India's growing focus on goods exports presents a prime opportunity for startups to connect Indian manufacturers with major global buyers

We believe that the rise of goods exports and its growth potential will spark a wave of startups to support firms in this area. They may be SaaS tool providers solving for specific use cases and pain points or crossborder marketplaces enabling faster and better trade. In this essay, we focus on the latter segment, crossborder marketplaces. We will cover exporter SaaS tools in a separate essay.

***

India's export landscape is transforming significantly. Historically a powerhouse in IT and support services, the country is swiftly expanding into manufacturing and goods. This growth spurt is driven by a blend of tailwinds, particularly the strategic 'China+1' approach that encourages diversification from Chinese sourcing. Various government initiatives, including attractive production-linked incentives (PLIs), are creating a unique opportunity for India to capitalize on these trends, setting the stage for a decade of substantial growth in its export market.

The rise of emerging markets has historically been closely linked to the growth of their exports. This pattern is evident in the economic ascents of Japan and the Asian Tiger Economies (Taiwan, South Korea, Hong Kong, Singapore) in the 1960s and 1970s, where exports played a pivotal role. Similarly, China's early economic boom and Vietnam's current growth have been underpinned by a boom in exports.

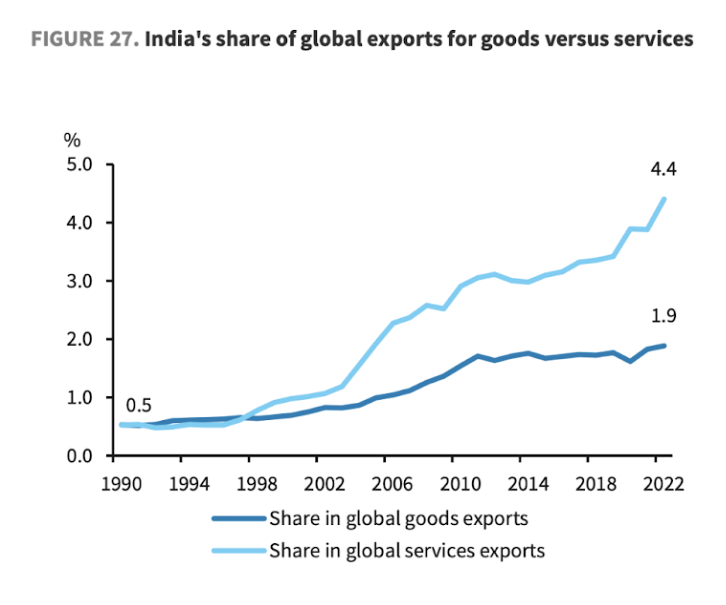

India’s road from an emerging economy to a developed one would also be helped by the growth of exports. While India has done well in terms of services exports (40% of total exports or $325bn, growing 14% annually), which is about 4.4% of global services exports, it has punched well below its weight in goods exports for a long time ($450b in FY23), where we hold just a 1.9% global share[1].

This contrast between services and goods exports presents a potential area for growth and expansion.

Tailwinds in the Export Sector

Recent years have marked the emergence of significant tailwinds bolstering India's export sector.

- Rise of India’s digital public infra: From identification to verification, invoicing to digital payments and access to credit, over the last decade India has come a long way towards digitization and formalization. As more and more businesses and factories adopt digital tools and benefit from public digital infra (UPI, AA, OCEN) they adopt common standards and practices that allow international buyers to work with them at scale.

- Supply Chain Diversification and China+1 Strategy: The West - China geopolitical tension has created a heightened focus on reducing dependency on China as the only supplier. This has led to various countries and companies beginning to diversify away from China and create multiple supply chain points, and India is beginning to emerge as a credible alternative to China.

- Government Incentives and Support: The Indian government's focus on increasing exports and production can be seen in their initiatives like Make in India and Production linked incentives (PLIs). Through a combination of increased tariffs, subsidies for producing in India, and in some cases, outright bans, the Government is trying to kickstart the growth and birth of certain industries.

