The Hunt For India’s Deep-Tech Unicorn: Blume Ventures Battles The Odds

- Published

- Reading Time

- 6 minutes

VC investor Blume Ventures is seeding a deep-tech ecosystem in India, funding a bevy of startups. It’s nurturing companies and helping them tap overseas markets and bring in global investors. Blume’s founders believe that a deep-tech unicorn in India may not be far away. Can they pull it off?

Noriaki Sakamoto, partner and board director, UTEC; Karthik Reddy, co-founder Blume Ventures; Sanjay Nath, co-founder Blume Ventures; Tomotaka Goji, managing partner and president UTEC: and Kiran Mysore, venture partner, UTEC, at Blume Day 2079;

A hubbub greets visitors at the modest office of Blume Venture in south Mumbai’s Byculla. Slightly less than a dozen people are huddled in the condo-size office, brainstorming investment opportunities in assorted startups ranging from a daily-grocery delivery company to one that builds agricultural robots.

Having bet big on India’s giant consumer market (with unicorns such as Ola and Zomato adding heft to its portfolio) already, a grocery-delivery business would now seem to be an obvious winner for the venture capital (VC) fund.

But then, Blume also has a weighty exposure to deep-tech in the country and is helping seed a startup ecosystem for the same in its quest for India’s first deep-tech unicorn. For the record, the US and China have a number of them as you’ll see in a bit.

About 45% of Blume’s portfolio comprises B2B tech companies with a significant chunk of them in deep-tech business (the remaining are SaaS, CRM, and enterprise-solutions startups).

