Blume Day VII – in a word: Scale!

- Published

- Reading Time

- 4 minutes

- Contents

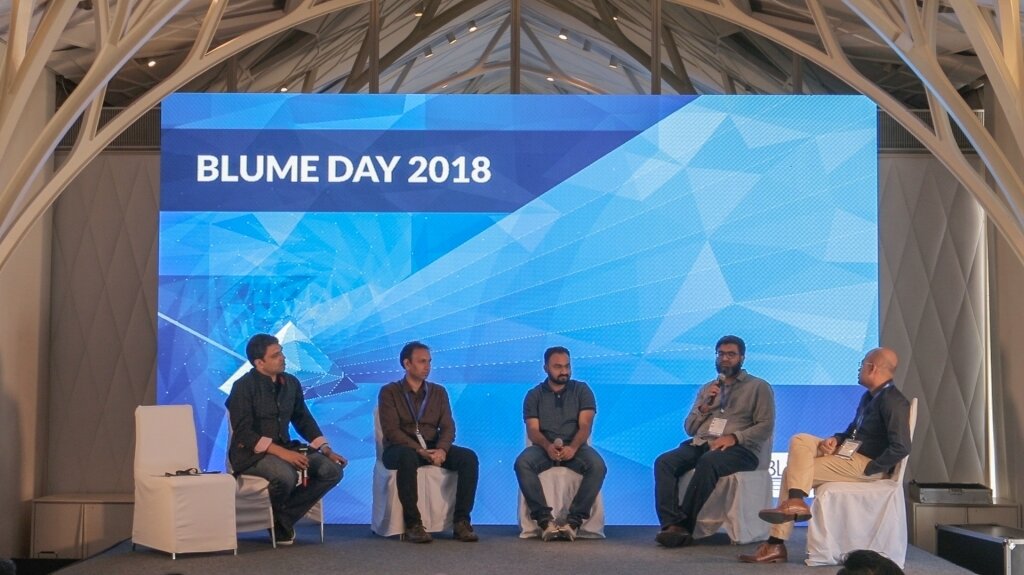

Feb 9th, Blume Day 2018, our 7th edition saw….

- An attendance of over 300

- More than 100 Blume founders (Blumiers, as we like to call them!)

- Panel / speaker guests from Zomato, Bain, Youtube, Unilever, TFS/Ola, Uber, and more

- Overseas visitors not only from the traditional Western hemisphere, but increasingly from nearer-shore regions like Japan, China, SE Asia, and UAE

Lets rewind for a moment – to 2011, our inaugural year ….

Blume Day Edition I – at Mumbai’s Breach Candy Club – saw all of 30-40 guests, half a dozen portfolios (actually fairly large even then, by Investment Year 1 standards!) …. The past 7 years in Blume’s journey have flown by so quickly!

What’s stayed the same?

First principles – all our events, and the sessions and keynotes around them, have always been designed around – our founders. The intent of inviting guest speakers, domain experts, entrepreneurs and business leaders has always been two pronged – an opportunity to keep learning new new things, and expand connections

What’s changed? - in two words: Scale and Maturity

- Scale delivered on a different magnitude-of-network level – has risen from a dozen founders to over 100+ today!

- Maturity of the ‘founder collective‘ – which has evolved significantly as a group, with individual emerging winners further breaking out. Many have secured follow-on financing rounds from leading VCs including Sequoia, Accel, Tiger Global, Nexus, Kalaari, Lightspeed, and many more; and also corporates and strategics including notably, Google (into Dunzo), Unilever (into Milkbasket) and more.

Blume Day, like every prior year, is also a time for introspection and reflection, and hence, while thoughts are still fresh in mind, this blogpost is meant to share the most significant highlights.

Momentum and scale of value creation and exits is increasing

It was timely to have Deepinder @ Zomato and Mohit @ Runnr share their parallel journeys of their paths converging, culminating in the latter’s acquisition by Zomato in 2017. This further builds on earlier exits, from Little Eye Labs/Facebook (~$18M), Zipdial/Twitter (~40M), to TFS/Ola (~ $200M) – showing the evolution and growing maturity of the exits landscape.

