EdTech Landscape In India: What Changed In The Post Pandemic Years

- Published

- Reading Time

- 3 minutes

- Contents

We launched our first EdTech report in 2020. Two years later, we take a look at the landscape again and review our findings. In this new report, we share how we envision opportunities to grow in this sector.

Resource

- Blume EdTech Report 2022 Docsend

It was 10th June 2020. Moumita had to figure out a way to teach her students online. Short on resources to purchase a tripod to teach her students, Moumita fashioned a makeshift tripod using a chair, cloth hanger, and cloth pieces. She knew how crucial it was for her students to continue learning and growing during the pandemic that had caught India and the world unprepared.

In August 2020, in the shadows of the early impacts of the pandemic, we published our first EdTech report ‘Summer of Indian Education’. Two years since then, we have seen several ups and downs, through which one thing remains unchanged - education remains the primary pillar on which our society progresses. And so, the sector has grown wider and deeper despite the ups and downs. We went back and tried to make sense of all that transpired in this time, re-looked at our EdTech report in the wake of a new world, deep-dived into what we see as large opportunity areas going ahead, and compiled all our understanding from the last two years in the Blume EdTech Report 2022. Here's what we found.

What has changed in EdTech since 2020?

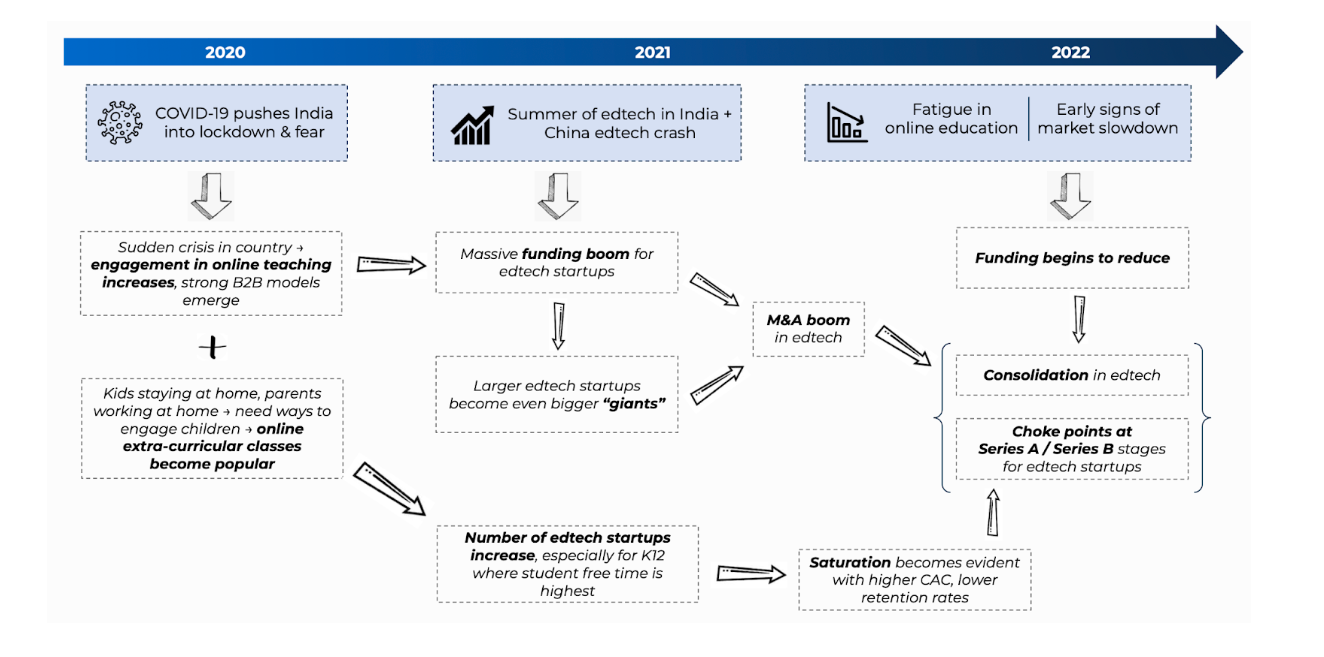

The last 24 months have been the most pivotal for the Indian edtech space since the Jio revolution in 2016 that brought online learning to students’ mobile phones in the most remote corners of the country. Here’s a quick look at what changed and how that impacts students, teachers, schools, edtech businesses, and investors:

