Disruptors in alternative investments: How big is the opportunity?

- Published

- Reading Time

- 4 minutes

- Contents

In the ever-evolving landscape of investment opportunities, an intriguing asset class has the power to enhance returns, reduce portfolio volatility, and offer much higher diversification to astute investors. Imagine an investment avenue that has offered an average return as high as approximately 12.5% in India. Picture a realm where a CAGR of a staggering 35% was witnessed during the fiscal year 2020-2021. Consider that this enigmatic asset class commands a significant 12.9% allocation of individual wealth globally. These have been alternative investments in the Indian market.

The world of alternative investments encompasses a broad spectrum of non-traditional assets, ranging from real estate and commodities to private equity, hedge funds, cryptocurrencies, P2P lending, lease financing and more. In this world, traditional investment instruments like stocks, bonds, and mutual funds take a backseat, and opportunities to invest in alternative classes open up for investors willing to venture beyond the beaten path. For our thesis, we have deep dived primarily in the emerging alternatives spaces like lease financing, invoice discounting etc

India by numbers

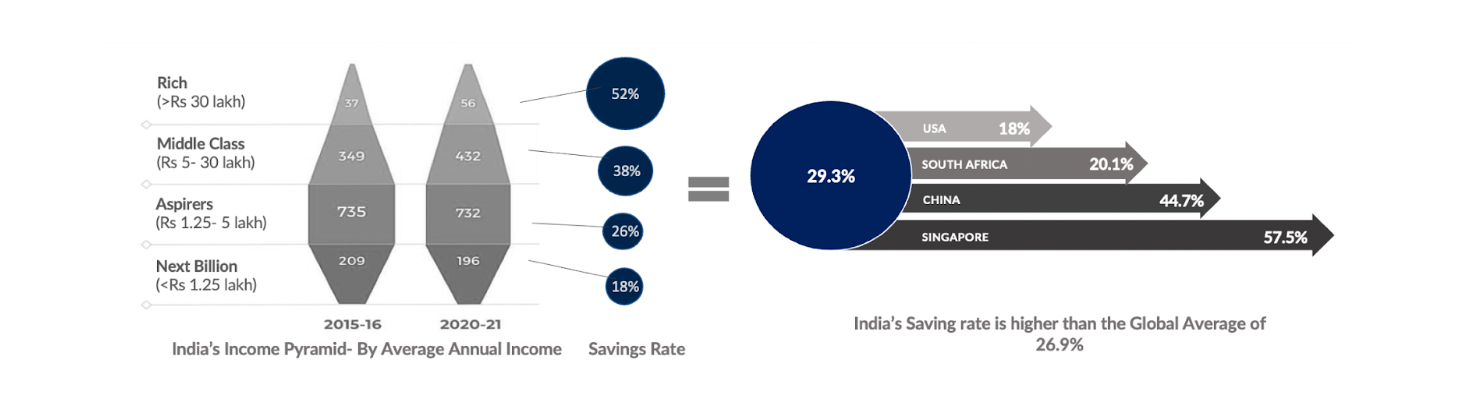

The Indian wealth market is highly tiered and stratified with four key segments, each with distinctly different savings and investment preferences.

Although India is an INR 43.2 Tn AUM market, it has just ~4mn wealth tech users who are digitally native and invest via tech platforms. They will likely be the customer base with ~30% of AUM.

India’s per-capita income crossing the $2,000 threshold, financialization of household savings (from a 44.9% to 52.5% in FY 21) with increasing bank account penetration (78% currently), growing fintech literacy and comfort (no. of number of Demat accounts rising from 55.1Mn to 89.7Mn), and access to capital market products lead to an emerging place of Alternatives within the portfolios of seasoned investors and novices alike.

