Our Partnership With Bluecopa – Bringing The Next Generation Of Business Observability & Finance Operations For The Data-Driven Intelligent Enterprise

- Published

- Reading Time

- 5 minutes

- Contents

We, at Blume Ventures, are very excited to announce our partnership with Bluecopa – A strategic finance platform, which is ushering in collaboration, near real time data transformation & normalization from multiple data sources, into a spreadsheet interface for high volume transaction enterprises.

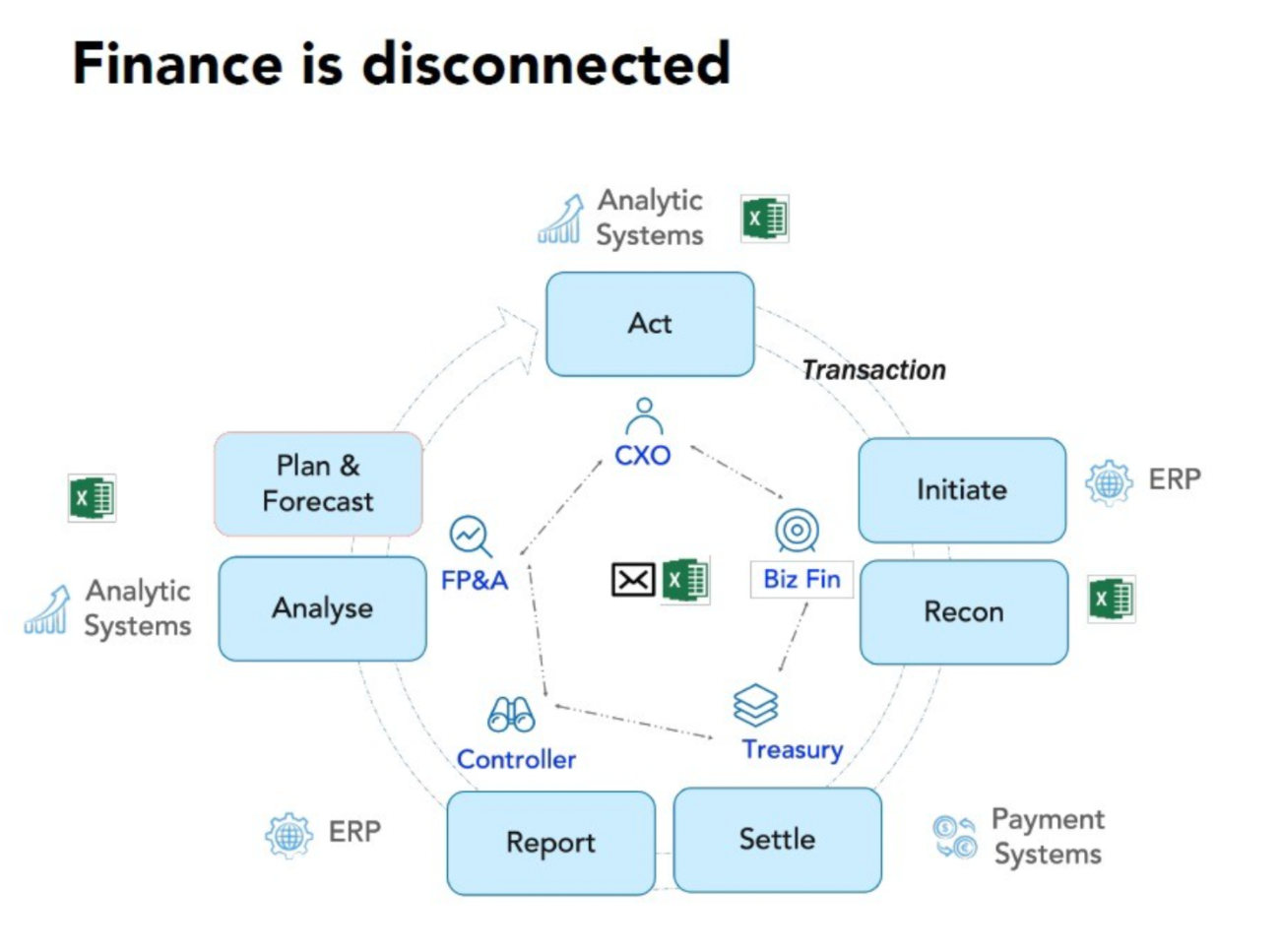

Anyone who has had the incredible fortune of collaborating with multiple functions on financial, business and operational numbers would be quite familiar with the friction around building and managing large spreadsheets – whether it is maintaining version integrity, ensuring the enigmatic formulae make sense, sourcing data from multiple individuals, or for that matter ensuring data fidelity & integrity, the number of ways a company’s numbers can go wrong, is quite high! Most business and financial planning is led by finance teams, and is executed through multiple meetings and exchange of information through mail, on the back of excel spreadsheets. When you think about this entire activity from the perspective of large enterprises with multiple business units & geographies, with data residing in multiple data sources and tool silos, the effort required to consolidate, normalize, transform and reconcile this data, is unprecedented. Consequently, a major part of these activities is done on a quarterly or annual basis – With all intelligent enterprises trying to bring in a data-driven mindset, understanding critical financial and business metrics at a higher frequency and recency, is imperative. We strongly believe that finance teams should focus on generating strategic insights into their business rather than spending a bulk of their time collecting, uploading, normalizing, transforming and updating numbers into excel spreadsheets.

While the scale of the problem and market need was very clear to us for a product like Bluecopa, our conviction in the business was built on the back of two major pillars:

Timing and differentiated approach

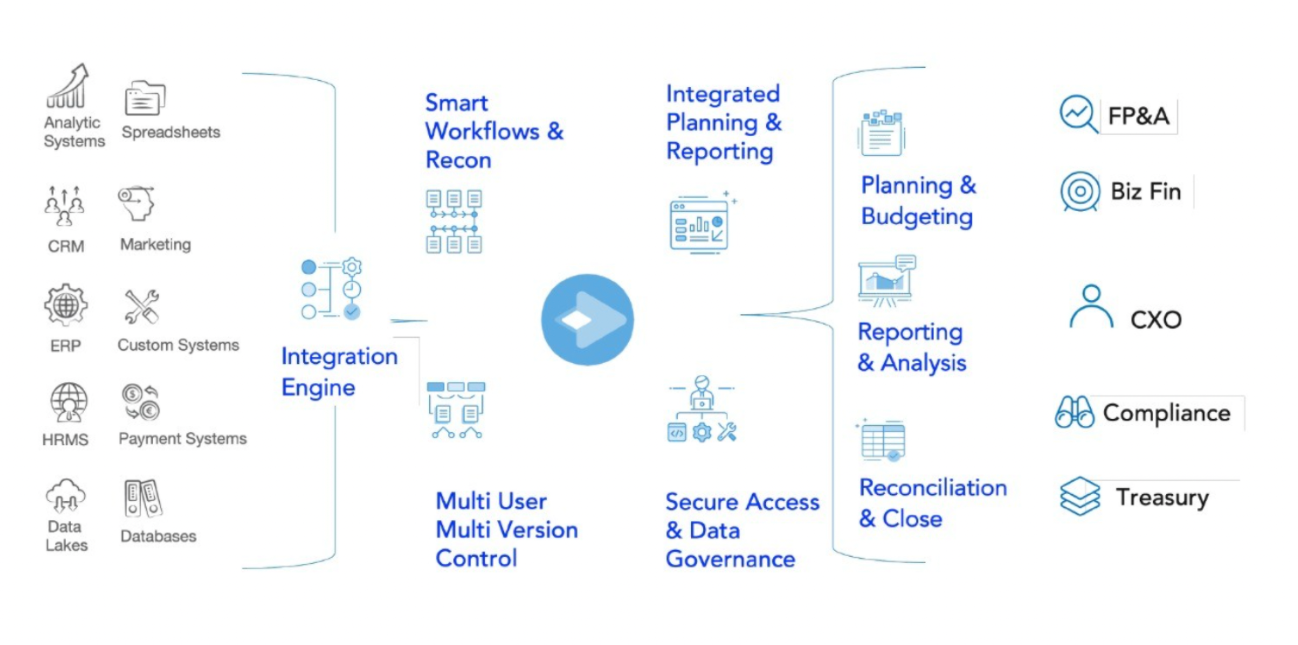

This problem isn’t a new one, and multiple waves of companies over the past 20-25 years have tried to solve this problem with different approaches – First came excel and still prevails, then ERP solutions which tried to become the system of record but faced the issue of being closed systems lacking interoperability, and then cloud native incumbent solutions like Anaplan, Planful, and others which have a broad approach, long implementation cycles and aren’t built for the modern enterprise. The timing to rethink products in this market couldn’t be better with enhanced data availability in different SaaS tools on the cloud, and the fact that there is more data mobility thanks to open APIs as well as iPaaS solutions. We believe with the volume, variety, and velocity of data exploding, and with the SaaS tool sprawl generating more data silos, this is more of a Data Infrastructure problem. Bluecopa has developed a differentiated approach in the form of i) A strong data engineering engine which can process large volumes of data in a matter of seconds, which makes them ideal for high frequency transactions oriented industries, ii) Purpose built for the finance function which enables an easier end user targeting, iii) An intuitive spreadsheet application interface in-built with boxed metrics and formulae, which reduces the training need. We believe that the timing for this differentiated approach couldn’t be better with multiple enablers helping the team build a focused product of this nature.

Strong founding team with complementary skill sets

Our understanding of the market told us that there needs to be a strong data infrastructure approach blended with a deep understanding of the core needs of a finance professional to be successful in this space, and we couldn’t have asked for a better team than Satya, Neel, and Raghava to go and tackle this problem.

Satya Prakash Buddhavarapu – The Chief and the Data Infra maverick

Within the first ten minutes of my first interaction with Satya I was in complete awe with his obsession with the problem, his knowledge of data structures and the core need of solving this finance focused problem with a hardcore data infrastructure approach. It was only after the first half an hour that I learnt that he had built a company called Tuplejump, which could have been Snowflake as we know it. Tuplejump ended up being Apple’s first acquisition in India, and after working closely in Apple’s backend infrastructure & BI team out of Cupertino, his