1) COVID-19 had a larger impact than expected

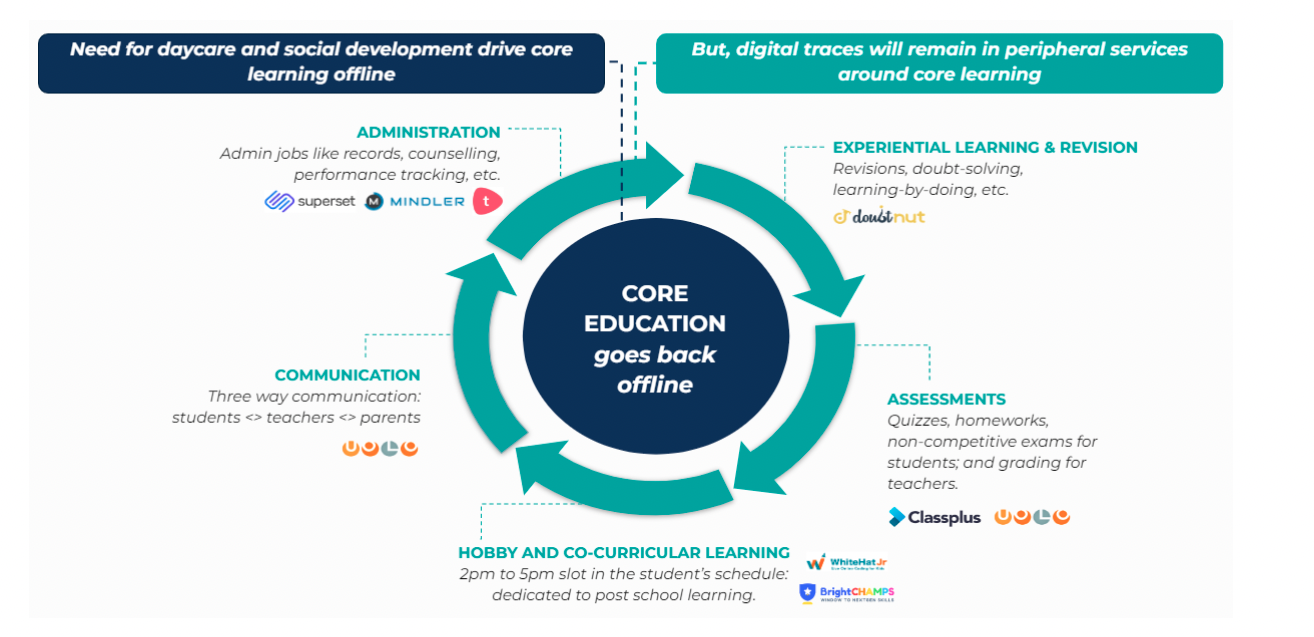

Schools and colleges moved online, after-school tuitions and hobby classes were a hit, and many daycare centers and preschools closed (at least temporarily). All of this opened up a host of opportunities. But, even as we see ‘core education’ going back offline, we believe digital traces will remain in peripheral services around core learning.

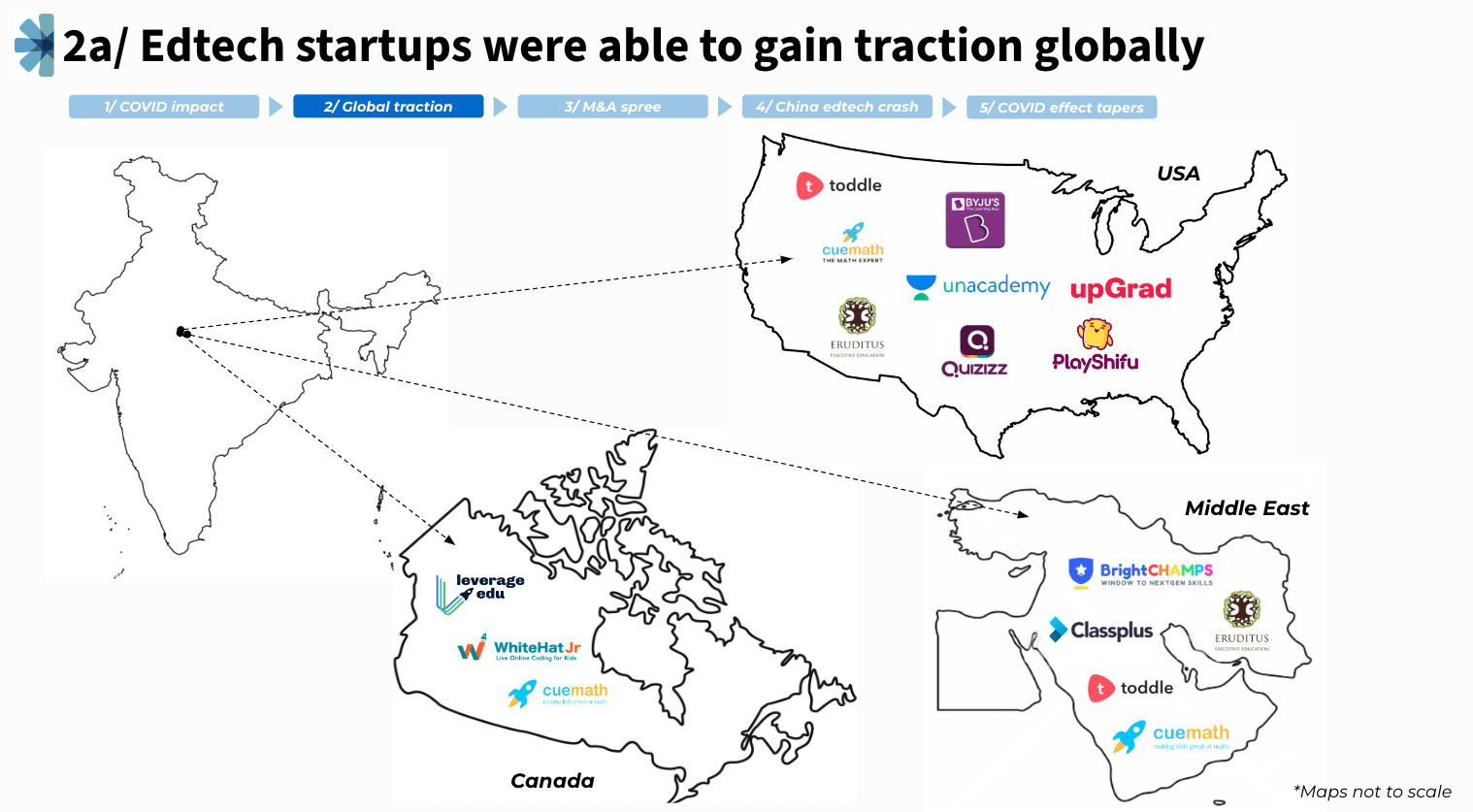

Even in a pre-COVID world, we saw early signs of Indian Edtech being able to sell abroad – with companies like Eruditus, LeverageEdu and more paving the way. But post-COVID, Indian players thrived globally and saw massive traction across both North America and South East Asia. This helped them capture higher ARPUs and provide services that would have had limited demand back home.

