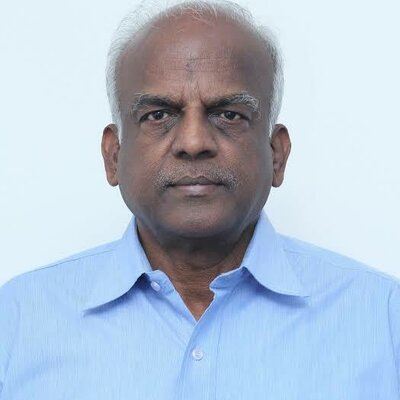

R.G. Chandramogan: From Ice Cream Carts to Dairy Dominance - The Hatsun Agro Journey

- Episode

- S2 E7

- Published

- Reading Time

- 38 minutes

Join us in a captivating conversation with R.G. Chandramogan, the visionary behind Hatsun Agro, as we explore his remarkable journey from selling ice cream on pushcarts in the 1970s to heading India’s largest private sector dairy company. In this insightful episode, we dive into the challenges and triumphs of building a 7,000+ crore revenue company from scratch.

Discover the origins of Hatsun Agro, a company that pioneered a unique model of directly procuring milk from over 4 lakh farmers and selling branded consumer-facing products. Unearth the secrets of Chandramogan’s success, driven by frugality, resilience, and compounding. From his humble beginnings in a village near Sivakasi to the growth of iconic brands like Arun Ice Cream and Ibaco, Chandramogan shares his wisdom and experiences that have shaped his entrepreneurial journey.

Takeaways

Learn how he faced bankruptcy multiple times, the inception of the Hatsun name, and his dedication to building not just one, but four successful brands, each a market leader in its segment. Tune in to hear how Hatsun Agro revolutionized milk procurement and marketing in India, setting new standards and forcing competitors to adapt. This episode is a masterclass in entrepreneurship, resilience, and building a legacy for generations to come. Don't miss it!

Karthik: From selling ice cream on pushcarts in the 1970s to chairing the largest private sector dairy company in India, it's true that R. G. Chandramogan has seen the entire spectrum of running a business over 50 years now. His company, Hatsun Agro, is over a 7 thousand crore plus company - not valuation, mind you, that's revenue - that has pioneered a unique model of directly producing, procuring milk from over 4 lakh farmers and selling branded consumer facing products.

I'm pretty sure you've enjoyed an ice cream or two from any of the Hatsun brands during the sweltering Indian summer. Arun ice creams and Ibaco come to mind, and if you're in the south, you couldn't have missed them. In Hatsun, Mr. Chandramogan and his team have managed to create a business that's built to last, using the first principles of frugality, resilience, and of course, compounding, which is our theme for today.

Interestingly, though, when asked about being a billionaire, he had famously replied, “..all this is national wealth. I don't consider myself to be a billionaire. In fact, the only asset I have is the house” such as the humility of the man himself. It's an honour today, sir, to have you on board for this episode of the Blume podcast.

R.G. Chandramogan: Thank you.

Karthik: Mr. Chandramogan. Thank you for joining us. I think people would love to hear what it was to be an entrepreneur in the seventies. We don't have too many of those born then and thriving today. So your childhood and young adult life… from the book that Mr. Damodaran put out and which I had the opportunity to read earlier this year… So the story has been told for the first time. So not everyone might have read it, but I got a glimpse of it. So I picked up some of those. There's an anecdote where you had to skip your pre-university exams. Your seed capital was all of 13,000 rupees after you sold off a family property. Would love to hear from that point in whatever way you want to characterise it for young entrepreneurs.

What gave you that courage to start Hatsun? Why did it feel like it was going to work? And any specific learnings that you remember which were instrumental in those early years of Hatsun?

R.G. Chandramogan: See, I hail from a village called Thiruthangal, near Sivakasi. All along in my life, in my childhood, I haven't seen a senior executive.

The executive ladder was not known to us. So the only people whom we know were small traders or successful business people or whatever it is. So my exposure was limited to that extent. So I also felt that probably I can be an entrepreneur one day. That's number one. Number two, our village was completely barren land. So two people brought prosperity to those places. They brought matches. Their names were Ayya Nadar and Shanmuga Nadar. They brought prosperity to that land. They were like demigods to those people. Because they gave employment to thousands of people around Sivakasi. So that was a childhood aspiration that one day we can also do it.

Karthik: Lovely, lovely. So it was a motivation to create an impact for the people that you grew up with…

R.G. Chandramogan: That's number one. Number two, actually my father was running a small business here. It was failing. I was a class rank holder. But the circumstances indicated that he won’t continue in business for long. Those days in my village, one would join their father or a business.. cutting the education (dropping out)… that was very common. So I also indicated that I'll join. But he was adamant that I have to go to the U.S. to study there. That was only an ambition, he didn't know where to study in the U.S. And one thing I was so sure of was that he couldn't find money to sponsor my trip to the U.S.

Karthik: The US’s loss was our gain. So it's all good!

R.G. Chandramogan: His ambition was to send me for two years and probably study there and stay there. It didn't work so I lost my interest in education… Deliberately I didn't study that well in PUC. Except for one subject I passed all the subjects. In those days we had to write all exams together. So my father insisted that you have to write the exam again because of his ambition of sending me to the U.S to work. I was so frustrated. Next time around, I didn’t study anything. I went to the exam hall. I was blank. First question paper was Chemistry. Same chemistry paper, I had scored distinction the first time around, but this time the paper looked to me as if the language was Latin, so I had no interest.

