(Re)discovering the valley – five insights from our recent visit

- Published

- Reading Time

- 3 minutes

- Contents

This blog post comes after a recent visit to Silicon Valley earlier this month. Thanks to our association with the Draper Venture Network (DVN), we find ourselves, along with a handful of our founders, in the US now a few times every year. This visit helped us discover some new learnings, while also re-enforcing earlier views.

Hope you’ll find these relevant and insightful!

India-tech is unique (moving beyond transplants from US/China models!)

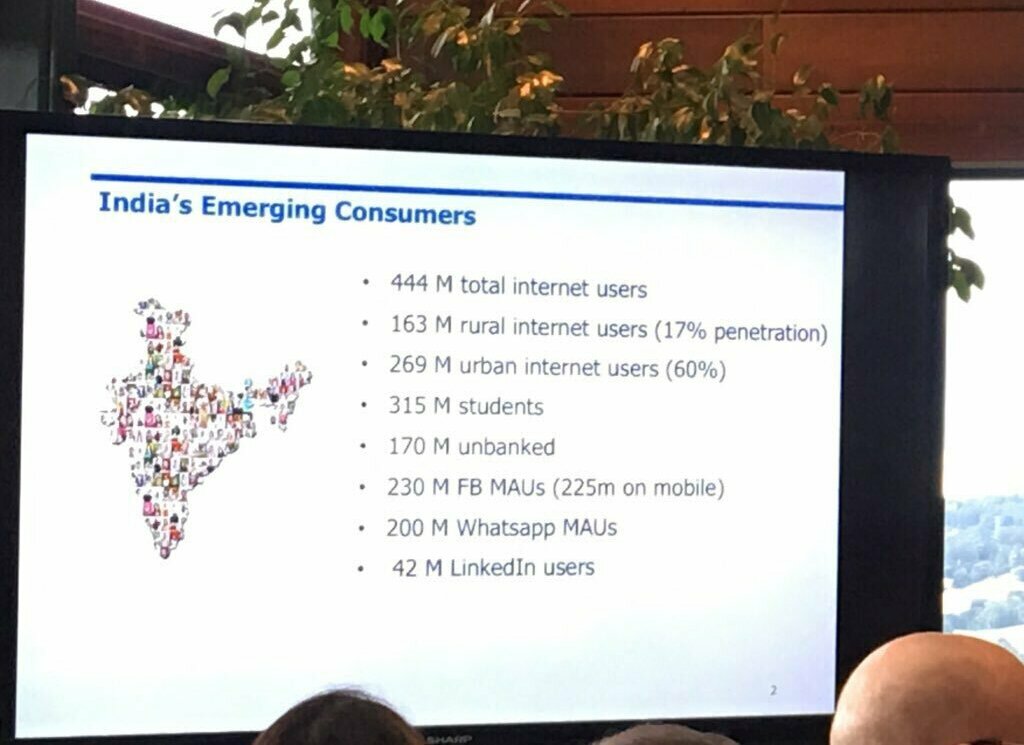

As a start, there is no comparison. The three are very different markets with their own set of opportunities and challenges unique to them. For instance,

- India’s Per Capita Income at $1,500-2,000 is still far less than China’s at $6,000

- Translating this statistic macro economically, makes India 1/5th of China and 1/8th of the US