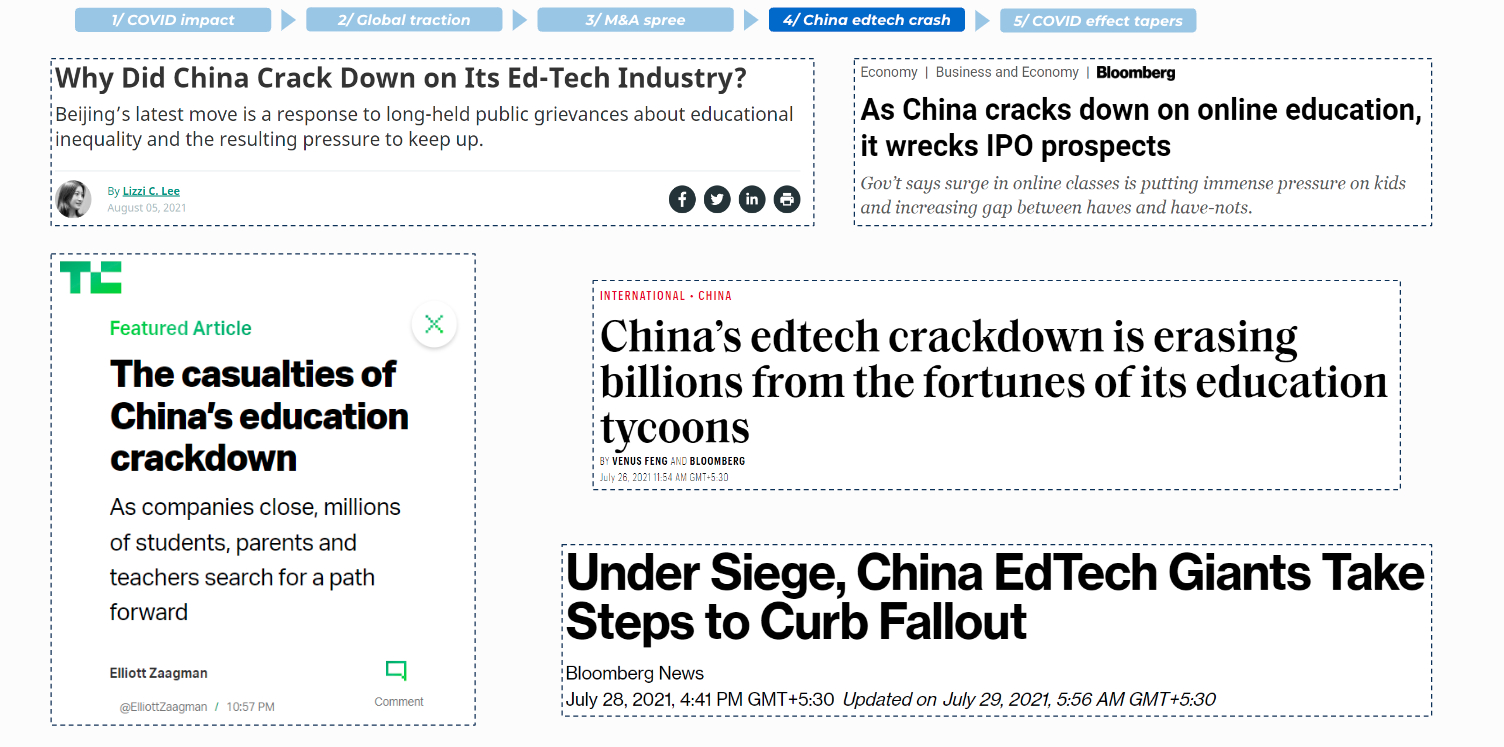

In 2021, China imposed a ban on for-profit tutoring services focused on public school curricula and entrance exams, which turned out to be catastrophic for China EdTech companies. India benefited as an alternate emerging market to invest in for the large sums of global capital that were earlier flowing into Chinese edtech. While funding in China’s EdTech market decreased by ~75% from 2020 to 2021, funding in India’s EdTech market in the same time period increased by ~60%.

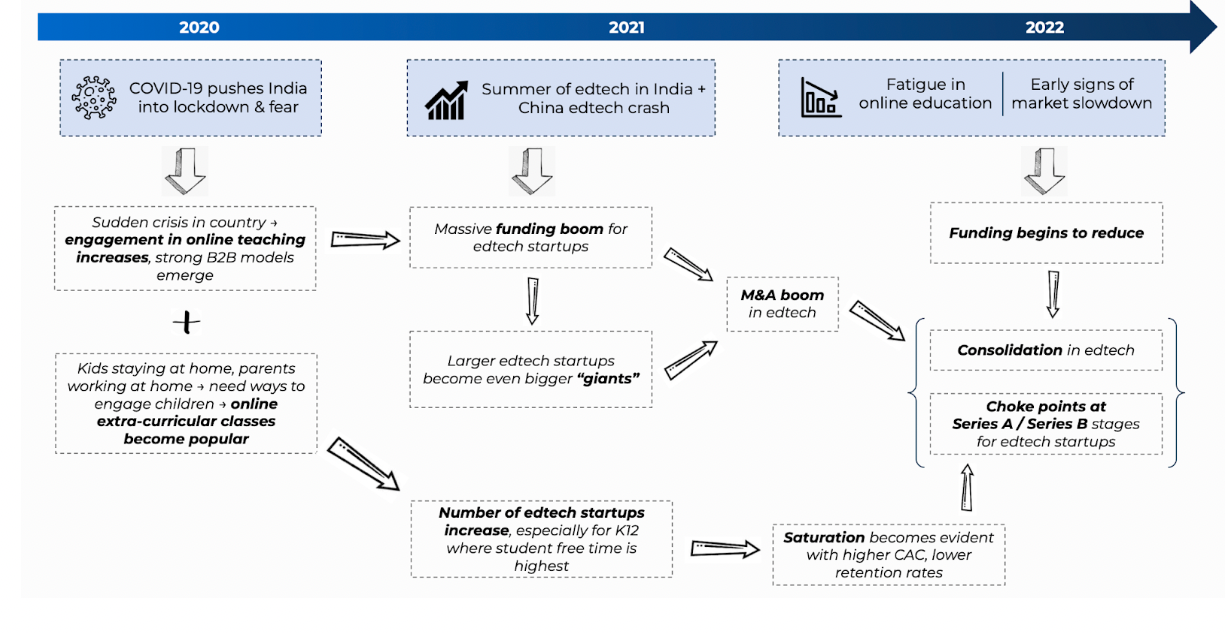

1) Instead of the revenue model (B2B vs B2C), we looked at the core consumer motivation

Is it acing an entrance exam? Is it finding new mentors? Is it something else? This became important because the goal of the consumer determines how much and where they will pay, how they will discover the platform, and how they will behave with the product.