At 2:15, I got up and told the examiner, "I'm quitting the hall... I'm totally unprepared." The examiner showed some sympathy and said, "Don't do it, and I'll help you pass this exam. Only when you pass the exam will you get a government job, with a 1500 rupees salary and a secure future."

I replied, "Any day, a government job is not my option. Maybe I don't like the smell of government buildings! I'm not going to be a part of a government. I'm not good. Nevertheless, I was quitting the hall anyway. Even if you're going to help me in this exam, in the next exam, I'm equally unprepared. It's no good." The examiner then reminded me, "Statutory demands that you should be here till 2:30. So you can only leave the hall only after 2:35. Think of your future”

At 2:35, I got up, gave the paper, and walked out. I saw two movies, not that I was enjoying cutting the exam; I was so frustrated. I was in turmoil, knowing that I was probably going against the wishes of my father and family. Just to escape… I went to watch two movies, spent the whole night roaming around, and then returned home. That was the beginning. Now, I wanted to do something on my own, inspired by the early entrepreneurs of Sivakasi.

Karthik: They were your role models then…

R.G Chandramogan: That was my aspiration then. After a year of cutting the exam, I was sent to a timber shop for training in Budapuram. I worked there for a year, and I was probably an outstanding salesman. Then some policy issues arose, creating a conflict of interest with my boss, so I quit the job. My family felt that they had a useless fellow.

He goes to the exam, he cuts the exam. When one lakh guys are writing the exam, this guy is the only one going out of the exam, and when he gets a job, he resigns from the job without communicating with us and comes back. So there was friction. Then finally, I was given 13,000 rupees by selling an ancestral property.

Then I started the ice cream company. That budget was all I could afford. Beggars can't be choosers. I didn't have money, and there were no venture capitalists in those days. Nor did I have any great ideas on how to raise the money, and the banks used to be very sceptical about funding an initial stages venture. So this is how it started.

Karthik: No, amazing. Congratulations again on a well-deserved biography that Mr. Damodaran has penned and recently won the Gaja Capital Award as well. The citation says it's an inspiration for every entrepreneur to see how you've constantly tried, failed, learned, pivoted, then scaled.

And that's the biggest fear entrepreneurs have, right? What if it doesn't work? It turns out that more people get defeated by the circumstances. They might have either taken venture capital, they can't get more capital, they haven't figured out how to turn profitable. How has that shaped you as a person? How does it make you get better? Any near misses there? Could this company have been dead a few times in that journey?

R.G. Chandramogan: If you ask me, I didn't have alternative options. I didn't have the education, or I didn't have the option to even think that I can juggle from here to there.

Karthik: So, no plan B.

R.G. Chandramogan: No plan B. So I have to stick with whatever irony I am fitted with. So I'm back to the wall. There was no way that I could just look at alternatives, which arose for one. During the journey almost… I was bankrupt four to five times. The first bankruptcy, or rather close to bankruptcy, was scary. Scary. But once you got through that, the second one, the third one was not scary. The fourth one was not even alarming. So you get used to it, and you only look at how to rectify things and go ahead. Initially fear was high. So the option was if I would have failed, I would have gone for some employment. So that was the only option. See, if you are taking a bath in cold water, the first dip is the one that gives you the cold shivers. The second and third don't give much. So the first jerk gives nerves. But the second and third didn't bother us much.

Karthik: You overcome them. Great anecdotes and great lessons. So there are two personality driven things, and a lot has been said about you in that book, but I've heard of this even before, being a Chennai boy - How come you didn't choose to give the company a name that attached the family name or your personal name? I think it runs deep. But how did you have that vision? And why did you choose to call it Hatsun? Where did the name come from?

R.G. Chandramogan: No, Hatsun came much later. It's not the day one name. Day one, the name of the company was Chandramogan Company. It was in my name. In 1986 only we coined the name Hatsun.

Karthik: And any motivation to do that? Partly because you wanted the brand to stay.

R.G. Chandramogan: Probably we were only into the ice cream business at that time. 1993-94…

Karthik: Yeah, until Arun Ice Cream was around…

R.G. Chandramogan: Actually, we were trying to coin a name suitable for an ice cream brand. We were trying to say that… probably this can be a protection against the sun. Hat-sun was the real name we looked at. Hat-sun probably looked a little different, then we made it as Hatsun.

Karthik: Got it. Got it. And you've also said… our researchers dug up an interview way back in 2007 where you said, you don't do too many interviews because the brand and the product should speak about the company, not the personalities behind it. Do you think it still holds true? And would you have done things differently in becoming the brand persona for the values that you have and for the products that you sell?

R.G. Chandramogan: Actually, my feeling is, if you promote yourself along with the brands, you are promoting a dual brand. The risk of the dual brand is …once when the demise happens to the founder, he's going to put a lot of pressure on the successor .. People may believe that he is the only guy who can just make it happen. The organisation should run on an autopilot system. With proper systems and proper management. Getting glorified as… founder recognition is okay, but still always in the limelight, trying to get things.. means you are actually putting the company at a risk… for the successor to do things in a proper manner. So we don't want to have that type of pressure.

