Understanding India: The Indus Valley Annual Report 2022

- Published

- Reading Time

- less than a minute

- Contents

We very excited to release the 1st Indus Valley Annual Report to the world. Indus Valley is our moniker for India’s startup ecosystem. This issue takes stock of the rise and evolution of this ecosystem, reviews 2021, and finally looks at what to expect in the future. In this article, we have tried to present a brief outline of the report.

The report has 3 sections

- Understanding India

- Understanding Indus Valley

- State of the Valley 2021

Resource

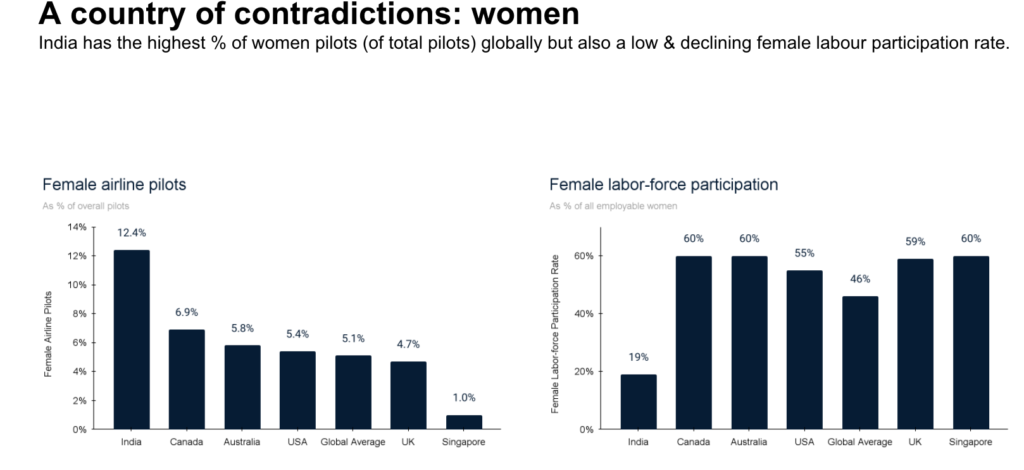

Understanding India as a country of contradictions

Here’s an astonishing fact – India has the highest number of women pilots at 12.4% of total pilots (one in every eight pilots is a woman), but simultaneously also one of the lowest female labour participation rate!