2) Expanded user palette

Most market sizing reports in the past have underestimated TAM for one simple reason - a good product creates its own market. In this report, we covered spaces like 21st century skills, financing, communities, and more.

3) Catalysts of education

Businesses that are not directly engaged in teaching but are servicing the overall education sector, have been seen as catalysts since their distribution, stickiness, and ARPU looks different than that of a learning platform.

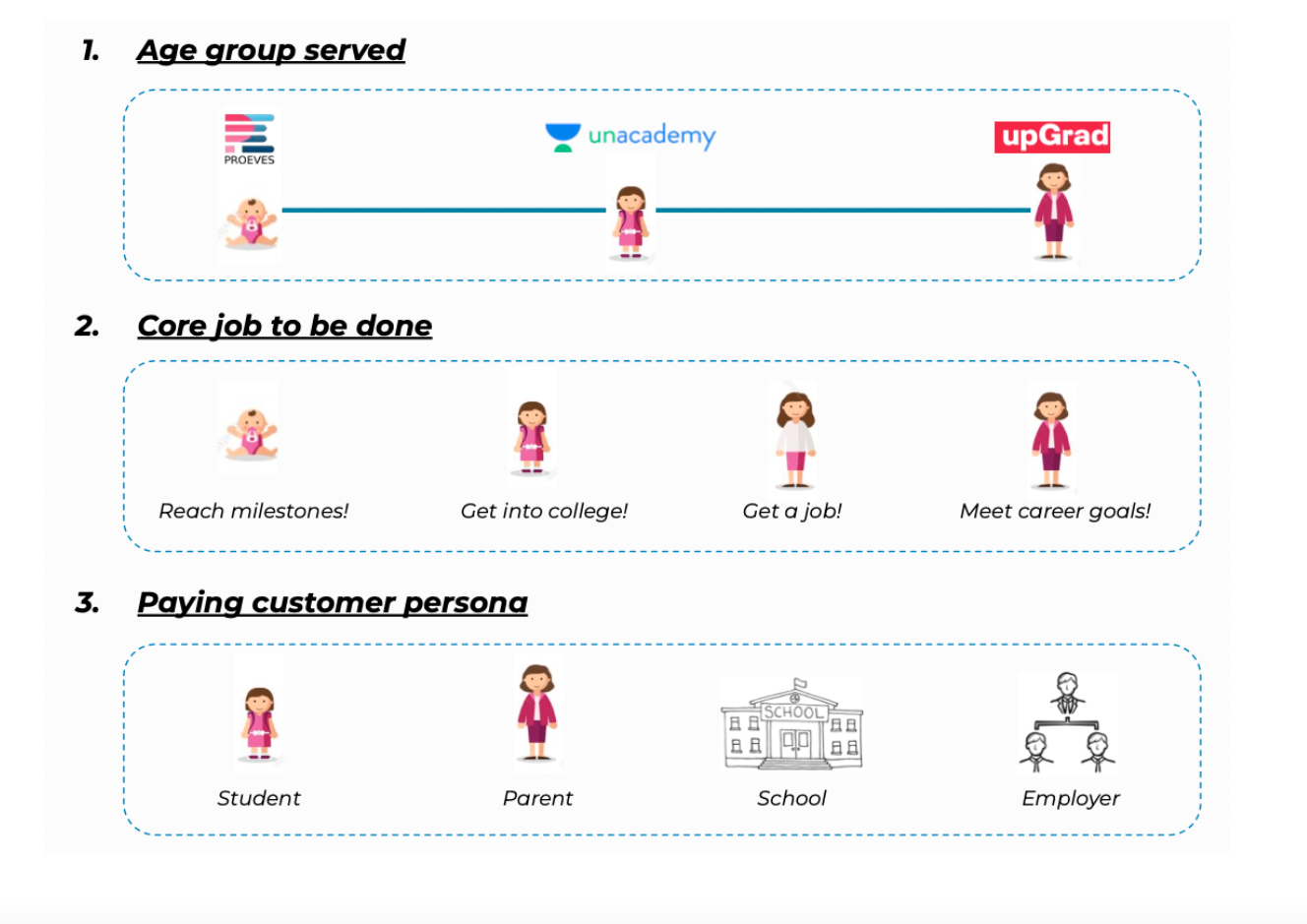

