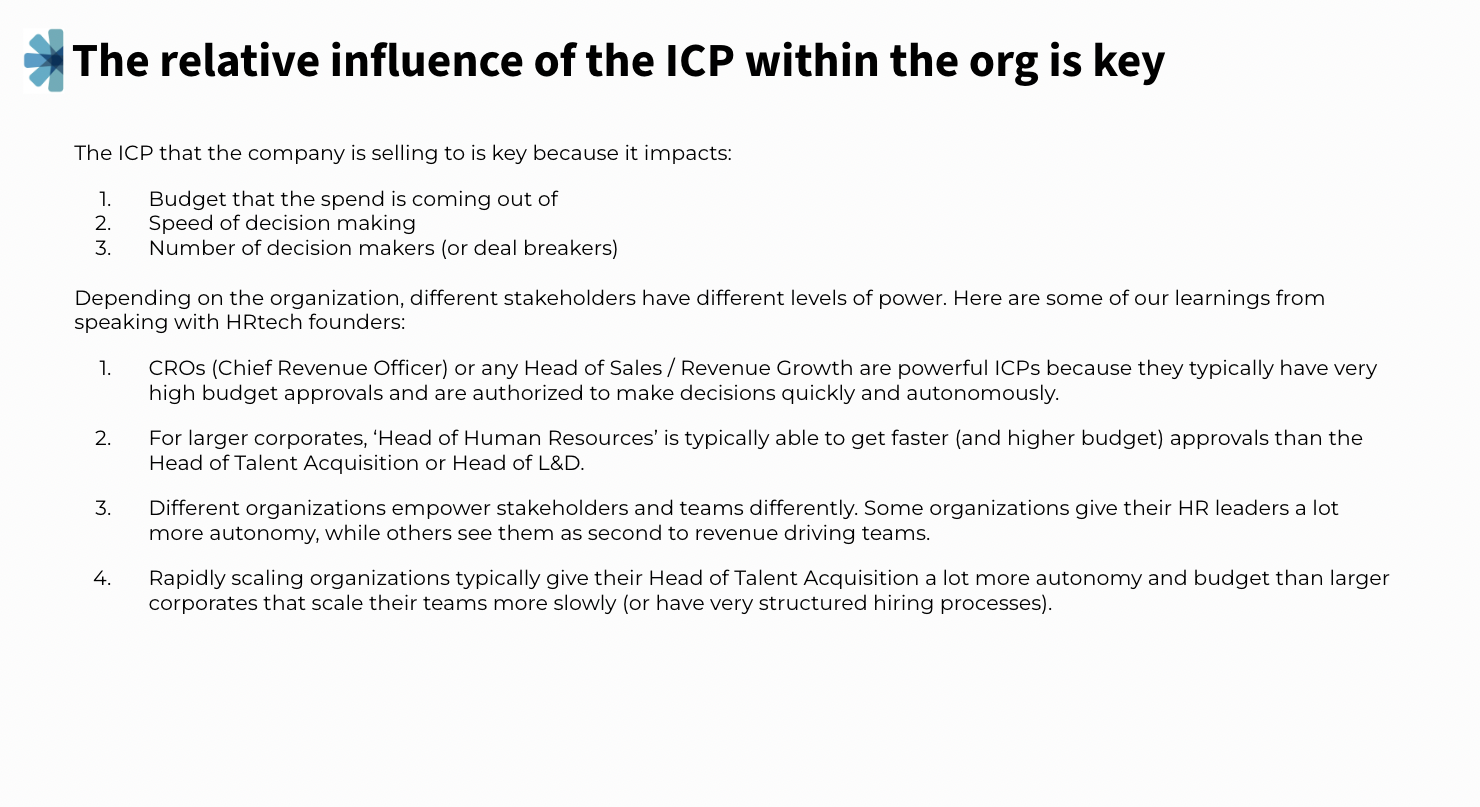

An ICP that a company is selling to dictates size of budget, speed of decision making, and layers in the decision making pipeline. Aligning with the priorities of the most powerful ICP within an org therefore translates into faster and more productive sales cycles.

