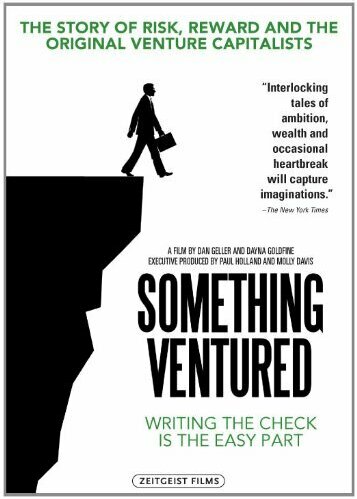

Something Ventured – A “Blume Team” Review And Analysis

- Published

- Reading Time

- 6 minutes

I’ve been hearing of the documentary “Something Ventured” for a few years now. I finally laid my hands on it, mostly because I wanted to understand how raw the ecosystem in the Valley (i.e. SF Bay Area) was when it started and wanted to draw learnings from it, and then to compare and contrast the Valley’s beginnings with our haphazard build out in India. Given 3+ years of such inputs in the Indian context as India’s leading seed fund, one also had to benchmark ourselves, as we contemplate the role of Blume Fund II in a few quarters from now.

I got the entire Blume team to finally see it. There is a macro point that I want to make, which is separately captured in our Q Investor Report #11 (coming up shortly), but I also wanted to consolidate all the reactions that our team had after they had watched it. As I left for a board meeting and left them to see it (I had already seen it twice in two weeks), I had only half joked, saying there would be a quiz!

This is what I asked of each of them, seeking answers to certain questions (and while the idea was to get an internal set of views, I thought it was worth sharing with the community).

"Whilst fresh in your mind, can each of you write down your key takeaways and share it with just me for now. I will compile and share it with the team. I don’t want biases from others' views when you write your bullet points."

In the documentary, what reminded you of where our (Indian) ecosystem is (compared the early days of the Silicon Valley ecosystem)

- The ecosystem seems more nascent but gutsier.

- Parallels of early stage tech VC pioneers in the 60s/70s = India early stage ecosystem of the 2010s

- A bias towards older experienced entrepreneurs, which was similar to the early investments when VC started in the US.

- Entry Rounds were similar for these billion dollar companies (sub $1.5mill)

- VCs mere a mix of entrepreneurial experience and financial experience

- Indian VC is very risk averse in contrast – do not take visionary bets

- It’s near impossible for people to understand as to how the founder sees it.

- Investor in early stage as lonely as founder – for the best of the businesses / ideas, the backers would be few.

What seemed similar to Blume’s philosophy (and which you liked)

- Involvement with companies, aggression, willing to continue backing the companies for a long time.

- Independent board members/advisors adding value – similar to our domain expert/small angel investors who co-invest along side Blume

- VCs getting in early with their gut but then backing companies deeper after real customer validation (eg : Tandem Computers – Sears intro case in the film)

- Investors share “challengers attacking incumbent” philosophy with the founders

- Believers of ideas and founders at core and can credit ourselves for spotting some geniuses.

- The world of entrepreneurship is about believers. In the initial days, being a VC also needed him to be a believer and the entrepreneur should raise from believers similarly.

- The VCs didn’t know what they were doing in the beginning, but were trying to make a difference. Evolved as they grew.

- Collaborative approach with other members of the ecosystem and their peer funds.

What was not like Blume’s philosophy (and which you didn’t like)

- CEO changes in 18 Months

- Little cowboyish

- While it may be right / take no prisoners style) A VC stating almost categorically that it was very common (and needed) for orig founders to move and make way for professional CEOs -Almost a formula. (YES often its needed – should be a case by case basis)

- No personal ties, very transactional in nature. Like the fact that Blume cares about people irrespective of how they behave.