Basis the above envisioning of the axes, we reworked our EdTech landscape

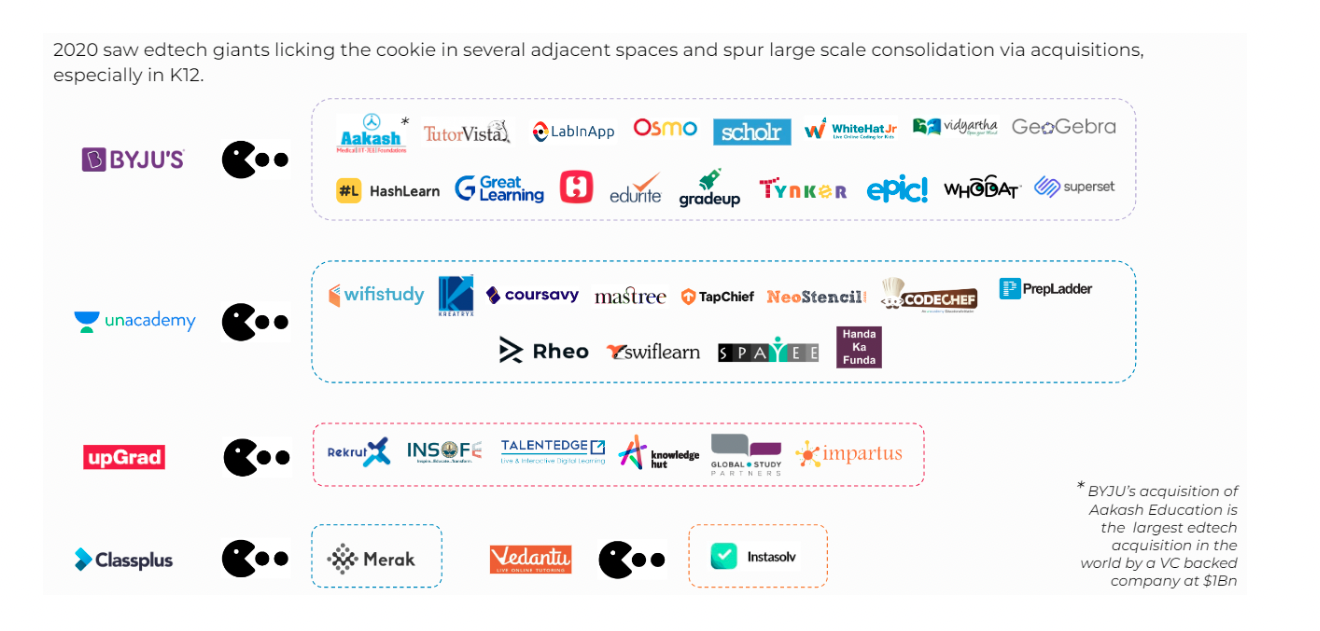

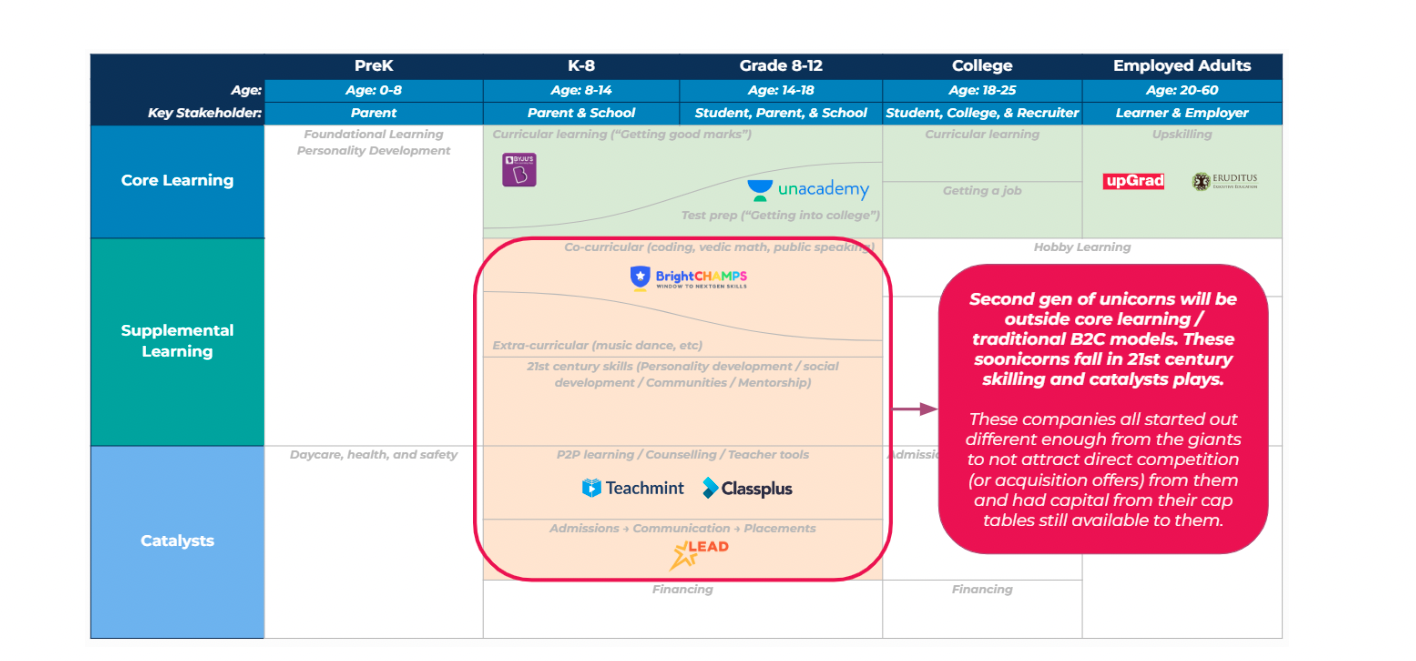

As we went deeper into the matrix, we realized that the first generation of unicorns mostly falls into the core education space - Get good marks → Get into college → Get a job. But, we are also seeing the second-gen of unicorns and soonicorns emerge who are outside the core learning/ traditional B2C models, and instead fall into the supplemental learning space like coding classes, and catalysts (who enable or provide support to education providers).