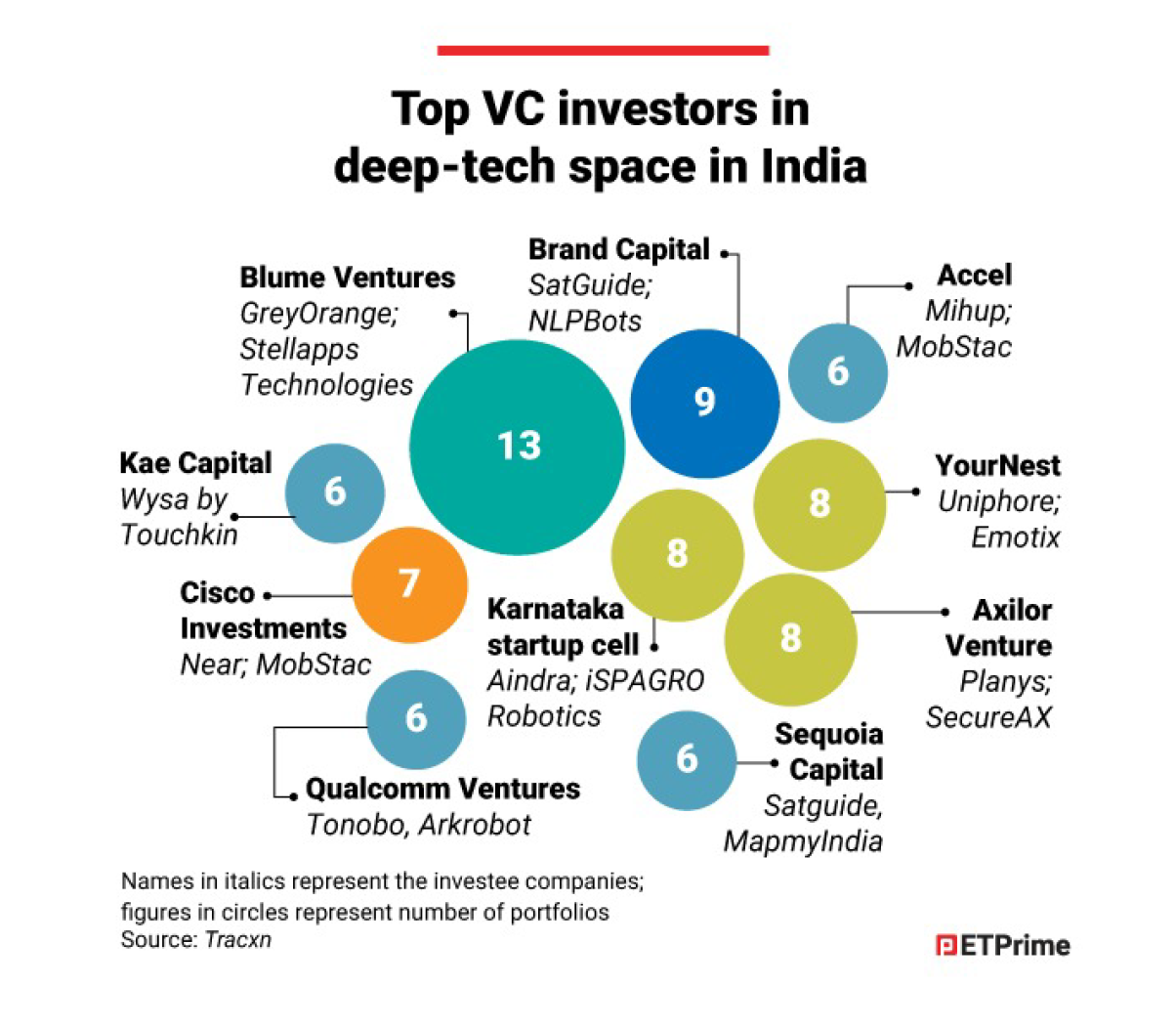

Blume has a few more than 15 deep-tech ventures spread across its three funds launched over the last nine years, according to data from market research firm Traxcn.

“Deep tech poses an interesting challenge — given many of the fields are new and undiscovered, often the founder and the VC are learning and digging deeper into specific pain points/identifying the universe of solutions, on a parallel path, on a journey together,” says Sanjay Nath, co-founder of Blume Ventures, the leading VC investor in deep tech in India.

“On the other hand, with a fintech or consumer company the ecosystem and the pool of available capital providers are well known and understood. Deep tech often sees nebulous use cases at the inception, which have to be honed and sharpened as the company grows,” says Nath.

However, a strong point for the VC firm is that it may have the right experience to steer startups in this space as Blume has been investing in deep-tech ventures ever since its inception in 2010.

India has a vast pool of IT engineering talent and hence the rise of startups using artificial intelligence, machine learning, virtual reality, blockchain, or robotics was expected. However, some of these startups may struggle to find use cases in India or even investors who would understand their business models.