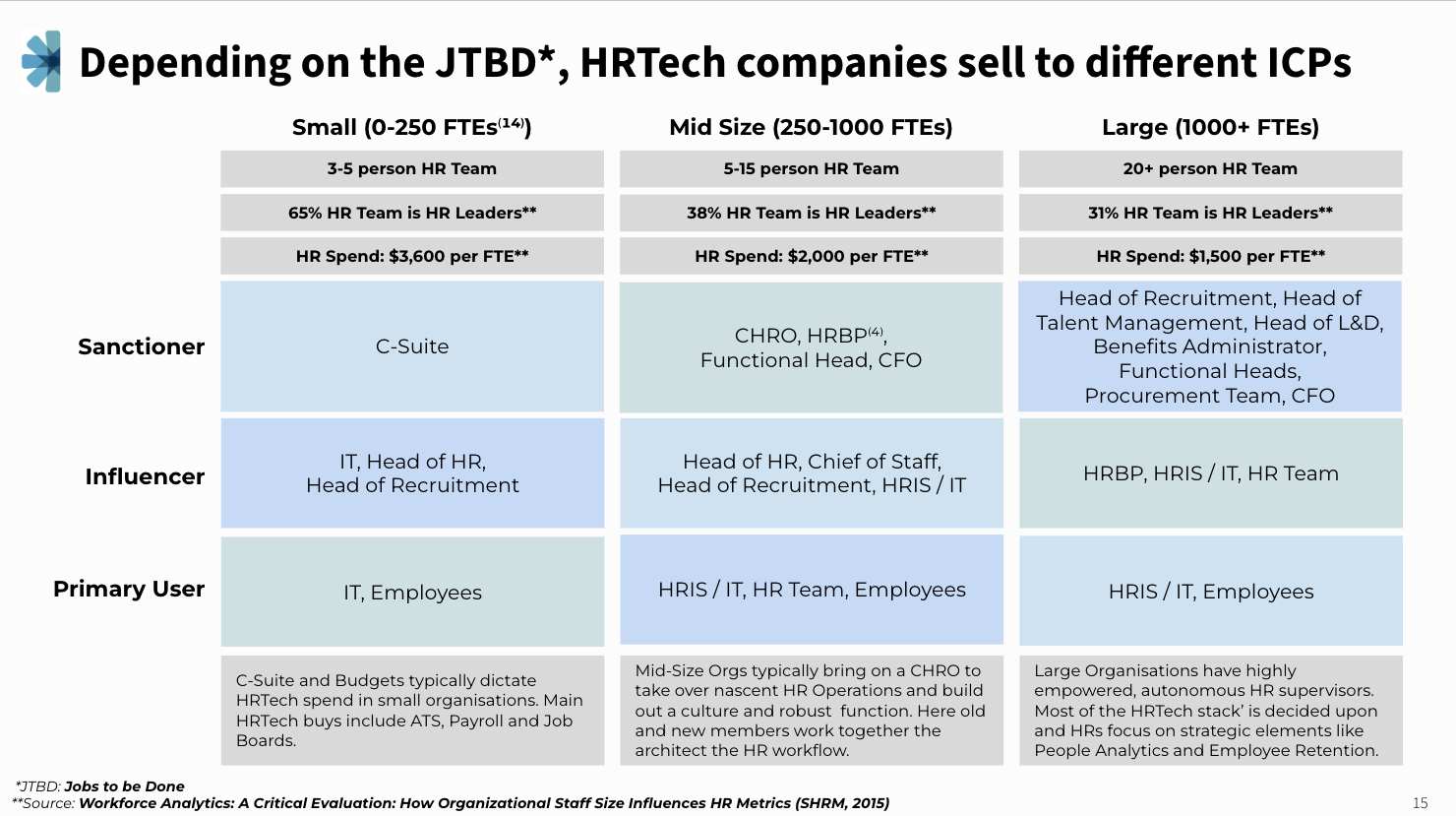

We have classified the decision maker personas into 3 broad buckets: User, Influencer and Sanctioner. To build a successful HRTech product you have to ensure user adoption, influencer trust and buy-in, and priority-alignment with the sanctioner. Therefore it is vital to a founder’s sales strategy to deeply understand and cater to these three personas.