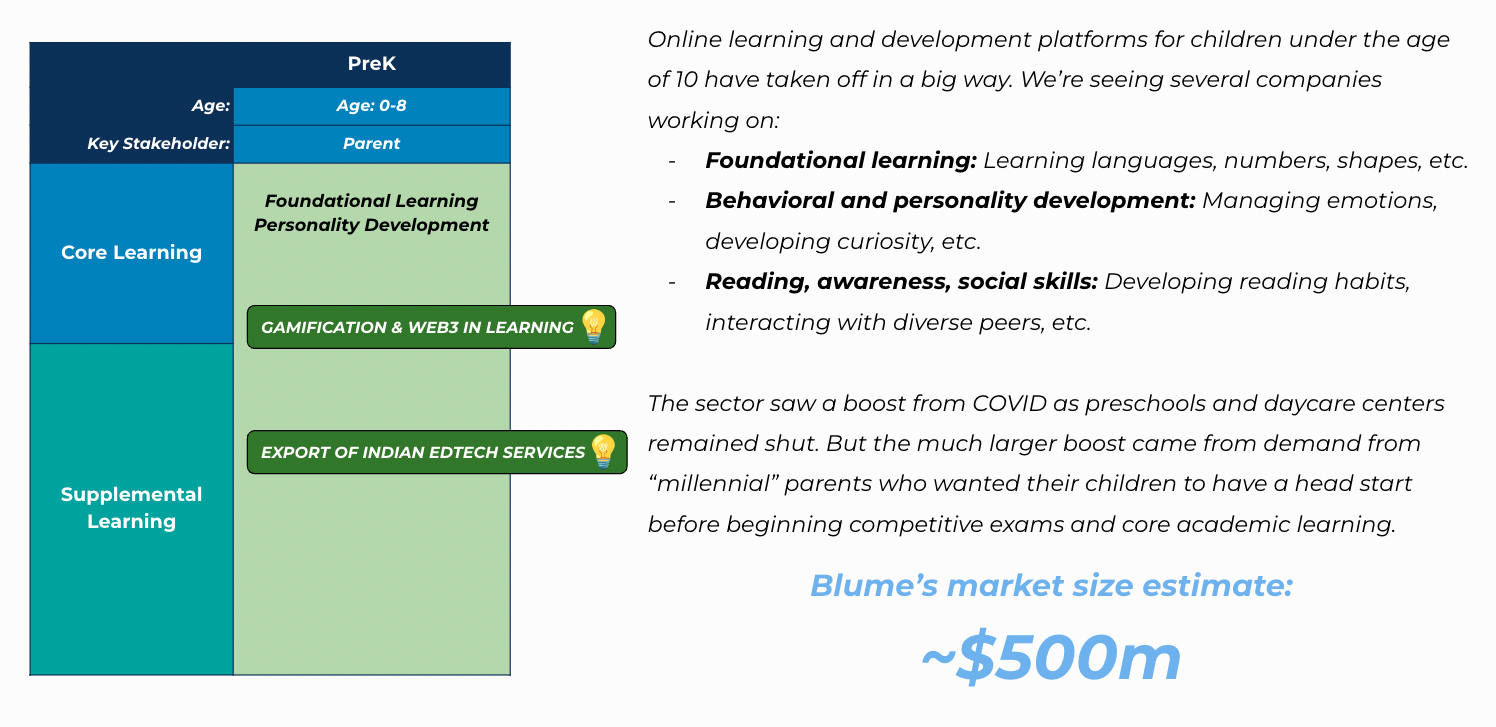

Companies working on foundational learning, behavioral and personal development, and reading/ awareness/ social skills. The sector saw a boost from COVID as preschools and daycare centers remained shut, and ‘millennial’ parents wanted their children to have a head start before beginning competitive exams and core academic learning.

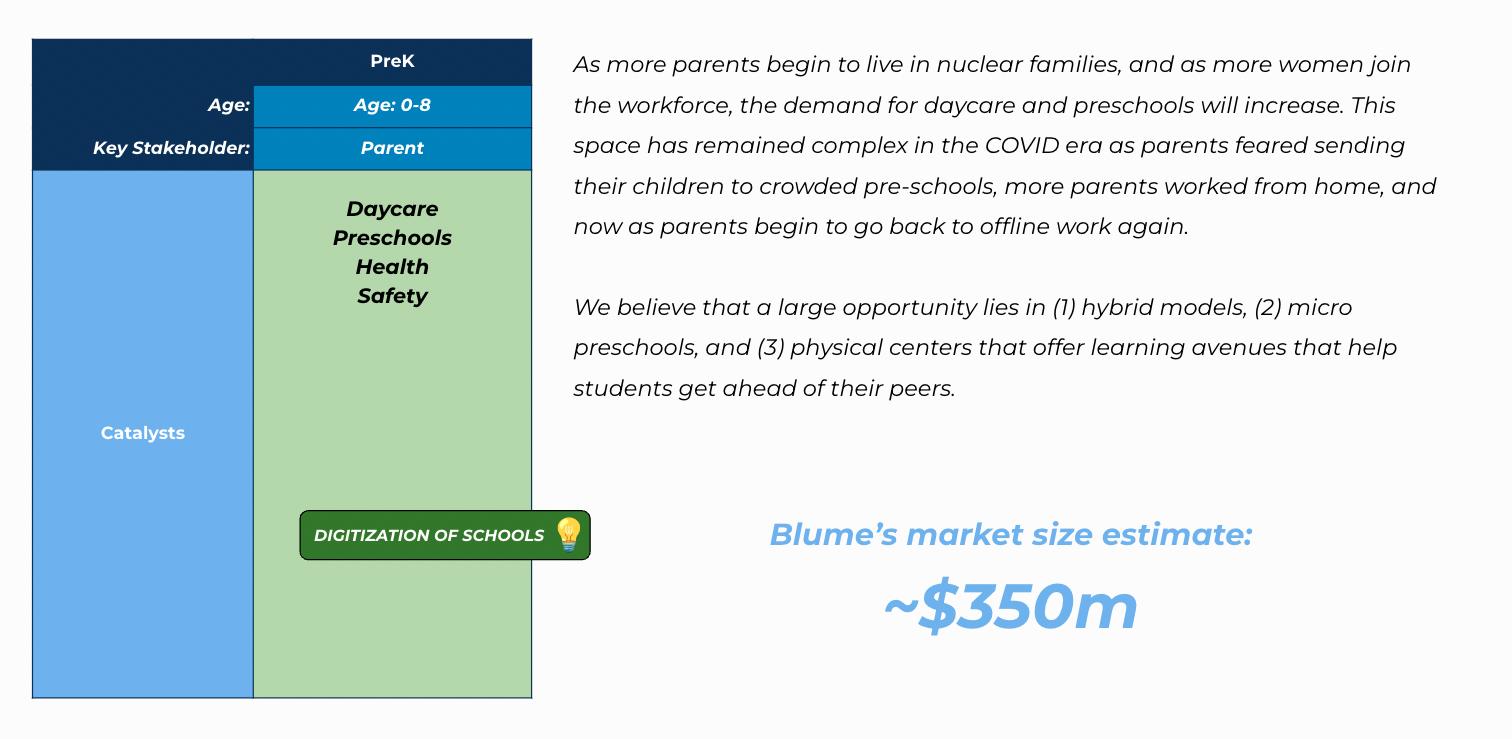

As more parents begin to live in nuclear families, and as more women join the workforce, the demand for daycare and preschools will increase. We believe that a huge opportunity lies in hybrid models, micro preschools, and physical centres that offer learning avenues that help students get ahead of their peers.

