The Venture Potential of the Electric Vehicle Sector in India

- Published

- Reading Time

- 5 minutes

- Contents

The rising flow of venture capital into global climate tech

The pace of venture investing into global climate tech startups is growing rapidly. As of January 2023, there were 83 climate tech unicorns recorded around the world, of which were collectively valued at US$ 180 billion. In 2022, the US market invested US$ 87 billion into climate tech companies, compared with China at US$ 48 billion and India at US$ 6 billion. Interestingly, with 3,300 deals being closed in 2022, the dominant sectors, which have seen the highest amount of capital raised, are energy storage, renewables, energy distribution, and electric mobility. Furthermore, the year 2022 marked a massive surge in India-based venture capital (VC) funding, aided by the fact that Indian regulators, policymakers, corporates, and investors alike see the potential for India to take a leadership role in climate tech venture investing for homegrown and global startups.

Blume Ventures’ climate tech thesis

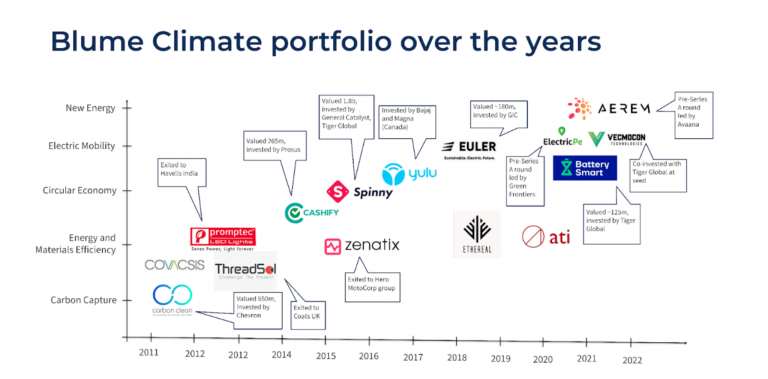

Our journey in building our climate tech investment portfolio is captured below:

We began our investments into carbon capture and renewables at the onset of our first fund in 2011-13. Over the last decade, we also invested in energy efficiency technologies and circular platforms. When we launched our third fund in 2018, we started looking deeply at the electric vehicles (EV) sector. What excited us the most was that this sector could disrupt the entire automotive industry, while also leading to a climate-positive, net zero transition. It was this driving force that led us to invest in several EV companies that are scaling up cutting-edge technologies. Over the last 5+ years, we have invested in 5 EV companies: Yulu, Euler Motors, BatterySmart, Electric, and Vecmocon.

The year 2022 marked a massive surge in India-based venture capital (VC) funding, aided by the fact that Indian regulators, policymakers, corporates, and investors alike see the potential for India to take a leadership role in climate tech venture investing for homegrown and global startups.

Since early 2021, we have been receiving pitches from multiple two-wheeler (2W) original equipment manufacturers (OEM) companies. After evaluating 50+ pitches, we aimed to ascertain the reason for the proliferation of these companies in the market. These companies had a few commonalities:

- They claimed to have developed a superior Battery Management System (BMS);

- They were all trying to raise US$ 10-20 million;

- They were all pre-production, and therefore pre-commercialisation.

We were sceptical about backing a 2W-OEM company, not because they would compete with incumbent players, but because the barriers to entry to be a 2W-OEM company were very low. Additionally, when we looked deeper at the supply side of such 2W-OEM companies, we realised that there were very few suppliers of quality EV components in the market. The government’s mandate and regulations for the use of indigenised components meant that if these companies were to benefit from the FAME II subsidies, they would have to source high-quality components locally, rather than relying on imports. This was a two-pronged problem, the first being access to robust components in abundance, and, the second, access to components locally.

On the demand side, the situation looked bleak as well: There were a large number of 2W EV brands emerging in the market, which meant this type of vehicle was set to become commoditised. In other words, there were too many choices for the end customers to buy from and hence as a 2W-OEM, they were broadly unable to command high sale prices and therefore robust margins. Hence, on both the supply and the demand side, with the margins of a 2W-OEM brand being squeezed, the result was an unsustainable business model. We decided this was a business that would not fit our VC mandate and hence we declined to invest into the entire sector of 2W-OEMs.