Karthik: Though I would say that this is a mindset of someone who already knows you're going to build a generational company, which will actually move a few generations and get professionally managed. Which is what I think the startup ecosystem is struggling to build towards. Like, how do I build a two generation or a two decade or a three decade company? Would you say that's true?

R.G. Chandramogan: See, everybody says there is a goal and I want to reach the goal. After reaching the goal, the complacency sets in.So I don't have a goal. My journey is infinite. Why should I bother about that goal in the next one year, two years and then? After the goal, probably I want to relax and I want to enjoy my life. See, I enjoy doing my job. And for me, the journey is important, not the destination. So that is the way we take it. Again, if you look at companies, we have built four successful brands. Arun Ice Cream is today one of the top two - three brands in the country. Arokya Milk is supposed to be the largest private corporate milk brand. Hatsun Curd is one of the top two brands in the country. Ibaco is one among the two top premium brands of Ice Cream.

Normally people build one brand or even three, four generations, the same brand continues. The second or third brand doesn't emerge. The creativity is struck at that one brand and they try to duplicate what they have done from the first brand to the second brand. If you're going from first brand to second brand, you have to do a lot of unlearning to build a second brand.

For example.. Arun Ice Cream.. the sales start by 11 o'clock in the morning, but the peak sales are between 7 to 10 in the night. Whether it is summer or not… 7 to 10 is the time of consumption. The milk sales start by four to five in the morning and over by 630.

Karthik: That's correct. Collections are done.

R.G. Chandramogan: So if I apply the same formula for Arun Ice Cream to Arokya milk, I'm not doing it. So I have to do unlearning. So comparatively we have built four brands. All the very different businesses and all the brands are market leaders in its own segment.

Karthik: Fantastic. It's explained in that large 7, 000 crore plus revenue. So none of us are doubting that. So I'm going to take you a little through the Hatsun journey itself. Maybe again, a lot of literature covers the success of when Hatsun moved out of ice creams into… not moved out rather started the milk business as well. But then I think there were three, four challenges and maybe you can break your answer up… one is, it was not the country that we had today. So you need a cold chain infrastructure to put together. Milk collection. Of course, there was an Amul, which had started enabling this, but no private players had the courage to go and maybe replicate this at scale. And three, there was an incumbent in Tamil Nadu, like most co-ops, which was Aavin, right? So suddenly in the early nineties, what prompted you other than backward integration from your ice cream business? To say that I'm ready to take on all of these folks and win all these challenges and win

R.G. Chandramogan: Ice cream business…we were having a factory in Chennai. And we wanted to expand the factory. The next season was applying pressure because the sales were growing. Literally, if you look at it, we built our Arun ice cream market from the potential market… And we never worked on getting market share from the existing market. Existing market was available only in Chennai. Chennai was having Das Prakash as the state's number one brand.

Qwality was India's number one brand. Joy was India's number two brand. All the people were prominently available. And we were relatively unknown. No brand. And we didn't have the muscles to give freezers. So we didn't have money. So literally what we have done is we tried to go around and build a market in outstations.

We are the pioneers in going to the outstation market for ice cream. We built a market and on those days we were giving parlors and the ice cream distribution is a very tough challenge on those days because there were no cold storage. That's correct. So what we used to do is we used to pack our ice cream with rice and put it on trains, regular trains.

R.G. Chandramogan: And the people who is the agent at their town, will take delivery and take it to his outlet. So this way.. we were doing it for years. And we started our journey in ‘81-82 and before ‘86, when we came back to Chennai, we were market leaders of Tamil Nadu without the three players knowing that we had already overtaken.

So we created a market that was only a potential market, which was non-existent. Coming back to outstation is a major chunk of business outstation business also apart from parlours. We have later diverted to points and other things. And today we have a heavy network. Now, the idea in 1991 was to start an ice cream factory, which will have a lesser logistical distance. So we chose Salem. Logically Salem by itself is a major town of Tamil Nadu. Coimbatore, Tirupur, Trichy, Madurai, all the places are within three, four hours. That's right. Very central. Then we started going through van delivery from the nearby point. So reducing logistics. Milk prices were low because it is supported by villages and our land prices are low.

Our wages are comparatively less than Tamil Nadu. So we had a lot of advantages to produce ice cream at Salem. Then we started. After starting ice cream, liberalisation was introduced for milk. Earlier it was reserved for co-ops. And once when it was served, we never started milk. We started a milkshake powder.

We wanted to market the consumer product. The milkshake powder didn't click. It was a failure. See, the market, you go with the perception. You have to take a shot. The consumer has a different perception.Not that you study the consumer 100% of the times and probably you are successful.

It doesn't work. Make a mistake, you correct it and probably go with a different version or whatever it is. So in this case, what happened? Our product was well accepted. Everybody liked it. The biggest problem was we were telling the milkshake powder, you put some milkshake powder, put some ice water, put some ice cubes, churn it in the mixie, you will get a fresh milkshake and you can drink. Now, housewife was concerned about putting ice in the mixie. She felt it would get damaged. See, this is something that we didn't anticipate. So it boomerang.. it didn't work. We were stuck with the product. We were making heavy losses. That was the first limited company with some of my friends' investment that I started, though, we invested about 60%, the rest of the 20-40% came from my friends. It was losing. This was also at Salem at a different location, within three, four kilometres. Then, the second thing was, this particular milkshake powder was doing better in the summer times and winter times the sales fell. The milk arrival in the winter is higher, milk arrival in the summer is low. So we have to dispose of the excess milk. We had some problems... Then we decided - we met some people, friends and other people, then we got into milk. We were forced because probably the failed venture, we have to come out of it means the milk was the only option. 95, July 10th, we introduced…

Karthik: The reason I brought up Avin is, a farmer, a milk farmer, is set in his or her ways, right? And how do you convince someone like that to work with someone? How do we execute that? And how were those, how were those conversations?