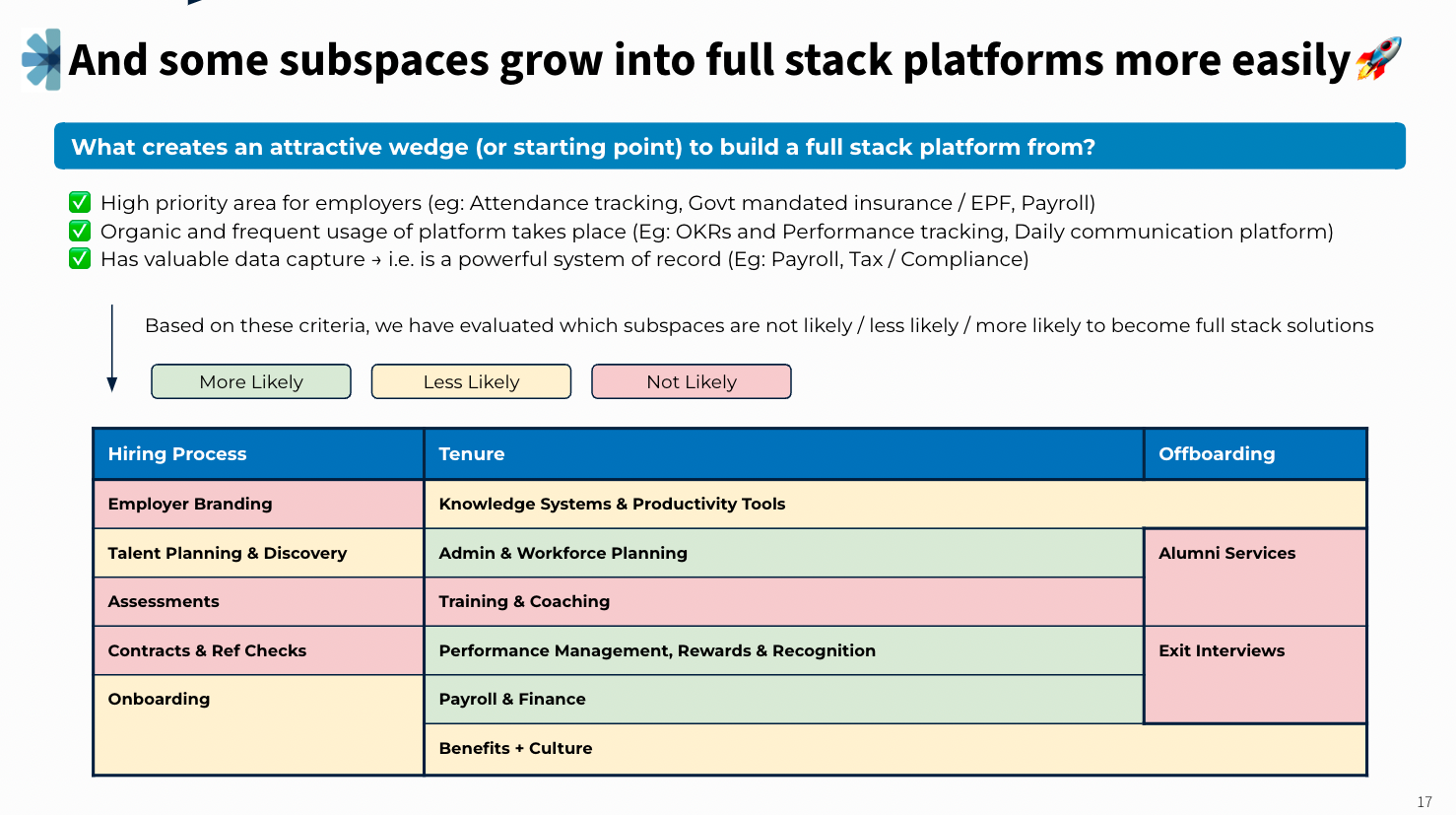

After unearthing ICPs and decision-making pipelines within an org, it became evident that the best way to grow in HRTech is to expand into a fullstack solution; expanding ACV is a quicker & easier route to scale than acquiring new customers