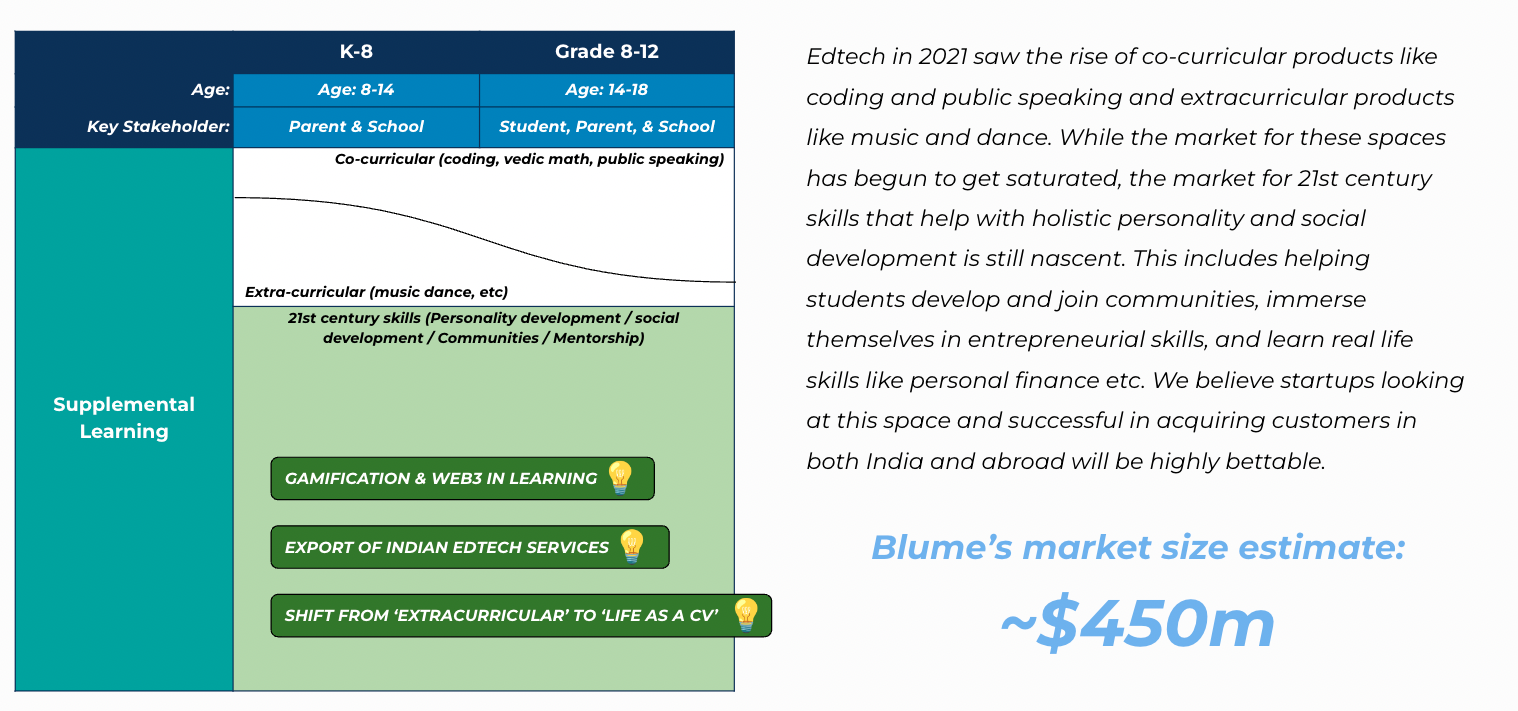

EdTech in 2021 saw the rise of co-curricular products like coding and public speaking and extracurricular products like music and dance. While the market for these spaces is getting saturated, the market for 21st century skills that help with holistic personality and social development is still nascent.

In India, education has traditionally been seen as a puzzle, the solving of which opens doors for economical and social well-being. The rising costs of school and college education have made way for K12 and college education financing players to enable parents to give their children the quality of education “they themselves could not get."