R.G. Chandramogan: Governments have got their own attractions. People are blind to go with the governments. This is one set of people. The other set of people also are there.. who want a better reaction. At that time when we launched Aavin was almost delaying the payment for farmers by about three months, but still there were loyal farmers who felt that they are the only alternative. Some guy may come today, he may buy milk. He may not pay for 15 days, he'll run away. With the government, the money is always going to come someday. Then we got in.. we then came into milk procurement. And we had tough times in milk procurement and we gave a stability of making payment every 10th day. We have been doing it from the year 1995, till this day.. 28 years. And we have given that type of stability which improved our competitors also to pay in time.

Karthik: You may brought a change in the industry in some sense, because you forced everyone

R.G. Chandramogan: .. that they were forced second thing on marketing on those days. If somebody wants 100 litres of milk, he requires the minister's recommendation or something to get that supply of 100 litres for a marriage party.So that was the situation in Chennai and it was a monopoly, though the industry was said to be liberalised. It was not liberalised. They had an order called MMP order. The peculiar thing was daily, Animal Husbandry will forward a letter on our application to the local state saying, so and so has applied for so much milk. And do you have a surplus? Will you please give us NOC? Giving a license.. our friends will say that there is no milk availability, surplus is not there, so it has to be rejected.. it will be rejected. Then we have to make an appeal to the joint secretary. Joint secretary will ask for a hearing. Present IAS will go there. They will be batch mates. They will just talk over a cup of coffee and then say that this is not worth giving and you will also say… somehow the secretary was convinced. That it is time to liberalise and probably he gave the permission.

Karthik: fantastic. No, it always takes one, one or two minds to push that development.

R.G. Chandramogan: Finally, probably we got through and then we started. Once when we came into the market, two things happened. Everybody who was licensed on those days. The local cooperative was marketing toned milk.. that is 3% fat and 8.5%(undeciphered). They were all trying to duplicate. The problem of this particular duplication was, they themselves were not making money. When there is a loss making company as a monopoly, you go with a similar product.

Karthik: They pick the wrong role models. That was a benchmark.

R.G. Chandramogan: And once when we started milk, people were saying that we should also make toned milk. Yeah. But we should price it 50 paise less than the local cooperative. If we price it 50 paise less than the cooperative and give them toned milk, that is the fastest way to go to bankruptcy. I said this is not the business model we can look at. Otherwise, we can close the milkshake factory and write off. It is not worth doing eight annas less and getting a market share. They are not going to revise the prices, whatever the losses they are making. Forget it.

We will go for standardised milk, which is 4.5% and 8.5%... You market it as a USP and the premium product and the premium product and charge two rupees more. They were charging seven rupees. I was asking them to charge nine rupees.

Karthik: That's a lot in those days.

R.G. Chandramogan: All the production guys, we used to have good meetings on those days. Production guy, marketing guy, procurement guy, all the people. My next deputy was my classmate Mr. Dhanrajan. All the people were of the uniform opinion… This will not work. They were saying that you are asking for the moon.

This is not going to be done. And this nine rupees will not work out. And we have to market it at 50 paisa less. We said, no, at least we will market it at the same price. No asking for an extra price. So the discussion went on for about three hours. I used to go to Salem once a week for two days. I was supposed to return back. The discussion started by 6:30PM , and went on till 9:30PM. I had a train to catch by 10. 25PM. Then I said, by 9. 30pm, I've heard you enough. I'm vetoing it. So we are going to go with standardised milk, four and a half. And as you people are scared, you market four and a half percent at seven rupees for three months. Then you will take it to eight, three months later. After three months, you will take it to nine. Though higher inputs, more losses is something I'm willing to take for three months and we will give a better product and get into the market, impress the people, and gradually increase the price.

Karthik: Risky bet…

R.G. Chandramogan: But we have anyway failed in milkshakes. So this is the way we came away from the run of the mill competition. Then the run of the mill competition started copying us as market leaders later. We are also like Arokya, but the initial break we gave, our people were not confident. The marketing guys and other people felt that I was pushing them. It may not work. But they were going and working, but the heart was not in it, heart and soul was not there. That was my feeling. So I wanted to give them a little better confidence. I sent a letter to Mr. Al Ries, who wrote the book, Marketing Warfare. So I wrote to him saying that I probably want a consultancy from you. For a bloody losing company, I wanted a consultancy from him. I said will you be in a position to come to India and offer consultancy? I didn't get any reply. Second mail I sent. Again he didn't reply. The third one, anyway I was going to the US for some work. The third Arun ice cream was doing well. Arun ice cream has already crossed the break even and it was paying. Then I sent an mail saying that I am planning to be in the US. His place was Atlanta. I prefer to meet you in Atlanta. In case you find some time. Then within three hours I got a reply. I sent that mail in the late evening and the guy replied in the morning. First time he replied.