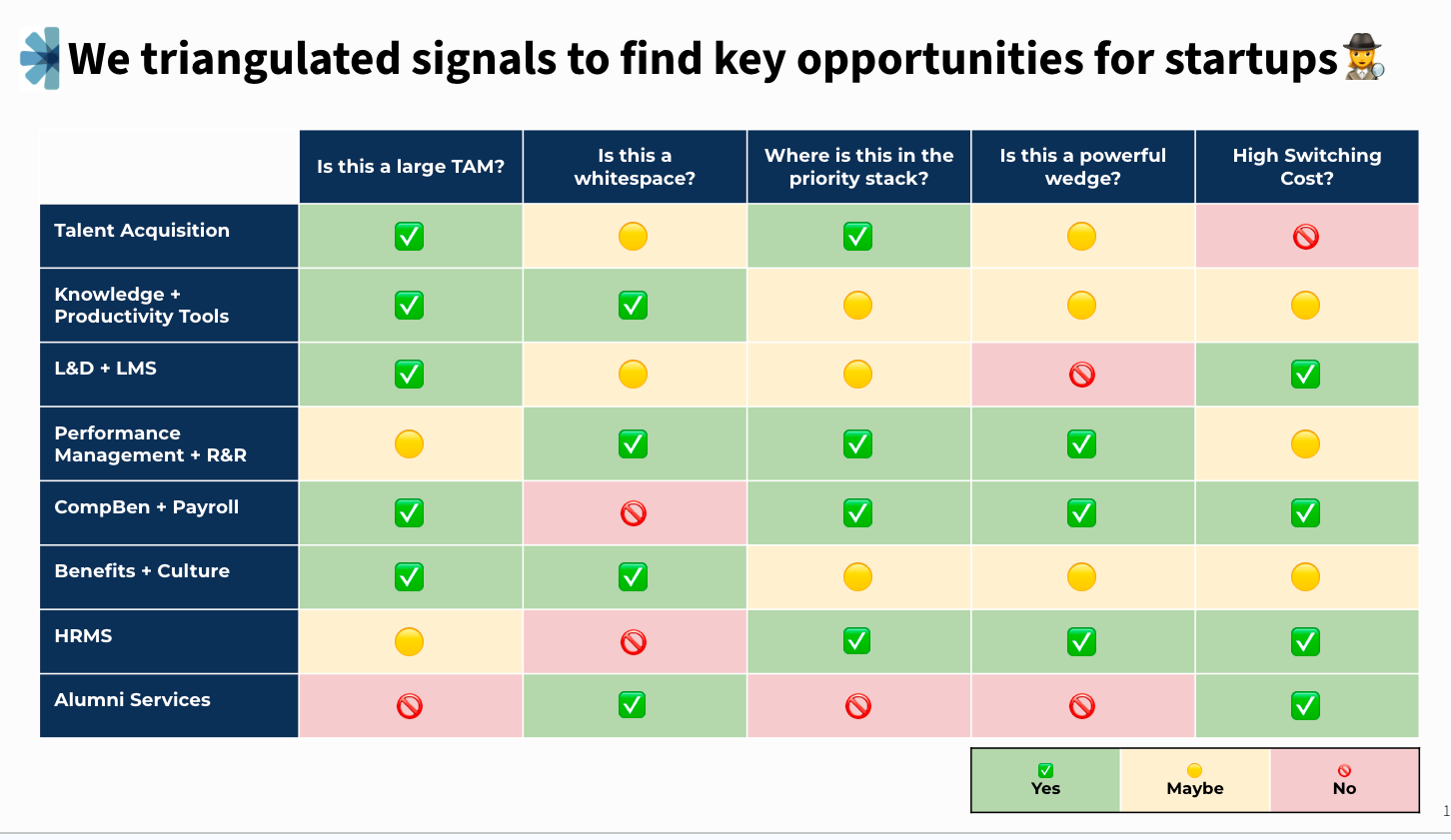

We combined learnings from these deep-dives and built out an opportunity scorecard…

…which finally left us with the following opportunity areas + 1 bonus opportunity area - Alumni Services, which we believe could be a new and exciting space that is yet to be productized