- We are and should remain humble, not always the case with all the VCs in the film

What was not like Blume (but you think we should be more of)

- Cos were more industry-starters, cheques were larger, ownership stakes were higher and involvement was much greater (though the film represents a very small fraction of the overall investments – maybe Blume will have its 1-2 industry-defining companies)

- One other thing which is partly there but could be more of – idea and execution become joint ownership of the capital and labor partners i.e. we believe in it as much as the entreprenuer believes in it and contribute to its growth as much as they do. Could mean deeper engagement and lesser width. Not sure how doable at seed stage.

- Given limits of deep domain expertise in core investment team, require systematic looping in of domain experts from Blume ecosystem

- Easy access to the top corporate CxOs/M&A etc – @Blume we need to built that directly and thru alliance w/ iSpirt and so on

- There is romance and excitement about entrepreneurship and success. But it takes tremendous amount of hard work, grit and determination to move the wheels. Investors should be ready to do what it takes.

- Successful investors know founders don’t always know the best and that it is okay to play villains if they have to deliver returns to the investor.

- Being critical with the CEO/senior people and making decisions about potentially changing early.

- Create a network of people who can be good sales people and push the point home early to the companies for choosing one of them or at least evaluating (Apple example)

- Adequate capitalisation is a must – Even in those days, the cheque sizes were well over couple of millions of dollars. Inference in our context is that if and when we cut the cheque, success is possible only if we are willing to cut a deeper cheque and an adequate amount as founder demonstrates greater traction. Failure to put in adequate capital is a bigger potential damage that playing a wrong cheque.

- Lay down terms upfront – Most important to let the founder know expectations / feedback of potential weaknesses and concern areas as and when they are noticed; ideal if sufficient diligence is carried out before and terms of engagement are decided upfront

and any additional ideas/thoughts

- Would love to see a sequel eg FB, Twitter in the 2000s or if not then Netscape from the 1990s.

- Completions of the stories took 25-30 years on average – still stellar returns all along the way

- VC is a very long term capital game

- Portfolio founders being measured as they graduate from seed to angel to A and beyond. If milestones not met (or a cultural clash), VCs replace them asap without batting an eyelid

- Obsession and importance to working with customers early and customer / user validation (testing, feedback etc). [as opposed to Indian founders spending an inordinate amt of time raising funds – also the Indian VCs’ fault!!!!! – vs customer acquisition and growth

- Best-in-class VCs regardless of their geo location have more similarities than differences amongst each other

- You have to have balls/nerves of steel, going against the grain

- The investor can make a difference in enabling those 1-2 inflection points when the hockey stick curve just takes off e.g. when one of the VC’s LPs – largest Sears shareholder – intro’d Tandem Computers to Sears, and that single distribution channel timed before Xmas helped Tandem take off in an exponential way

- Contrary to what some of the best founders say (i.e. VC is mainly capital, smart money is over rated), the VC does* become part of the company, and hence drives / shapes / influences the portfolio co in significant ways. Blume is as much part of the portfolio cos as the founders are – the key here being capital is king – and hence in Fund II, deeper checks will allow us to retain that influence longer.

- No VC has been successful without making a life-altering bet that kept him on the edge of his seat for many years.

- One of us needs to be in the city where most of our investments are.

- First 3-4months, weekly meeting mandatory to set the culture and expectations right

- Should provide more money and lead in Fund II

- Monthly touch points on the metrics for the first 6months a must.

- Strong pertinent Referral Networks.

- It’s a brutal world – VCs have not shied away from taking the founder off the business and entrusting the reins of the business into hands of outsiders / professionals. Its important to keep a closer look at how founders are shaping up to the next level of talent and growth.

- Long term game: It takes time for winners to emerge and exponential returns to be created. Patience is the key, being with the founders throughout the journey is the next most important

We hope that you get to see the film. If you walk into the Blume office anytime and have 90 minutes, we’ll provide the DVD, a projector and a conference room for you to view it. Its a must-watch for everyone in the Indian ecosystem. The above mostly reflect the views of my team members collectively (almost entirely unedited for most part) and not any one individual in the team.