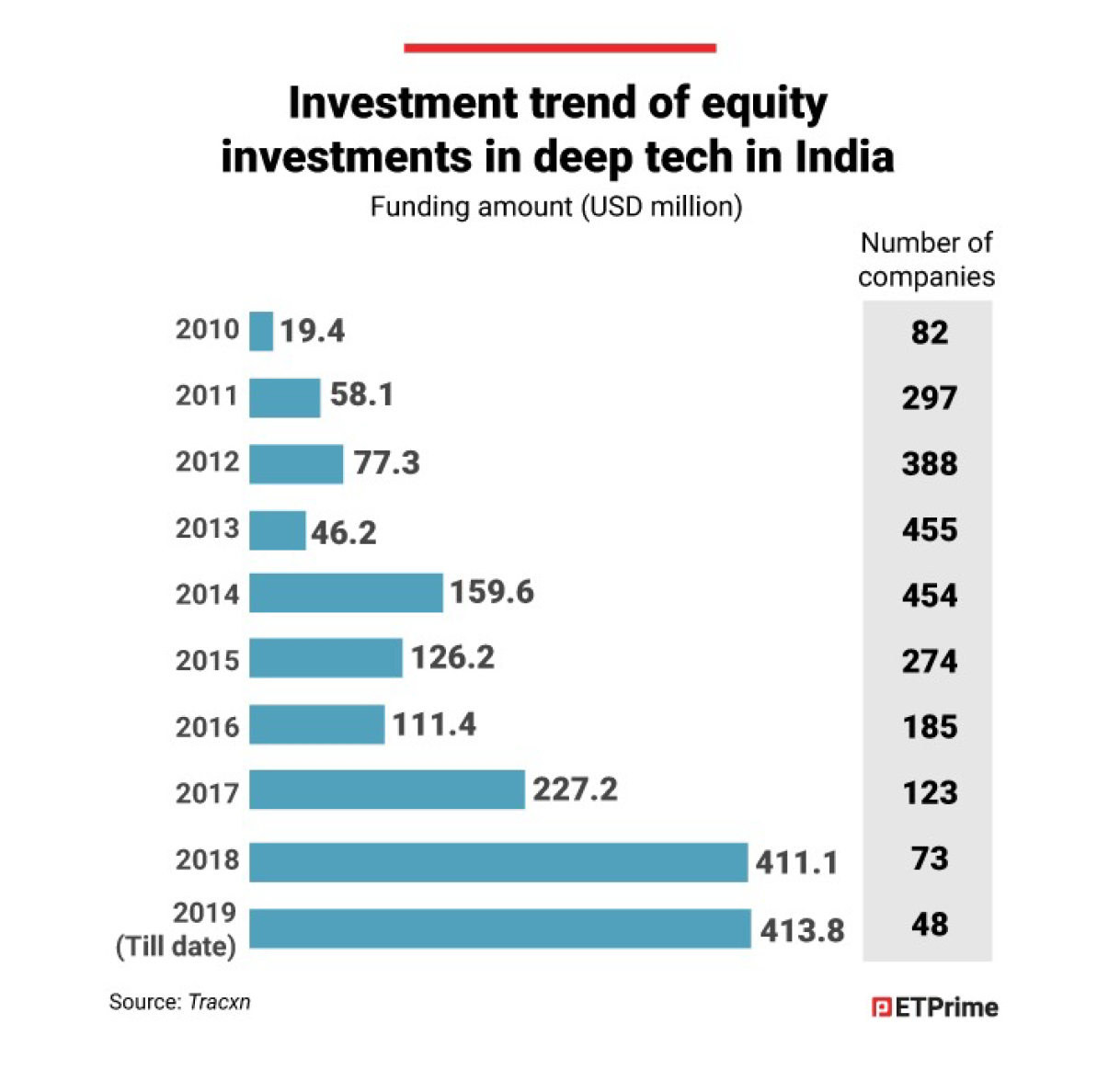

According to a report by Boston Consulting Group, globally, in the four years ending 2018, private investment in deep-tech startups has doubled from USD9.8 billion in 2015 to USD18 billion in 2018.

“The US and China landed about 81% of global private investments in deep-tech companies from 2015 through 2018, with approximately USD32.8 billion and USD14.6 billion invested in each country, respectively,” the report says. US-based Argo AI (developing virtual-driver system), Hong Kong-based SenseTime (developing learning-based image recognition solutions), and China’s Meevii (a facial-recognition technology) are some of the deep-tech unicorns.

The problems with deep tech

Blume had launched its Fund I in 2011 with a corpus of USD20 million, and crossed paths with the creators of AcYut, thanks to the alumni network of BITS, a leading engineering college in India.

Nath was not only a BITS Pilani alumnus but also part of the screening committee for a competition of robots. He was impressed with the idea and knew instantly that Blume Venture Fund I had found one of its investments. But, then came the real problem: Who will write the next cheque?

“After we invested into Grey Orange at the seed stage, we showed it to the Series A ecosystem, but the common challenge many faced was a deep understanding to evaluate a robotics company, since this was 2012,” recalls Nath. According to Tracxn, Blume gave seed funding to the company in June 2012 and followed it with Series A funding two years later.

While Blume participated in both Series A and B, there was a surprise entry as well with New York-based Tiger Global Management participating in both the follow-on rounds.