A clear opportunity: Help SMBs export to large buyers

We believe that startups can aid a large number of Indian SMBs (Small and Medium Businesses) plug into the export economy and grow their business. SMBs aim to grow their business by acquiring new customers, moving up to higher Annual Contract Values (ACVs) with existing customers, and improving their unit economics and margins.

However, they often grapple with scaling issues, handicapped by limited capital and limited access/knowledge, which adversely affects their ability to sell into international markets. A common struggle among Indian suppliers is the inability to deliver products on time due to challenges in procurement, labor coordination, and overall supply chain management. It is not just delivery, in fact, these SMBs face hurdles in acquiring overseas customers by effectively marketing their offerings, further hampering their export potential.

Given these challenges, there's an emerging need for a business model where startups function as comprehensive sourcing platforms for foreign companies. By aggregating Indian SMBs or operating as managed marketplaces, these startups can facilitate superior transaction experiences for international buyers. Such models are likely to gain traction, offering streamlined solutions to the pain points currently faced by Indian exporters.

We illustrate this model here:

There is also an inverse of this, helping Indian manufacturers import relevant raw materials that they can process and export. This is where, say, a Ximcart operates, helping manufacturers source better. Both these models constitute the domain that we call Crossborder Marketplaces. We believe that crossborder marketplaces are low-hanging fruit for startups and investors seeking to benefit from export tailwinds.

All crossborder marketplaces are fundamentally B2B marketplaces. It is just that their customers (or sellers in the case of procurement models like Ximcart) are based in a different country. To understand cross-border marketplaces, we would do well to understand B2B Marketplaces.