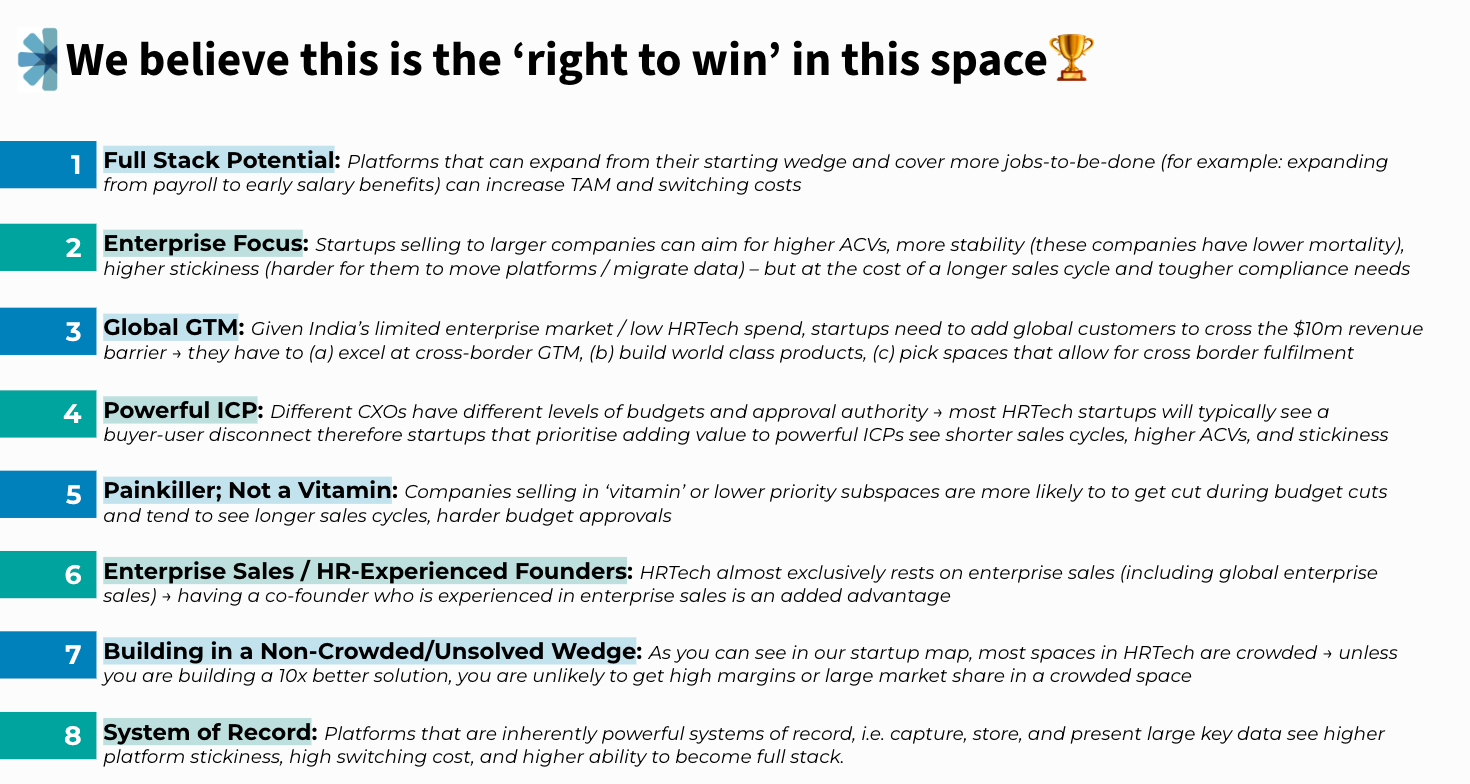

This is our take on the Rights to Win in HRTech. Startups that are able to tick most of these boxes are ahead of the curve in one way or another, and thus more likely to ‘win’ in our view.