“The eventual lead investor sent an MIT research professor down who came and spent two weeks on due diligence, talking to possible customers and visiting warehouses to see the nature of the demand,” says Nath.

And with the attention from global funds began Geiringer’s transition into an international player. From 2017 onwards, the company has been selling more robots overseas than in India as warehousing (the sector it’s catering to) is much more developed overseas. Today, GreyOrange has two offices in US, one in Singapore (where it is headquartered), one in Germany, and one in India (where it was founded).

The robotics company, tagged a ‘soonicorn’, is likely to become the first deep-tech unicorn in India and has received USDi80 million in total funding so far. But the fact remains that global investors and access to overseas markets play a key role in making Indian deep-tech startups successful.

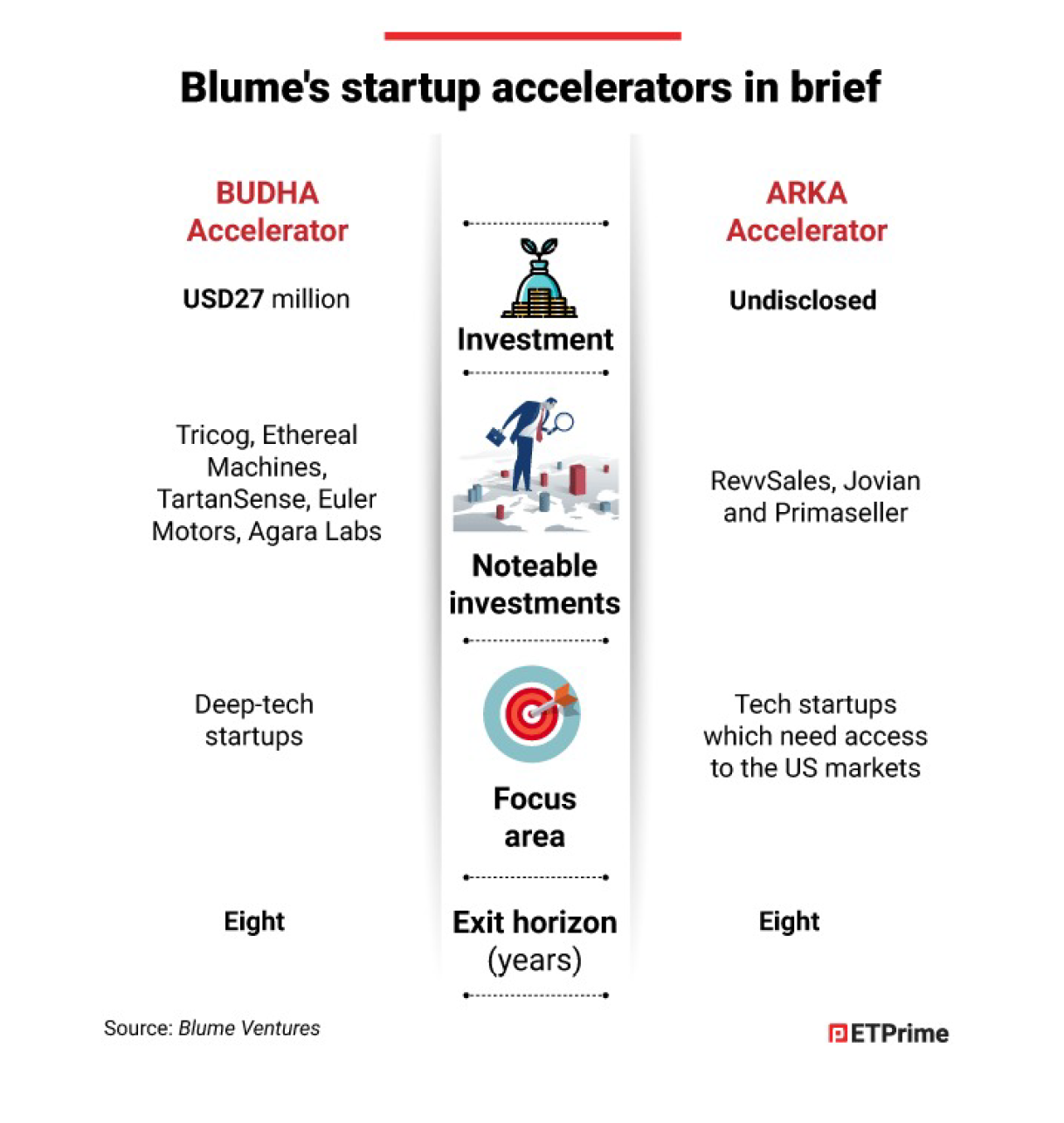

In July last year, Blume in collaboration with US-based Benhamou Global Ventures and Emergent Ventures launched Arka Venture Labs which would double up as a startup accelerator as well as a venture-capital fund. The focus of Arka is to invest in tech startups — mostly customer relationship management, Saas, and enterprise solutions — servicing the B2B market. Apart from funding, Arka plays a vital role in helping these companies move from Bangalore to Silicon Valley.

Arka has a fund life of eight years and, apart from five investments made in the last 12 months, it will invest in 15 more startups over the next two years. Arka will not only help Indian companies build a market presence in the US and European markets, but also help businesses secure funding from the top-tier US-based VC firm.

In March, Blume joined hands with the University of Tokyo Edge Capital or UTEC to set up an accelerator-cum-funding platform for deep-tech startups. Blume UTEC Deep-tecH Accelerator or BUDHA is tasked with funding and assisting these ventures in creating a

“We usually do investment in Series A, but in India we realised deep-tech companies raising Series A are an exception rather than a norm. A lot of deep-tech companies in India were in early stage and they need more of hands-on support,” says Kiran Mysore, a venture partner at UTEC.

So far, BUDHA has invested in AI healthcare platform Tricog, drug-discovery startup Bugworks, automated 3D printer-developer Ethereal Machines, agricultural-robotics company TartanSense, electric-vehicles developer Euler Motors, and Al-based analytics- and interaction-solution maker Agara Labs.