Understanding B2B marketplaces, and the advantages of vertical marketplaces

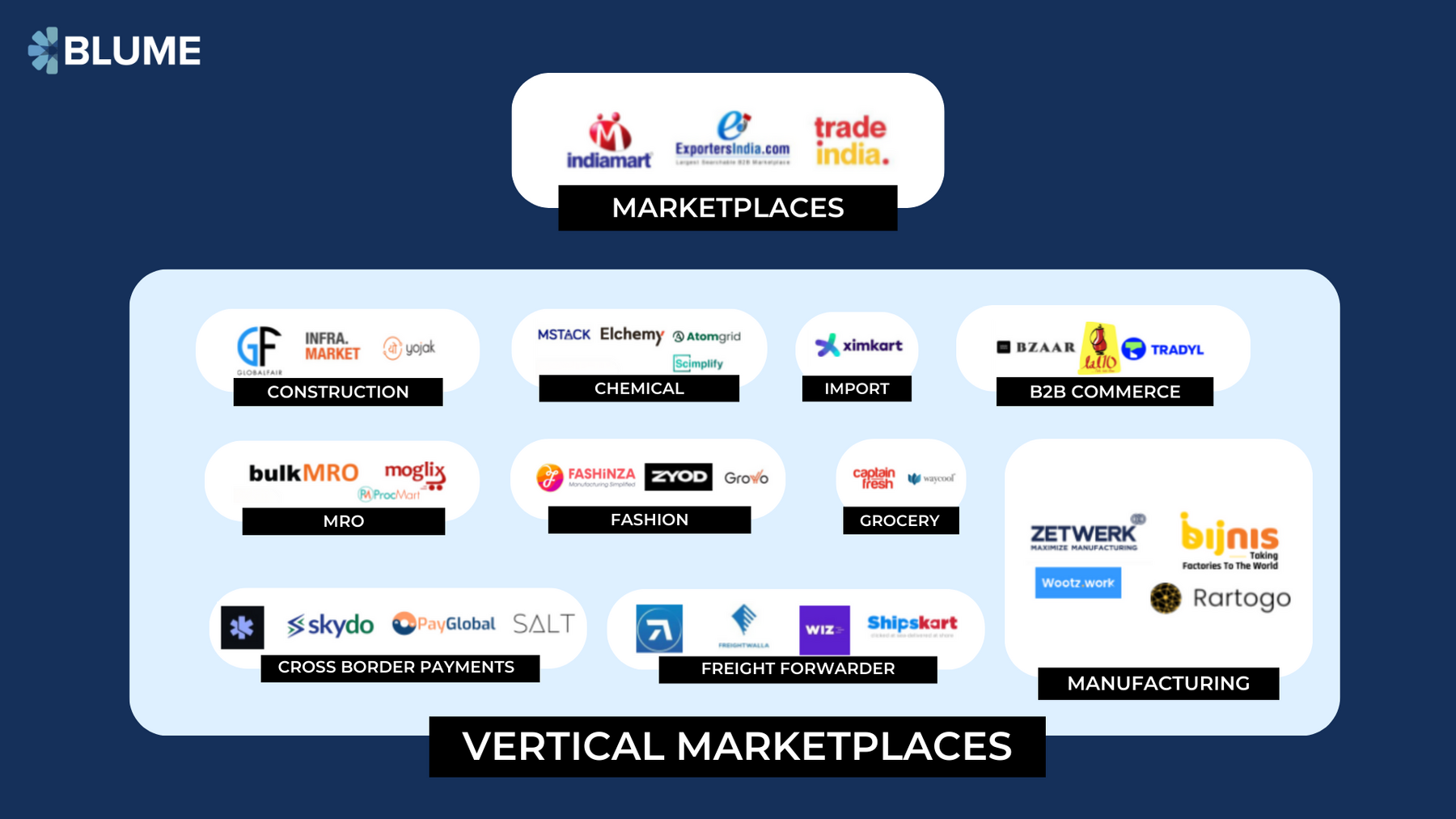

Marketplaces can be bifurcated into horizontal and vertical categories.

Horizontal marketplaces, such as Alibaba and IndiaMART, cater to a wide array of industries and transaction sizes. Despite their success, these platforms often fall short in personalized support and understanding the unique needs of each buyer, leading to subpar experiences in complex B2B transactions.

This shortcoming has paved the way for the rise of vertical marketplaces. These platforms focus on specific industries and manage the entire transaction process. Because these platforms are specific to an industry and can customize themselves to the needs of buyers and sellers in the sector, they reduce transaction friction and create a better customer experience. Thus, the vertical marketplace model is recognized for its ability to quickly create liquidity and onboard marketplace participants, leading to faster and more frequent buyer-seller interaction.

The vertical, managed marketplace model offers significant advantages for all stakeholders involved:

- Buyers: They benefit from the convenience of a single point of contact, transparent order tracking, and the reliability of engaging with established companies.

- Sellers: Their focus remains solely on production. The marketplace alleviates their need to seek out customers, manage logistics, or deal with administrative complexities.

- Marketplaces: This model allows marketplaces to expand rapidly while maintaining an asset-light approach. They also have ample room for growth through both backward and forward integration.

We are beginning to see vertical marketplace models proliferate in the crossborder marketplace landscape. Here’s a list of prominent players.

Given the advantages of the vertical marketplace model, including the lower capital outlay needed to get to product-market fit, we believe that crossborder marketplaces built around vertical industries are better poised for growth and capital efficiency.

Navigating the Startup Landscape for Maximum Impact

India's substantial $775 billion exports figure might suggest a wide-open field for marketplace disruption, but the reality is more nuanced. Success in marketplace innovation is not uniformly distributed but concentrated in sectors where the conditions are just right.