He said you're most welcome and probably I can book the room here. And you from the airport, you can come to this room and I will come and pick you up and all that. Then we met. Then he said Chandramogan, I saw both of your mails, and I felt an Indian entrepreneur may not be willing to pay my fee. So hence I was reluctant to reply . He thought it was a junk mail. Then I asked him, what is that you demand as a cost for the consultancy, he said 30,000 USD per day. 30,000 USD per day!

And for him and his daughter, Lara, to come all the way here. Lara has also written a forward in our book. Lara and himself, to come here in business class and also stay here in the home. I also tied up with two of my friends here. One is Reynalds at that time and the Shriram Chits. Both are good friends. I negotiated with him saying you want to charge 30,000. You want to travel one day to India and one day back. And one day you are going to be there, I'll give you a three day assignment, three different companies, 60k!

Karthik: 60,000 USD

R.G. Chandramogan: ..for three days, stay is given, room is given, everything we will provide. So we shared the expenses as one third each. At 20,000 USD plus the hotel and other things.

One day he took the session for our sales people, marketing people, our senior people and all that. He was convinced. Don't get into it… the toned milk competition… the stand, what you have taken is the right one. So it required an American to come and endorse me.

At that time, the 20,000 US dollars, the exchange rate was not 81. So we spent about 13.5 lakhs on those days, including the flight ticket, one third of our share and all that. He took a one day session. Our people put all the apprehension away. And finally, he said, Don't try to say you are giving standardized milk versus toned people who don't understand what toned is. First of all, it's technical jargon. You are playing. The mind has got a little space. You should simplify it. What is that standardised milk you are trying to sell? He said four and a half percent fat. That is three percent fat. That's more than enough. He said four and a half. He put it on the board, made a round circle

R.G. Chandramogan: He said, market it as four and a half percent. That's it.

Karthik: That's all that he had to do. So that's sometimes the genius of marketing, don't you think so?

R.G. Chandramogan: This simply gets registered. See, he said, the mind is a crowded place. There are too many communications happening at once. Too many brands they have to remember. Unless you give some specifics, they will not remember.

So don't say standardised milk. Don't say toned milk. You say it's 4.5% milk. He went for four and a half percent milk. We put a teaser, we supported it with advertisements and all that. Finally, it worked well. My JMD was just very apprehensive on the day of the meeting. He said, You brought this man all the way from the U.S. Yeah. Paying 13.5 lakhs. Yeah. He has put 4 and a half and put a round. I could have done it myself. I said, you should have done it much before him. And also you should have a logic to convince our people. You didn't have a logic. You are arguing against me. Now you are saying that this man is charging. This conviction came because a rank outsider is evaluating it. Yeah, and he's a management guru and he's also from U. S. .. which gives credibility!

Karthik: It's a great lesson in organisation building. Sometimes you need that external validation. We've seen this now as we completed a decade a few years ago. We also struggled to get everybody to understand what we were saying to each other because we said if you're building for the next few decades, It needs a lot of structure in the way we push ahead. And finally, we had to bring an equivalent of an organisational coach, then put in leadership coaches. But as you rightly said, it is to validate these fears and concerns and prepare everybody on a sort of common mission. And as much as a founder you feel like … I think founders do get taken a little for granted, don't you think so?

R.G. Chandramogan: I know they're accepting to do the job, what I'm saying, but I was not convinced whether they were fully convinced to do the job. Once they don't have a conviction, the delivery is going to be not to the optimum levels. So now they were fully bought out.

Karthik: I'm going to weave in a small personal anecdote and ask, have you asked a couple of questions on Arun Ice Cream? And I know I've mentioned this to you before the podcast started, but the love relationship with Arun Ice Cream goes into the 80s. We grew up in Chennai.. And my brother and I actually used to run into your son, the current CEO, cycling down the road where we both stayed. So I think our paths overlapped. Of course, I did not know you at that point. And we were huge fans. And you talked about how you used a very unique strategy to go and win markets that your competition didn't know existed. And then you came to Chennai. And all I can remember is downing hundreds of choco bars and casatas, which were my favourite when I grew up. Also a very unique marketing places. The one I remember distinctly, just as I saw it in the book, almost rewind it to that day. When I went to that Egmore place and ate all you can eat ice cream.

R.G. Chandramogan: Guildhouse service in 1987.

Karthik: I can't imagine how much I ate, but it was like all you can eat for what, 30 rupees or something like that?

R.G. Chandramogan: 8 rupees

Karthik: 8 rupees, sorry, even worse, yeah. 30 I'm calibrating to current prices. And, it did these unique things. Two things actually.. . One, how did you win Chennai? Is it simply quality, price, this marketing genius? And two.. dozens of brands have come after that. So why do people go back to Arun? I know Ibaco started to cater to the premium segment.

Just maybe some gems from your flagship. Arun is the heart of the company, I feel sometimes, at least as I know it.

R.G. Chandramogan: See Arun Ice Cream, once when you were trying to build up in the city, after winning the outstation… more than the advertisements, the ice cream mela, what we have conducted was unique. It was covered by all newspapers and magazines. So it gives a wide publicity and word of mouth. Both are free compared to advertisement and we built a brand over it.

Karthik: Basically, that works for one year at a time, right? Do you think you've always won by marketing or product and what has happened to other brands?