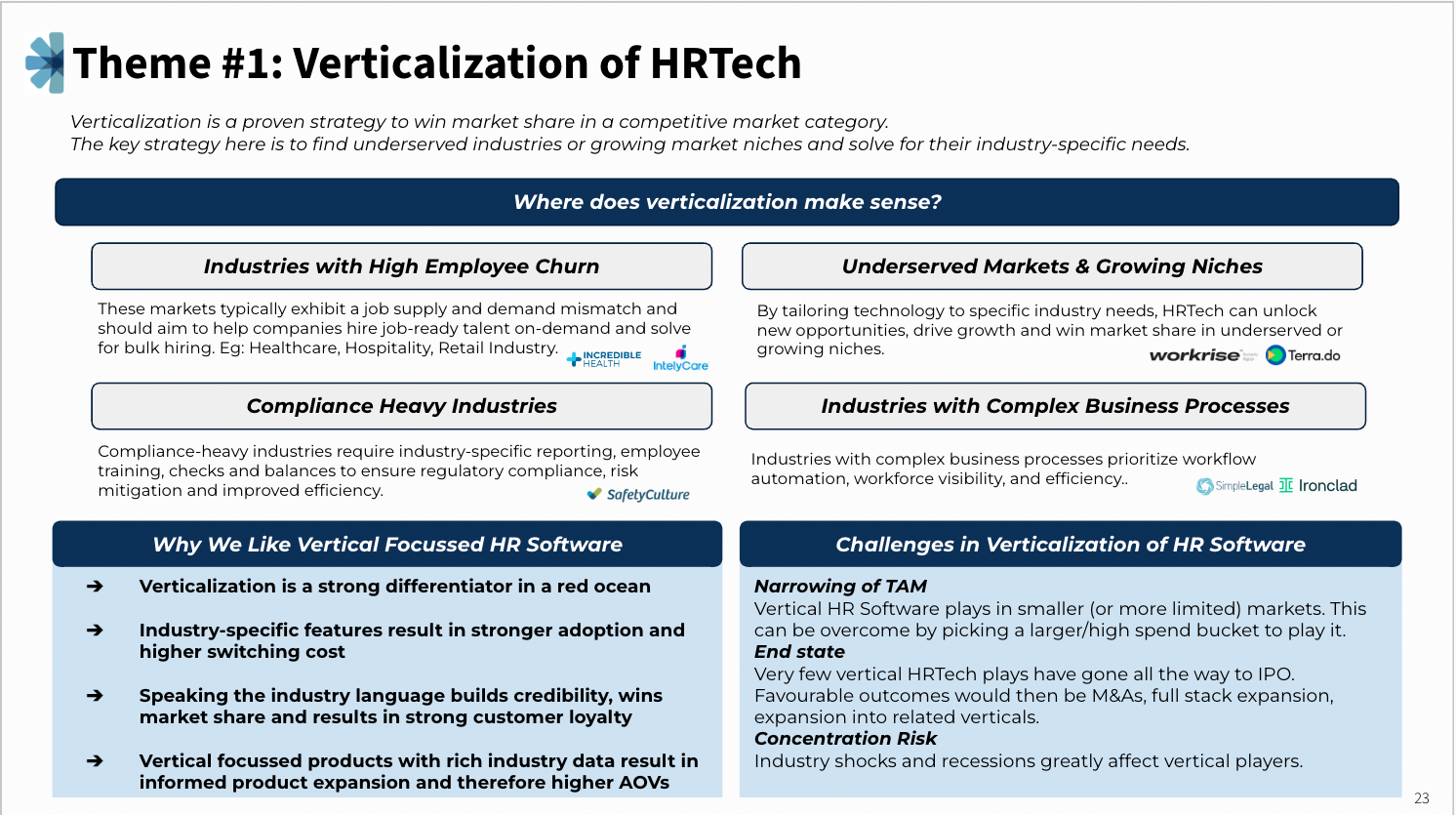

Verticalization is a great strategy to employ when building in a red ocean/crowded and competitive market like HRTech. With verticalization, founders will be able to build strong loyalty and credibility within a niche market which then translates into higher ACVs, more renewals and stronger retention.

