In April 2023, India surpassed China to become the world’s most populous country. While India will continue to be a relatively ‘young’ country for years to come, India’s elderly population (aged 60 years old and above) of ~145 million population is growing — both in population size and wallet size. The elderly population will grow by ~40% in 2021 – 31 compared to ~8% for the general population in the same period.

In the Eldercare BLUprint, we explore the seniors’ pain points, the decision-making process, how the businesses in this sector are serving them, and opportunities. You can check the full report here.

Resource

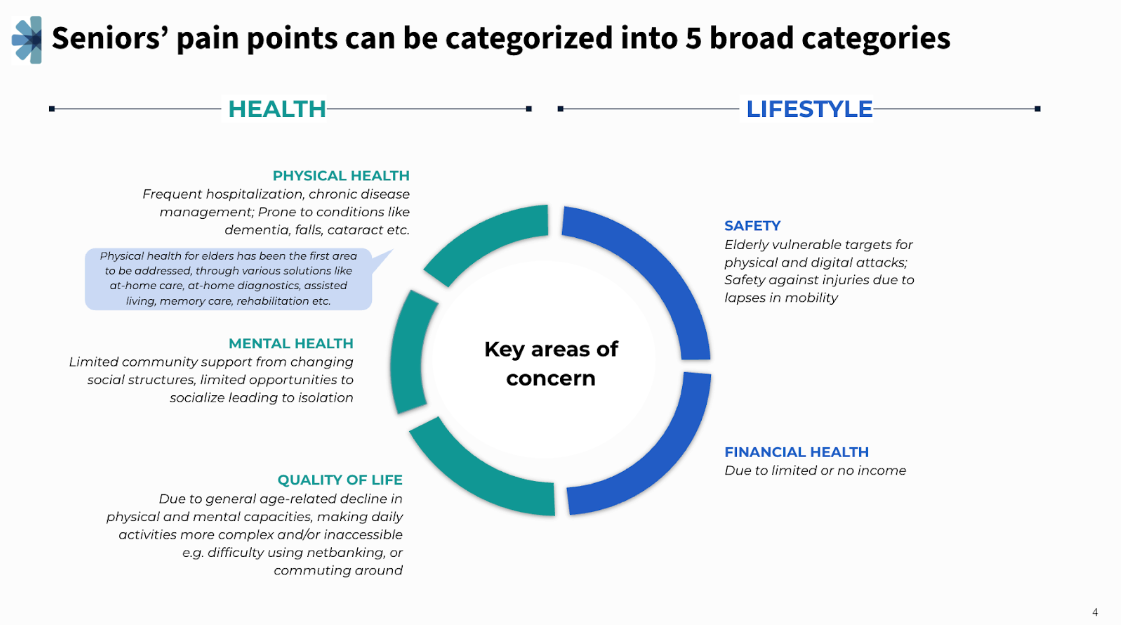

We have identified seniors’ pain points into 5 broad categories corresponding to:

Health - Physical health, mental health, quality of life.

Lifestyle - safety, financial health.

We believe that children might be the ones who make the decision to pay. Based on our research and discussions, the first movers for any new eldercare service tend to be people who’s parents live in India whereas they live overseas. The roles reverse with time as children end up being caregivers for their parents in the later of their parents’ lives.