R.G. Chandramogan: This is almost like breaking the ice in the initial stage and making the brand known. And then probably you support it with advertisements and other things and you start going with the market.

Karthik: In this 50 year journey now.. Is it the 50th year or..?

R.G. Chandramogan: 53rd year.

Karthik: 53rd. You've worked in building multiple businesses. And did you see that as the… and I'm moving now gently into the compounding journey, right? We went from the story of how ice creams moved milk. It was a ‘necessity play’ at that juncture. And I know you know these numbers, I think the one time we met, and somebody introduced us, it was a 10 minute conversation, but you spoke about this 1 crore, 10 crore, 100 crore, 1000 crore sales of the company.

I would love for you to recount that for the audiences. So how long did it take to get to 1, 10… the logarithmic expansion? And that, in some sense, defines the power of compounding, right? If you can replay that for the audiences, that would be great, sir.

R.G. Chandramogan: See, we started in 1970. First 8-10 years were a struggling period. We didn't move anywhere. In Our first year, we made a turnover of 1,15,000 for the whole year, and maybe we did 4.25 lakhs, ten years later in 1980-81.

Karthik: It just grew four times in 10 years.

R.G. Chandramogan: but it is mostly due to inflation. So this has not helped us much. Today, that first 10 years since we can do it in under 30 minutes, the first 20 years, we can do it in under one day. 30 years, we can do it within a month, 40 years, we can do it under a year. It has been a gradual pace. So it's a journey of endurance and patience, nothing else, but probably over a period gradually things started.

Karthik: No. Fantastic. Fantastic numbers. So the one question in that context I had was, do you see natural market saturations or geographic saturations? So compounding is, almost in India, given how tight a market it is. Customers look for every rupee of value that they can get. You can't.. bloat up employee salaries overnight. So when you look at the constraints that India throws at you. There is a natural market saturation that tends to happen. And does that prompt you to then say, I need other business models to come and help me on the compounding, other products to help me on the compounding. So did that force the creation of four great brands? Or, did that just happen as a natural evolution? And you're very happy with that journey, as you said, where you didn't set a goal for yourself as much as, I'll go where the journey takes me.

R.G. Chandramogan: See we are one people. We started as a tiny industry, gradually we went to small, from small to medium, to big, to large. So these five different transitions, where the time I'm saying that probably I was close to getting broke. Each transition was a different lesson course. What we did at one stage, we had to do completely the reverse on the other stage.

When we were tiny, I was doing everything myself. When it came to small, we had a very small team, which was.. under instruction they were doing the job. We didn't have a thinking staff. So once when you start going to medium, you require subordinates to do the job. It requires colleagues to do the job. They have to think for themselves. So at every stage, my thinking process has to change. When it comes to a large sized company, mostly I'm not doing any work. I'm only into strategy and planning and finance, but the rest of the people are performing on the field. So I can't lead from the front. I have to go to the backseat, allow the other people to perform, but these people have to think and work.

These colleagues are much different from the people whom I hired on day one. Day one, I required people who would carry out my instructions. Of course, things are always changing. I had one accountant who was writing the book. Today we call it a CFO. An accounts manager, probably an internal audit chief… Cost accountant… company secretary. See, one job, one simple thing that we are doing, we have too many people in it today! You take marketing, branding is separate. Marketing is separate. Selling is different. Different selling of different brands. So all these things over a period, in my lifetime, I have seen. First of all, I have to get educated to adapt to the new conditions.

Karthik: We keep saying that. I think the biggest role for a founder CEO is that they actually don't know the job that awaits them 5 or 10 years in advance. You almost have to go and learn how to become that person you will be in 5-10 years.

And the best CEOs or founder CEOs - we've seen evolve over a decade or two are folks who are incredible learners themselves. You have to have a lot of humility to know that you have to be a very different type of leader at say 5-10,000 crores, compared to as you were, when you were at 50-100 crores.

Would you broadly agree with my assessment, sir?

R.G. Chandramogan: No, mostly I'll say the refusal to learn gets in at some time. People start working for basics and then for comforts. Then the ego comes in - People recognizing you wherever you go and all that. A lot of people get settled at ego gratification. Beyond that point they are just in the limelight and probably they feel that the journey is already over. So this type of attitude, once it comes in, this can also be… The entrepreneur is the asset at the beginning, and he will become the biggest liability at a later date. Once he becomes complacent or arrogant. Complacency and arrogance can creep in with personal success.

You have to be careful not to get complacent, not to get arrogant. So these two things are the real destroyer of any future growth.

Karthik: Well said, sir. I think there's a philosophical tone to your answer, which I think I'm hoping a lot of young entrepreneurs learn from. That's who I'm doing this podcast for. So I hope they take that lesson. There's this corollary to what you just said, which is, I know you built this business in an era where private capital did not exist. So we'll come to the public part of the journey, but it forced you to go public. You also didn't have the luxury of ever losing money in any given year. That is what you call near-bankruptcy in your case.

But as you grow to this middle - large stage.. really where you're at today how difficult or easy is it? Because I want more founders to think in that fashion. Can they build lasting organisations rather than simply be in the venture race for the first 5-8 years? So at some point, even when you're playing with the venture capital money, which comes fast and quick and expects you to grow unreasonably…If you don't turn to a profitable cash flow business, your hands, your fate is at the mercy of either you get acquired by somebody who wants you as an asset or eventually you might flame out, right? And this is a very trying time for entrepreneurs. How do you build a culture of a profitability slash frugality, this balance of growth v/s profitability and how do you sustain it when you have to get top talent to come and run the company, which is very different from where the company's talent base was say 20 years ago.