The government’s mandate and regulations for the use of indigenised components meant that if these companies were to benefit from the FAME II subsidies, they would have to source high-quality components locally, rather than relying on imports.

By virtue of serendipity, we came across Vecmocon (abbreviation for VECtor, MOtion, CONtroller) which had interestingly positioned itself upstream of the 2W-OEM value chain. This company was designing and manufacturing quality components and supplying them to OEMs. The team led by Peeyush Asati, Adarshkumar Balaraman and Shivam Wankhede have been working on this model since 2015, much before EVs were mainstream. They had been supplying the components to multiple OEMs, had large order books, and were profitable as well. They could potentially supply to the 200+ EV 2W brands that were emerging in India and build a large sustainable business. We were able to rapidly build our conviction in the VC investible case for this business. Subsequently, we led a US$ 5.2 million round into Vecmocon along with Tiger Global.

In the long term, we envision Vecmocon to build cutting-edge next-generation components for EVs across multiple segments—2W, 3W, 4W and buses. The ancillary components industry is very large (in India and globally) and with the rapid rise of EVs, we are hopeful that Vecmocon can disrupt this industry with their solutions and become a global leader. Therefore, our investment into Vecmocon pushed us to map the entire value chain of the EV industry and make a bold decision to back various other technologies in the EV sector.

Our EV investments now include: Euler Motors, a manufacturer of light commercial electric vehicles used for intra-city, hyperlocal goods transportation, such as for e-commerce or any last mile goods delivery; Electric Pe, an EV charging platform, which partners with thousands of independent charge point operators; Yulu, a dockless bike and electric scooter service across Indian cities; and Battery Smart, a network of battery swapping stations providing drivers of electric three-wheeled rickshaws a 2-min battery swap.

The ancillary components industry is very large (in India and globally) and with the rapid rise of EVs, we are hopeful that Vecmocon can disrupt this industry with their solutions and become a global leader.

Recommendations for key actors

India has benefited from increased policies and regulations promoting the adoption of EVs and clean energy solutions, and this phenomenon can be described as “policy-led growth” (PLG) in the sector. However, a major obstacle to the widespread adoption of EVs and other clean energy solutions in India continues to remain the lack of adequate financing. These solutions are relatively new, hardware heavy and capital-intensive, making it challenging to assess and underwrite their future asset value. Enabling various forms of financing, such as government bonds, priority sector lending from private banks, and blended finance instruments, can significantly catalyse adoption.

Furthermore, addressing awareness is a critical issue that the government should actively tackle. Similar to the “Mutual Funds Sahi Hai” campaign, which the Indian government conducted in recent years to educate citizens about the benefits (and risks) of investing in a new and growing asset class, similar campaigns for EVs and clean energy could be developed. Increased adoption leads to greater traction, ultimately driving scalability. Currently, India is at the initial stages of this journey, facing multiple challenges that require a concerted effort.

A major obstacle to the widespread adoption of EVs and other clean energy solutions in India continues to remain the lack of adequate financing.

Additionally, India must make substantial investments in research and development (R&D). These investments can take various forms, including government grants, innovation challenges, publicly-funded research laboratories, innovation parks, and facilities equipped with world-class equipment and systems. Such investments have the potential to accelerate innovation in the country significantly and promote collaboration among various stakeholders. Moreover, involving the public in solving the challenges of achieving net-zero emissions is crucial.

Establishing the right innovation infrastructure, accelerating existing solutions through policies and financing, and enhancing public awareness are essential steps for India to reach its net-zero emissions targets.

Conclusion

As we continue to build our footprint in the EV and the broader climate tech space, we are extremely grateful to the entrepreneurs who continue to build, flourish, and develop differentiated technologies to help propel India towards net zero carbon emissions and a climate-positive energy transition. While the current EV market in India is at a nascent stage, we believe that slowly, steadily but surely, India will be a global leader in EV adoption and the key actors at the forefront of this revolution will be venture-funded startups.