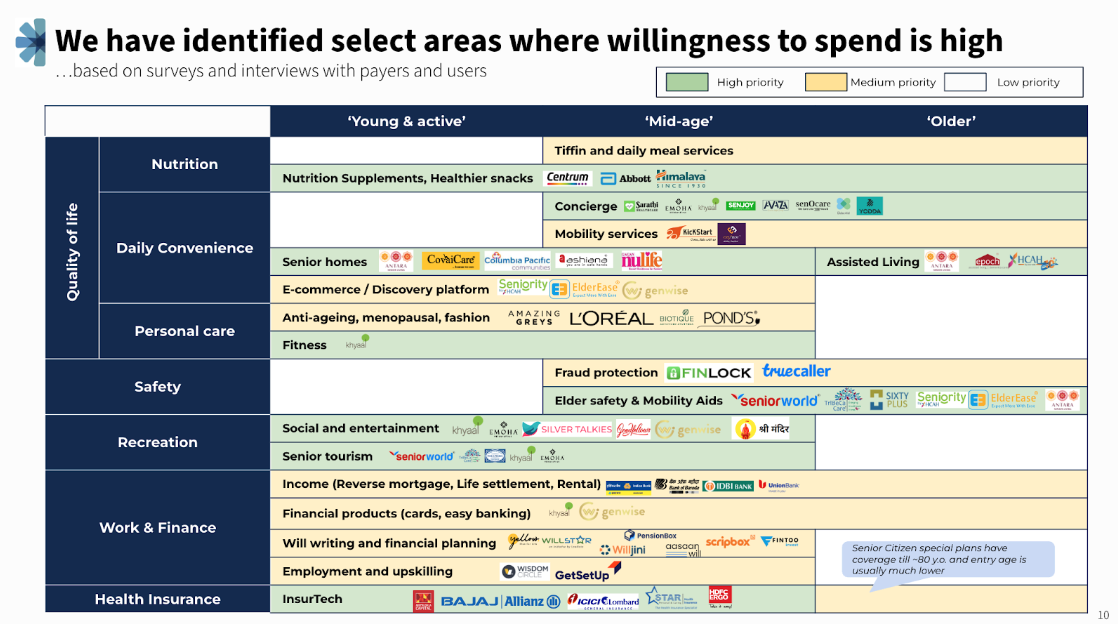

We’ve identified the following areas with a very high willingness to pay:

Nutrition supplements, concierge, senior homes & assisted living, fitness, social & entertainment, mobility aids, senior tourism & insurance. Of these, we believe that near-term opportunity areas lie in all of the above except for insurtech.

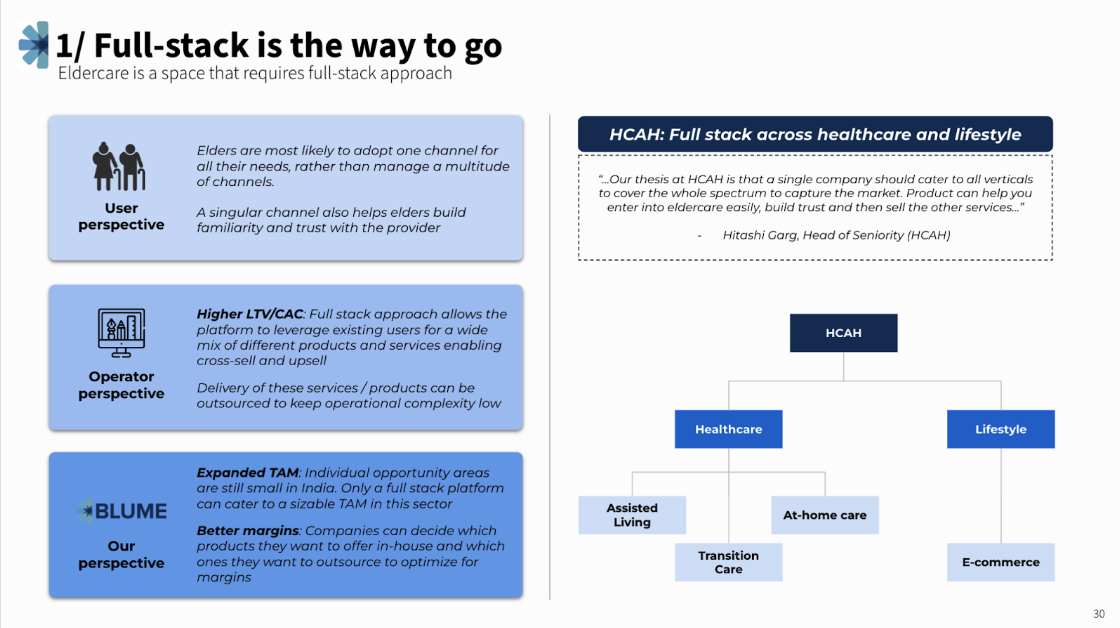

We believe that full stack is the way to go because elders are most likely to adopt one channel for all their needs. A singular channel helps elders build familiarity and trust with the provider.

Community leads to referrals, especially among this demographic. Offline communities like senior citizen clubs, rotary clubs, etc., can be strong channels to drive awareness and engagement. This typically doesn’t work for other demographics.