BUDHA’s first investment was in Tricog, wherein the Indian startup brought in medical data and software that identify irregular heartbeat, and predict strokes and heart attacks. While irregular heartbeats and stroke are a big problem in Japan as much as in India, collecting medical data is a highly regulated activity. “Japan has great device makers, but India has good software and AI developers. Because of these complimentary qualities, we can make this idea work and take it globally,” says Mysore.

Tricog is collaborating with a Japanese device maker in Philippines and Kenya to make innovations that match global standards at competitive costs, he adds.

With partnerships such as the one with UTEC, Blume is no longer just another VC with money. Partners from developed markets are now providing access for better due diligence of deep-tech technologies and support in scaling up startups overseas.

The road ahead for deep tech

Citing the example of Israeli startup Mobileye, which was acquired by Intel for USD15 billion, Nath says, “People who missed out Mobileye will go to Israel looking for the next big opportunity. India needs that home run for a deep-tech startup.”

Apart from exits, the Indian IP regime needs to improve. Right now, global investors are hesitant to invest in deep-tech companies, as future litigation in Indian courts could pose a problem. Hence, a lot of deep-tech startups opt for a US or Singapore domicile.

Local VC firms need to hire new talent that can build domain expertise in emerging tech areas, he says. During its transition from Fund I to Fund III, Nath says that expertise and quality of the founders mattered the most. The quality of founders is important even for Fund III, but now with the help of past investment experience and a young team of explorers the VC firm has managed to map a large part of Indian deep tech — from space tech to gut biome.

“As an industry we need to take risk, but we are often risk averse when it comes to new sectors and areas of innovation one doesn’t naturally understand. If you don’t understand a space, you can do two things — one is to stay away from it (and play it safe) or the second is to build a thesis around it. And in deep tech, we’re doing the latter,” says Nath.

That said, India’s first deep-tech unicorn may not be far away.

(Graphics by Sadhana Saxena)