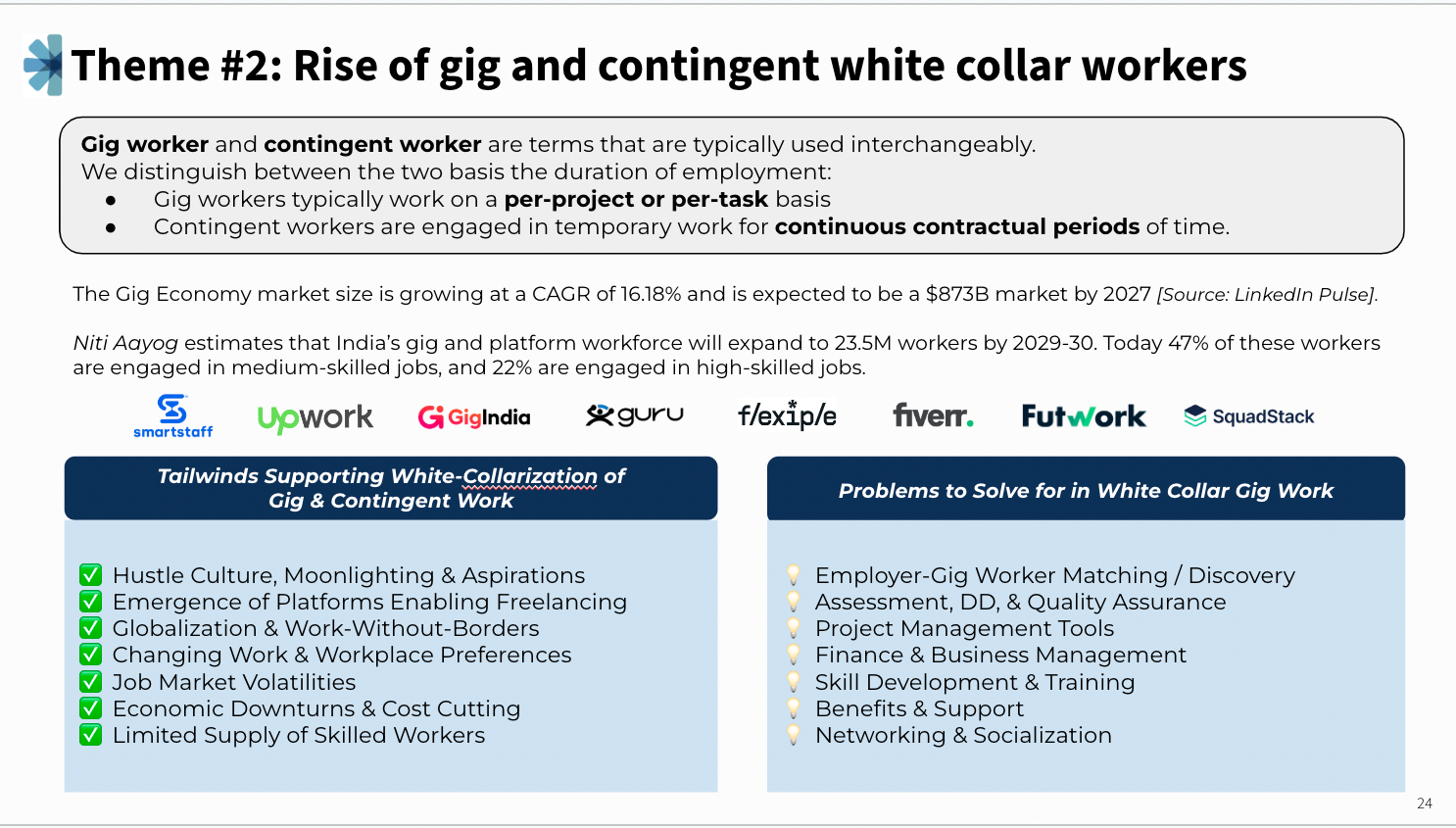

Of late we are also seeing the rise of white collar gig and contingent workers as a result of job market volatilities, hustle culture and globalization. Platforms catering to the discovery, assessment, training, and performance management of these white collar contingent workers can benefit from take rates on high contract values associated with white collar workers .

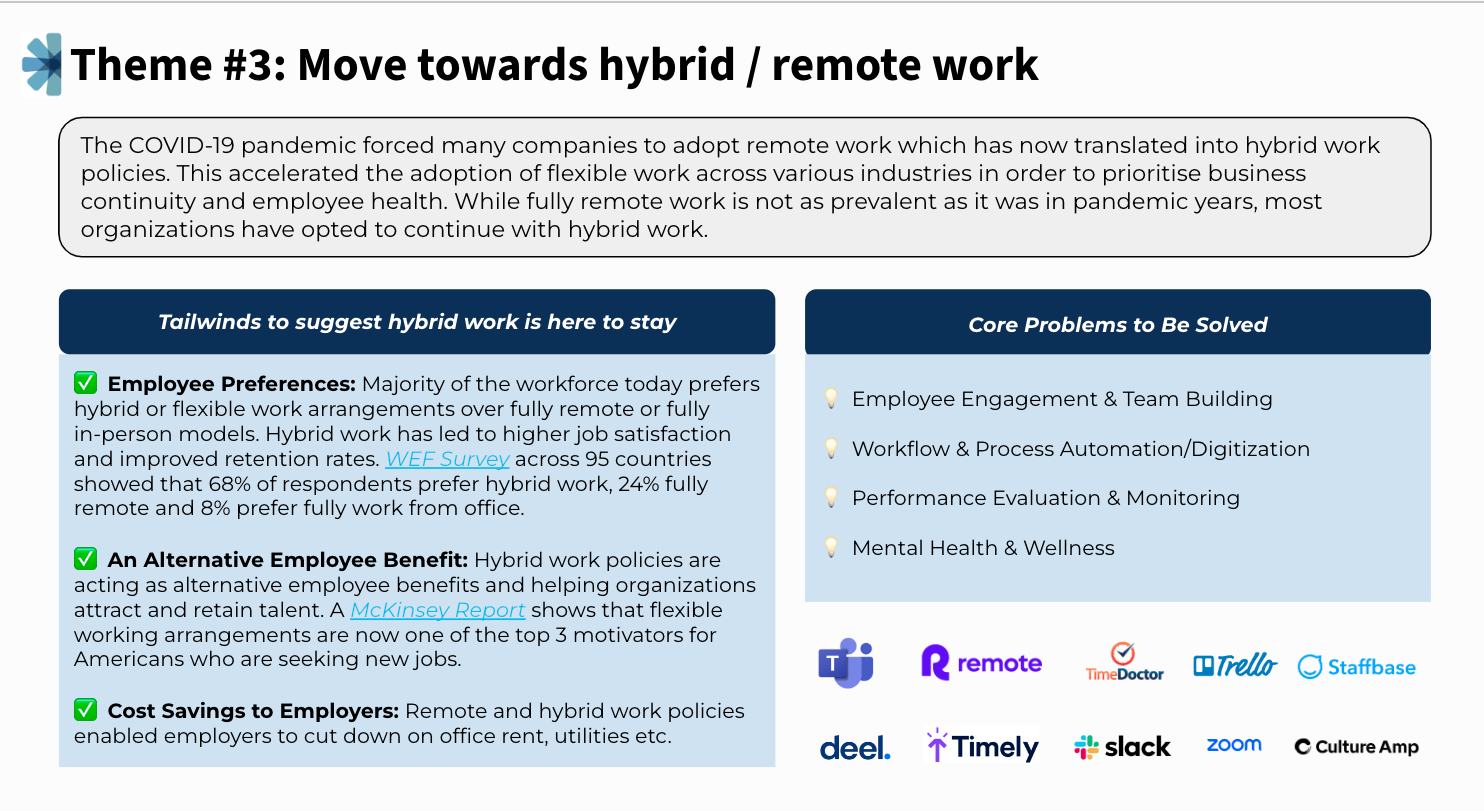

Even in the post COVID-19 world, many employers have remained remote and many employees have become cross border. This has created a new market opportunity – tools to manage, motivate, and hire distributed teams.

