From an Investor’s Lens – Empathy and Entrepreneurship

- Published

- Reading Time

- 2 minutes

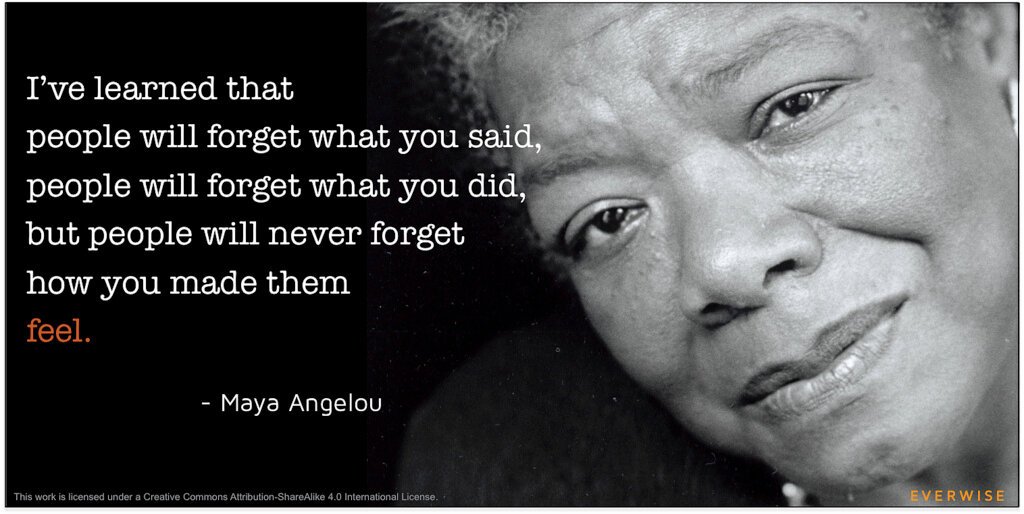

I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.

Make no mistake – the world of venture is about making numbers work

- Starting with a broad funnel to attract the best startups

- Finding your Facebook or Flipkart early on

- Having deep reserves to keep backing them

- Which in turn possibly return X times your fund

The cornerstone pillars of angel investing and venture capital are indeed numbers – with power laws and other such key constructs! This is the science of early stage investing.

What about the art – the people, or human side?

In early stage, we like to think of sourcing not as ‘deal flow’, but people flow. As much as VC is about finding that secret formula to produce superior returns, it is as much as about - People flow, entrepreneurs…. and empathy

Empathy (noun): the ability to understand and share the feelings of another

Empathy – translated to our startup world

- We are in the people flow business. Networks, relationships, reputations. As angel investors/VCs, we can yet reject the value proposition of the business idea being pursued and choose not to invest, without questioning the sense of being and entrepreneurial integrity of the founder

- Being empathetic doesn’t necessarily mean agreeing with the founder’s thesis or views (applies to portfolio founders too – not just pipeline) – it essentially boils to seeking to understand the motivating factors, the what’s and why’s that are important to the founders

Case study in point:

After a recent funding round, it emerged that one of the best skilled and available candidates for hiring a CxO level role was the founder’s spouse.

One response from us board members could have been [despite the candidates’ superior skills and eminent fit] a blanket policy statement – “this won’t work, as there is a conflict of interest”

We instead came up with an approach that the spouse be interviewed by one or two board members independently, in the absence of the founder, to better vet, assess and double-check the fit. The team [including the other founders] appreciated the maturity, transparency and objectivity of how this was handled.

The good news was the subsequent onboarding of the spouse, seen indeed as the best available candidate.

So, some quick takeaway thoughts [from an investors’ lens]

- Our business is driven by a funneling construct – accepting a small pool of applicants for funding, while rejecting a vast majority of the rest

- Putting ourselves in the founders’ shoes and thinking proactively / empathetically how we’d react and act when faced with the same situation [yes – we’re talking here –

- founder fights / breakups

- disgruntled employees stealing customer data

- illegal competitor actions

- grave health issues

- untrue accusations

- even prison time threats ]

- For both segments [even those accepted, who become our portfolio founders], listening and operating with empathy, “listening to listen and not necessarily to agree”

- You could call these hats a mix of FPG (Friend + Philosopher + Guide), chief sounding board, chief listener-at-large – rather, all of the above!

Ultimately, results are all that matter….. creating value = translated into exits remain the key defining metrics. Yet – as investors we can be both objective as well as empathetic – as we continue to back great founders and see them charge ahead, on their arduous but fantastic voyages !