entrepreneurial bug pushed Satya to move back to Hyderabad to start Optobizz, which was acquired by Open. One of the brightest minds in data infrastructure in India, his unassuming attitude about himself in spite of building tech that is being used by Apple till date, is one of the most endearing things about Satya. We have complete confidence in his ability to build a robust and powerful data engine, and his words in his Hyderbadi accent ring in my head while I write this – “Inshallah, Is baar bahut bada banega!”.

Nilotpal Chanda – The GTM guy and the Sales Maestro

Neel, as we fondly like to call him, is an alumnus of the reputed Indian School of Business, and in his fifteen year long career has been a sales leader across Ramco, Netcracker and Open. During his tenure at Ramco and Netcracker, he was responsible for building multi million dollar P&Ls from scratch across multiple geographies. Having enterprise sales expertise across geographies and having built teams in both inside and outbound sales, we felt very confident about backing a seed stage company that had a strong sales leader driving the GTM motion from day one. One of the biggest issues of most SaaS companies built from India for the globe is that they don’t think about their GTM scale up from day one, and go hunting for GTM talent after acquiring the first set of customers, which we believe would be a major advantage for Bluecopa.

Raghavendra Reddy – The Finance guru & hands on Ops guy(Fire extinguisher)

Raghava, a career finance professional and also an alum of the Indian School of Business , comes with deep expertise working in finance with Wipro, HP, Optobizz and Open, and has also co-founded a company in the past. His on ground experience in FP&A & complex finance operations, and having faced the problems on a daily experience that Bluecopa is endeavoring to solve, makes him an invaluable asset to the team with his product/workflow insights. In addition, Raghava doubles down as the person running the show on every front like finance, operations, hiring, etc., which is critical for any startup trying to scale at an astronomic rate.

The most interesting part about the team for us is that they have worked together in their previous startup Optobizz, and have come together with the heady ambition of becoming the workspace of every finance professional. We couldn’t have been more fortunate to have had the opportunity to partner with the Bluecopa team, and are super excited to be a part of their journey in building a connected finance platform from India for global markets.