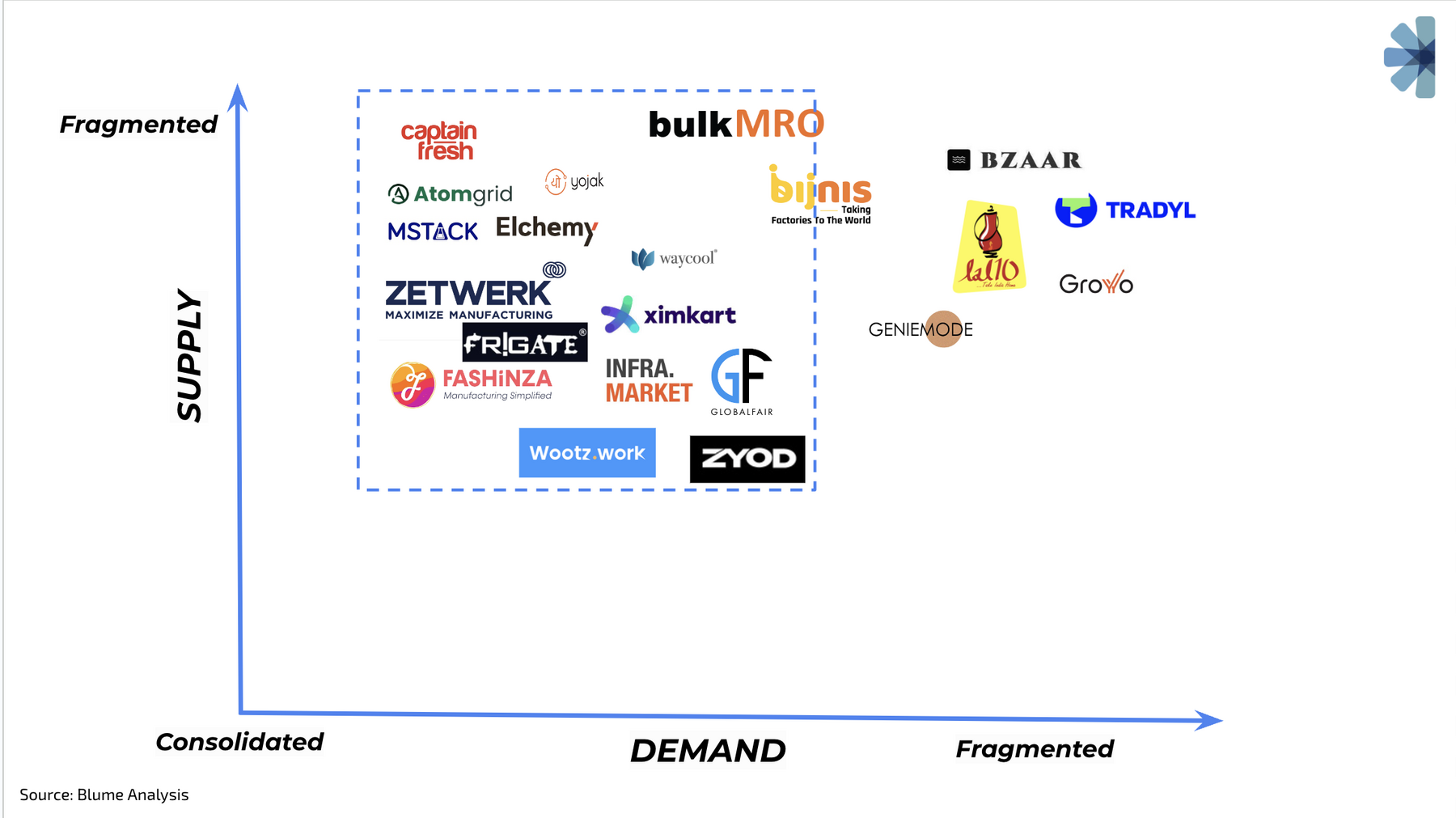

When we map venture-funded, cross-border-focused companies in a 2 x 2 matrix contrasting fragmentation/consolidation of their supply and demand, a clear pattern emerges.

Successful (crossborder) B2B Marketplaces are characterized by aggregating fragmented suppliers and selling into a consolidated demand base.

- Consolidated Demand: B2B businesses thrive with a consolidated customer base that places high-value orders, necessitating a high-touch approach. Larger orders and higher absolute margin fees help cover the customer service investments that go up front. These large buyers find it hard to aggregate orders from smaller suppliers or need help processing the goods to a certain quality and then buying, etc. They find intermediation helpful and are willing to pay for it.