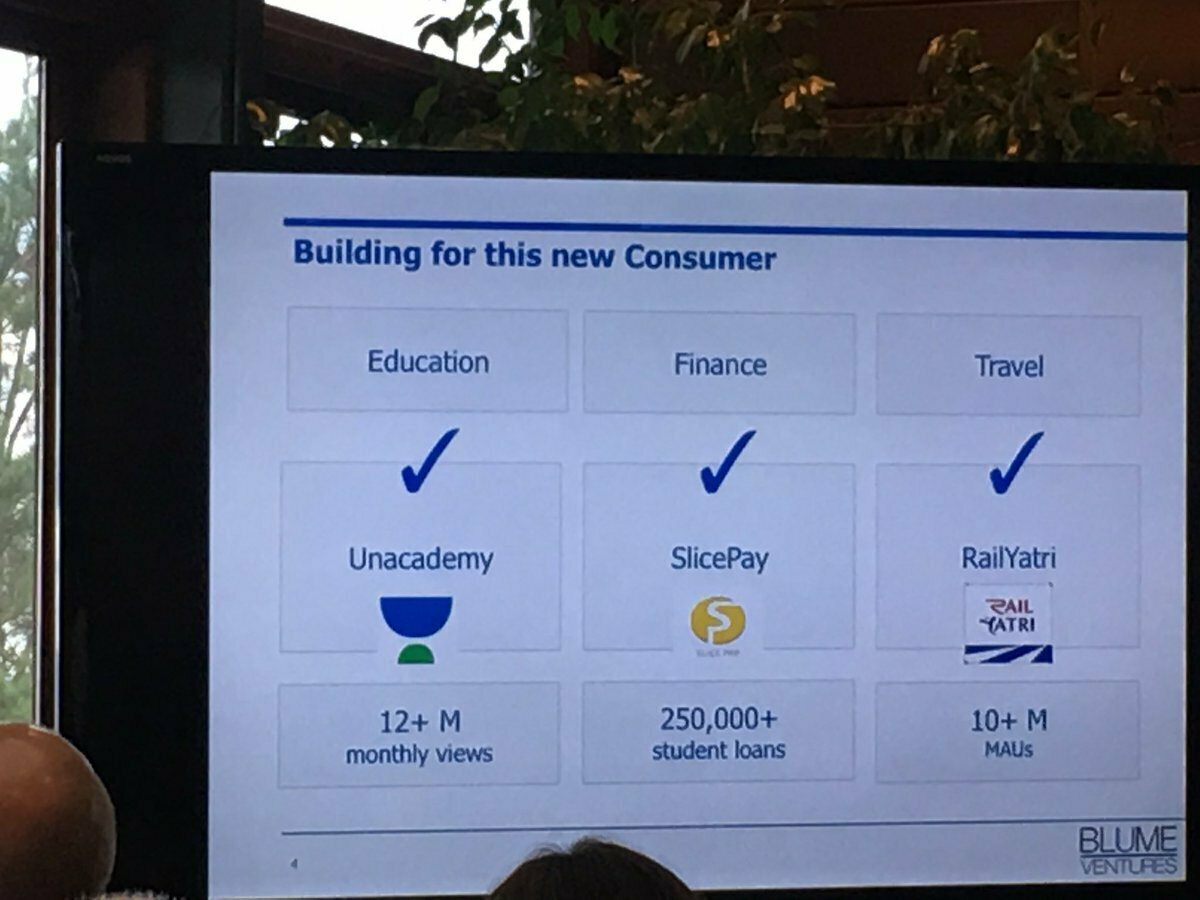

- Just three of many relevant examples of such India-unique disruptive models from the Blume portfolio, here:

- Dunzo - chat based concierge service for offline tasks

- Railyatri - a one stop solution for train travelers – furnishing an expanse of data-based travel discovery from PNR status information and live train status/trip sharing and even fun ideas!

- Stellapps - Internet of Things (IoT) & Big Data to improve agri-dairy supply chain including milk production, milk procurement, cold chain, animal insurance and farmer payments

There are two sides to the India opportunity

We’ve discovered a neat separation between “two sides” of India tech –

- Built in India, for India – this traditionally still covers a majority of startups addressing a vast array of consumer internet use cases – A few examples from our portfolio include Turtlemint (insurance), Cashify (refurbished electronic items), Pitstop (after market car servicing).

- Built in India tech, for global enterprise markets – this segment has been growing at a fast pace, leveraging India’s talent of engineers who have comfort with English, with customer-facing teams adept at selling B2B tech products and platforms. Some examples include GreyOrange (robots for warehousing automation), Botmetric (AI for the public cloud), Dataweave (competitive pricing intelligence and analytics for strategic/financial decision making), Squad (AI + gig economy driven liquid mobile workforce for business process outsourcing).

Extrapolated to other frontier/fast developing economies, there are many similarities!

