Davids Vs Covid 5: Managing SaaS Businesses During Covid-19

- Published

- Reading Time

- 6 minutes

- Contents

During these unprecedented times, SaaS founders, CEOs and leadership teams are grappling with rising uncertainties on a daily basis. While it is impossible for any one person to have all the answers on the path ahead, our belief is that, collectively, we might be able to wade through these troubled waters.

As a part of Blume Ventures’ Davids vs Covid sessions, we invited Sreedhar Peddineni (Co-founder, Gainsight and Host Analytics) to talk to SaaS founders from our portfolio companies and other SaaS startups. In addition to starting one of the most successful customer success companies globally, Sreedhar has been in the SaaS ecosystem for as long as SaaS has been around – he has experienced Y2K, 9/11, and the subprime crisis.

Inflection points leading to founding of Gainsight

Sreedhar’s entrepreneurial journey started with his long time partner, Jim Eberlin, when the duo founded Host Analytics in 2001. Host Analytics was amongst the early Enterprise B2B SaaS businesses globally. And is a market leader in the space of “Corporate Performance Management”.

Early in 2008, Host Analytics had raised their Series A, after many years of bootstrapping by its founders. While the company was scaling well on all fronts with marquee customer logos, large enterprise deals, analyst recognitions, etc, the broader economy & all businesses were hit with the subprime crisis and ensuing recession.

For most SaaS businesses, the economic crisis resulted in slower growth and increasing churn rates. This also lead to a growing realization that:

While every business is affected in an adverse market scenario, SaaS businesses are much better placed to weather the storm, if (and only if) the existing install base of customers can be retained.

And Customer Retention requires intentionality and proactive initiatives from the SaaS business to ensure on-going customer engagement and satisfaction.

With this realization and while executing on customer success (as we know it now) manually at Host Analytics, Jim Eberlin and Sreedhar Peddineni started ideating on the tooling necessary for customer centric SaaS businesses to get ahead of the curve on monitoring customer health, driving proactive customer engagement and delivering value. This effort led to the founding of Gainsight in 2011, which today is a market leading “customer success platform” and widely credited to be the creator of a new category.

Ironically, and little over a decade later, the world is facing yet another crisis. And yet again, the top priority for most SaaS businesses is customer retention!

Sreedhar walks us through the common patterns that emerge during such crises – both from the perspective of end customers (externally) and that of SaaS company founders (internally). For both these groups, “#1 goal” would be self preservation.

Customer perspective

While customers are cutting down on costs, business continuity is also on the top of their minds, and the tools required by their workforce (“essential services”) and the tools with strong / demonstrable ROI will be less impacted during the first wave of cost reduction.

Unused software subscriptions, followed by software subscriptions where the ROI perception is not strong enough, will be amongst the first expenses to be cut by the customers.

Even when the subscriptions are not cancelled, there will be downward pressure on pricing, discounts, payment terms, etc. This will inevitably lead to an increase in churn for most SaaS companies.

Most new purchases will be deferred, unless they are critical to their business and can directly help the customer to save on their costs to do more with less!

Given this broader economic context, it is important for SaaS founders to understand where their product & services fit in the customer’s hierarchy of needs. It is imperative for every SaaS business to deliver demonstrable and meaningful value to the customers, if we are to avoid facing the proverbial axe during each downturn.

SaaS founder’s perspective

While the decisions made by SaaS founders during these times will be influenced based on the “runway” the company has, judicious allocation of capital, reducing the burn and increasing the runway for the business will be on everyone’s priority list.

Some common patterns from a SaaS business perspective and suggestions shared by Sreedhar include the following:

Expect increase in Churn

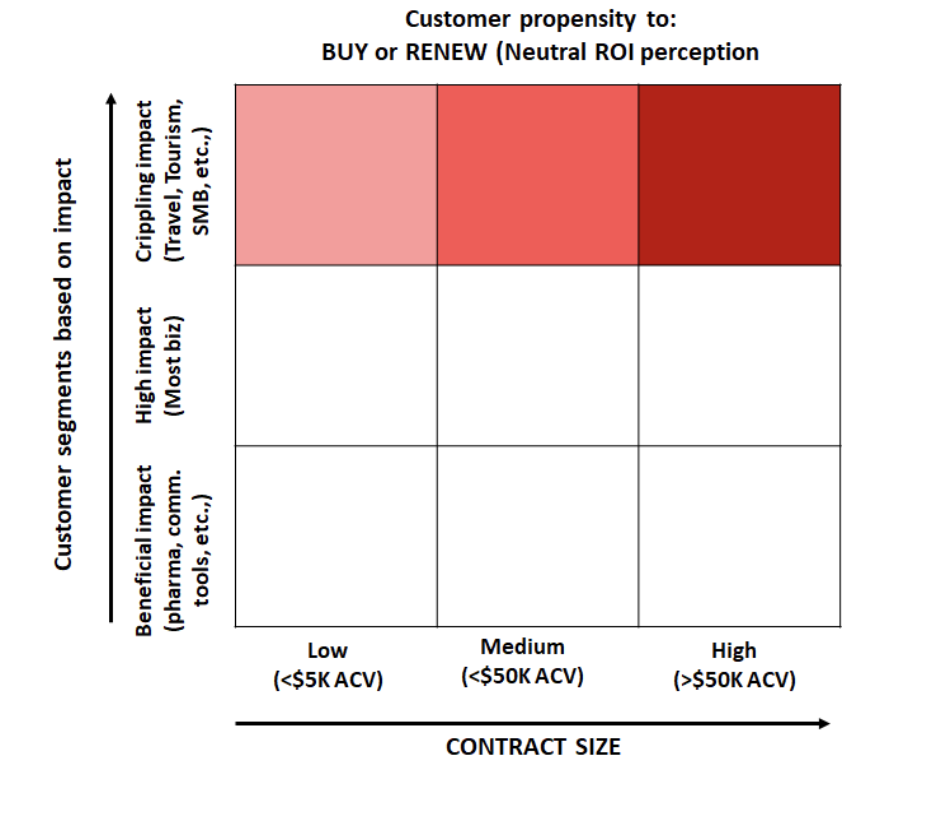

Churn will increase across all customer segments. But a closer analysis of the install base data will help the SaaS founders to make well informed decisions to manage the churn proactively. Sreedhar laid out the matrix below to assess the customer install base and pipeline:

If your SaaS business is a horizontal play, selling to customers across all industries and sizes – it will be helpful to analyze your install base and also the pipeline by industry and recessionary impact on that industry.

Churn has a direct correlation with customer’s business; and the customers operating in highly impacted sectors such as Travel, Tourism, etc will have a higher tendency to cancel their software subscriptions, compared to the segments that are less impacted by the current scenario.

Similarly, transactional SaaS businesses (small contract sizes and large number of customers) are likely to see a greater increase in churn, compared to the SaaS businesses selling large deals to enterprise customers.

Prioritization of Customer Retention Effort

Armed with install base data, businesses can appropriately prioritize their efforts with customer retention. We can look at this from two ends of the spectrum.

- Retaining Large Customers: At most SaaS businesses, large customers (based on contract sizes) tend to have named Customer Success Managers (CSMs), with each CSM managing a smaller number of customers (say 20 customers or less). In this scenario, it is worthwhile to carry out a deep account health review for each customer, starting with the customers coming up for renewal in the near term. There are many parameters that go into Enterprise Customer Health Reviews, including parameters such as product adoption, ROI perception, customer satisfaction (ex: NPS by Customer), executive relationships, etc. Customer retention related decisions for these large customers may be made on a per customer basis. For example, for a customer who is severely impacted in the current scenario, you may choose to offer your service for free or nominal charges for a 3 or 6 month term, instead of letting the customer to churn and win back the business when the economic cycle turns for the better!

- Retaining Small Customers: For SaaS businesses with a large number of small customers (based on contract size), it is common to see a CSM manage several hundreds of customers and the relationships with these customers tend to be more transactional in nature and less relationship driven! In this scenario, it is not practical to make decisions on a per customer basis and instead decisions are made either on a global basis (applicable for all customers) or based on a customer segment. For example, a SaaS business offering a “starter pack” to startups may choose to launch a special discount to eligible startups that meet predefined criterion.

Changing priorities across the business & cross functional collaboration

Every crisis has a silver lining – with SaaS founders leading their startups from the front, these times of crisis can help bring their teams together, get them to collaborate better and work towards the common shared goals!

During difficult times like these, most functions within the SaaS business undergo an objective reprioritization exercise, with a singular focus on sustaining the business. Some examples include:

For most SaaS companies, Sales and Marketing constitutes the largest spend. During times like these, most big ticket expenses such as marketing events, non essential T&E expenses, etc would be cut significantly. And Sales teams will focus on reprioritizing their pipeline of leads and opportunities based on the impact.

All functions should rally behind the Sales team and support the initiatives that help in customer acquisition. Similar rally effort happens for saving the customers – i.e. retaining existing customers.

While Marketing teams will spend more time on content creation, inbound lead generation, etc, they should also help the renewal teams in articulation of the value delivered to the customers. And help the sales teams with enablement content such as case studies, whitepapers, ROI calculators, etc.

Customer success teams should also double down on obtaining customer testimonials and customer references.

Product and engineering teams should be more open to look at ways in which they can help customer facing teams to:

- Improve customer retention: Are there long pending customer asks and low priority bug fixes that can be prioritized?

- Improve efficiencies: Can the product(s) be improved to reduce the incidence of customer support issues? Can products be improved to simplify the customer onboarding process?

Founders of SaaS startup businesses have a critical role to play in motivating their teammates to rally together and face the challenges that lie ahead of us, together.

Conclusion

While these are challenging and stressful times for all businesses, SaaS businesses with strong business models and strong customer orientation across all functions in the business will emerge stronger out of this storm.