- Fragmented Supply: While large suppliers often have the infrastructure to cater to (and even create) demand independently, smaller manufacturers face numerous challenges, such as generating overseas demand, establishing sales and service teams, and managing logistics. They are happy to work with intermediaries to access demand.

Examples of such managed marketplaces that aggregate fragmented supply chains for the benefit of larger organized pools of buyers (midmarket or enterprise) include GlobalFair for tiles, Fashinza for clothing, as well as AtomGrid, mStack, and Covalent in chemicals.

These marketplaces play a pivotal role in streamlining processes for factories, facilitating access to raw materials, financing, and markets, thus creating a more efficient and competitive export landscape.

The opposite, that is, selling into fragmented buyers and sourcing from consolidated sellers often means having to work with lower margins and a more expensive GTM machinery/feet on the street. Udaan is the canonical example of this model, though it is not a crossborder marketplace. Udaan’s opposite is Zetwerk. They are the canonical example of the opposite and better model in our mind - sourcing / aggregating a fragmented supply base to sell into a consolidated demand/buyer base).

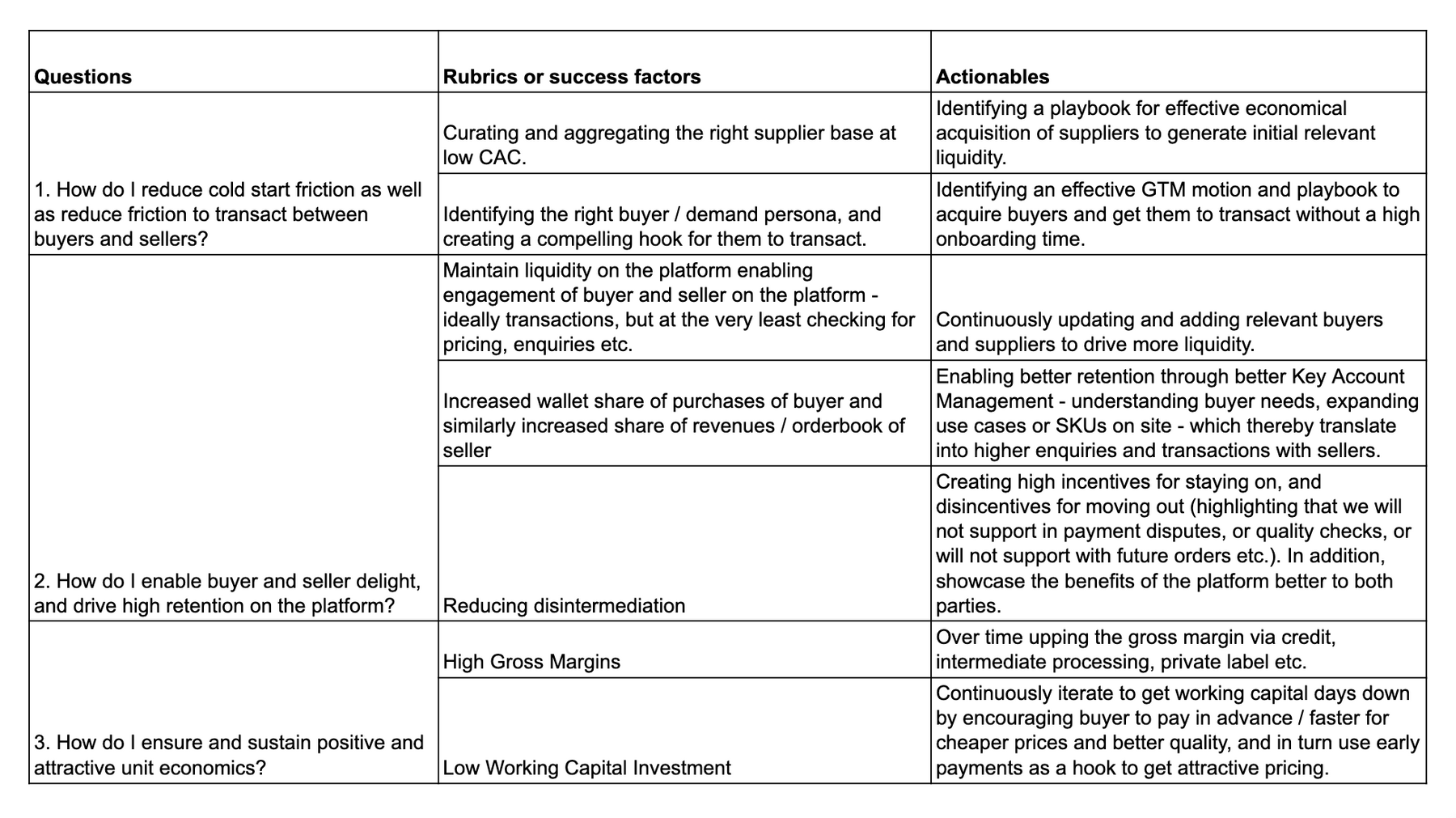

How Founders Should Approach (CrossBorder) Marketplaces