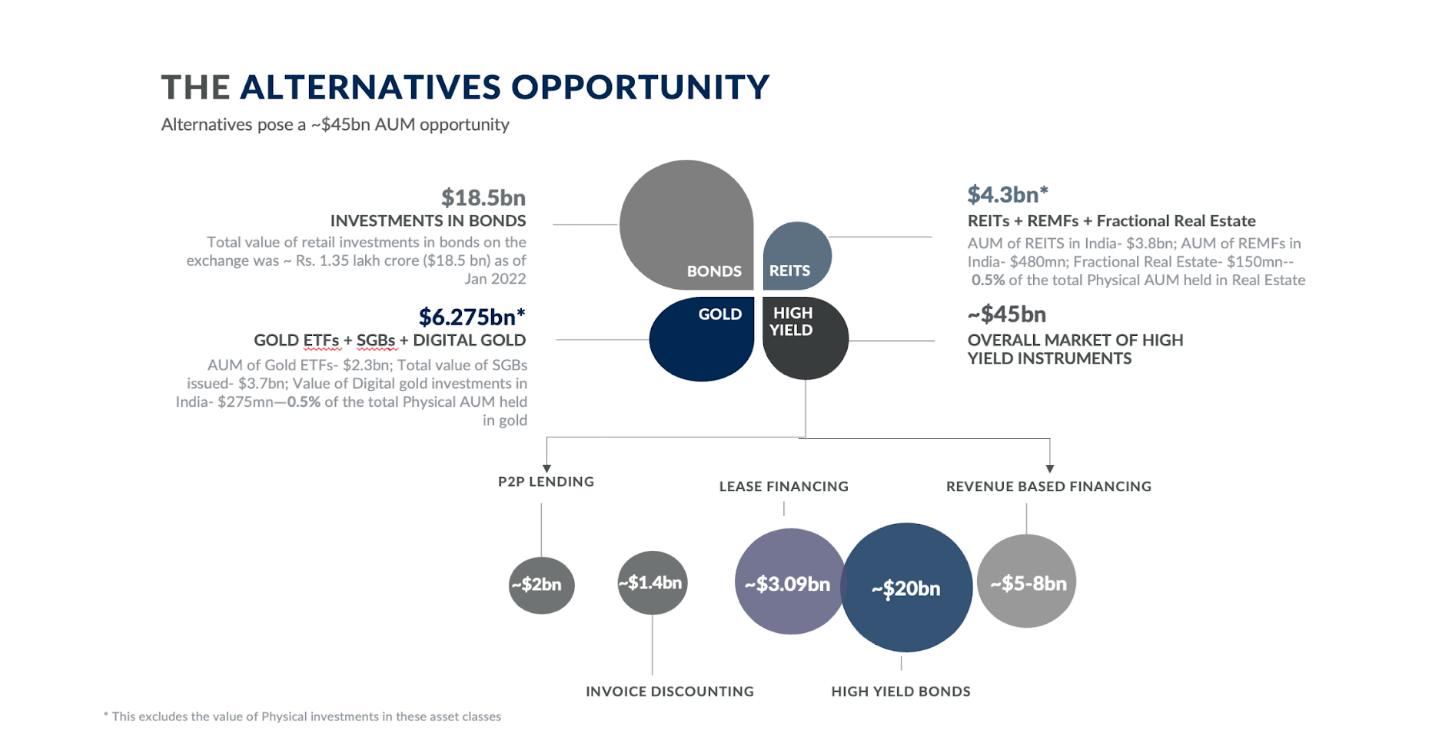

While the global allocation in alternatives stands at ~13%, <1% of individual wealth in India was allocated to this investment class in 2020. Critical reasons for such limited participation- 1) Illiquidity of investments 2) High Minimum Thresholds 3) Regulatory complexity, and 4) Lack of client education. As a result, its availability has been restricted to the top 100k families in India.

A Tale of Two Portfolios

Alternatives, as an asset class isn’t new. For more than 30 years investors have been actively diversifying their portfolios and enhancing returns by adding alternatives exposure to it. But, this investor pool has been limited to the HNIs and UHNIs of the world for the longest time with investors being primarily drawn to Category II AIFs which broadly include real estate funds, private equity funds and credit funds.

- Retail investors continue to have greater reliance on traditional investment

- Safer assets including Gold, Real Estate, FDs etc- make up 80% of the asset allocation

- This is suboptimal for long term wealth creation at the investor level as well as at the economy level -Retailers, for the longest time have been dealing with the “problem of access” in this market

- HNI’s have access to a much wider gamut of instruments

- Gold, Real estate and FDs account for only ~35% of the HNI portfolios

- Higher yield assets including bonds and alternate debt assets play a key role here

- Due to the higher entry sizes, these asset classes are often not accessible for the retail investor

Possible whitespace in building for the alternatives opportunity

Gold investments have traditionally dominated the Physical Investments market. However, the rise of digital platforms such as Jar, Paytm Gold, and other players indicates a shift in consumer investment preferences. Likewise, the Real Estate sector is experiencing disruption with the introduction of REITs and fractional investment platforms like Propshare Capital.

With the market moving towards greater financialization, more significant digital disintermediation in the value chain and higher returns in yield-bearing assets- Potential AIF investments stand close to ~45bn by FY24. However, our own realistic estimate suggests a TAM of 100k users in the Indian market.