R.G. Chandramogan: See, in the year 1996, we went public. We tried to raise eight crores. We barely did it. And there were comments in the newspaper, very negative comments said, ‘Empty cone for the investors. Cream for the promoters’. See? All fancy slogans. They felt they're very creative in writing slogans and all this nonsense we saw.

What we did was, fortunately or unfortunately, no P.E invested in our first venture. It was all distributed to the public. We had long term investors. I'm really scared of getting PE money. They come with an agenda of 5 years or 10 years. They wanted to get out. At the time of entry, they want to decide the exit. Once when they do invest, in the five years, they tried to pressurise the company. And they say, you give a statement like this in three years - I will do this and that… I will go to the moon and I will go to Mars. So these statements are going to hound the entrepreneur. They are very difficult to chase, say in five years I will do so much and in the five years COVID may come. Economic recession may happen. Too many things may happen, but still that five years answerability stays. We had the fortune of not committing towards the future. If somebody were to ask me, we have our inner plan and details and all that. But if they ask “In 5 years, will you do so much? I always say I'm no Nostradamus to predict the future.” The reason is if you are committing for the future for a third party or to the press or to the open community, what happens is then you start chasing vanity and the business goes out of sanity. You start compromising because you said that you will do so much turnover and you try to do all juggernauts to do that. And the PE would have pressurized and you would have walked out. So I don't want to get into that trap. I don't give any futuristic projection to the market saying I'm going to do this, that and all that. But we have in our heart what we want to do and we want to do it without any pressure. If there is going to be COVID or anything, we would like to take the shock as much as possible and still we will be far more efficient than our competitor to come out of it.

That is the only thing we can do and we don't want to commit. Maybe our past record can just speak to them and if they're happy with it, let them be.

Karthik:. That's right. Now you've established that over 27 years. So basically they've seen you deliver year after year. And eventually you have to get to that point where investors trust you…

R.G. Chandramogan: As you are talking about compounding. The guy who invested 45 rupees with me in 1996 for a 10 rupee share. Today he has got 28 shares of 1 rupee. With bonus and all that. The amount of 45 what he has invested today is about Rs. 32,648 on today's market price. And we have compounded 27.63% over the period of 96 to 2023. 27 years. We have compounded at a speed of 27.63. This is part of it for the same 45 rupees we are giving a dividend of 165 rupees per year. The last 4-5 years. 28 shares are getting six rupees dividend that is coming to 165. That is.

Karthik: Bonus… So this is the power of ..

R.G. Chandramogan: …his capital. Now I started with Rs. 13,000, whatever Forbes says, if it is true, market capitalization that they call it - this Rs. 13,000 on the present market. We have compounded by 36.52% over 53 years. I looked up Warren Buffett's record for 55 years. If you had invested 10,000 USD, it is today worth about 280 million years at 20% CAGR. But the gentleman has invested into different companies and he knows.. see there is an average for it. There may be a company which is giving a much better return. Some other company would have given a lesser return. And he has got a basket of products. I have only one product, one company. I stay with it and I don't have any basket. I have no regrets.

Karthik: No, absolutely. It's an iconic company now, sir. It gives us pride to say that a company like this was built out of Chennai. And thank you for that. I still consider it my hometown. And thanks for giving those numbers. I wouldn't have been able to do the math. This is fantastic for the audience to hear. On other compounding drivers. I know we didn't answer that question fully, how important are people, culture, technology - and specifically in tech, we're a big beneficiary, Stellaps, one of our companies, I think when they were looking around speaking to private dairy, where they thought they'll get a break, I think Hatsun was the first company that gave a break. And if you look at your biography as well, there's a history of you making very bold technology bets ahead of everyone. So people might not see a stayed direct to consumer brands company - doing milk and yogurt and ice creams - as technology. But I tend to see that the best performers in this are great adopters of technology early. So that's our angle because we're also a tech investor. But broadly, if you look at the drivers of compounding, do you have a sequence or do you have a group of value drivers that actually allowed for this crazy growth? This, as you said, I do 40 years worth of revenue in one year. How does it happen? What is the magic of that? .. What is the magic formula?

R.G. Chandramogan: We were comparatively frugal in ‘personal’ expenses. We were putting all the money back into only one company. I stayed in a rented house from 1970 for 30 years. So I moved to my own house only in 2000…after 30 years. This office last year we moved, till such time we were in a rented office. So all the 52 years we were in a rented office and this is the first time we are moving to our own office. But our factories are heavily modernised. We invest into productive assets and the non productive assets we try to avoid. A house, I consider it as a non productive. Office, I consider it as a non productive, but today the government is taxing rent at 18%, that is making rent prohibitively high. I felt that I could go for a new office, pay the bank interest where I don't have to pay the GST. The milk doesn't have the facility to absorb the GST. So we decided to go with it.

And again, probably we pioneered too many things. Two of the guys came from Boston. Primitin powers, those people, came to India and they said, your power supplies are frequently disrupted. We can cool the milk with the installed solar system. But they didn't have money. This guy got an award from MIT for developing new products and they approached me. They said we don't have the seed capital, can you help us? We will develop a system and come and install it. They wanted only 5,000 dollars. The guys came down and installed it. It worked.