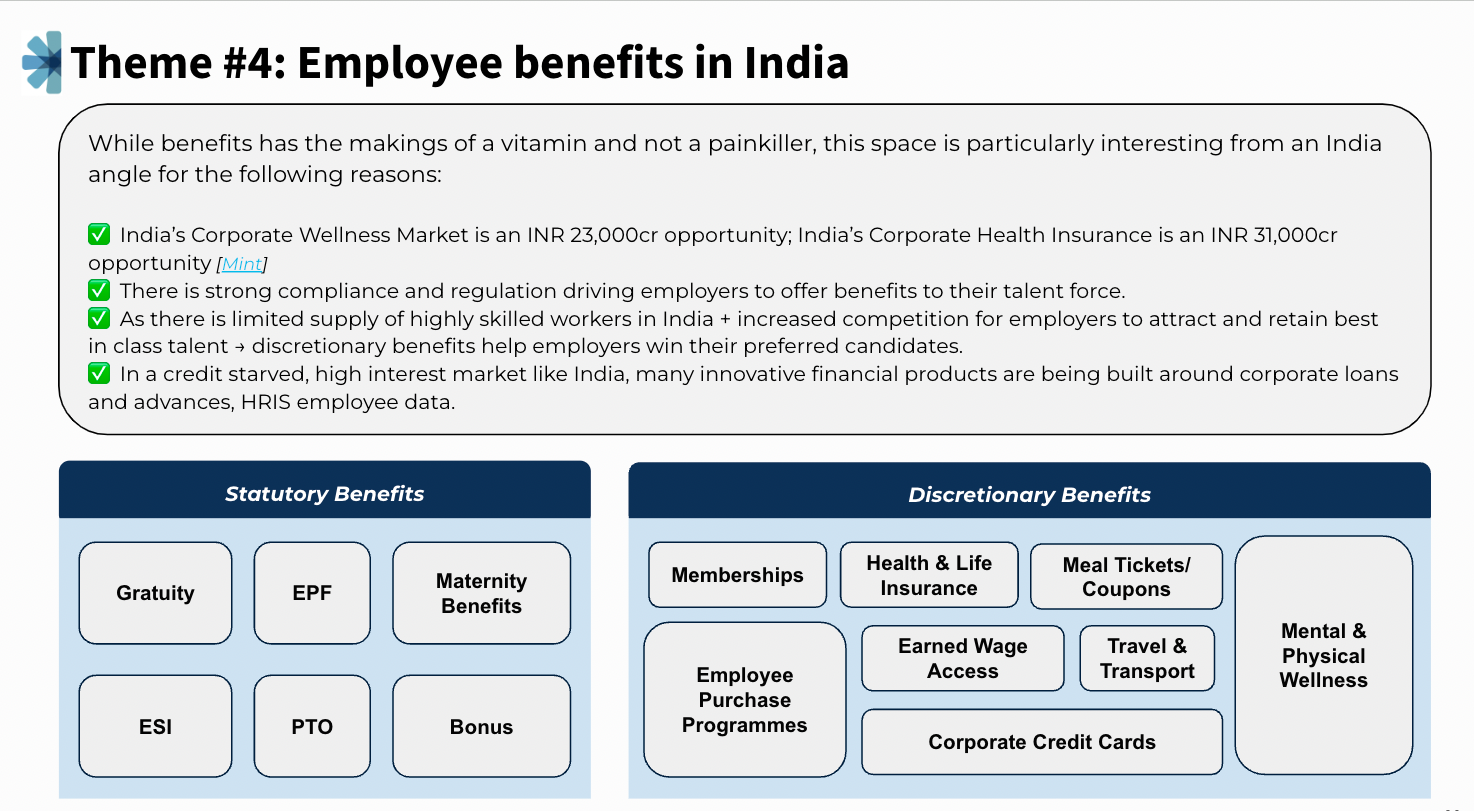

While benefits adoption as a % of employees remains low in India, we have conviction that rethinking the way benefits are designed and distributed can be game changing – especially as employers struggle to retain their best employees in a competitive labour market.

....and other domain experts.