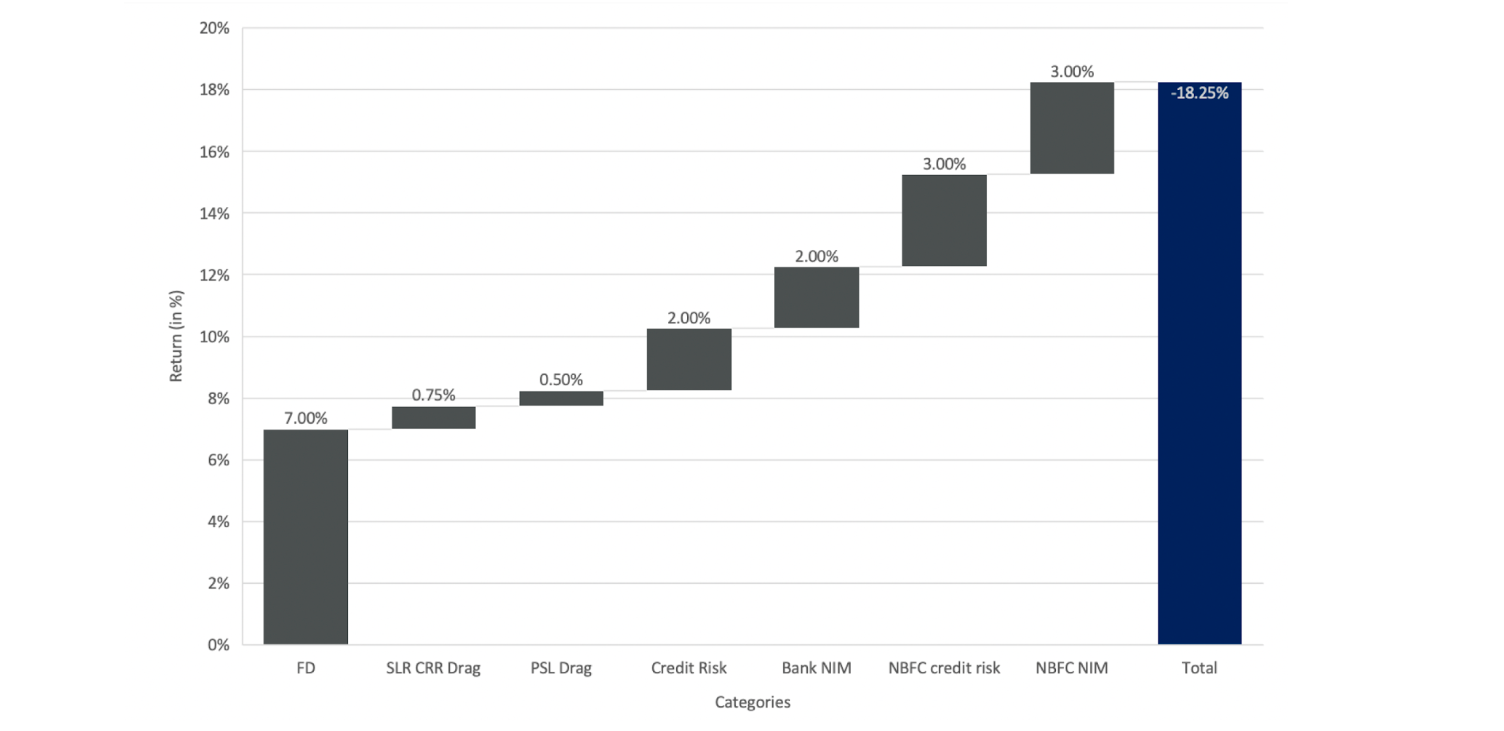

The reason for a possible market opportunity for platforms trying to disrupt the alternatives space comes down to inefficient credit transmission in the economy.

Savings of the savers reach the borrowers in two loops- first, savings getting transmitted from the savers to Banks/NBFCs and second one, Banks/NBFCs lending them to the borrowers. This is how a traditional Capital distribution network works.

However, there are two reasons why inefficiencies exist in the above flows:

1. Aggregation of depositors with different returns expectations in the value chain. Depositor preferences are wide- some depositors want high returns while others want non-risky low returns. Such dissemination doesn’t happen much at the Bank/NBFC level. Thus, there’s a bundling of different return expectations that come with bank deposits- hence, instruments like P2P lending, lease financing, invoice discounting allow such disintermediation.

2. Credit transmission ( as illustrated in the chart)- NBFCs operate at a high cost base and address a wider risk spectrum, thus, disintermediation in every large non-PSL credit category is expected. Alternatives is an asset class best suited for retail investors (foreign capital and institutional capital)

We think an effective Distributor Platform in this space would:-

- Provide easy access & global integration of a suite of asset classes- Emergence of fee based multi-asset distribution platforms/managers who have a rating first approach, not originators of the assets, eg a mix of Smallcase and Crisil

- Solve for customer trust- A platform that provides customer access and unbiased advice on the quality of investment products

- Solve for customer experience- A platform that provides services such as auto-reinvest will allow investors to automatically redirect returns to newer opportunities providing hassle free compounding of returns

Conclusion

While alternative investments do pose an exciting opportunity, preliminary estimate suggest that total number of users who are actively investing in alternative instruments through online platforms in India today are only ~100k users

However, there is a notable opportunity for disruptors to tap into the growing demand for credit in sectors like renewables, agriculture, wholesale trade, and commercial real estate. This presents a chance to expand the market beyond the exclusive top 100,000 investors and make these asset classes accessible to at least the top 5 million families in India. We think, trust-based multi-asset distribution models can potentially disrupt the market in the desired manner.