But the problem was the space that they were asking for, was not possible to be provided. I said, this will not work again in the winter season - when the sunlight is not there - we have to go back to the generators. This will not work. Then the guys went back. They came with the technology of thermal batteries. Today we have about 1,500 machines doing the chilling.

Whenever milk arrives, we won’t always need to have power. These batteries will chill a liquid. That liquid will take care of chilling the milk. And they developed this technology. They put up a factory in Pune. Even today, we are the largest buyer.

Karthik: Beyond technology, any other levers that have allowed you to grow to this scale?

R.G. Chandramogan: The technology in the sense, probably, if you take our ice cream factory, this is a world class factory. Technology wise, today, we are updated with any technology available in the world. The best of the machineries and all that. We are the first people to connect 4 lakh farmers. Digital payment. We are the first people to do it in the entire country. No cooperative has done it. No private entity has done it. The reason why we did it was we were literally handing over cash earlier and it called for too many people. Moreover, the cash that was given was also misused by the farmers. The Wife would run the household but the farmer husband will collect the money. They will go to TASMAC and spend the money and go with the balance. So things are not running well. And the loan sharks used to lend the money. Loan sharks used to charge 6% interest and the banks considered them as not. Or the customers. Customers. Most of the farmers used to ask for a loan waiver. So at this juncture, we brought the farmers into the bank records. That completely changed the game. The farmers were initially against it. They said, you have been giving cash and we will not take cheque. We thought we did it at the peak of the flush where they can't run away to anybody. We said, this will work well for you.

And then we did it. Two things happened. Today that farmer is a worthy customer of a bank. Earlier, if they went to the bank manager, the manager wouldn't meet them. Today, the bank manager is at his door to service. You want an education loan, you want an animal loan, he will give it. Today, he's a worthy customer.

Today, if I tell those farmers, I will revert back to the old system of paying cash. He will again revolt. The thing is, we did it much before liberalisation. We were already digitalized by 2015.

Karthik: Oh, fantastic. I thought it was more a UPI initiative.

R.G. Chandramogan: Much before that. Actually, Harish Damodar was introduced to us at that time. Okay. He came to know about us and he made a phone call. He said, “How you people are managing payments. It is giving sleepless nights to all the people. People are standing” and I said probably my farmer and I are sleeping well, no issues!

Karthik: Personal question, sir. So it's kept you going for 50 plus years. Have you ever felt now it's time to fully retire? And now do you feel like the company is in hands where it can build, as you said, for eternity?

R.G. Chandramogan: Day to day, I'm not running. Day to day, Sathyan is running. I'm not into day-to-day and I don't get involved. But if there is something exciting, something new, where probably some new technology is coming, say if somebody is talking about wave energy, then I prefer to go and see what this new energy is. So such things excite me.

Karthik:. Last question before I get to a set of fun rapid fire questions. You keep reading the papers. Now you hear the stories of how we, as venture capitalists, are probably building a very different type of entrepreneur, corrupting the mind with too much capital without necessarily comparing and critiquing. What would your advice be for young entrepreneurs starting today? Very different environment, a lot of private money, and a lot of pressure also to deliver quicker outcomes. How do you resist that? How do you build?

R.G. Chandramogan: Today, probably, most of the entrepreneurs are coming with a very good educational background. Again, when they start a company, they also decide to have an exit date. Maybe it's new to me, but I'm not used to that. I don't believe that exiting is worth it. My pleasure is in doing the job. By getting the money, what will I do with the money.? I don[‘[t know. It's a different mindset. The question, I'm not competent to answer. I can say my mindset is different.

Karthik: No, it's a great answer, sir. Thanks again. It's been a lovely hour or so. Before we wrap, I thought we'll just ask you some fun questions. One word, one phrase, one sentence, whatever suits your mood today. What is your favourite ice cream flavour?

R.G. Chandramogan: Cassata.

Karthik: Okay! That makes two of us. I feel like from memory's sake, I need to go and have one of those today, if not in the dairy business, where would you have been? Do you ever think about another business?

R.G. Chandramogan: I would have retired in the U.S., working for DuPont or some other company.

Karthik: You've been in the business for more than 40 years.

Karthik: What are the top three words of caution you'll give to young entrepreneurs?

R.G. Chandramogan: Frugality. If you are going to just go for a long run. And once when a failure comes, facing it with confidence. Not getting biased by people around. They will always put negative sentiments that this will not work, that will not work and all that. So believe in yourself better than... believing in others..

Karthik: One, one piece of tech now that has consumed you that you think you can't live without,

R.G. Chandramogan: I don't use technology. I'm not a technology freak.

Karthik: In this journey, when you look at these 53 years, agility versus endurance, what do you think has served you better?

R.G. Chandramogan: Endurance. In the long run, endurance.

Karthik: So, Marathons versus sprints. And once again sir, been a pleasure. Thank you for the time today. And it was great capturing the Hatsun journey. As I said, it has a lot of personal connections. I was very moved by the fact that you agreed to do this for us today.

We've had some fantastic guests on the show, and I think this will add to a different flavor of not ice cream, but learning for the young founders who are listening in. Thank you again.

R.G. Chandramogan: Thank you.