Another interesting revelation – while we all continue to get excited about today’s e-com soon-to-be-unicorns, usually funded by giant Chinese strategics (or SoftBank) – we also re discovered a new breed of existing startups from our own portfolio, that have been profitable for 3 years running! With positive EBITDA and decent growth rates, these are actually qualified for an IPO listing! (in turn, resulting in tangible and immediate wealth creation for the founders, VC, and Fund LPs) on SME exchanges, for example. This represents a new avenue for liquidity creation, and is worth noting.

Moving beyond the traditional base of investors

Above the $100M level, the ecosystem has always seen active and growing interest from the West (Amazon and Naspers being two prime movers).

Recently, there has been a visible shift to the East – the Japanese (though at late stage growth stages, there’s still only Softbank), Chinese (adding to the BAT trio – now more recently, Xiaomi, Meituan, and even more early stage investors like Shunwei – the latter coming into two of our Blume cos) and a host of SE Asian VCs leading the charge.

Whats more interesting – this overseas interest continues even into the earlier stage. Witness a broadening contingent of Japanese and Asian corporates, strategics and family offices – interested in both financial returns and also in helping entrepreneurs via portfolio synergies or taking them to their Japanese corporate clients

Most importantly, it is a positive and welcome trend to see these new breed of investors making investment decisions and moving quickly! Google’s first ever India investment into our Dunzo is a prime instance.

The two Indias

Beyond the SMB, the definitions of B2C and B2B have also undergone a shift –

- Consumer internet 3.0 – solving India-specific, nuanced problems

Horizontal e-commerce is more or less done, ergo – more a battle between the top 2 or 3 (Amazon vs Flipkart and Paytm)

Vertical e-comm is also similar, with category leaders in different verticals having already emerged (e.g. health care / pharma / medicine delivery; online furniture and so on)

What we’re seeing today is founders thinking carefully and creatively, creating solutions to solve very India nuanced/specific pain points. From Blume’s portfolio, these include Railyatri (your single stop for all things related to online rail travel – full stack platform from bookings to ordering food to tracking minute to minute delays); Milkbasket (super-local grocery and related daily deliveries), etc.

- B2B: life beyond Saas!

For the past decade, B2B was synonymous with SaaS, from CRM to Payroll to HR to Salesforce effectiveness and other such functional products/platforms. When asked the question “is real product-driven tech innovation happening”?, one could point perhaps to the same base players existing since the 2000s e.g. Inmobi, Druva, and Capillary.

Fast forward to today – where IoT, robotics, life sciences/biotech, healthcare tech and other sectors are seeing deep tech platforms like AI/ML, AR/VR, data science etc applied to them and becoming a reality

Within Blume’s portfolio – Locus (AI/ML driven routing optimization for logistics), Tricog (again an AI driven ‘virtual cardiologist’ platform with an integrated hardware and software stack), Grey Orange (robotics for warehousing automation) are just three examples of deeper-tech IP driven enterprise startups for global markets.

Evolution of the SMB!

Lessons from a founders’ personal journey

The audience at Blume Day were keenly awaiting the keynote finale with Zomato’s Deepinder Goyal being “interviewed” by Bain & Co Chairman Sri Rajan (interestingly, where Deepinder began his career!)

What made the fireside exchange even more engaging:

- It brought to the fore, the full stack virtuous lifecycle of an entrepreneurial journey – showing the founder’s genesis as a consultant, eventually leaving after 2 years to start Foodlet (that then became Zomato) and here today, sharing the same stage as his former Bain Boss !

- Hearing what a large war chest of capital (a further $200M from Alibaba recently) changes – yet doesn’t change

- Finally and most importantly, hearing first-hand candid insights into the personal journey of a founder. We all know founders/ceos have lonely lives, and the nature of their cycle is go thru ebbs and flows, dips and spikes, and the cultural aspects of acquisitions (“people, not balance sheets”)

- Hearing this personal side of a founder’s journey was one of the more striking parts of the evening – and a special thanks to Deepider and Sri for making it !

Thanks again to all those who could make it to Blume Day!