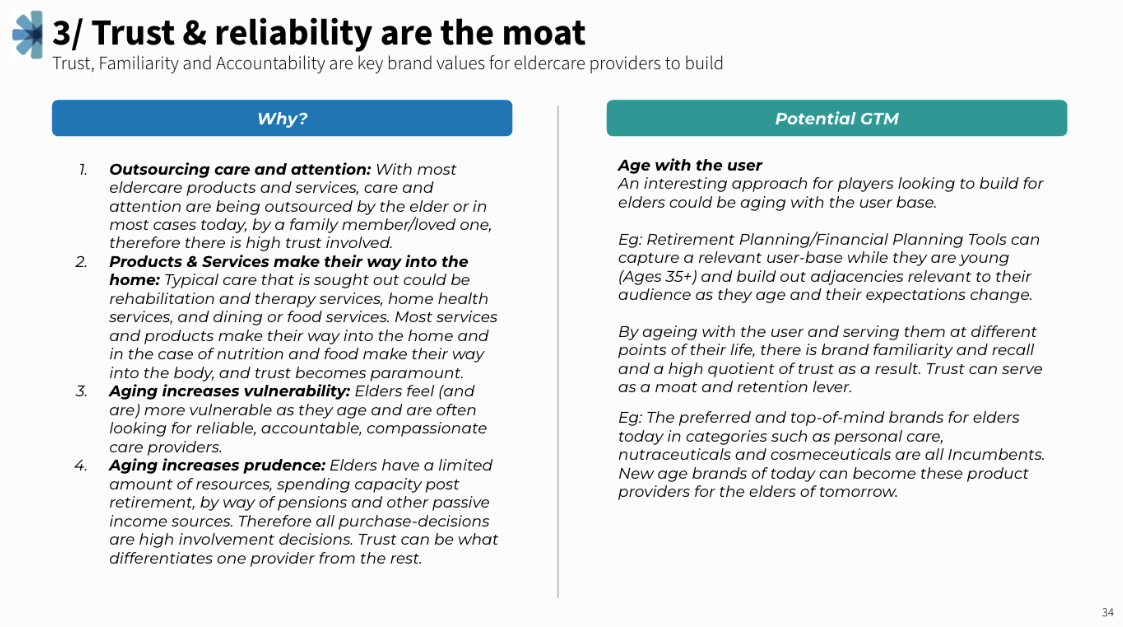

An interesting approach for players looking to build for elders could be aging with the user base. Aging with the user and serving them at different points of their life, results in brand familiarity and higher trust. Trust can serve as a moat and retention lever.

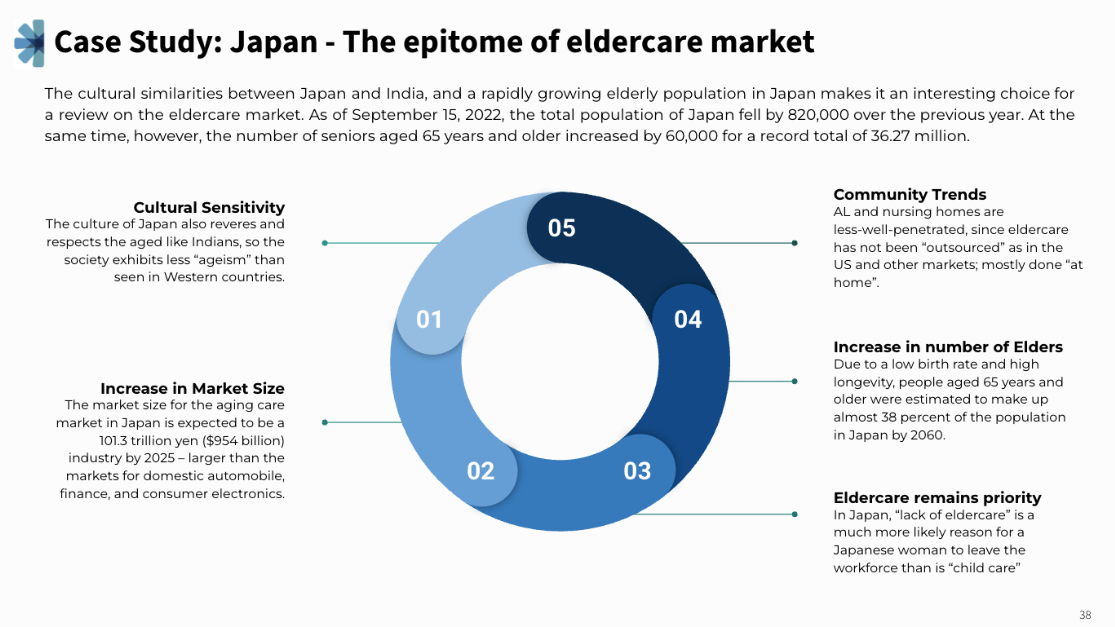

We also review a few case studies from Japan, the epitome of the eldercare market. Japan's cultural similarities with India and rapidly growing elderly population make it an interesting choice for a review of the eldercare market. As of September 15, 2022, Japan's total population fell by 820,000 over the previous year. At the same time, however, the number of seniors aged 65 years and older increased by 60,000 for a record total of 36.27 million.

Authors

Radhika Agarwal

(Former Associate, Investment Team) Radhika covers the consumer sectors within Blume. As part of this, she supports sourcing and running the investment process on all consumer-focussed investments including in the media, e-commerce and…- Current Section

Simran Malik

Simran interned with Blume Ventures. She is a graduate of IIT Delhi with a B.Tech. in chemical engineering and a minor degree in business management. She is pursuing MBA from Kellogg School of Management.- Current Section