From our conversations with founders and readings, we suggest that founders should ask themselves the following questions. These cover key rubrics or success factors in (vertical) marketplace startups (specifically ‘Aggregating fragmented supply for consolidated demand’ models) and imply certain actionables that you need to undertake to win. This framework holds true for crossborder marketplaces as well as the vertical marketplaces, a special type of crossborder marketplaces.

A good way to assess your chances of success is to look at each of the actionables and assess if you have a right to win there. Do you have a capability (either people / processes / culture) that gives you a unique advantage to doing better than a competitor on each specific actionable? If not, go back to the drawing board and determine how you can gather the capability.

Our advice based on some common patterns we have seen at other marketplaces is:

- Focus on Enterprise or High ACV buyers vs SMBs or low ACV buyers: Every B2B order, big or small, requires roughly the same amount of work. With the added complexity of crossborder trade, it is better to serve larger but fewer customers.

- Customisation is okay, but complexity should be avoided: Most enterprise B2B marketplaces will get custom demand from buyers, which cannot be avoided. However, it becomes a problem when each order requires the company to set up new processes, find new suppliers, or spend a lot on R&D. There is no easy answer, but you have to walk this tightrope carefully.

- Focus on areas where an SMB would face a very high barrier to entry: Marketplaces’ biggest value unlock happens when it allows its supply to access demand which it could have never tapped into before and needs to keep using it to get that demand. Avoid spaces or sectors where you don't have a unique advantage over SMBs.

