When I finally tire of saying something so often, I know it's time to write it and share it with the team and the world. This practice of writing or a podcast episode for me is my rendition of emphasizing a lesson I would like to spread. Blume Day T-shirts are a manifestation of these. The Blume Podcast is a variant of this. The entire 2023 season is dedicated to just expounding the ‘power of compounding’. It may be a very simple idea, but it comes alive through practitioners who show how it’s been done.

Similarly, my right to write this piece took a dozen years of self-training first. I chuckle sometimes at the naivete of many social media gurus around a topic, especially Venture Capital, who’ve not put in the time, leave alone not delivered outcomes (I’m still getting there, crawling to the peak of mountain #1 in my 13th year). I’m not against airing views but they should be about learnings and the courage to state your views on markets that your startups are building for, not on Venture Capital - for the latter, one has to return 3x cash to the bank and then begin talking. Yes, I’ve earned that right finally. I’m nowhere close to a master sushi chef yet, but the training continues.

What I’ve been saying for a few years to young colleagues and mentees is that training to be a world-class Venture Capitalist is no different from a sushi chef apprenticeship. I’ve chosen the adjective “world-class” carefully, since it’s important in venture to benchmark to a global standard. A good-to-great VC’s benchmarks - the competition, the capital, the talent is all global - so, you’re either aspiring to be world-class or you’re never making it. Please understand that you’re handling the most sophisticated capital in the highest risk asset class. In that, the analogy to a master sushi chef is most appropriate, where you are trained in Japan, with the most expensive or sophisticated ingredients, with the best cutting tools on the planet (you need to visit a Japanese kitchen’s knife section sometime), whittling the cuts to perfection, boiling rice to the right moisture, and serving 15-20 pieces of an omakase (Chef’s tasting menu) exquisitely, at perhaps $150-300 per gastronome. We aren’t talking about serving sushi in a box at an airport. That’s like trying to be the 15th investor in an angel syndicate! You can make money and boatloads of it, but for perhaps oneself. But if you’re saying you can consistently do that over a few decades with large pools of institutional capital and on $100’s of millions, I beg to differ. Lucky is the middle name of Venture Capital, but as everyone will tell you, getting lucky is not a good long-term strategy in the longest of long-term equity capital plays.

As I was writing this piece, I ran into a quote from the film “The Outfit”. The protagonist says “I’m not a tailor, I’m a cutter”. He says he apprenticed on the Row (Savile Row) and the art form is in the cutting of the fabric, not the stitching of it. That’s the detailing that makes for a great craftsperson. Most of the best conversations with sophisticated LPs (our investors) have always paraphrased the same maxim “we’ve realized that we judge the best VCs on input parameters - how they choose, what they stand for, how they spot great talent at the team and from the pipeline, how they assess risk, portfolio construct, portfolio manage, etc; what comes out of the funnel is more in the hands of the entrepreneur than the VC.”

VC is not for the faint of heart, for impatient hands and minds, and those without steadfast discipline. I’m no sushi chef, nor know one personally. I’ve just done my research as a lover of the food, viewer of “Jiro dreams of Sushi” and browsing through a handful of YouTube and public accounts of what it takes to be one. I recently asked one of the three omakase chefs in a Hells Kitchen restaurant in NYC: “How long did it take to get here? Do you think you’re ready for what’s next?”. He replied “Eight years of training done. A few more and I think I will be ready for my dream of my own place.”

This is why I find a stark similarity in the journeys. I’m proud to be a VC and see the impact it can create for entrepreneurship, the leverage it enables for technology to build a more equitable and improved society. I want to master it. It’s not a “job” for me or any aspiring partner as I’ve hopefully articulated passionately. It’s a craft that one wants to singularly master over a lifetime of learning and hand over elements of the abstract craft to the next generation. And hope that they, in turn, become the venture capitalists who will be financing the next generation of dreamers - driving our pursuits of the moon, Mars, the depths of the oceans, and the limits of human innovation.

“It's at the finishings that you must come to terms with the idea that perfection is a necessary goal, precisely because it is unattainable. If you don't aim for perfection, you cannot make anything great. And yet true perfection is impossible” - The Outfit, 2022

Epilogue

This essay also precedes a series of questions and topics we began answering for our own culture guide, hiring and team that we want to share with the VC ecosystem at large. We think deep and hard about our roles and alignment of incentives to our primary stakeholders - investors and entrepreneurs. We will be launching these Venture Craft snippets soon.