Understanding India through data

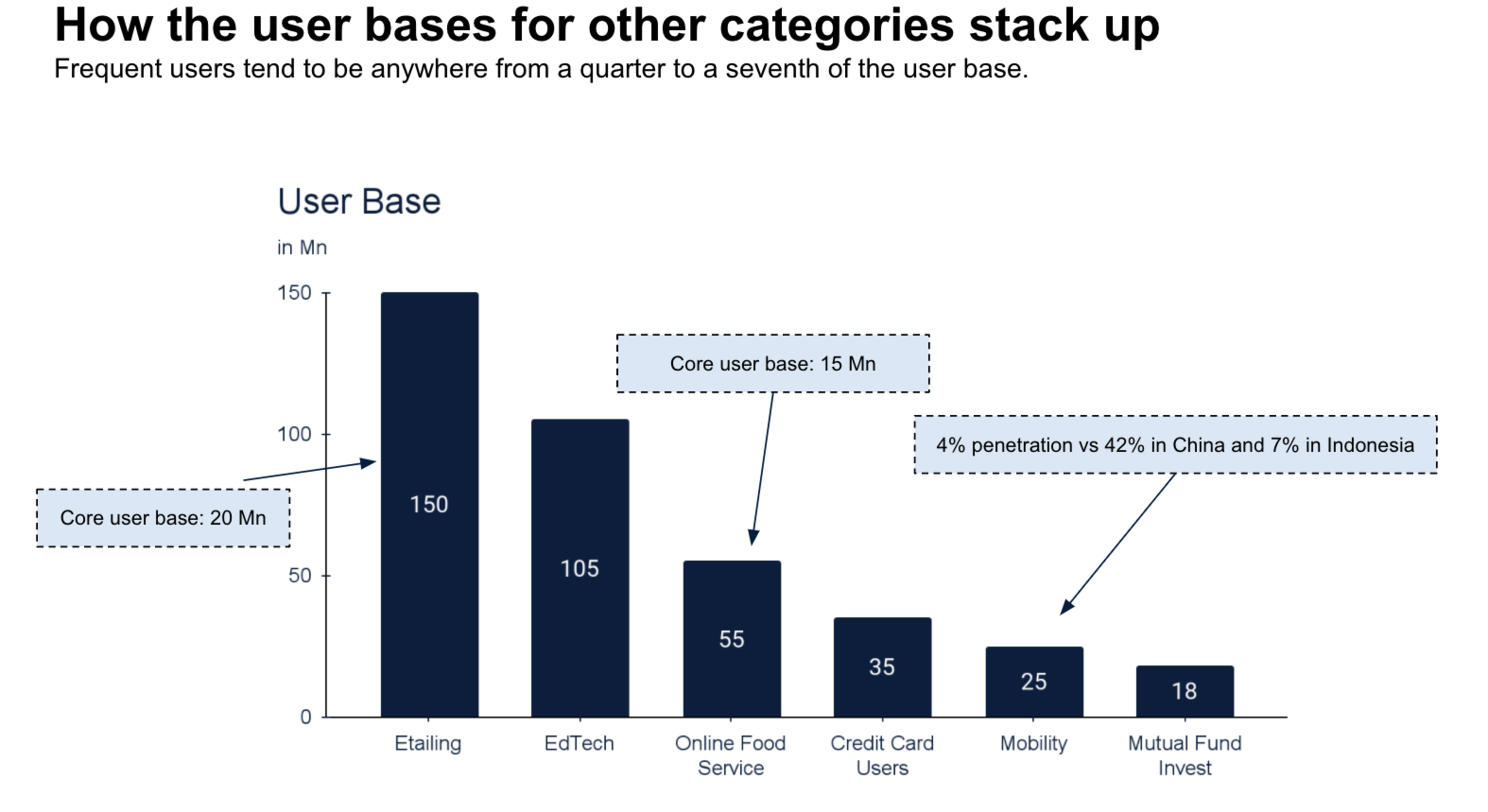

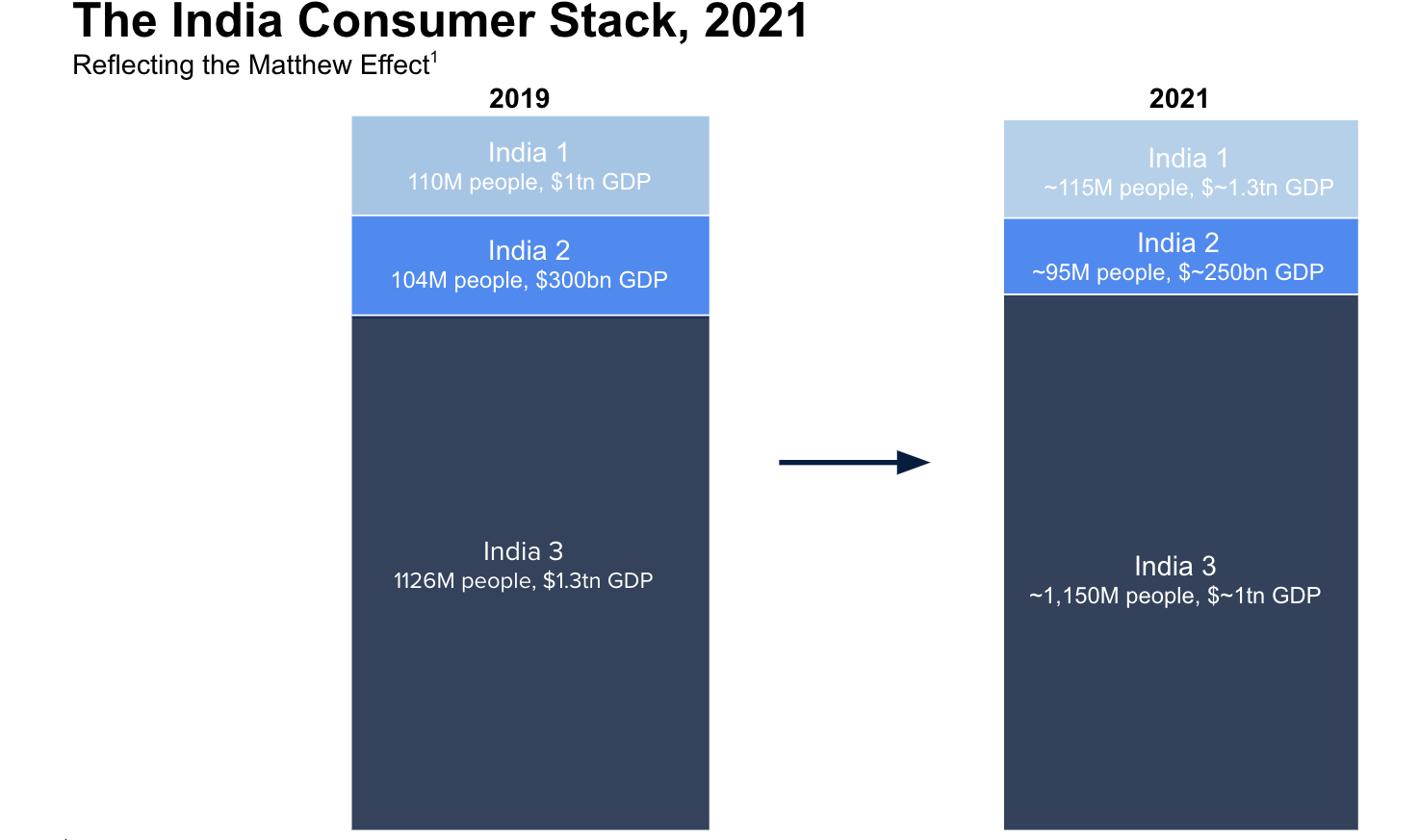

While we all think of India as a billion-large population, much of the heavy lifting on consumption is by a slim class of consumers, about 10-12% of the population, though still sizeable at ~100m.