Metrics to track

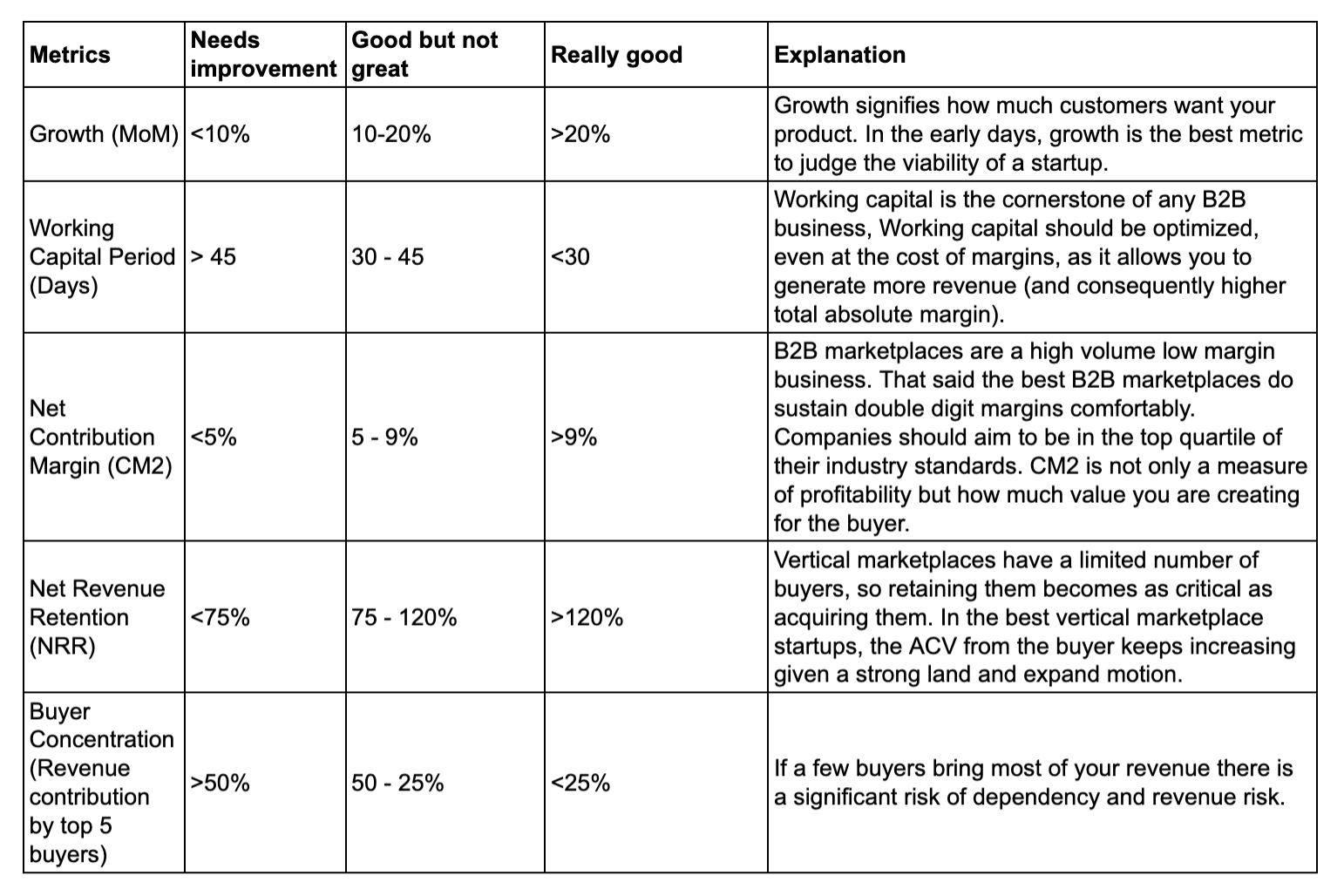

These are the key metrics that founders should track religiously.

1 - Retention, Recurrence, and Growing Wallet Share: In our preferred B2B Marketplace Model (Consolidated Demand + Fragmented Supply), the focus is on cultivating deep relationships with a relatively limited customer base that has the potential for recurring business. High customer retention rates, along with a continuously growing order book (and higher wallet share of the buyer), are indicative of a marketplace's value proposition. A cohort retention rate that is double the industry average, or closer to 80%, is a strong indicator of future success. Recurrence of orders on a periodic basis and having a stable or growing wallet share for every quarter is a must for success.

2 - Average Order Value: Due to the limited number of potential buyers (in our Consolidate Demand + Fragmented Supply model) and the intensive nature of B2B sales, high average order values are critical. A benchmark of $50,000 per contract is considered healthy, though this figure varies by industry. The rationale is that with fewer buyers, each account must contribute significantly to revenue to justify the high-touch sales process. A good sign is a continuously rising Average Order Value figure depicting that the buyer is trusting you more.

3 - Net Working Capital Days: The ideal scenario for a marketplace is to maintain working capital days at 30 or fewer. In cross-border trade, partial advance payments often provide some financial cushioning. Working capital scales linearly with GMV. So, if you want to get to $100 million in GMV With

30 days of working capital -> you need $8MN

45 days of working capital -> you need $12MN

60 days of Working capital -> you need $16M

The more working capital requirement, the more needs to be raised all other things being equal, and consequently the harder it becomes to scale the business.