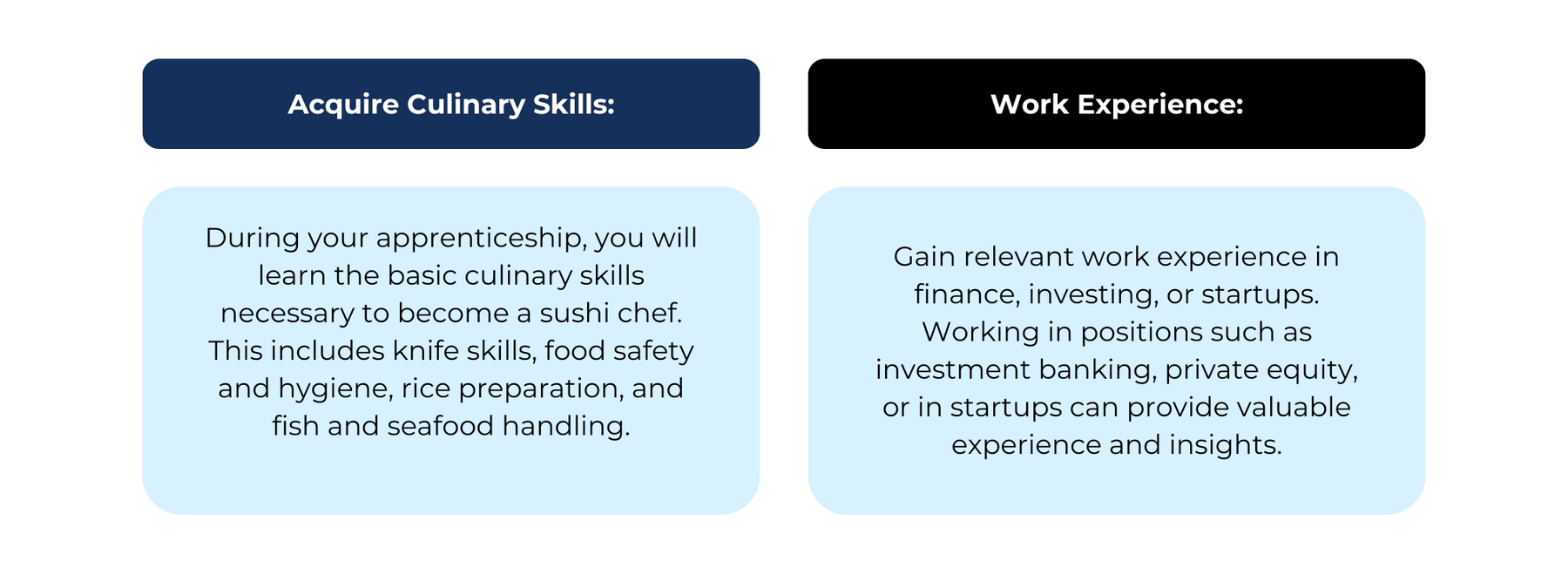

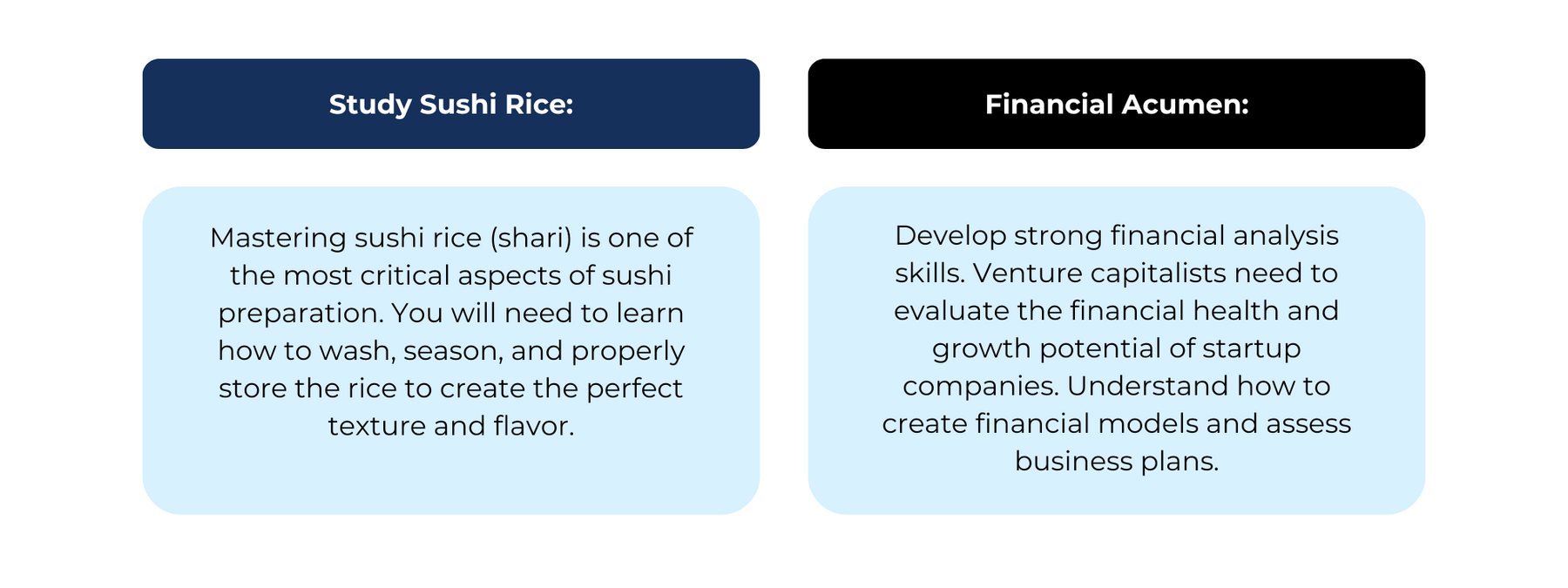

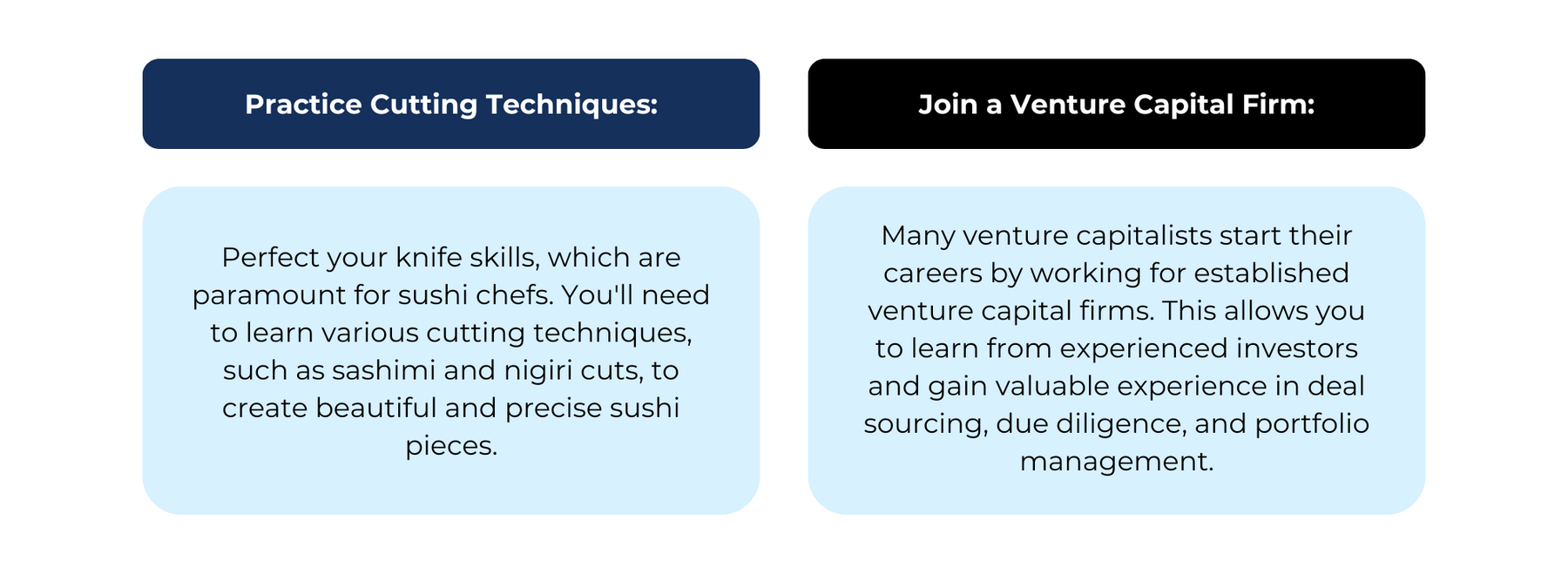

I also asked chatGPT to give the parallel paths a shot, asking it to first detail the steps that it takes to be a great sushi chef and then requesting it to suggest an analogous series of steps to make a good VC. It’s not a bad expression of intelligence. Easier to leave some abstractions of this nature to generative AI nowadays - you get the broad points that the author is trying to make.