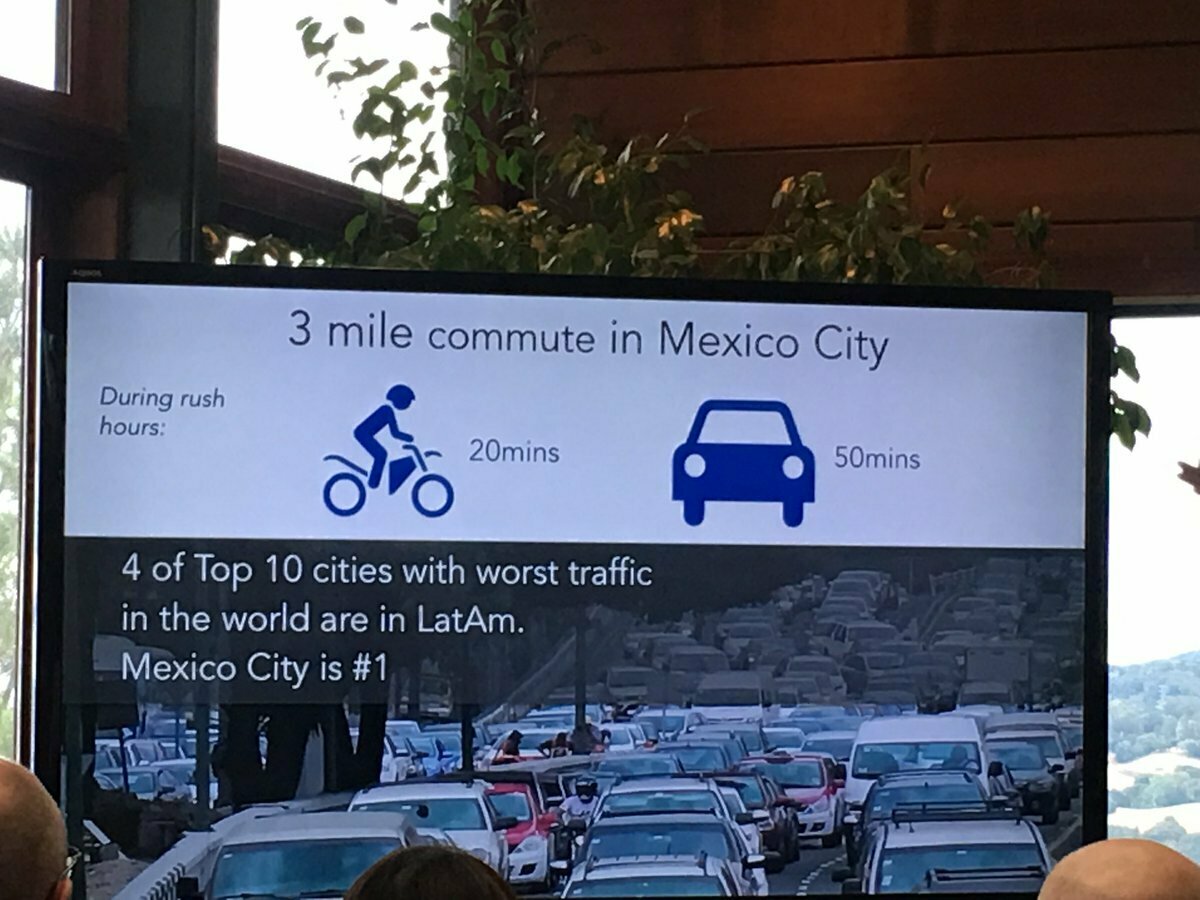

- Some examples – India (Bangalore), LATAM (Mexico City) and SE Asia (Jakarta) all have poor last mile infrastructure, which is an opportunity; enter the likes of Locus (logistics last-mile routing & mapping)

- In Mexico City for example, on average a 3 mile commute by bike takes 20 minutes, whereas a car ride across the same distance takes 50 minutes! Eventually, cross investment strategies could help aggregate capabilities, resulting in strategic partnerships, M&A and so on

However, Global Go-to-Market does not equal simply selling the India playbook

Often, sharper positioning/repositioning is needed

Typically, the first move from a founder-CEO targeting a global customer base is to hire that first “local” head of sales. However, we see that simply taking the current playbook to market is not optimal. What is needed is hiring someone who understands strategy and positioning equally well, tweaking the value proposition first before launching the GTM plan. In other words, a chief strategy + business + sales/BD officer, all rolled into one!

Get out to the customer early

One of our learnings from Fund I – founders should go to where their customer is at the earliest possible. So, going to the valley only makes sense when that is indeed your target market and the startup is uniquely positioned to win. If these criteria are met, then getting to early adopters can create network effects, accelerate customer wins and then drive virality/annuity.

In the US, think beyond the valley (not a one size fits all)

Broadly speaking, especially to Indian founders, Silicon Valley (the San Francisco Bay Area) offers the most comfort. However, it may make sense to tailor your presence and be located closer to the customer especially if youre in a specialized domain:

- Fintech, retail : ‘Silicon Alley’ (New York)

- Hardware, AI/VR, manufacturing tech : ‘Silicon Beach’ (Southern California)

- The intent is to be close to the ecosystem and to your early adopter user/enterprise customer base

Go big, go home OR find a great home!

Along the way, as you’re growing fast, be expected to be approached by larger companies that may offer different forms of partnering/outcome possibilities. M&A is far more the norm than the exception (vs IPOs) and can occur at different points of your growth lifecycle

However, translated to the world of tech/venture, some elements of performance has been missing to some extent – the frequency, size and scale of value creation / exits. The current wave of product innovation is now in full swing and only likely to further increase, thanks to home-grown growth stories like Inmobi, Freshdesk, Druva, Grey Orange [Robotics], Delhivery, and more.

We need to transition the lens thru which the world looks at India/tech – performance (size and scale of value creation/exits) is the ‘enabler’.

So, here’s to collectively taking on this challenge and responsibility, helping transition the India/tech paradigm – from “India is interesting” to “India is a can’t miss, exciting opportunity!”