India is yet to realise its true potential

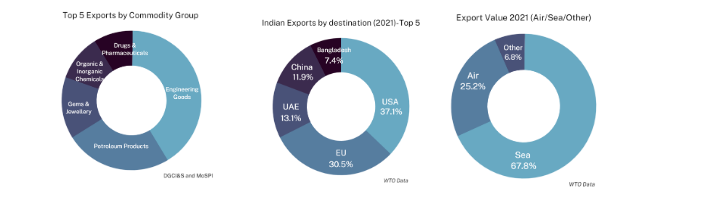

India’s merchandise exports crossed $400 Bn in FY21-22, making merchandise exports 13.3% of the annual GDP in the same year. India’s merchandise trade is at 30.5% of the annual GDP. The government targets $1 Tn in merchandise exports by 2030. This creates adequate hope and scope for an export-led economic engine that runs on an efficient system of transport, warehousing facilities and tech-enabled logistics operations.

The current status of India’s merchandise exports and cross-border trade, in general, is set to undergo transformative change over the next decade. This change is being led by the evolving global trade scenario, India’s own policy push and market dynamics necessitating the need for efficient cross-border logistics.

A look at neighbouring China’s rise may have some lessons. China’s mature logistics set-up has been foundational to the growth of its exports which make up 15.07% of world exports. It has emerged as a logistics superpower providing impetus to its $3.36 Tn of merchandise exports.

However, the evolution of the sector in India is likely to have some key differences compared to our Eastern neighbours. For starters, the challenges faced by the Indian logistics sector are fundamentally different. The logistics sector continues to be fragmented, technology adoption is still nascent and moreover, consumer expectations on fulfilment timelines have changed substantially.

There are three key trends shaping the sector today:

China+1

The world today is seeing massive supply chain reconfigurations with excessive reliance on any one geography being seen as a key risk. While China emerged as the singular “factory for the world” over the last 30 years, geopolitical tensions and recent Covid-related disruptions have led the world to believe a diversified supply chain that relies on friend-shoring and a China-plus-one strategy is a sound way to establish business continuity.

While Vietnam, Bangladesh and India are countries that are set to gain from this move, India is already emerging as a major beneficiary. Apple Inc intends to make one out of four iPhones in India by 2025. Samsung has already spent $650 Mn to set up a factory in Noida, UP-a display manufacturing unit that has been moved from China to India. Apart from Samsung, Foxconn, Hon Hai, Rising Star, Wistron have availed of the government’s PLI (Production Linked Incentives) Scheme, a scheme that targets growth in manufacturing output across sectors like electronics, textiles, pharma, and specialty steel, to name a few.

All of these developments lead us to believe that China’s loss will indeed be India’s gain. The increased trade will also necessitate the logistics sector to become more efficient.

Policy support

Toward this objective, the Government of India released the National Logistics Policy in September this year. It has been envisioned to aid India’s efforts towards becoming a manufacturing hub. This in turn will boost international trade. The aim as stated is to reduce logistics costs from 13% to a single-digit percentage, thus unlocking much-needed efficiency.

In addition to logistics emerging as a policy priority for the government, cross-border exports have also been seen as an important step towards sustained growth. The twin objectives of a $5 Tn economy and Atmanirbhar Bharat rely on two components - exports and employment.

Exports rely on two facets of the economy - manufacturing and infrastructure. A network of well-connected, integrated logistics network is integral to infrastructure.

Market Dynamics

The continued growth of E-commerce in India is at a stage today where Indian sellers are actively starting to explore greener pastures of overseas markets.

- The Amazon Global Selling Program has had close to 100k exporters since its launch in 2015. During the Black Friday and Cyber Monday sale in 2021, Indian exporters registered with Amazon Global Selling witnessed a nearly 2X surge in demand across North America, Europe, the Middle East and North Africa.

- From Indian D2C brands to global D2C brands from India. Indian D2C brands are increasingly looking at adjacent markets to fuel growth. (Logistics market size estimate is $5 Bn)

Given this context, there are a few key green shoots progress that we at Blume Ventures have been noticing from our vantage point as investors in this sector. These could help unlock India's potential to build much-needed cross-border logistics infrastructure to enable greater velocity of trade.

Green shoots of Progress

- The emergence of express logistics/air cargo:

- Only 25% of India’s exports utilise the air route as compared to China’s 30.6% A parliamentary committee report on the status of air connectivity in India noted that the total air cargo throughput handled by all Indian airports put together is less than that handled by individual airports like Hong Kong and Shanghai.

- Seen in this light, China’s emphasis on air freight provides direction. The direct-line model popularized by Shein has driven air cargo demand. Small volumes are moved via air freight to enable swift last-mile deliveries. Air cargo from China is projected to increase from 1.3 million tons in 2020 to nearly 2.0 million tons by 2025.

- Growth of Digital freight forwarders

- Digital freight forwarders have emerged in every major geography around the world. They seek to solve bad customer experiences by providing transparency. Major players such as Flexport in the US, Forto in Europe and Wiz Freight and Cogoport in India have already achieved reasonable scale and significant funding. These players specialise in a few key lanes to be able to scale effectively. The window of opportunity still remains for another digital freight forwarder to emerge in India however Wiz Freight and Cogoport would have made headway in key lanes already. Players with a differentiated cargo or lane focus still have an opportunity.

- The emergence of Orchestration platforms

- The emergence of tech-led orchestration platforms is in sharp contrast to the evolution of logistics in other geographies (which have largely relied on large players). This model acts as a virtual 4PL helping customers choose services from multiple 3PLs via a decision-making engine. Orchestration is particularly relevant in the Indian context given the extreme fragmentation in the sector, these platforms incentivise greater adoption of technology thereby solving for greater control and transparency in the process. Omnivio and Clickpost are a few names in India.

- Solving for the needs of D2C brands

- Fulfilment by Amazon is a solution that allows users to send their products to Amazon Fulfillment Centres. From there, Amazon takes care of packing, shipping and delivering the products. Ecommerce export programs like the one hosted by Amazon is one way to sell in global markets. India, however is seeing a spurt in the number of D2C brands that will have an appetite for end-to-end logistics solutions similar to the one offered by FBA.

Given the changing consumer preferences, a favourable geo-political and domestic policy environment provides a fertile ground for new players to emerge cross border logistics, not just for India- but for the world.