While we were hoping for this consuming class to expand steadily, COVID has led to the poor taking a massive hit from the economic disruptions. As a consequence, Post-COVID, India1 has further pulled away from India2 and India3. While we are still calibrating these numbers, we expect the broad trends to still hold.

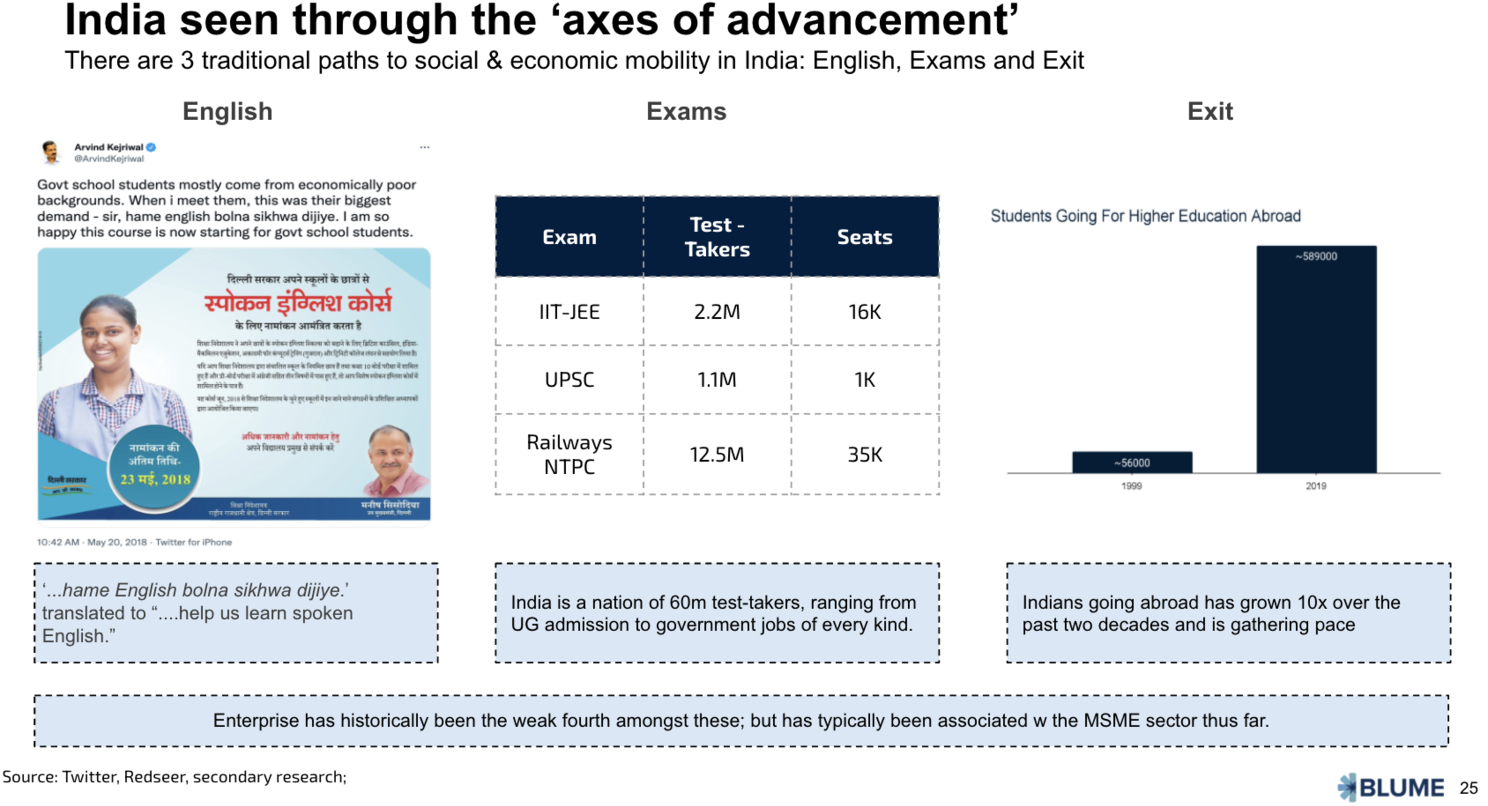

Understanding India through ideas of India

Here, we try to understand how English fluency, success in exams, and achieving exit to a country abroad can be taken as the three axes of advancement in India.

Access the full report here to further understand the Indus Valley and State of the Valley 2021.

This article is merely a shadow of the overall picture we’ve tried to show in our full report. We say ‘tried’, because we took a data and observation oriented approach. While the observations are ours, the time spent in writing this report made our conviction stronger on the fact that India is a data-starved nation. So. a special thanks in particular to all of the analysts, writers and researchers whose work we built on; in particular RedSeer and Bain & Co. for their data rich reports.