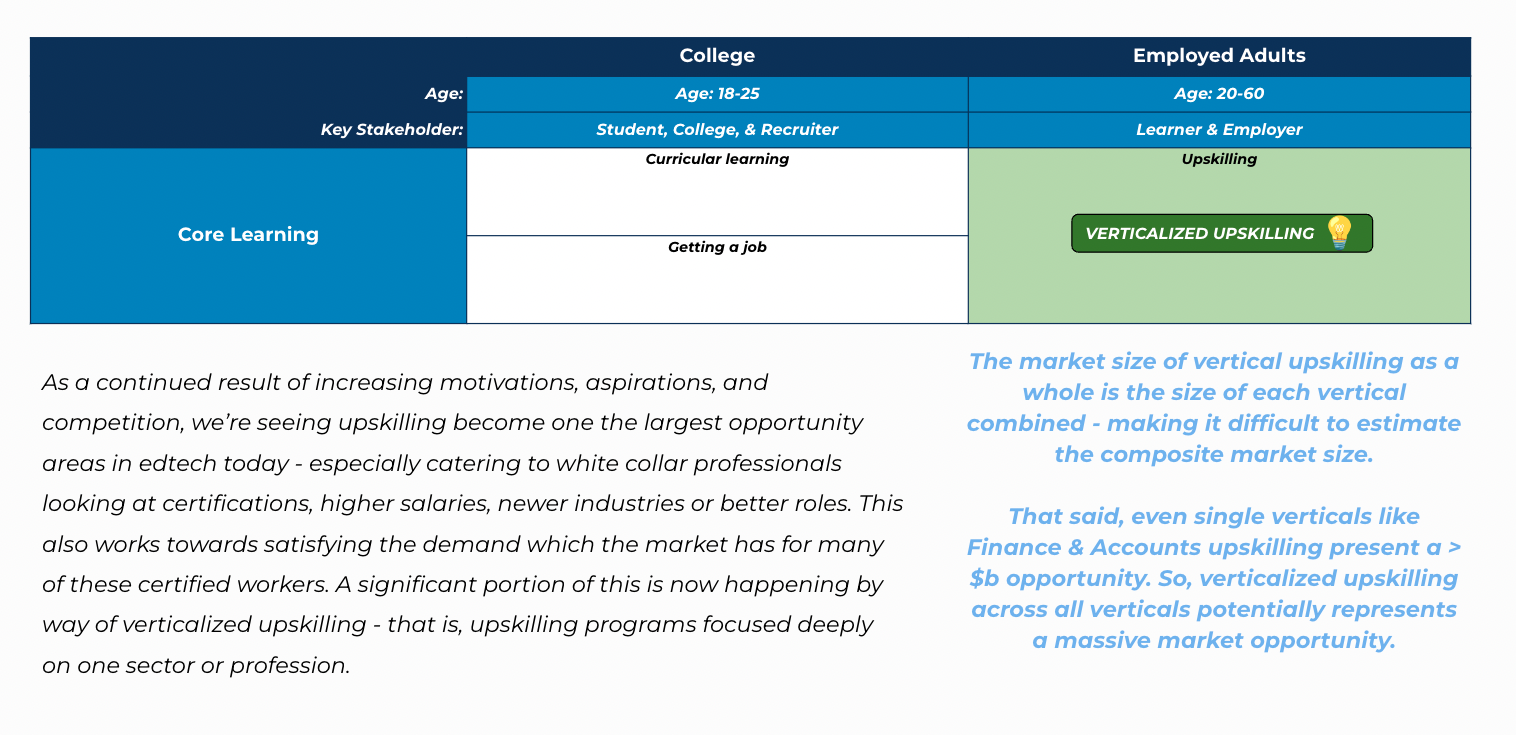

As a result of increasing aspirations, and competition, we’re seeing upskilling become one the largest opportunity areas in EdTech today - especially catering to white-collar professionals looking at certifications, higher salaries, newer industries or better roles. A significant portion of this is now happening by way of verticalized upskilling - that is, upskilling programs focused deeply on one sector or profession.

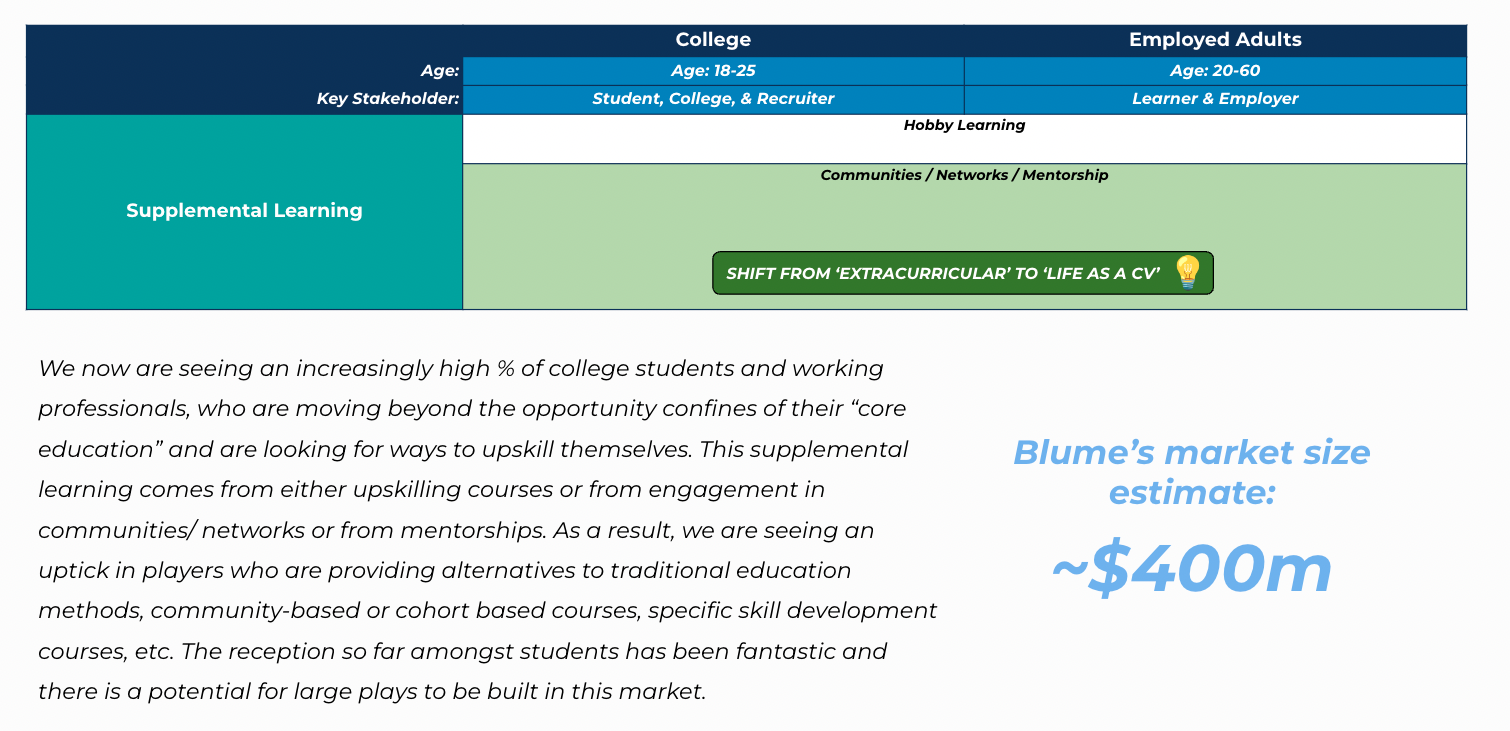

We are now seeing an increasingly high % of college students and working professionals who are moving beyond the confines of their “core education” and are looking for ways to upskill themselves. Often, these are not via traditional upskilling courses, but as a part of communities, learning cohorts, and organized networks.

To read more about our view on how the space has changed over the last 2 years, how new opportunities have evolved, and most importantly, to see our in-depth take on each opportunity area, please read the full report here.

Blume's report in the EdTech space builds on our experience of investing in the sector over the last 12 years, as well as our interest in exploring new sub-sectors within the industry for future investments. While we have deep-dived into a few opportunity areas in this report, in no way do we believe that this is a final and exhaustive view of the entire sector. We are always on the lookout to improve our understanding of the sector and to learn about new developments and themes.

This is a living, breathing, ever-evolving report - please let us know if you have feedback or data that contradicts our view. We look forward to hearing from you :)