Working capital employed has a huge impact on ROCE (return on capital employed). Naturally, the lesser the working capital employed, the lesser the capital, and hence, the better that ratio.

For instance, consider three businesses, all with Rs 1 crore of capital.

- 10% CM2, 60-day working capital and 7% interest on capital

- 5% CM2, 30 days working capital and 7% interest on capital

- 5% CM2, 15 days working capital and 7% interest on capital

The third business generates 35% ROCE whereas the 1st produces just slightly better (29.9%) than the 2nd one (29.5%), even with 2X CM2.

The VC perspective

Here is a handy way to understand how a VC will look at your pitch.

If you are curious as to why we did not include TAM here, that is because TAM is a subjective topic. A lot of TAM projections, at best, are Excel guesstimates. Even with well-estimated TAM numbers, the VC evaluating it brings his or her own subjective lens to evaluate it. At Blume, we don't overweight TAM in our evaluation. We believe that great founders fashion TAM from great products. The TAM for rideshare apps in 2009 before Uber launched was zero (via Jason Calacanis).

Challenges in B2B Business and Crossborder Commerce

The landscape of B2B business, particularly in the context of crossborder commerce, presents a unique set of challenges. Do keep these in mind as you set out to build your play.

- Tech Adoption: Many SME factories and buyers are slow to use new technology. The biggest issues come in observability of progress on the factory floor (poor updation of work progress, due to poor adoption on the floor) and poor response speed. This makes it tough for startups to provide visibility for buyers on the exact status / progress on work completion. There's no quick fix, but startups should work with a few suppliers who want to use the platform. If suppliers don't want to use the system, it means they don't see its value, and startups should hence avoid working with them.

- The Missing Middle: In India, there's a gap in the manufacturing world. There are lots of small factories that don't have the right tools or knowledge to deal with foreign buyers and big factories that don't need help from a middleman. The middle is, effectively missing. The best bet for serving overseas customers is the medium-sized factories that have the right skills and extra capacity. Startups that focus on these mid-sized factories will likely do the best.

- Trend of Onshoring: There's a growing trend among countries to localize manufacturing, a shift from the previous globalization trend. This poses a challenge in convincing the market that there's still a significant demand for products that can't be met by local production alone. Startups need to find a balance between supporting local manufacturing and promoting imports from India.

- India's Supply Chain Issues: The Indian supply chain is fraught with challenges, including opaque pricing, unreliable raw material sourcing, long working capital cycles, and limited access to formal credit for SMEs. These issues can lead to significant operational delays and inefficiencies.

- Competition with China: China still makes things cheaper, better, and with more variety than India, except for a few areas like pharmaceuticals, chemicals, and to some extent, car parts. It's tough to compete with China, and there's no easy solution. Getting bigger and more efficient over time is the only way to start closing that gap.

From a Barclays Research report, we have

Crossborder Marketplaces - The Time is Now!

The next decade is poised to be transformative for India's internet economy, particularly in B2B innovation and cross-border commerce. As the global market seeks alternatives to over-reliance on a single country, India could emerge as a key beneficiary of the China+1 policy shift. Factors like increased digitization, access to formal credit, and supportive government schemes are expected to accelerate this growth. Startups would do well to take advantage of this opportunity. However, it's crucial to be aware of potential pitfalls, such as focusing too narrowly on Gross Merchandise Volume (GMV), grappling with long working capital periods, and navigating the risks of bad debts.

In conclusion, while the opportunities in the B2B and cross-border commerce sectors are significant, they come with their own set of unique challenges that need strategic addressing. For those interested in this space or currently building a B2B marketplace business in India, the potential for innovation and growth is substantial.

If you are a founder building a B2B marketplace business in India, please write to us at anurag@blume.vc or sajith@blume.vc

My thanks to Sajith Pai, and our ex-colleague Amal Vats, for their help with the article.

- Barclays_Global_Equity_Strategy_India_Part_II_Right_Place_Right_Time_Global_Sector_Opportunities